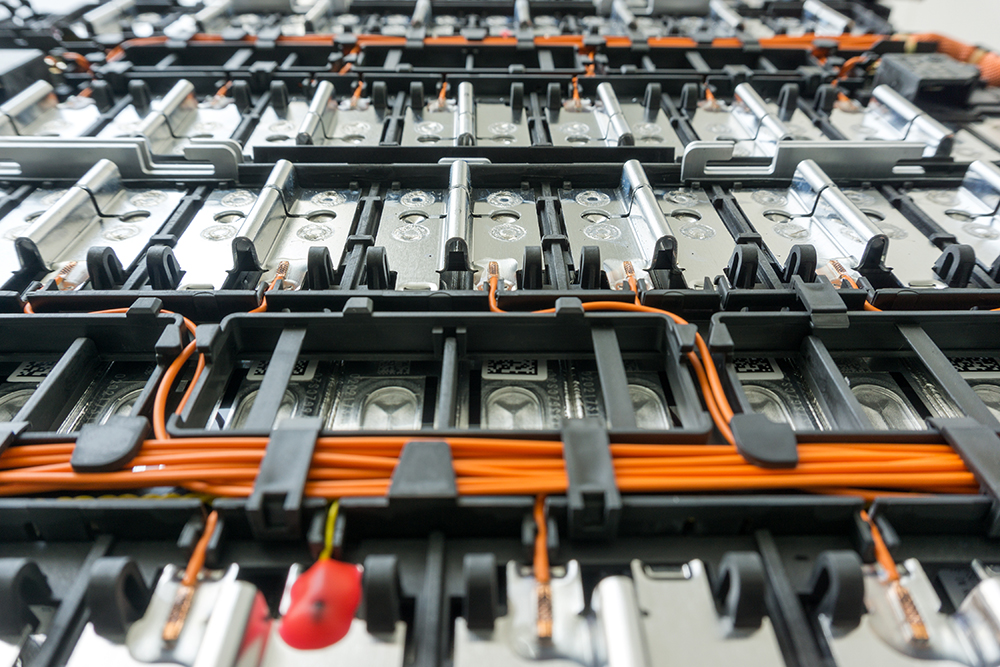

Electrifying transportation is going to require beaucoup batteries, and for a raft of reasons, those batteries need to be built near the vehicle markets they serve (not shipped halfway around the world, as is often the case today). The Biden Administration’s Inflation Reduction Act includes incentives for automakers to source their batteries here in the Good Old USA, and similar regulations are in the pipeline in Europe.

The incentives are working. Automakers and battery suppliers have been announcing new US battery plants (most dubbed “gigafactories”) at such a clip that we can hardly keep up: FREYR and Hyundai are separately planning plants in Georgia; Panasonic will soon be building batteries for Tesla in Kansas (with recycled stock from Redwood Materials); Stellantis and Samsung SDI are investing in Indiana; LG Energy Solution is expanding a facility in Michigan; GM is also upping its game in Michigan; and the list goes on: Arizona, Tennessee, South Carolina.

How much investment does this represent? No one seems to know exactly, but it’s a whale of a lot. According to the Center for Automotive Research (via the Wall Street Journal), automakers announced plans to invest some $22 billion in battery plants in the US in 2022 (plus another 11 big ones for auto assembly facilities). Atlas Public Policy (via NPR) puts the figure at $73 billion for US battery plants in 2022.

And that’s just in the US in 2022. Benchmark Mineral Intelligence calculates that, globally, almost $300 billion of investment has been announced in new battery gigafactories since 2019.

Many of the new US projects are going up in the Southeast, and some are already calling the region the “battery belt.” Governors and other pols from both sides of the aisle are showing up at ribbon-cuttings, happily chanting “jobs, Jobs, JOBS!”

Tom Taylor, an analyst with Atlas, told NPR that “in some states [these are] some of the largest, if not the largest, economic development projects in the state’s history.” He calculates that in the aggregate, the plants announced in 2022 should create more than 150,000 direct jobs.

States and regions are competing to lure battery-makers with generous tax breaks—some $14 billion in state and local subsidies this year, according to Good Jobs First. The watchdog group also reports that eight individual projects received over a billion each in subsidies in 2022—and five of those were EV and/or battery plants.

Moving battery production to the US (and Europe) is not just about reducing reliance on China. “It helps us with logistics costs, it helps us with material costs,” Volkswagen of America’s then-President Scott Keogh told NPR last January.

These are heady times, but as NPR’s Camila Domonoske writes, “Now comes the hard part: opening the plants.” As Tesla and GM could relate, there’s many a slip twixt ribbon-cutting and rolling cars off the line. It’s also worth mentioning that by all accounts, bringing raw material extraction and processing to North America and Europe will be a longer and more difficult process than establishing battery production. But that’s an article for another day.

Source: NPR