(Updated 4/5/16 11:00am EST to include link to IRS code and information suggesting how Tesla could maximize available tax credits.)

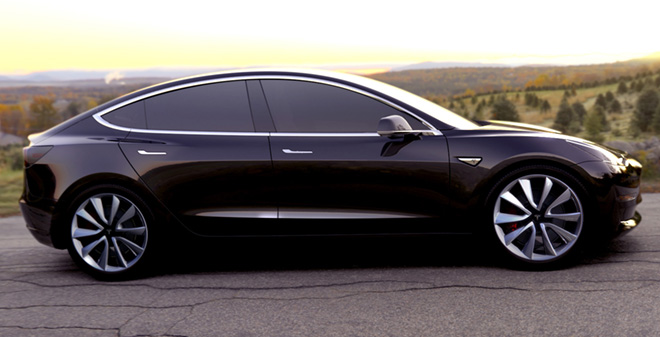

Tesla’s mission has always been to bring EVs to the mass market, and the culmination of the company’s grand strategy is the Model 3, unveiled last week at a price of $35,000. Auto market analysts tell us that about a third of US car buyers buy cars at or above this price point, so the potential market for Tesla’s new EV is huge.

If you are able to take advantage of the federal tax credit for EV purchases, the final cost for your 3 might be as low as $27,500 (kudos to Tesla for not disingenuously quoting the price after the tax credit, as some automakers do). But don’t count your little green chickens just yet.

The EV tax incentive was designed to give a boost to early adopters of a new product, and as such it is designed to “sunset” once a particular automaker reaches 200,000 in EV sales.

By most estimates, Tesla has already sold around 50,000 vehicles in the US, and it plans to sell about that number again by the end of 2016. If it keeps ramping up production of Models S and X as planned, it could be very close to the 200,000 mark by the end of 2017, when deliveries of Model 3 are scheduled to begin.

According to Internal Revenue Code 30D, when the 200,000-unit threshold is reached, the tax credit will automatically be phased out “beginning with the second calendar quarter after the calendar quarter in which at least 200,000 qualifying vehicles manufactured by that manufacturer have been sold.” Then, over the following 12 months, the credit will drop to $3,750 for six months, then to $1,875 for another six months, and then…gone!

Tesla has already logged over 200,000 orders for Model 3. Even if only half of those translate into deliveries, many of those buyers are not going to get the whole cookie. There’s no way to know if you’ll skate in before the cutoff point, because Tesla will probably be producing the Model 3 in batches – all of one trim level first, then the next, and so on.

It will be ironic if all the tax credits get soaked up by the affluent buyers of the Roadster, S and X, leaving none for the theoretically more deserving middle-classers waiting patiently for the 3. “One could argue [that Tesla] sort of wasted their credits on the very wealthy, people who didn’t need it,” Kelley Blue Book’s Rebecca Lindland told Wired.

The Tesla team is well aware of the issue. “Our production ramp plan should enable large numbers of non X/S customers to receive the credit,” tweeted Elon Musk. How that would work is not clear, but Musk assured us that “we always try to maximize customer happiness even if that means a revenue shortfall in a quarter.”

@RGspan Our production ramp plan should enable large numbers of non X/S customers to receive the credit.

— Elon Musk (@elonmusk) April 3, 2016

Forbes suggests that if the timing of Model 3 deliveries is scheduled just right, Tesla could extend the full $7,500 credit for almost six months after reaching the 200,000 mark, becuase the tax code then switches from counting cars delivered to counting calendar quarters. However, this assumes that the production schedule for Model 3 is on time, otherwise the tax credit could expire in mid-2018 through the deliveries of Model S and X.

In any case, the fate of the EV tax credit may depend on the outcome of November’s US election. A Republican-dominated government could conceivably ax the credit as soon as possible, whereas a Democrat-controlled Congress might vote to extend it.

SEE ALSO: Tesla kills the instrument cluster