- Revel aims to promote EV adoption in cities by solving two interrelated problems: The company’s rideshare fleet generates demand to justify the cost of installing DC fast chargers, and its charging Superhub ensures that the fleet stays charged, while also offering charging to the public.

- Public charging and rideshare charging tend to take place at different times, so combining the two allows a charging provider to maximize its station utilization. And vehicle-to-grid technology offers alternate revenue streams for its vehicles.

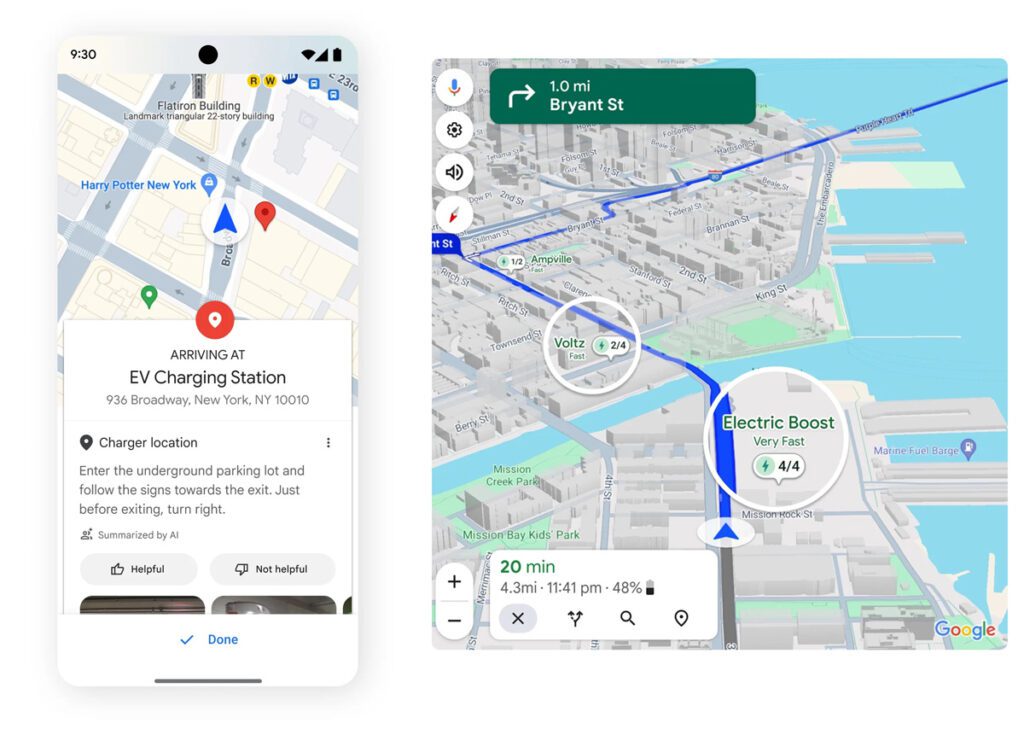

- A large charging site can perform AC-to-DC rectification in a central location and share power among individual chargers. This enables more efficiency in terms of grid connections and capital investment.

Q&A with Revel COO Paul Suhey.

New York-based Revel is riding two timely trends. Because rideshare vehicles log so many miles, electrifying them can deliver outsize emissions reductions—and drivers for the likes of Lyft and Uber will need strategically located urban charging hubs. Meanwhile, millions of drivers in dense cities like New York live in locations where, unlike suburban drivers, they don’t have the possibility of installing chargers at their homes.

It’s easy to see that there’s a connection between ridesharing and urban public charging, but as Revel COO Paul Suhey recently explained to Charged, the synergies run much deeper than are apparent at first glance—and Revel’s approach could prove to be a model for advancing EV adoption in cities around the world.

Charged: You’re doing three different things in New York City—you have fleets of electric scooters and Tesla rideshare vehicles, all in highly visible blue, and you also have a large public charging station called the Superhub in Brooklyn, with ambitious plans for more around the city. What’s the overarching business plan that ties all these related activities together?

Paul Suhey: The primary challenge that we’re focused on is enabling EV adoption in cities. All of the challenges and opportunities, technology, regulatory issues, business model issues that are associated with enabling EV adoption at scale in major urban markets, that’s where we’re focused. From there, every business line sort of ladders up to that core mission. I think the two most important things that we’re doing right now are: enabling the build-out of fast charging in major urban markets; then, as we build out that infrastructure at scale, thinking about how we ensure that EVs can actually be integrated into that infrastructure in a way that enables or supports a reliable grid.

“You have a certain level of utilization to justify the CapEx of putting those expensive chargers in the ground.”

Sort of a dual challenge: How do you execute and put chargers in the ground today? Then, how do you think three, four or five years ahead to the time when EV adoption really starts to pick up, and the types of innovation that we’ll need to see, and how can we be on the ground floor of driving that innovation today? As that relates to our general business models, I think one of the things that makes us different is we’re not just an infrastructure company and we’re not just a mobility company. We think it’s important at this stage in the industry that we’re integrated under the same roof. We’re very familiar right now with building fast charging, but to make a business case for that, you have to be confident that you have a certain level of utilization to justify the CapEx of putting those expensive chargers in the ground.

So having this infrastructure business integrated with our rideshare business, that gives us confidence that we have this captive source of demand, and if we build out this infrastructure, we have confidence in the level of utilization that we’ll see from our rideshare fleet. We build out that infrastructure, utilize it with our rideshare business, but then also make it completely publicly accessible. So if you’re a consumer, or if you’re another business such as a rental car company, you start to have confidence that there’s infrastructure available for you to charge. So that sort of solves the initial business model challenge of building infrastructure and then, whether it’s vehicle-to-grid or dynamic smart charging, beginning to pilot various elements that we think will be essential as this industry continues to grow to ensure that we’re supporting a reliable grid.

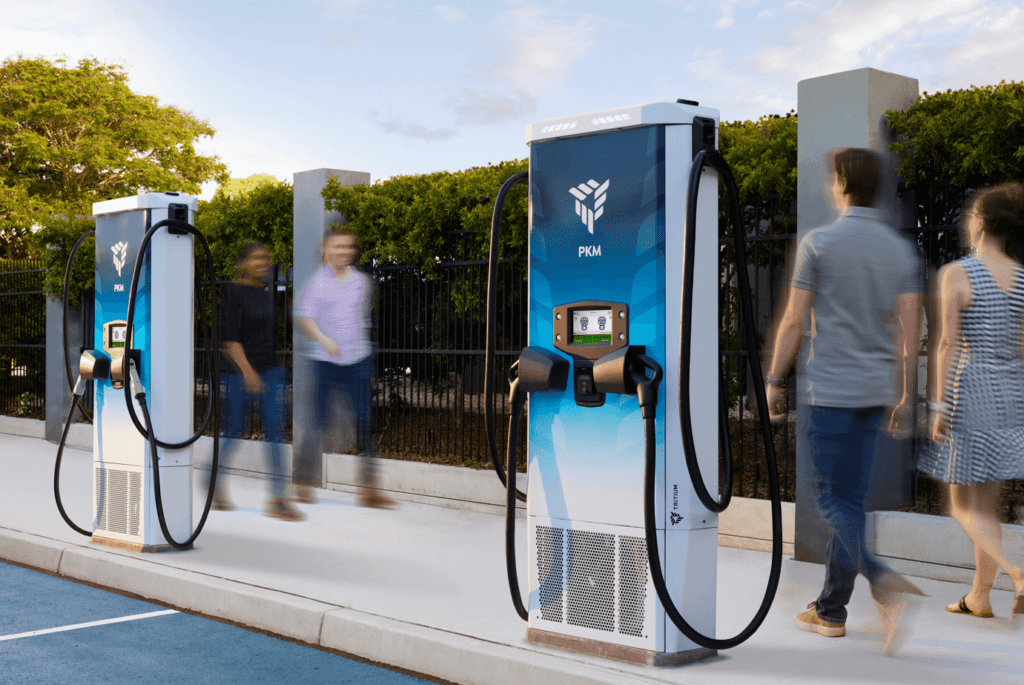

Charged: The chargers themselves are Revel-branded chargers, but who’s the equipment manufacturer?

Paul Suhey: We have a strong partnership with an OEM called Tritium. We work closely with the charging market, sourcing chargers from various vendors. If you really focus on fast charging, there are probably five or six major players.

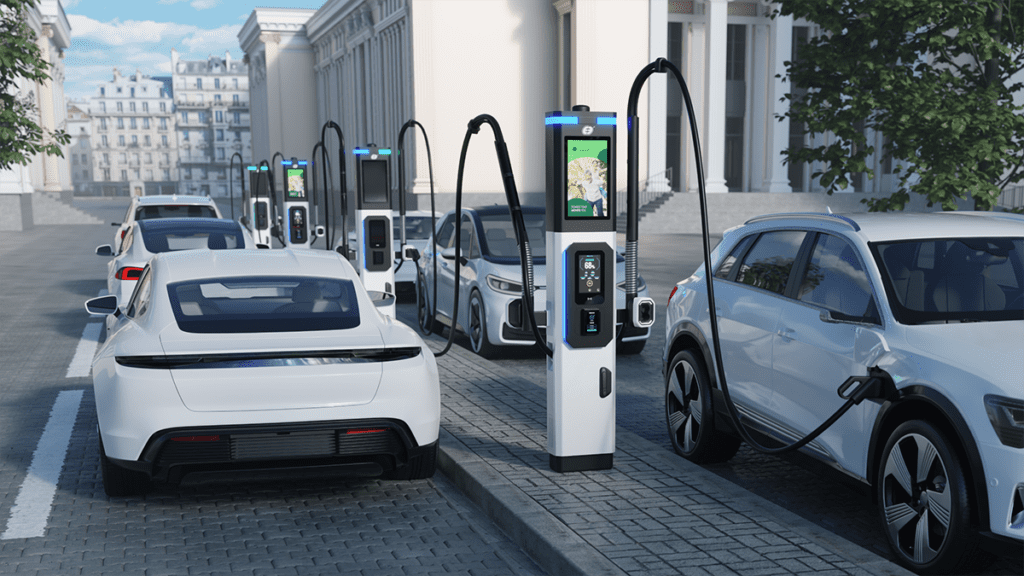

Charged: What’s the advantage of having a Superhub as opposed to distributing public chargers in ones and twos around the city?

Paul Suhey: I think one of the key differences with the types of sites that we’re building compared to what’s been common in the industry is building sites at scale. Typically, outside of Tesla, the normal fast charging station maybe has two plugs on average. We’re building sites that have 10 to 25 plugs.

The main difference from a technical perspective is that when you have two plugs, it’s what I refer to as an all-in-one unit. You have AC-to-DC conversion happening within that one unit. It’s 50 kW, 75 kW, that’s it. With bigger sites, you’re able to do that AC-to-DC rectification in a central location, and then power-share across dispensers, so you can be much more intelligent around what charger is getting what speed at what time. It allows you to be more efficient with grid connections, and it allows you to be more efficient with your CapEx costs.

“With bigger sites, you’re able to do that AC-to-DC rectification in a central location, and then power-share across dispensers… It allows you to be more efficient with grid connections, and…your CapEx costs.”

Charged: At your Superhub, you have partnered with a company called AMP Control. Can you explain how the pieces of the puzzle fit together?

Paul Suhey: Maybe one way to describe it is just the different components of the general ecosystem. On the Amp Control side, it’s really about load. We’re able to look at what vehicles we have due out at certain times, how much energy we expect them to use, what constraints we have on how we want to manage our peak load, and then how we ensure that we intelligently charge our fleet at the right speed to ensure that vehicles can make it out for their shifts on time—that they have enough energy and we minimize costs as much as possible. It allows us to minimize our electricity costs without impacting system reliability at all.

Because this industry is so new, there’s a lot of interesting upstart companies. It’s a very disaggregated space. You have a lot of companies in the software space, some working in hardware, and there’s a lot of exciting technology development happening.

Charged: Your Superhub in Brooklyn powers your own rideshare vehicles and also is open to the public. Do you have different chargers designated just for your drivers?

Paul Suhey: All the same chargers. All of them have either Tesla connectors or CCS connectors, and we also have a few remaining CHAdeMO chargers. But all 25 chargers are completely open to the public as well as to our fleet.

That’s one of the interesting synergies with our use case of combining these two different demand profiles—combining public charging with rideshare charging—because it allows us to interplay those two profiles to maximize the station utilization. General public charging, you’ll have certain demand profiles throughout the day. Maybe you have a peak in the morning, it goes down in the afternoon, you have another peak in the evening. We can control when and where our vehicles are charging, so when we know that we have more dead time at chargers, whether it’s overnight or it’s early in the morning or in the afternoon, that’s when we will charge our vehicles. Combining those two demand sources really allows us to maximize our station utilization more than just being a standalone public charging business.

“Combining public charging with rideshare charging…allows us to interplay those two profiles to maximize the station utilization.”

If you take the very simple use case of overnight, that’s when there’s very little, if any, demand for charging. That’s also when there’s very little, if any, demand for rideshare, so then we can take those vehicles off the road, charge them primarily overnight, then during the day, that’s when they’re doing rides. When they’re doing rides is when the public is primarily using the site. So that gives you one example, but there’s a lot of blocks in the middle of the day when there’s less demand on the road for rideshare vehicles, and you can charge your vehicles.

That’ll change over time as well, because the demand profile of a station in a residential neighborhood might be different than the demand profile you might get on a major thoroughfare that’s connecting between a residential and a primary commercial district. So it really will depend on the site that you’re looking at.

Charged: You started a V2G pilot last August involving Fermata, another company that we’ve covered quite a bit.

Paul Suhey: Yes. If you take a step back and think about V2G, I think the primary focus to date has tended to be on residential V2G or school buses. Both use cases make sense. School buses, you have a vehicle that is utilized nine months out of the year, not really utilized during the summer when the grid tends to be more stressed.

Residential, one of the primary challenges has been that it’s confusing enough to convince consumers to go electric and teach them about charging and everything that goes along with it. So try doing that at the same time that you’re trying to teach them about selling energy back into the grid, why they should care or how it should work. It’s complicated. With us, I think we see a big opportunity.

A: We’re focused in major urban markets, and those tend to be environments where the grid is more stressed and there’s more opportunity to participate in grid services and provide a valuable service to the grid.

And then B: We’re talking about operating a fleet that we own and operate and control. It’s much easier for us as a business to make these strategic decisions and investments when we control the vehicles. You don’t have to worry about individual consumers making individual decisions.

But the use case that we see is participating in V2G operations the five to ten times a year when the grid is most stressed. So, unlike a school bus where you’re exporting energy every single day of the summer for weeks at a time, what are the ten times throughout the year when we can get a signal from the utility that there’s an opportunity for us to export energy back into the grid for a four-hour period? What that allows is at scale, as we control these EVs, we can make the determination: should this vehicle be doing rides via our rideshare business or should it be dispatched to a certain station at a certain time to send energy back to the grid?

Charged: So you might take a vehicle out of rideshare service if it’s more profitable for it to act as a battery for the grid at a particular time?

Paul Suhey: Correct. And then it’s important to keep in mind that the times that we’ve wanted to do that is maybe ten times a year—certain locations on the grid, certain networks will have signals at different times. So maybe at one location there’s a need from noon to 4:00 PM. At another location it might be 6:00 PM to 10:00 PM. So the number of vehicles that we need to take out of our service to provide a lot of value to the grid does not materially impact the quality of our rideshare service.

All of the backend ride operations, the determination of where vehicles should be used is our in-house software. Just the one-to-one V2G tech is what we’ve partnered with Fermata on.

Charged: You have plans to open five more of these Superhubs in New York City over the next few years. I spoke to another company recently, called Beam Global, and they told me that it can take up to two years in New York City to get through the whole process: permits, environmental impact, getting the power hooked up. Does that sound about right or are they exaggerating?

Paul Suhey: It’s spot-on. There’s a big window of uncertainty depending on the nature of the site, how much power you’re bringing, a lot of different factors. But it can be anywhere from a year, if you’re lucky, to three years. Two years is a safe average.

Each site that we look to build, before we sign a lease, we’re working with the utility, we’re going through the engineering process to understand the estimated timeline to bring power to the site. That’s what gives us the confidence of where we’re focusing, depending on how long we’re projecting those development timelines to be.

“A utility taking two years, that’s not a major constraint in the general construction and operations of a building, but this is a major constraint for our [charging] site going live.”

One thing to keep in mind when you’re dealing with the amount of load that you would have for a typical fast charging site at scale, that’s the type of load that usually goes in a major commercial building. The utility is used to working on much longer timeframes because if you’re working on a massive ground-up development process, that’s a four- or five-year build process. A utility taking two years, that’s not a major constraint in the general construction and operations of the building, but this is a major constraint for our charging site going live. So working through the process that typically takes two years or three years and trying to say, “Hey, we need this done faster,” you’re kind of working in a way that the utility hasn’t really done before. It’s a kind of new time crunch.

We definitely have a very strong relationship with Con Edison, the utility here in New York City. They’ve been very open and transparent about their process, how things need to improve, what they’re working on. We give them suggestions. But the reality is on both sides, whether it’s the customer or the utility, we’re working through these issues together for the first time. This is new, so until you actually go through the process and do it, it’s going to be difficult to say how long it takes to bring power to a site. I think each side gets more efficient as we work together.

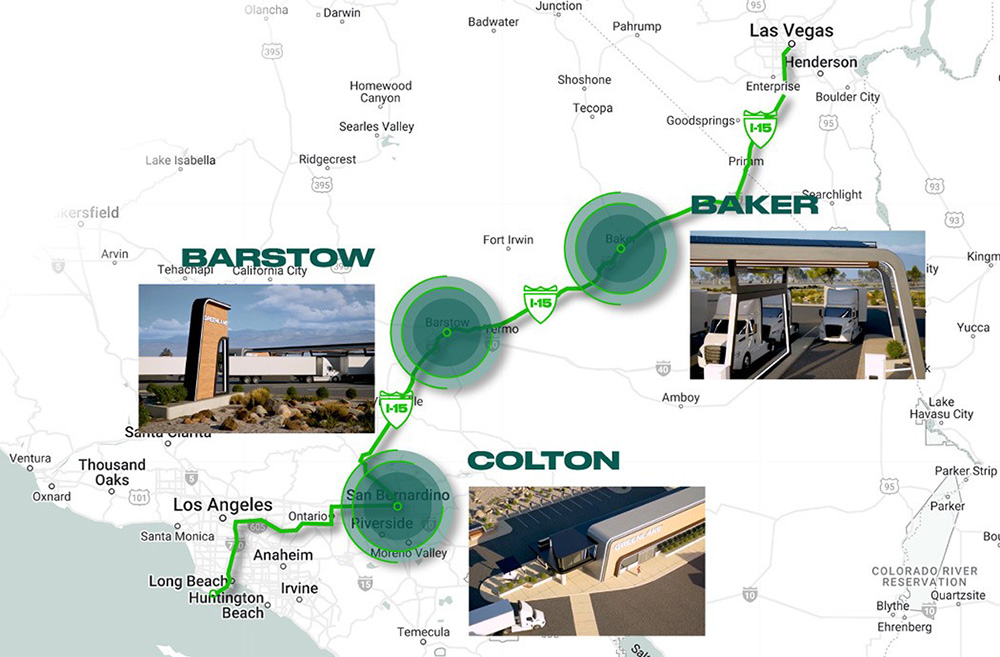

Charged: At the moment, your Superhubs are just planned for New York?

Paul Suhey: Just in New York, but definitely looking to expand that network to other major cities soon. Our primary focus is on New York City. That’s where we’re based, that’s where we’re founded. That’s the market that we know the best, where we think there’s a massive gap in opportunity. But infrastructure, you have to think in a time scale of years, so if we want to build infrastructure in X City in 2027, you almost have to be thinking about that now.

Charged: Tell me about the other users of your Superhub besides your own rideshare vehicles. Have you also partnered with some other rideshare providers or fleets?

Paul Suhey: Yeah, of the third-party users that we get, meaning non-Revel usage, I’d say about maybe 50% tends to be from other taxi or rideshare customers—EV drivers that are driving for Uber and Lyft, or driving a yellow taxi that are going electric. And I think that’s a trend that we’ll continue to see because those are the drivers that are putting the most miles on their vehicle, can see the most benefits of going electric and operating cost savings versus an internal combustion engine. And then the remaining 50% is general consumers looking for somewhere to charge, leaving the city for a weekend, coming back, doing small trips. We’ve also seen a lot of people that are buying an EV or leasing or renting an EV because we’re in their neighborhood, they’re confident that they actually have somewhere to charge. That’s also our hope as we build infrastructure, make it more publicly accessible, you start to give consumers more confidence that they can make the switch to electric because they will have somewhere to charge.

Charged: When it comes to public chargers, a lot of people are appalled at how often they’re out of order. I’ve talked to a lot of people about this and nobody seems to know exactly what the problem is. Why can’t companies keep those darn things working?

Paul Suhey: A lot of answers to that. And it depends on if I’m talking fast charging or Level 2 charging. First and foremost, it’s hard. The technology is new, hardware is new, things break, growing pains. But I think there are a couple of challenges at play.

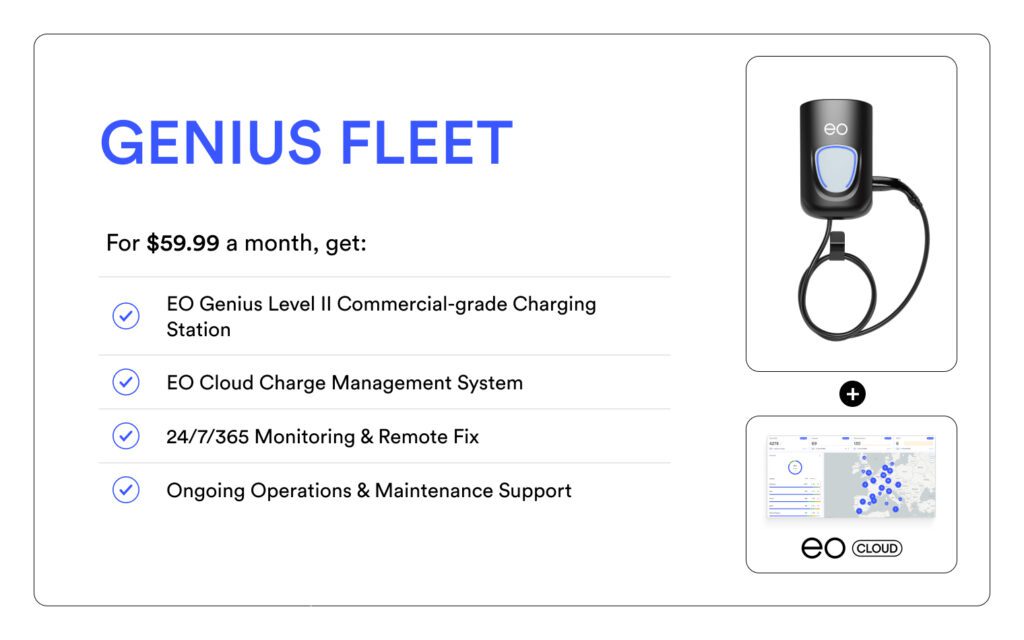

For Level 2 in particular, there can be differing business models on how those charging installations get installed. Oftentimes you might have a municipality or a grocery store, a location that wants to install that charger as an amenity. Charging company comes along, sells the hardware, and that’s it. They make money on the hardware sale, but they don’t really have to worry too much about ensuring utilization. And you’re bringing revenue through that utilization. You don’t have the right incentives—the store operator or whoever owns that real estate, they don’t care too much, they’re not making a bunch of money off of it. So no one’s really incentivized to ensure the uptime of that charger.

Then from a fast charging perspective, I think one of the challenges that we hope to solve is that, when you have two or three chargers, if one charger is broken, that means that half or a third of the chargers in that site are down. But if you have 10 or 20 chargers, if one charger goes down, two chargers go down, you’re able to fix that without materially impacting the customer experience and the reliability experience.

As we focus on building out a dense network within one location or one city, that allows us to concentrate our service and our spare parts network in that location. As opposed to if you’re a company where you have chargers here, a hundred miles over here, it can be difficult to stand up the service network, the spare parts network, to really support that operation, especially when you’re dealing with new technology where you’re not always certain which part is going to break.

We want to be the largest and most reliable fast charging network in major cities. The major component of that is thinking really hard about the maintenance in cities, spare parts operation, warranty with the manufacturer, timeline of getting things fixed, communication. It’s a whole operation to ensure that you understand when you have issues, which is a problem in and of itself, and then you pinpoint the root cause of those issues and fix them on a timeframe that keeps that experience where it needs to be.

This article appeared in Issue 63: Jan-Mar 2023 – Subscribe now.