Upcoming electric passenger vehicles and light trucks from GM get most of the attention, but its new commercial EV brand is a quiet and very serious push too.

Many US drivers now have a vague idea that General Motors is doing something with electric vehicles. They’ve seen Super Bowl ads for the GMC Hummer EV, or heard news about the lengthy, painful Chevrolet Bolt EV battery recall.

More knowledgeable shoppers may even be able to name some upcoming EVs from GM: the Chevrolet Silverado EV pickup, the Cadillac Lyriq luxury SUV, or the EV versions of Chevy’s Equinox and Blazer compact crossover utilities.

But very few consumers will come up with BrightDrop, the name GM has given to a new unit that builds electric commercial vehicles: full-size vans and even electric cargo containers. BrightDrop offers a fascinating window into the breadth of GM’s EV plans, though even many people in the auto industry know little about it.

Kill four, then add one

Roll back the clock to the dark days of 2009, when two of the three US automakers collapsed into bankruptcy and were restructured by the White House Auto Task Force in the early days of the first Obama administration.

GM then had eight separate brands, and the Task Force proposed that the company should shutter all but two: Chevrolet and Cadillac. That would give the radically slimmed-down GM a mass-market brand and a luxury brand. Just like, say, Ford—which was then in the process of killing Mercury, to leave it with only Ford and Lincoln.

Executives at GM told the Task Force that, for profitability, two other brands should survive. GMC started as a commercial-truck brand, and made largely the same light-duty trucks as Chevrolet. But an ongoing luxury revamp meant it could sell them at far higher prices, ensuring that the brand was consistently profitable. Buick, meanwhile, was vitally important for the Chinese market, where today more than four times as many Buicks are sold as in North America. The Task Force ultimately agreed.

Thus, the restructured GM was composed of Chevrolet, Buick, GMC and Cadillac, while the Hummer, Pontiac, Saab and Saturn brands died. Sure, the Hummer is now back as a 9,000-pound EV truck, but it’s sold under the GMC luxury-truck brand. The other three: R.I.P.

The idea that GM would launch another brand just 12 years later would have been anathema to the White House Task Force. But that was then, and this is now.

Fastest development in GM history

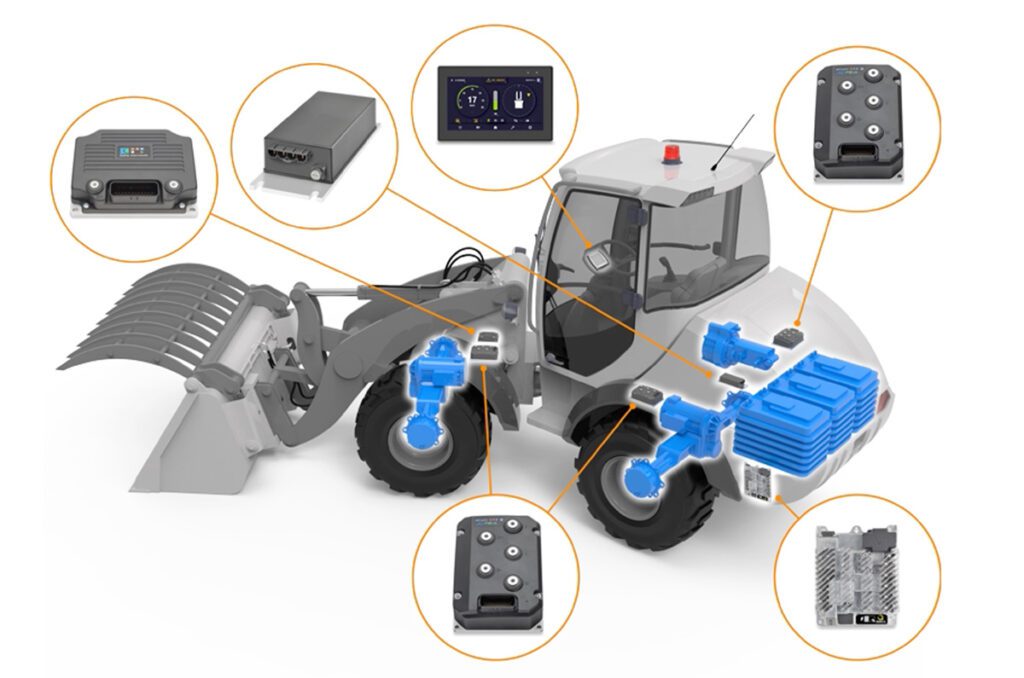

Announced at the Consumer Electronics Show in January 2021, the BrightDrop brand will sell only battery-electric commercial vehicles. Crucially, that encompasses both on-road—delivery vans of various dimensions—and other electrified cargo vehicles, including rolling pallets and containers.

The BrightDrop brand encompasses both on-road electric delivery vans of various dimensions and other electrified cargo vehicles, including rolling pallets and containers.

The road vehicles are all based on GM’s flexible Ultium architecture for EVs, which includes various battery packs, cell types, motor placement (front, rear or both), and configurations that span light- and medium-duty trucks and passenger cars. It will be used in more than a dozen vehicles to be sold in the US by 2025.

“BrightDrop’s mission is to decarbonize the world’s deliveries,” said BrightDrop CEO and President Travis Katz in January. “We leverage the best of two worlds: the innovation, agility, and focus of a technology startup with the engineering and manufacturing might of GM.”

That combination enabled the company to produce its first vehicle, the Zevo 600 large delivery van (originally dubbed the EV600), in just 20 months, from conception in January 2020 to a complete vehicle rolling off the line in September 2021. That line was located at a US “supplier partner” that is building low volumes of the Zevo 600 while GM converts its CAMI plant in Ingersoll, Ontario, for mass production of Zevo 600 vans. The company has committed $800 million to that conversion. Production of the gasoline Equinox at CAMI will end in April, and the first Zevo 600s should come off the lines seven months later, in November.

Early Zevo 600s were delivered in December 2021 to FedEx, which was announced as the first BrightDrop customer when the brand debuted in 2021. The delivery giant said then that it had reserved 500 Zevo 600s. That number rose to 2,500 a year later, to be delivered “over the next few years.”

FedEx will also test BrightDrop’s Trace electrified container in 10 markets this year. The Trace will have a built-in electric hub motor to help reduce the physical strain on workers. The operator can adjust the speed up to 3.1 mph to match their walking pace.

The company said it is “working on a plan to add up to 20,000 more in the years to follow,” though negotiations remain underway. As for the name, the Zevo 600 has 600 cubic feet of cargo volume.

More name-brand customers followed, including the third-party fleet-management company Merchants Fleet, which said it was negotiating to procure 12,600 Zevo 600s, the first of which are to enter its clients’ fleets early in 2023.

As for the name, the BrightDrop Zevo 600 van has 600 cubic feet of cargo volume.

Second van: Zevo 400

Next came Verizon, in September 2021. The telecom firm said it would order unspecified volumes of a second BrightDrop vehicle, the Zevo 400—again, named for its 400-plus cubic feet of cargo volume. This van is intended for shorter, more frequent trips with less cargo than its larger sibling. Just 20 feet long, the smaller Zevo 400 is expected to fit into standard parking places (at least in some areas) but will offer the same projected range—up to 250 miles—as the Zevo 600.

This past January, retail giant Walmart joined the queue of customers. At CES 2022, the company said it had agreed to reserve 5,000 BrightDrop vans, split between the Zevo 400 and the Zevo 600. They will be used to support Walmart’s expanding network of last-mile deliveries from its stores and distribution centers directly to customers’ homes.

BrightDrop hasn’t publicly released either technical specs or pricing for either vehicle, but both are said to share a battery pack and motor, and to have a gross vehicle weight under 10,000 pounds. Battery size, motor power and most other details remain unknown.

GM has been coy in general about specs and capacities of its emerging lineup of Ultium electric vehicles, though it’s thought that the Hummer EV—which we know has a stacked pair of Lyriq packs—has a battery capacity of about 200 kilowatt-hours. Given their size and cargo volumes, these vans could well have batteries of 100 kWh or more.

Why not GMC?

Ford recently launched its E-Transit electric delivery van as an electric variant of its well-known existing Transit model. However, GM chose not only to build its electric commercial vehicles on a dedicated platform, but also to create an entirely new brand for them.

Ford says the E-Transit benefits its existing fleet customers, allowing them to transfer expensive custom “upfit” gear—tool racks, gear cupboards, and much more—directly from a Transit with an engine to a very similar-looking Transit powered by a battery. Those Transits largely aren’t used for last-mile delivery—they’re concentrated in small businesses across multiple trades, not companies delivering packages to households.

GM didn’t really have the option of adapting an existing model. Chevrolet retains a strong foothold in the commercial fleet market with its light-duty pickup trucks, but it doesn’t have a modern commercial van that competes with Ford’s Transit or the Ram ProMaster from Chrysler’s truck brand (now part of Stellantis). It still sells the Chevrolet Express cargo van, but that archaic vehicle is now more than 25 years old.

Worse, GM was forced to shut down its medium-duty truck division during bankruptcy in June 2009, pretty much taking it out of the commercial fleet market. The company announced four years ago that it would reintroduce some medium-duty trucks in a partnership with Navistar, but those are not delivery vehicles. As a result, GM’s van shelves were essentially bare. Meanwhile, GMC has evolved from a commercial-truck business rarely visited by retail buyers into a high-profit luxury truck brand—a niche GM has no intention of disturbing.

Creating a new, all-electric brand may have been the smart decision. It guarantees that any company running a BrightDrop van will instantly be seen to use an EV.

So, creating a new, all-electric brand may have been the smart decision. It lets Chevy focus on passenger vehicles and SUVs, along with fleet sales for its pickups. It guarantees that any company running a BrightDrop van will instantly be seen to use an EV. And the electrified pallets and cargo containers may offer clients an option that Ford and Stellantis can’t match.

CEO Mary Barra has frequently said that GM sees electric vehicles as “additive” to its sales, not substitutive. If BrightDrop can earn a substantial piece of the growing EV delivery-vehicle market, she’ll be proven right.

This article appeared in Issue 59: Jan-Mar 2022 – Subscribe now.