EVgo has the highest number of CHAdeMO and CCS fast chargers of any charging network in the US – currently over 1,000 DCFCs in 66 markets. That makes it the largest public fast charging network capable of serving every EV made by the major automakers, as well as any Tesla Model S or X with a CHAdeMO adapter (Tesla has yet to specify when/if Model 3 will work with the adapter).

Each EVgo fast charge station is capable of delivering 50 kW or above, and the company is sharply focused on getting ready to increase the power capabilities of its sites as soon as the major automakers begin delivering next-gen EVs.

“In 2017, we really began to invest in that infrastructure so that we are prepared for these new models that are coming to market that can take a charge of 150 to 350 kW,” Terry O’Day, EVgo’s VP of Product Strategy and Market Development, told Charged. “Last year we saw our total power delivered on our network increased by 83%, while EV sales increased 26% in 2017. So we think that trend will continue in 2018, where we continue to deliver more and more power on this network, that they’re being more and more heavily utilized.”

In 2017, EVgo’s network powered 40 million miles worth of electric driving, almost double the figure from 2016. With the increase in popularity of EVs, EVgo is also focused on providing a seamless public fast charging experience.

“What makes EVgo different is its driver-centric focus,” said O’Day, “and that means working with these partners to make a great retail experience, it means making charging affordable and easy, and it means taking full responsibility for the uptime on the chargers. Unique to EVgo is that all of the stations that we operate have the same pricing. So you won’t show up at one store and pay one price and show up at another one and pay a different price.”

Simplified pricing

In early March, EVgo announced that, after careful review of its customer’s habits and feedback, it was reducing and simplifying pricing – effective immediately.

The previous iteration of pricing had four options, which have been reduced to two. First is the Pay As You Go plan, offering a per-minute rate with no additional session fees. Second is the Membership plan, which has a $9.99/month fee and offers EVgo’s lowest per-minute rate. Per-minute rates for each option will vary by region.

With the Membership plan, the $9.99 monthly fee acts as a pre-paid credit that is applied towards charging activity for the month. Members pay between $0.18 and $0.21 per minute depending on charger location. Through June 2018, EVgo will offer a special promotional rate in California of $0.15/minute for members.

With the Pay As You Go plan, customers pay only a per-minute rate of between $0.25 and $0.35 per minute, depending on the state. Through June 2018, California chargers will offer a special promotional rate of $0.20/minute.

“People are really excited about the new plans and lower-cost charging rates,” said O’Day, “because when you can get to publicly charging your EV for a lower cost than what you would pay for fueling a gasoline-powered car, that’s really where the market takes off.”

O’Day said it’s likely that residential charging will always offer lower electricity rates than public fast charging, and perhaps that’s the way it should be. It’s cheaper to make a cup of coffee at your house than to buy one at the cafe or rest stop. Charging infrastructure requires large new capital investments and operational costs, so most drivers will understand that they have to pay for the convenience. However, EVgo believes it’s also important to drive down the cost of public fast charging to enable EV drivers who don’t have the option of home charging. “With longer-range vehicles, higher-power charging, and ubiquitous charging opportunities in public, then you can see new people entering the market and finding the cost and service advantages available from EVs,” said O’Day.

Drivers using EVgo’s Membership plan can now charge for up to 60 minutes during off-peak hours and 45 minutes during the daytime, whereas Pay As You Go customers are limited to 45 minutes around the clock. Both limits have been increased from the previous limit of 30 minutes – a feature that drivers of longer-range EVs like the Chevrolet Bolt have been requesting. “We don’t want you to have to stop and restart charging sessions because you’ve got a big battery pack,” said O’Day. “We want you to be able to get a streamlined charging session.”

EVgo has also simplified the sign-up process, so new customers can start charging within minutes. Customers can initiate a charge directly from the EVgo app, with no RFID card required.

Customer-focused growth

Today there are a few engineering firms that specialize in helping automakers and charging networks find and evaluate potential charging sites. However, those firms didn’t exist when EVgo launched, so it developed the expertise itself. O’Day explained that taking responsibility in-house for these types of core business functions has been key to EVgo’s success.

“When we started, there weren’t any firms specializing in [charging site selection],” said O’Day, “So we are the first that specialized in it. We’ve developed really important relationships building infrastructure with Simon Property Group, with Whole Foods, with Kimco, with Walmart, with Save Mart, Raleigh’s, Mother’s Market. These are all great retail partners of ours that have helped us to expand the charging infrastructure to where it is now.”

“It’s [also] really important that there’s clear responsibility for repair and maintenance on charging stations. We have seen [cases] where that responsibility is not clear, and stations will continue in a state of disrepair for too long and affect the customer experience. We have strict service level agreements and critical repair thresholds that provide for, say, 12-hour, 24-hour, 72-hour repairs when our chargers go down. And we stock parts to repair them with service technicians in the region so that we can meet those strict service standards. For us, having clear responsibility comes from a culture of owning and operating assets.”

EVgo owns about 70% of the chargers on its network, and works closely with the other 30% of property owners who are interested in owning the equipment. “In those cases we think it’s important to maintain a consistent price across the network as well as consistent quality, so that a driver knows what they’re getting every time they arrive at the charging station,” said O’Day.

EVgo thinks of the public charging infrastructure business model as analogous to that of telecom. Some companies have a phone-booth-like model, in which they sell the charger to the property owner. The property owner pays for the electricity, repairs and maintenance, and collects the revenue, the same way that in the past, a retailer would install a phone booth and then collect every quarter.

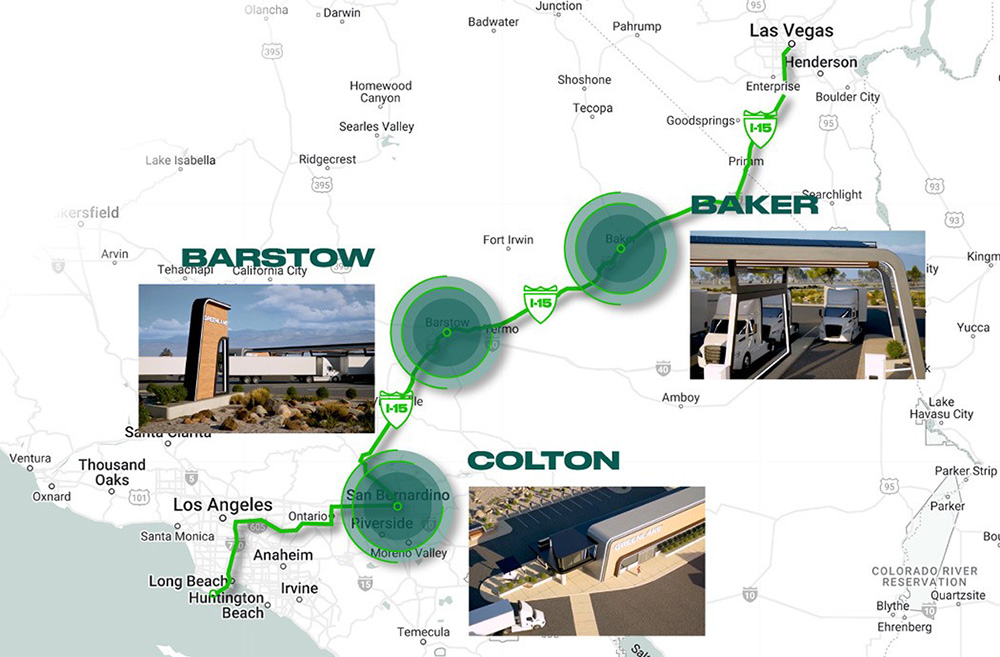

EVgo, on the other hand, thinks of itself as being similar to a planned distributed network across a region, sort of like wireless cell phone towers. “You can go anywhere in this region, you’ll never be far from a fast charge,” said O’Day.

This article originally appeared in Charged Issue 36 – March/April 2018 – Subscribe now.