Green initiatives are on the chopping block in Washington these days, but two of the most important federal incentives have escaped the axe for now. After a bit of back-and-forth, the federal tax credit for plug-in car purchases survived in the final version of the Republicans’ tax cut bill.

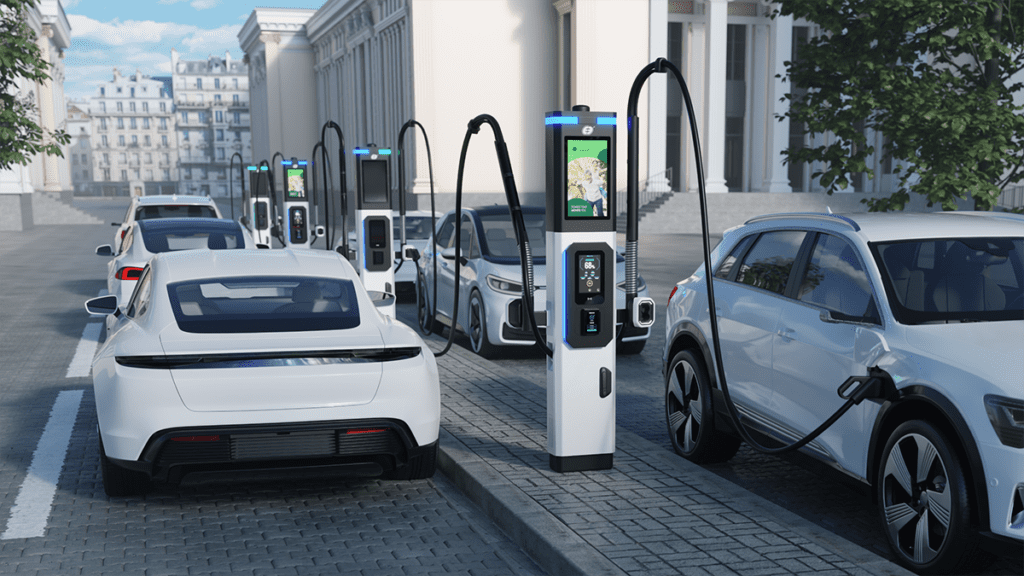

Now Congress has added a few other EV-related tax credits back into its recent budget bill. The Bipartisan Budget Act of 2018 (HR 1892) extends a tax credit for installation of charging infrastructure that had expired at the end of 2016. Taxpayers can take a credit of 30 percent of the cost of purchasing and installing a home charging station, up to a maximum of $1,000, on their 2017 federal tax returns. Congress extended the credit for only one year, so it will surely be the subject of another battle later in 2018.

Lawmakers also restored a 10-percent credit (up to $2,500) for the purchase of an electric motorcycle, and a $4,000 credit for the purchase of a hydrogen fuel cell vehicle.

Environmental groups generally approved of the reinstatement of the credits, but noted that the bill also includes extensions of tax benefits for the nuclear and coal industries.

Source: Green Car Reports