- EcoG offers an operating system for EV chargers, as well as a suite of hardware and software tools for designing chargers. It’s all part of a system that’s designed to enable manufacturers to quickly scale up production of charging infrastructure products.

- As the EVSE market matures, EcoG CEO Joerg Heuer believes we’ll see a move away from extreme vertical integration, towards more of an ecosystem approach.

- EcoG is deeply involved in ensuring the interoperability of Tesla’s NACS with a growing number of current EV models.

Enabling the next phase of EV charging station manufacturing.

We tech writers often refer to “ecosystems,” and biologists may shake their heads at our appropriation of the term, but the analogy is an apt one in many ways. A biological ecosystem has its charismatic megafauna (elephants, lions, whales), but it couldn’t function without its less-glamorous denizens (ants, fungi, bacteria). Likewise, a technological ecosystem has its headline firms (Apple, Microsoft, Tesla), but these rely on interrelated networks of companies that are little-known to the general public (FoxConn, Panasonic, ABB), but that provide indispensable services (and sometimes substantial profits).

EcoG is an example of the latter kind of company—its logo doesn’t appear on a lot of EV charging stations, and you’re unlikely to see its name in a headline outside of the trade press. In fact, most of the journalists working for newspapers and consumer mags, who so often write about the Teslas and ChargePoints of the world, might be hard-pressed to figure out what EcoG actually does (we’ll do our best to explain it).

Like the ant, which makes up some 20% of the world’s biomass, Munich-based EcoG has a surprisingly large footprint in the EV charging infrastructure market. The company was founded by three former Siemens professionals in 2017. By 2022, its software was being used in 15% of the DC EV chargers sold within the EU. At the 2022 CharIN Testival, 30% of the new DC chargers being tested were running EcoG’s OS.

The tech behind the chargers

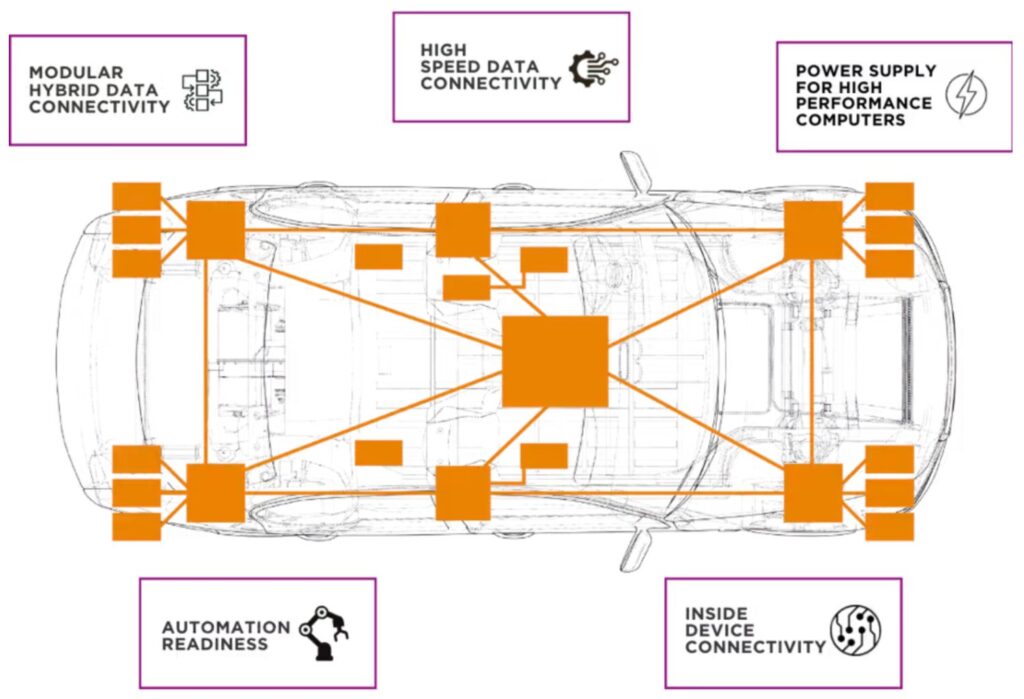

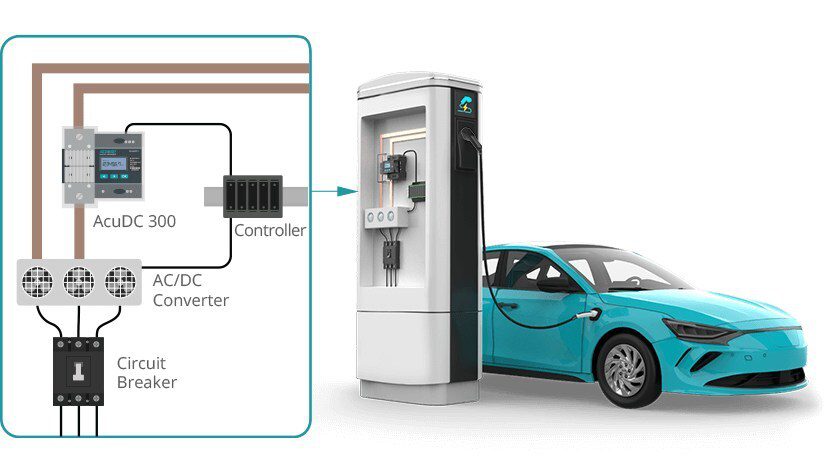

Like every other digital device, from a mainframe to a hearing aid, an EV charging station runs on software. EcoG’s Universal Core is a universal operating system designed to give charger manufacturers maximum flexibility. According to the company, the OS supports 6 architectures that are used by more than 40 types of chargers, and it integrates over 15 different power converters, and all chipsets on the market. It can be delivered integrated in a charge controller device or as a firmware release for a customer’s own control hardware. The software features Open APIs and a customizable web platform to help customers build their own application layers.

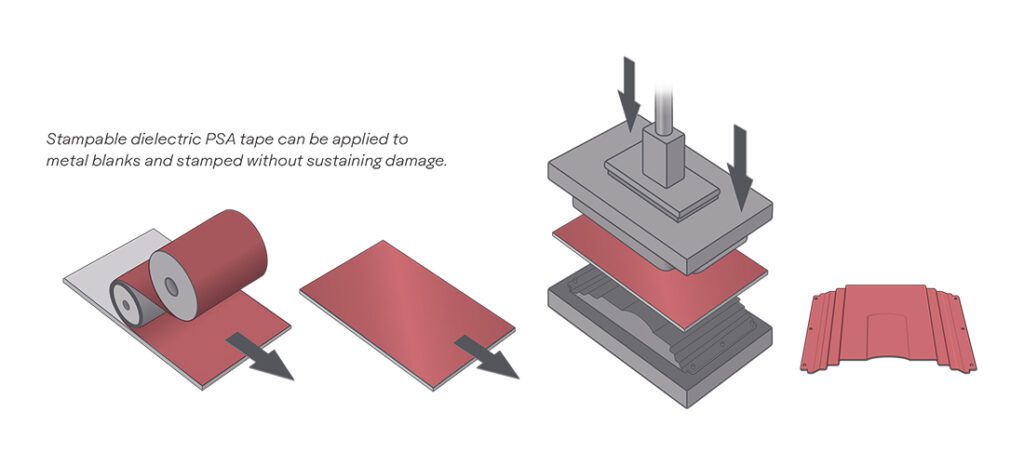

EcoG also offers a suite of hardware and software tools to help companies develop and manufacture charging stations as quickly and efficiently as possible. The EcoG Starter Kit prototyping environment is a fully-functional DC and AC charger that allows customers to modify components, develop their own applications, and verify charging functionality.

EcoG offers a suite of hardware and software tools to help companies develop and manufacture charging stations as quickly and efficiently as possible.

Three hardware tools provide additional functionality. The EcoG Charge Controller handles circuit control and charging status, and ensures vehicle interoperability. It works with multiple I/Os and interfaces. The CPPP Monitor provides a redundant monitor of the charging status between the vehicle and the charger, and can shut down down the charging process if an irregular state is detected. The Application Board provides an application layer that interfaces with the user and with systems running in the cloud, allowing the EV charger to be upgraded with new features, and to use third-party services to run custom applications.

Of smart phones, mainframes and EV chargers

EcoG CEO Joerg Heuer has helped to shepherd several developing technologies from birth to maturity, and he sees parallels between the progression of the EV industry and the development of mobile telephony. As he sees it, 15 years or so into the EV industry’s development, it’s at a stage where companies need to “professionalize”—that is, to be able to quickly ramp up manufacturing of standards-based, interoperable vehicles and infrastructure.

EcoG offers an architecture that’s designed to enable manufacturers to build EV chargers at scale. Returning to the mobile phone analogy, Heuer says, “We are not targeting the Nokias, but the Foxconns. Those who really professionalize how to build chargers and make that a reliable, robust thing in the market, that’s where we focus.”

Heuer expects that there will be a few different operating systems in the EVSE market, and his company provides the reference architecture that allows manufacturers to build an ecosystem that can incorporate a wide variety of hardware. “We have 50 ecosystem partners on the component level—converters, isolation monitors and so on.”

“We are not targeting the Nokias, but the Foxconns. Those who really professionalize how to build chargers and make that a reliable, robust thing in the market, that’s where we focus.”

Some of EcoG’s customers are charging network operators (aka charge point operators or CPOs) and some are site hosts or integrators, but most are manufacturers—two prominent customers are Siemens and i-charging. “We are very much focused at this stage of the market on the manufacturing side,” Heuer tells us. “In Europe, we now have a 15% market share, so more than every tenth charger is produced with our architecture and operating system.” EcoG is also well-established in India, and is quickly moving into North America.

Heuer sees EcoG’s OS and its design tools not as separate products, but as integrated parts of a whole. “We are an IP tech company, something like a Qualcomm in the mobile phone industry,” he told Charged. “If you contract with Qualcomm, you not only get their chip, you get the whole ecosystem around it, so it makes you fast at building smart phones. That’s what we want to do in the EVSE market. We want to enable those who have manufacturing capability to be fast to build professional products. This wave of electric mobility is running, and the question is, are you fast enough to catch the wave? We address those who are really thinking not about how to design the product, but about how to scale the manufacturing.”

Walled garden or open ecosystem?

EcoG has called “infrastructure segmentation” one of the biggest obstacles to EV adoption at this stage of market development. But what is meant by segmentation in this case?

When Heuer started working in the EVSE market back in 2008, he was struck by the irony that one of the most global industries—automotive—is having to learn to work with one of the most regional industries—electric utilities, which operate differently in different countries, and indeed in different US states. “What we saw then was that, especially in North America, the market started with very vertical offerings like ChargePoint and others. And this is good for a kickstart, but in the medium term, it often results in user fragmentation. It’s good to get started fast, but to scale up the market it’s good to think of how you collaborate and integrate stuff together.”

“Especially in North America, the market started with very vertical offerings like ChargePoint. This is good for a kickstart, but in the medium term, it often results in user fragmentation.”

“Think of roaming and the mobile phone networks—it increases reliability if you make it the right way. And that’s what we believe is going to happen. I think getting away from these vertical networks is important because electric mobility is really a cool opportunity to get more renewables into the electric grid. But this needs different business process integrations, and a monolithic company will not have the expertise in how to integrate into the energy system. We are an enabler of that.”

Enabling V2X

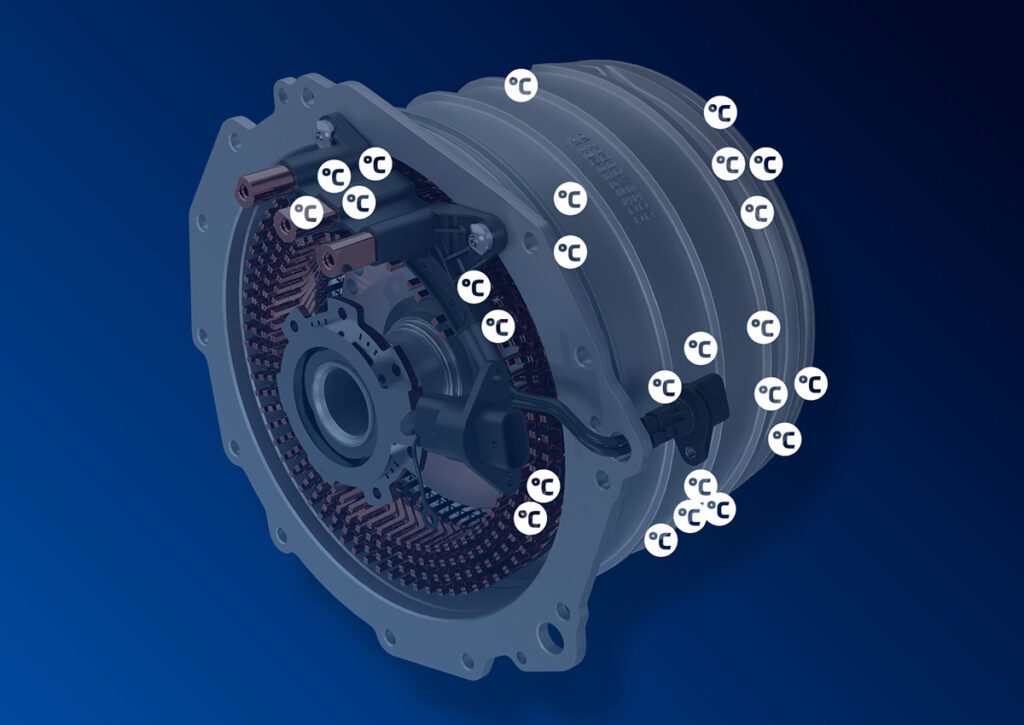

EcoG’s system supports bidirectional charging, which is widely expected to be a key technology enabling a variety of useful applications (V2X). Obviously, ensuring interoperability among V2X-capable chargers and EVs will be critical—and interoperability testing is one of EcoG’s specialties.

Last July, EcoG presented an ISO-compliant bidirectional charging solution that follows charging standards association CharIN’s guidelines. EcoG’s software is designed to support all V2G-capable vehicles—including those still under development. The company has tested its bidirectional solution with multiple vehicle manufacturers in accordance with the new ISO 15118-20 bidirectional power transfer (BPT) standard, as well as the BPT Application Guide from CharIN.

The company has partnered with power semiconductor manufacturer Infineon to develop a starter kit with an integrated 22 kW bidirectional converter and controller.

“The fact that bidirectional charging actually works according to ISO 15118-20 BPT is a major step forward,” said Xi Zhang, EcoG’s Director of E-mobility. “This allows the technology to be applied to the mass market, as customers can now be sure that their wallbox can communicate with any V2G-enabled vehicle in the field.”

“V2G as a standardized feature is essential for broad adoption of this technology,” said Heuer. “EcoG provides the V2G technology in the form of a starter kit to charger manufacturers to enable products with short lead time to market, and to OEMs for interoperability testing.”

Heuer told Charged that the key to enabling wider V2X tech is to make it available on a low-cost product. “When we look at chargers today, they’re built like photovoltaic inverters 20 years ago—they include something like 100 components. Today, if you look at PV inverters, we have maybe 10 components—and in the last 20 years, the price has declined by something like a factor of 10 to 20.”

Where does vehicle-to-grid stand today from a commercialization standpoint? Like most of the EVSE industry folks we talk to, Heuer concedes that V2G is still mostly a pilot-level technology, but he expects more commercial applications to start appearing soon. “We have several pilots, but Volkswagen recently announced that every Volkswagen is supporting V2G— it’s already in the menus of the vehicles.”

Ford, Hyundai and Tesla are also now selling EVs with power export capabilities, and the market for bidirectional-capable charging hardware could expand quickly. “With partners like Infineon, we are targeting this market, because then you are talking about 10,000 units per year [as a conservative estimate].”

Reliability, reliability, reliability

The poor reliability of public chargers is an industry-wide scandal. Some casual observers seem to assume that adopting Tesla’s NACS charging system will solve all the problems. However, like many industry players we’ve spoken to, Heuer believes that one of the main reasons Tesla’s Superchargers are so reliable is that the system is controlled by a single company—which will no longer be the case once large numbers of EVs from other brands start using the Superchargers.

“We have been working a long, long time in standardization, and I remember the days when we had the discussion of Microsoft versus Apple. Here we see basically the same. We see probably 20 or 30 implementations out there on the vehicle side and on the infrastructure side. With Tesla, you have both in one, and with their automation they can do testing to ensure that things are working with each other.

Right now, we’re looking at a landscape with about 100 charging station manufacturers and a growing number of EV manufacturers. Tesla might test its EVs with 5 to 10 charger types, but the broader challenge is much more complex. To achieve a truly seamless charging experience for any EV driver, we’re tasked with ensuring that every electric car can use any charging station. Achieving this interoperability means testing over 500 different combinations of cars and chargers.

“We’re tasked with ensuring that every electric car can use any charging station. Achieving this interoperability means testing over 500 different combinations of cars and chargers.”

One thing that will hopefully facilitate interoperability over the coming years is the fact that Tesla’s NACS is not radically different from CCS. “The plug is quite different, but all the processing behind it is quite similar,” Heuer explains. “That’s also the reason why in Europe they can easily use a CCS plug, and in US they have these adapters. Of course, in the foreground, it looks very different because the plug looks different. But in the background, the automation, the really complex stuff, that’s quite similar.”

“About two weeks after the announcement that Ford would adopt NACS, a customer of ours just added a Tesla cable to their CCS station, and the thing worked with a Tesla vehicle. That’s the nice thing. It’s no longer this competition between CHAdeMO and CCS, which were really totally different systems. Compared to CHAdeMO, I would say 90% or 95% is really the same between CCS and NACS.”

Some find it ironic that in Europe, Tesla adopted the CCS plug, whereas in the US, vehicle OEMs and EVSE manufacturers are adopting the Tesla plug. Heuer explains that there are several reasons for that. “One reason is that in Europe we have a three-phase AC system, so this would be a shortcoming of the Tesla plug because then they would be only be able to charge one phase. In Europe, we would then be limited to three kilowatts in most countries, maybe maximum seven. That’s one physical aspect.”

A second difference between the North American and European markets is that the latter has developed in a less vertically-integrated way. “The networks started quite early with roaming and so on—it was not so dependent on what network or mobility service provider you contracted with. So the advantage Tesla had compared to the rest of the networks was not so significant.”

The North American market could benefit by learning from some mistakes that were made in Europe. “There’s obviously a different development in markets and there are learnings out of that, which I think are beneficial for all. I think what’s interesting in North America to see is, how to integrate vertically like a ChargePoint, for example how to integrate direct payment via app or credit card, conveniently including all the processing behind it with logistics and so on.”

“On the other hand, I think Europe is doing quite well to think about this more collaborative role, how you create ecosystems. What we see right now in the market in US is really more the speed and integration, where we see more of an ecosystem approach in Europe. And now that things become more integrated with Tesla as a crystallization point, we have the opportunity to combine networks and to really move forward.”

This article first appeared in Issue 67: January-March 2024 – Subscribe now.