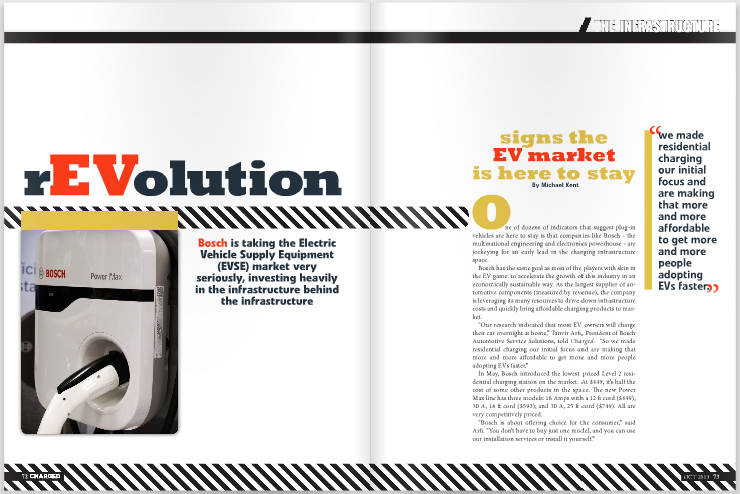

Bosch is taking the Electric Vehicle Supply Equipment (EVSE) market very seriously, investing heavily in the infrastructure behind the infrastructure

One of dozens of indicators that suggest plug-in vehicles are here to stay is that companies like Bosch – the multinational engineering and electronics powerhouse – are jockeying for an early lead in the charging infrastructure space.

Bosch has the same goal as most of the players with skin in the EV game: to accelerate the growth of this industry in an economically sustainable way. As the largest supplier of automotive components (measured by revenue), the company is leveraging its many resources to drive down infrastructure costs and quickly bring affordable charging products to market.

“Our research indicated that most EV owners will charge their car overnight at home,” Tanvir Arfi, President of Bosch Automotive Service Solutions, told Charged. “So we made residential charging our initial focus and are making that more and more affordable to get more and more people adopting EVs faster.”

In May, Bosch introduced the lowest priced Level 2 residential charging station on the market. At $449, it’s half the cost of some other products in the space. The new Power Max line has three models: 16 Amps with a 12 ft cord ($449); 30 A, 18 ft cord ($593); and 30 A, 25 ft cord ($749). All are very competitively priced.

“Bosch is about offering choice for the consumer,” said Arfi. “You don’t have to buy just one model, and you can use our installation services or install it yourself.”

The infrastructure behind the infrastructure

One of Bosch’s biggest behind-the-scenes investments in the charging industry is its sprawling network of certified and trained EVSE (aka charging station) installers. Establishing the network was a significant investment in both time and money, which is often overlooked by the average consumer. “Providing a true national installation program for an OEM partner essentially required us to launch a start-up business within the Bosch organization,” said Arfi.

Bosch partners with approximately 300 companies who work as installers. Each has to meet certain criteria, including specialized training, maintaining proper insurance, and passing business and criminal background checks. If you count the number of electricians in each company, you’ll find that there are more than 700 certified and trained in the North American network, and another 3,000 in Europe.

While the company continuously works to lower installation costs, it will never be able to beat the quote from your “neighborhood electrician” who does not have the same overhead or obligations that come with an OEM, utility or government agency partnership. A close look at the details of its network could help consumers understand why there is a price difference.

When a customer buys a charging product online and indicates interest in installation services, Bosch will coordinate with its dealer network to provide a free on-site estimate. It’s not uncommon for other companies to charge a fee for similar estimation services. Apart from the electrician estimate, Bosch employs experts who audit the installation quotes for accuracy and pricing, to match the company’s expectation for service, installation time and affordability. Most of the company’s charging products have a one-year warranty, and if the installation is done by a certified installer, a three-year warranty.

Bosch installers also will, in most cases, handle all local and federal rebate paperwork for eligible incentives, saving customers time and money. For example, Michigan residents can claim rebates of up to $2,500 for buying and installing charging stations.

All of that extra overhead – the training, legal expense, back-office support, computer systems and the three-year warranty on installations, etc. – is what makes it difficult for Bosch to compete with a neighborhood electrician who will do the installation for cash.

“We’ll continue to drive the cost out of our installation network,” Arfi told us. “The primary factor in that is volume, obviously.” He believes that as more OEMs launch new plug-in platforms – particularly high-end vehicles like the Cadillac ELR, BMW i3, and Porsche Panamera S E-Hybrid – the demand for white-glove installation support will only increase.

Financing for all

Along with the aggressive price point of its new product line, Bosch hopes that providing financing will help widen the field of buyers considering plug-ins. For EVSE and installation bills from $1,000 to $3,499, it offers zero percent down and no interest for 12 months. For purchases of $3,500 and up, a 2.99 percent interest, five-year plan is available.

“We really think that’s going to drive more adoption of Level 2 because the consumer is going to have another option,” said Arfi. “It’s not in any way tied to the vehicle purchase, so the financing is available to all customers through Bosch irrespective of which EV they purchase”

A unique pairing

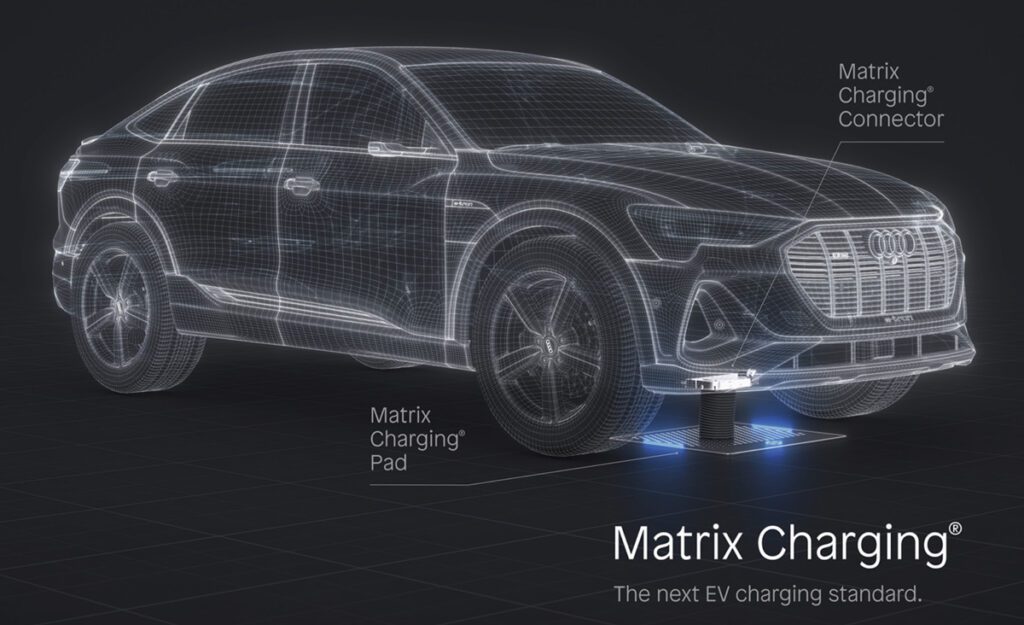

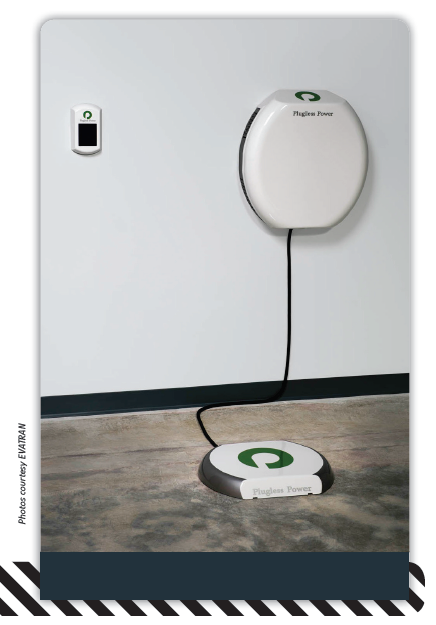

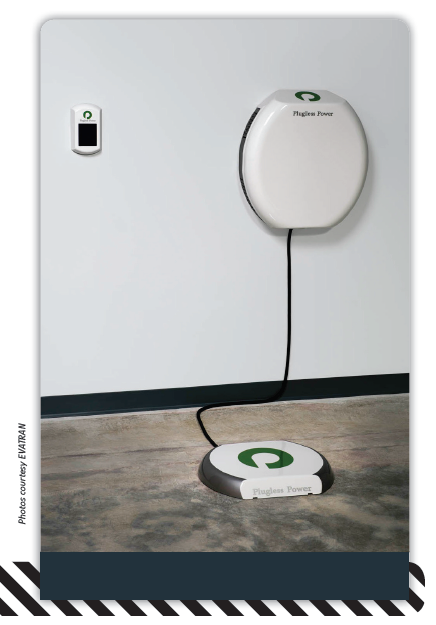

Through a partnership with Evatran, Inc. announced in June, Bosch has also delivered another first for the industry: commercially available wireless charging via Evatran’s Plugless system. In July, the pair began taking orders for systems that are designed as an upfit for the Nissan LEAF and Chevrolet Volt.

What makes this partnership such a good fit are two unique elements of Bosch’s existing infrastructure: its EVSE installation network and its nationwide franchise network of Bosch Car Service centers.

When a Plugless system is purchased through Bosch, customers bring their vehicle to one of Bosch’s 1,400 service centers in the US, where the aftermarket wireless vehicle adapter is mounted on the undercarriage of the vehicle. A Bosch-certified electrician will then install the parking pad and control panel equipment at the customer’s home.

Bosch reports “strong early interest” from LEAF and Volt owners. The 3.3 kW Plugless Level 2 system is priced at $3,098 for the LEAF and $2,998 for the Volt – which includes hardware installation on the car but not the electrical work at home. At that price, it won’t be for everyone, but Bosch says there are a lot of hand raisers who want to be the first to go wireless. Beyond that, the company thinks there will be a good market for EV drivers who already have a Level 2 corded system installed and want to exchange it for a Plugless system.

“There is cost involved with bringing a dedicated 240 V circuit to your wall,” said Arfi. “We believe that out of the thousands of people that have already done this, a good percentage of that population will want to go wireless. But it’s more than just dipping our toe in the water. We do believe that there is a real market for this.”

“If you think about it, most people don’t need Level 2 charging systems at home, but it’s a convenience and peace of mind,” said Arfi. “Wireless is just another level of convenience. It’s not going to be for everybody, but there will be a market for it.”

At the moment, there is no other company with a wireless system close to commercial availability. While other companies were working to install wireless charging during vehicle production, Evatran started with the aftermarket approach, partnering with Bosch for distribution and installation.

As the EV market expands in the coming years, Bosch’s early investments could prove to be a shrewd move that gives the company a solid foothold in an industry with gigantic potential. In the next few decades, it’s quite possible that the automotive market and EV market merge into one and the same. With the recent launch of its priced-to-sell Level 2 charging station and the first commercially available wireless system, the 130-year old company is delivering on its goal to help nudge the needle in that direction.

This article originally appeared in Charged Issue 10 – OCT 2013