It would be understandable to be a bit skeptical about Electrify America—after all, it was founded by decree of a court, as atonement for VW’s diesel-related dirty deeds. However, by all accounts the company is taking its mission to increase EV adoption by building a first-class charging network quite seriously, and is setting a fine example of how a nationwide network should be designed.

EA’s network was designed from the beginning to be future-proof—the company will invest its $2-billion budget over 10 years in 4 cycles, learning from each cycle before deciding how to proceed with the next, and taking advantage of the inevitable advances in charging technology

This future-oriented stance embodies the visionary, risk-taking culture that created the modern EV industry, but it hasn’t made for a problem-free rollout. EA was embarrassed by some highly-publicized customer service issues, but the company responded with cooperation and openness—it invited our colleague Tom Moloughney to its HQ, and he wrote a no-holds-barred piece for InsideEVs—and it seems eager to address the problems, and bring its service up to the highest standard.

EA might have avoided some of these early issues if it had taken the easy route and set modest goals. Instead, EA’s leaders have chosen to implement the newest and most forward-looking technologies—for example, installing 350-kilowatt charging stations, even though cars that can take advantage of this much power won’t be on the roads in significant numbers for a few years. “We deliberately selected the most challenging road because 50 kW is the past,” CEO Giovanni Palazzo told Tom. “We wanted 150 kW to 350 kW. That decision challenged the industry because the product simply was not there.”

The company has also made a point of being inclusive, testing every single new EV model to make sure all of its stations will deliver a good charging experience to all drivers.

Many of the challenges stem from the sheer speed at which Electrify America is moving—it installed its first DC fast charger in May 2018, and now has 315 stations with nearly 2,000 charging posts in operation. Cycle 2 of the investment plan began in July 2019, and will continue for another 2 years—when it’s done, EA will have 800 locations with 3,500 chargers.

EA’s rapid success is largely down to the highly skilled team it has assembled. COO Brendan Jones is one of the most experienced execs in the EV infrastructure space, having been a Director at Nissan, a VP at EVgo, and a board member at the Roaming for EV Charging Association and the Electric Drive Transportation Association. He recently spoke with Charged about the electrified road ahead.

Charged: In Cycle 1, EA focused on highway infrastructure, installing fast chargers along the country’s major travel routes. We understand that, in Cycle 2, the focus will shift to urban charging sites.

Brendan Jones: The only one of the big routes we didn’t cover was the Northerly route. What we’re doing right now is adding some regional routes and some gap fills, [but] we’re focusing over 75% of the allocated funds [for Cycle 2] in metros across the country—we’re in 28 metros. All of that investment is 150 kW and above. Some of the metros are getting 350 kW, if the station has proximity to a highway.

We’ve deployed faster at a higher [charging] speed than any company in the history of EV charging in the US, which was quite an accomplishment. But that accomplishment may come with some complexity [in terms of] managing multiple manufacturers, multiple chargers, new levels of charging that no one has seen before, with a plethora of new product coming on the market from OEMs. All of that is a bit of a challenge, but it’s a challenge we have a plan for.

Charged: What about Level 2 chargers?

Brendan Jones: We did do some Cycle 1 investments in L2 chargers, primarily in multifamily dwellings and in workplaces. We’re doing a little bit different take on L2 chargers for California and the 50 states in Cycle 2. In California, we have an obligation to [invest in] charging that serves rural communities on an L2 basis. And we’re figuring out methodologies with CARB in California, on how to make home charging more accessible through a variety of tools and services, that we’ll have more details on in the coming months.

Charged: California has implemented some new regulations—pricing rules that require operators to charge by the kWh, not by the minute, and a requirement that most public chargers have credit card readers. These requirements are bound to require major changes in the industry.

Brendan Jones: They provided enough lead time on it, and we have the programmers and our network specialists well in front of it. So, from Electrify America’s perspective, we will meet it, no problem. All of our chargers already have credit card readers on them.

We’ll be able to reprogram the chargers to eliminate the per-minute pricing across the entire portfolio for California, hopefully with no physical changes to the chargers, just software changes to the backend system. And [that] sets us up for when other states convert—we’ll be able to do that. The industry is moving in this direction, and I think the customers want to see it that way. It’s more transparent in the end to the customer. California did the right thing in terms of providing the requisite lead time to get this done, and we’re in a very, very good position to meet that challenge without limitation.

Charged: The only real reason for charging by the minute in the first place was that some states don’t allow selling by the kilowatt-hour. Is that situation changing?

Brendan Jones: Not all the states have converted yet—there’s a few stragglers out there—but with this initiative in California, we will build the ability to convert wherever we need to. I think some states are going to come around and do it this way because consumers are going to want it. Some of the other states, I don’t know—it depends on what their priority [is] on EVs in general. But down the road, I see [per-kWh pricing] as the unit of measure as EVs get up to five, six, seven, eight, ten percent market share across the nation. California is already at five and six, so it makes it easier for them to be the leader on this. But they’ve always been a leader in EVs as a whole, so they’re just leading on this one as well.

Charged: EA works with four different charging station manufacturers—Swiss giant ABB, Portugal’s Efacec, South Korea’s Signet EV and California-based BTC Power. It was an arrangement born of necessity, because EA was determined to provide 350 kW DC charging stations, and no single vendor could provide the needed volume—more than 2,000 chargers—in a short period of time. It sounds like the experience of working with four companies has been mostly positive, but will EA be narrowing the field in the future?

Brendan Jones: We’re still working with the four. We’ll have an announcement later if we’re still buying from all four of them. But we’d maintain relationships with all four, of course, for continuity of service and parts supply and technology updates, even if we’re not buying chargers from some of them anymore. But definitely, the goal as we move forward is to get more efficient, and to commonize platforms so that you’re not managing a multiplicity of chargers in the long term.

They’re all four good partners. We made a decision at the beginning to commonize the [user display screen], which is referred to as the HMI [Human-Machine Interface]. No matter if it’s a BTC, an ABB, an Efacec or a Signet charger, you have the same look and feel on the screen. That took a lot of collaboration, and a lot of complexity with the manufacturers to commonize everything on the HMI front. But we believe that, long-term, that was the right move for the customers, so they don’t get a different look and get confused, depending on the equipment. While it’s different manufacturers, the look and feel and process is identical across all of them.

Charged: What tips would you give to a charger manufacturer? How can they make a better product, from the network standpoint?

Brendan Jones: The more open the manufacturer is to the addressability of that charger from the network, meaning you can solve a lot of charging issues over the air, the better, because most things today, including cars, are very software-driven. The more firmware and software upgrades you can do over the air, the more cost-effective it is to service those chargers and to provide a better charging experience.

Chargers aren’t that different than gas pumps—they have a lot of parts inside them. A lot of these parts are electronic, and they’re subject to the same environmental issues out there—wind, heat, cold, precipitation. You walk into gas stations, you see one, two or sometimes three pumps that are out of order. All of them need to be serviced. The advantage that we have in chargers is that, as we move forward working with charger manufacturers, we can have a lot more addressability, fix a lot more of those problems over the air, without having to roll a truck and without having a disabled unit out there. That’s the goal. [The four suppliers] are all doing pretty good on this, and we have a window into the chargers, so we can do our diagnostic work and resolve problems before they happen.

Charged: You must work with many different utilities. What are some of the challenges of getting the required power on site?

Brendan Jones: We’re fortunate that [although] there are over 2,500—some say 3,000—utilities across the US, we’re only dealing with around 200 to 230 of them in our installations. We have a concentration in California of chargers that are going in the territories of PG&E, Southern California Edison and San Diego Gas & Electric.

There have been challenges with PG&E—but you might imagine that when you’re dealing with rolling blackouts, to prevent fires, a lot of the folks are working on those. Some of them may be the same people that you’re waiting for to energize the charging sites. With that, you have to take a deep breath. What they’re doing is for the public good, so we support it. We work closely with them.

The utilities are, today, very engaged in the EV infrastructure space. They have been very, very good partners to Electrify America, overall. In certain cases, we wish they would move faster, because we’re moving at a pretty breakneck speed, but by and large, they’re attentive to what we ask for. When we ask to have meetings to clarify certain [issues], they do.

When we first started installing chargers in the US, we just stuck a charger wherever we could, and we typically put that charger on host power. A lot of times, when we first began doing DC fast charging, if we installed two chargers, that was the exception—most of the time it was one. If you look at where we’re at today, we’re building much bigger stations. Instead of being on host power, we’re asking the utility to bring in a new transformer. We’ve increased the complexity, but we’ve also increased the sustainability, and we’re future-proofing the installation. As we’ve upped our game, we’ve also asked the utilities to up their games.

So, they’re being good partners, but everybody has to catch up with the speed and the power needed to serve the vehicles that are coming on the market today, tomorrow, and into the foreseeable future. We’ve seen announcements coming from Rivian [about a pickup] that has over a 400-mile battery on it—that’s going to need a lot of energy to charge.

Charged: Every EA charger provides dedicated power, without power sharing, so the maximum load of a fully built-out site could theoretically be as much as 1,900 kW (8 times 150 plus 2 times 350). That’s a lot of juice!

Brendan Jones: We commit to every OEM that their vehicle will receive dedicated power. So even if that station’s full, we don’t curve back, we don’t throttle back, we don’t power-share. The largest investor in the EV space is the OEM. They put more capital—in the hundreds of billions of dollars—in this space than anyone else. And when they go to sell that car, they need to tell that customer, ‘You can charge at this rate at this charger.’ If we power-share, then that customer promise goes down the drain. So we dedicate every charger, and that requires a bigger level of commitment with the utility, a larger transformer and a future-proof charging station, where you have the requisite power modules to be able to service each one with dedicated power.

Charged: Demand charges—extra, and potentially enormous, fees that utilities charge commercial customers for using energy at peak times—are the bane of the charging industry. Mitigation strategies, such as adding battery storage, can shave the fees, but demand charges are still a major factor that network operators have to take into account. In 2019, Southern California Edison announced a moratorium on demand charges for five years. EA must have been happy about that.

Brendan Jones: That was a great move—we certainly hope that they make that a permanent position. It makes the economics of charging for the public sustainable for the long term. What we do, and what every other charging company does, is absorb demand charges internally. Because if we pass the demand charge on to the customer, it would be $125 to $140 to begin charging a car, if you charge during peak demand. So, with Southern California Edison waiving [demand charges] for a period of five years, that makes the economics lots more sustainable, and we can plow more money into capital investments and build more chargers. For the industry as a whole, it’s a very bright move for the sustainable future of the EV. Because eventually, if demand charges stay where they are today, the sustainability on the charging side becomes a question. Not that it can’t be done, but it’s much harder to get done.

Charged: What are some major lessons you’ve learned working with the site hosts?

Brendan Jones: Lots. We learned a lot by making a lot of mistakes. When we deal with a site host, first we have to give them a commitment that we’re going to take care of everything for them. We don’t want to be on their power because we don’t want to interrupt that site’s ability to expand their own footprint in their operations. We want to make sure we bring in power for them instead of being on host power. When you do that, they see [charging] as a convenience to their business as opposed to a burden on their business. So, that’s one big lesson learned.

Also, make charging more meaningful and aesthetically pleasing. You’ve got to have an eye towards quality if you want to attract quality sites. The better you build it, with more quality and aesthetically pleasing elements [the more you can] sell it as an amenity to the site owner.

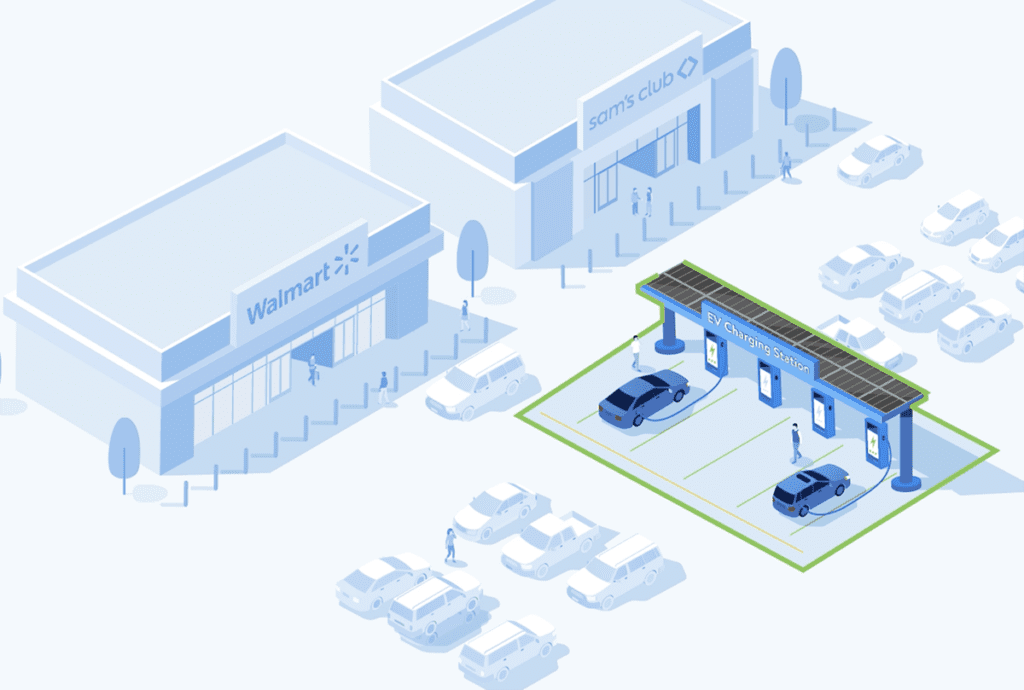

If you look at Walmart and Target and then look at the buying demographic [of] some of the EV drivers that are out there, they’re getting a new customer that they might not have ever seen before. Some of our site owners are very enthusiastic about that, especially when you consider some of the new vehicles that are coming out.

We’ve got an interesting relationship with Bank of America, because a lot of their locations are within previously established retail areas, and they can have [drivers] come to charge [and] use the B of A for banking services, and also have other things to do while they are parked. Bank of America’s done a great job on placement of their banks in [high-traffic] retail areas. Customers are drawn not just for banking services but for other purposes, and that convenience factor that B of A established with their customers works to our advantage as well, so it’s a big win-win.

These are some of the nuances when we’re looking at sites: Do you have everything a customer wants? Do you have a well-lit area? Does it have 24/7 access? Are the sightlines and safety good? And as you might imagine, banking services, because they have ATMs, are very particular about the way they place their centers, and the way they light their lots. So that was a big win for us. The Ohio Turnpike was the same thing—they had great concessions as a site host on the turnpike. The customers come in, they hook up to charge and within one minute, they’re inside the concession, using the bathroom and getting some food.

We don’t place chargers around the back—it’s front and center. Feel safe where the charger is, good sightlines, good light. And where some of our site hosts are a little light on lighting, we do lumens tests. We’ll go in there and add additional lighting around the chargers, so that it’s bright all the time for the customers.

Don’t put a charger where the customer doesn’t have anything to do, or doesn’t feel comfortable going. At the beginning we installed chargers like that because we were mostly focused on managing how things got in the ground. Now the quality of the site host is premium and the customer experience is premium. That’s what we focus on. Place chargers in locations that our drivers want to go to, not that they are forced to go to because that’s the only place to charge.

Charged: In the frontier days prior to Electrify America, a lot of chargers got installed wherever it was cheap and easy. But you had already been through all that, and by the time you got started you had a much better idea about the best places to locate charging stations.

Brendan Jones: Yeah. We learned a lot in the lessons of the past and focused on the EV driving public and where these chargers need to be.

The visibility of those chargers is [also] key because when you see it, then you get range confidence: ‘Hey I can fill up in a multiplicity of places.’ I mean, you can see them on the app, but when you see them with your eyes, just like when you move into a new neighborhood and you drive around and see the gas stations, we want people to move into a new neighborhood and see the chargers.

Highway chargers are easier to put in than metro chargers. Metro chargers, the logistics is making sure that you’re reducing the size of the equipment and the efficiency of the space so that you can put two, three, four, even five chargers into a densely populated metro area. And we’ve made a lot of progress on reducing the size of our installations. For every logistical problem we have, we keep coming up with new solutions, and I’m not talking just Electrify America, the industry keeps being innovative and bringing positive change.

Charged: What about those poor souls who live in urban locations, and have no assigned parking spaces?

Brendan Jones: We need more public charging and more accessibility. The ideal state [is like] a three-legged stool. In the ideal case you get all three: home charging, workplace charging and public charging.

On the public [leg], that’s where we need to make sure that it’s fast fueling, so that we get them in and out. And that’s why we adopted 150 kW and above, to make sure that they’re not spending a lot of time on that public charger. If they don’t have [charging] at home, we make it as quick as we can for them, and they can get fueled up and get on their way.

Charged: Plug and Charge (based on the ISO 15118 standard) will be introduced in 2020, enabling charging with no need for a credit card or an app to initiate a charging session. Drivers will simply pull up and plug in (as Tesla owners do at Superchargers), and the station will identify the vehicle and automatically bill the customer’s account for the session. How’s the implementation of that coming along?

Brendan Jones: EA is 100% committed to Plug and Charge. All our hardware is capable. I can’t tell you who we’re working with, but we’ve made a significant amount of progress, and as long as an OEM wants to put in that feature, EA can enable it for that car. We will enable every vehicle they bring to us—we will make sure the charger can do it.

This article appeared in Charged Issue 47 – January/February 2020 – Subscribe now.