The European oil giants Total, BP and Shell have been buying up assets all along the EV charging value chain. The latest news is that Shell has agreed to buy 100% of the European charging network ubitricity.

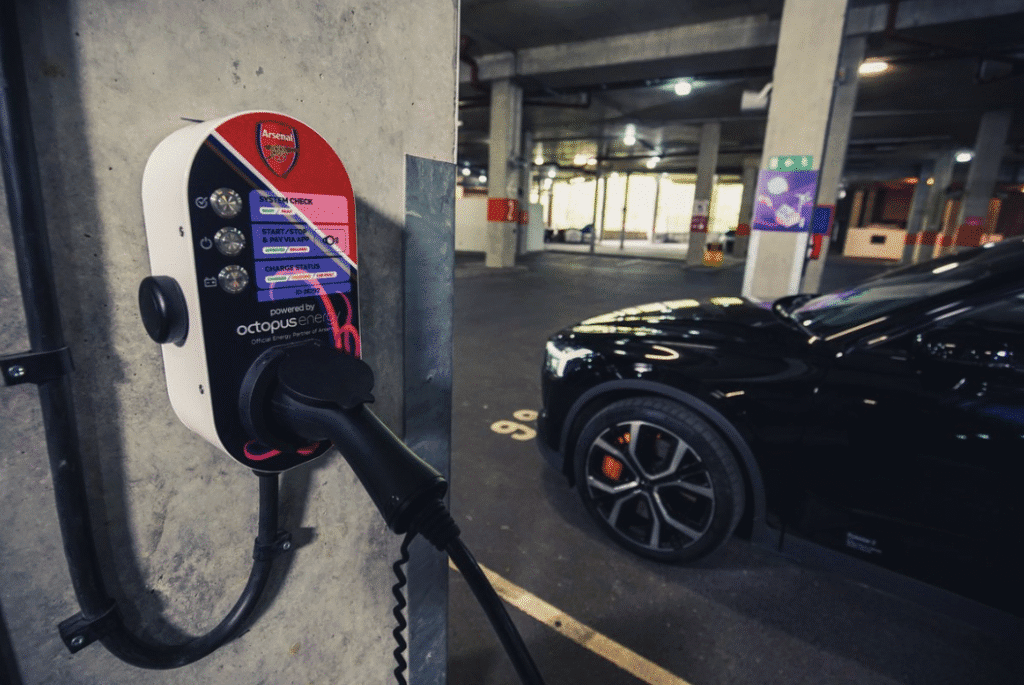

Founded in Berlin, ubitricity operates in a number of European countries, and claims to be the largest public EV charging network in the UK, with over 2,700 charge points (a 13% market share). The company also operates public charging networks in Germany and France, and has installed over 1,500 private charge points for European fleet customers.

ubitricity specializes in integrating charging into existing street infrastructure such as lamp posts and bollards, a solution that could make EV ownership more attractive to city dwellers who don’t have private driveways or assigned parking spaces. “Our integration of EV charge points into existing on-street infrastructure makes EV charging easy and accessible for everyone who needs it, where they need it. Particularly in larger cities where there is limited access to off-street parking, this is the solution many people have been waiting for to allow them to transition to EV ownership,” said ubitricity CEO Lex Hartman.

What’s behind the oil giants’ investments in EV charging?

The optimist believes Shell et al when they say they are preparing for a transition to a post-petroleum future. Commenting on the ubitricity acquisition, István Kapitány, Executive Vice President of Shell Global Mobility, said, “We want to support the growing number of Shell customers who want to switch to an EV by making it as convenient as possible for them.”

Shell has said that it hopes to become a net-zero-emissions business by 2050, and BP and a few other fossil fuel firms have made similar statements. The Financial Times reports that Shell is expected to release a plan to reach its net-zero goal at an upcoming strategy update.

The skeptic (or conspiracy theorist?) wonders if the oil majors’ real aim is to gradually strangle the EV charging sector, helping to make EVs less attractive than vehicles powered by hydrogen, which is made from fossil fuels. Shell already operates over 1,000 DC chargers at some 430 retail gas stations. It is also one of the world’s largest providers of hydrogen—it operates dozens of hydrogen fueling stations in Germany, and a few in the UK and California.

FT opines that “while top leaders at [Shell] plan to accelerate spending into cleaner businesses, they are also wary of abandoning lucrative legacy hydrocarbon divisions too soon,” and notes that “demand for petrol and diesel is expected [by whom?] to remain robust for decades to come.”

See also:

- Oil giant Total acquires London charging network

- Shell to acquire home energy storage company sonnen

- Shell acquires EV charging management software company Greenlots

- BP to acquire UK charging network Chargemaster

- BP invests in mobile EV charging company FreeWire

- BP invests $20 million in battery developer StoreDot

- BP invests in Chinese charging platform PowerShare

- BP sees big opportunities for EVs and has recently been investing in EV-related companies

Source: Ubricity, Financial Times