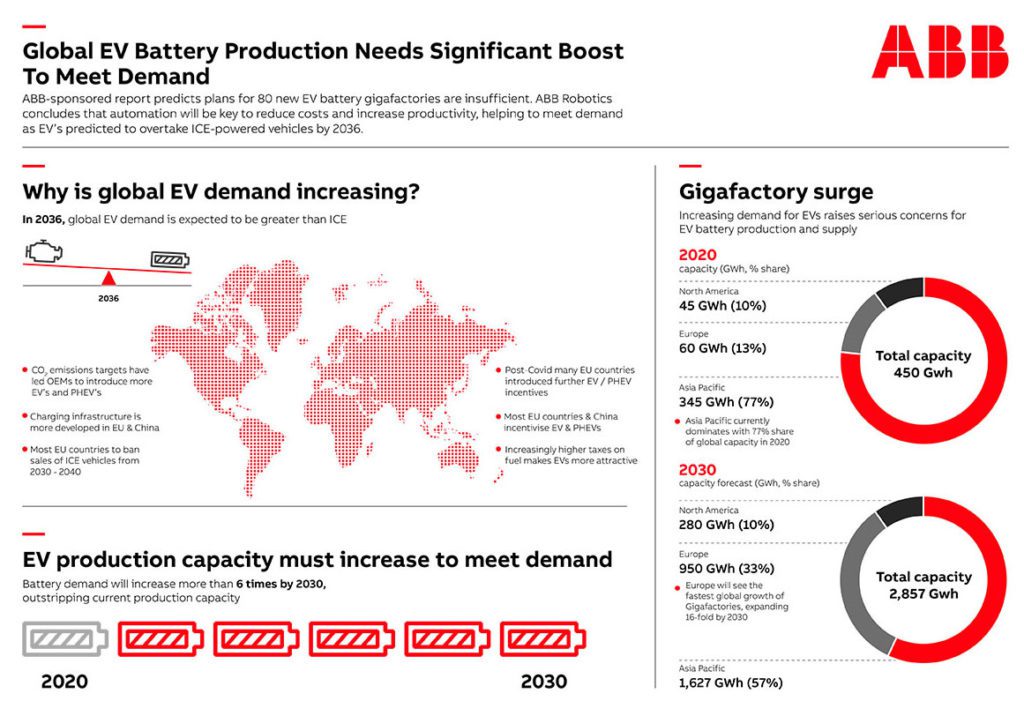

As demand for EVs escalates, the supply of batteries could become a bottleneck. Global firms are collectively planning to build 80 new battery gigafactories (sorry Tesla, but everyone’s calling them that now). A new report sponsored by ABB Robotics and authored by the automotive intelligence unit of Ultima Media suggests that this won’t be sufficient.

The new report, Electric Vehicle Battery Supply Chain Analysis, predicts that 2036 will be the crossover year in which sales of passenger EVs will overtake sales of legacy ICE vehicles.

“While we forecast global EV sales to grow by a remarkable 21% CAGR over the next decade, the increase in battery production and capacity will be even higher,” write the authors. “That is because the kilowatt hour (KWh) battery capacity required per vehicle is likely to rise as well. Thus far, fully electric variants have tended to be of the smaller to mid-size models in an OEM’s range, which were easier to electrify to meet emissions targets. But OEMs will increasingly be compelled to electrify most if not all of their fleets. The increase in the e-SUV globally and electric pickup truck segment in North America, for example, will likely increase battery sizes and thus battery demand.”

“Battery production will thus need to increase faster than EV sales volumes would suggest. Furthermore, battery capacity needs to exceed demand significantly because the theoretical maximum capacity of battery plants is rarely achieved as a result of technical and logistical issues. For example, there may be a slowdown due to a shortage of cobalt, cathodes or quality control issues, which could mean that not all cells produced will be viable. A rule of thumb is that a realistic production output is around 70% of the stated maximum capacity.”

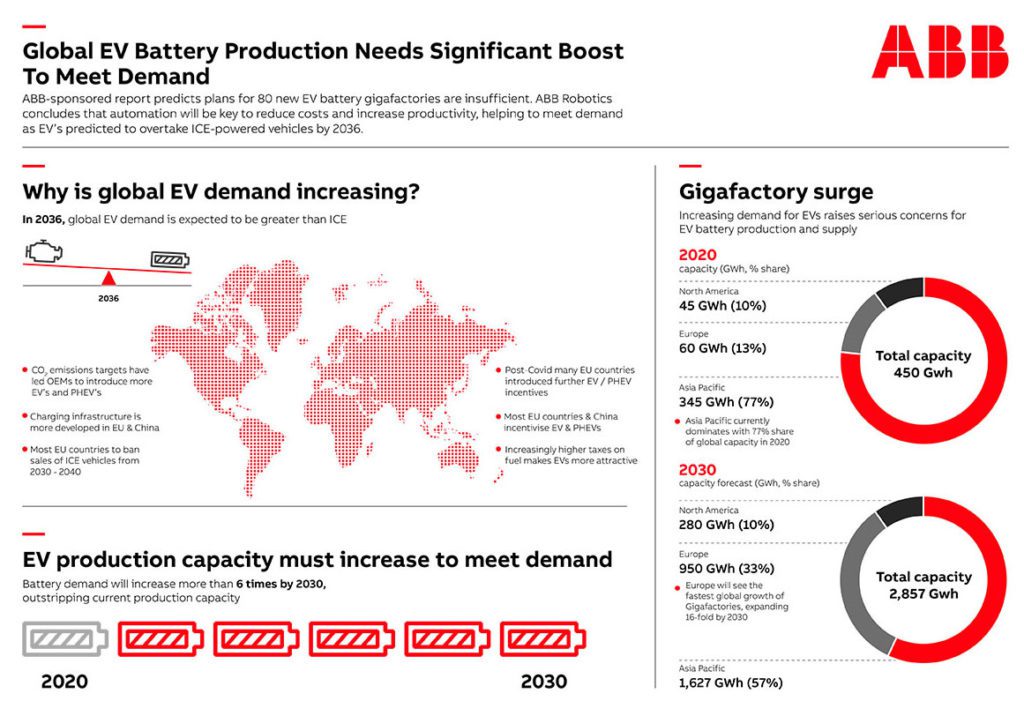

The report forecasts that battery demand will rise from 330 GWh in 2020 to 2,180 GWh in 2030, and that battery production capacity will rise in the same period from 450 GWh to more than 2,857 GWh.

The report’s researchers note the importance of battery pack assembly being located close to or within car assembly facilities. “Co-locating battery pack assembly not only boosts sustainability by reducing transportation, it increases flexibility. A cellular approach to production is easily integrated alongside existing lines. If the demand curve moves, cells can be added or removed quickly to maintain accurate production scale.”

ABB sees its industrial robots as a key to improving battery manufacturing productivity.

Increasingly we see that higher productivity and lower costs are driven by assembling battery cells straight into packs,” said Tanja Vainio, Managing Director of ABB Robotics Auto Tier 1 Business Line. “ABB is working in partnership with a number of manufacturers to increase productivity, quality and safety levels, as well as reduce finished pack costs through automated assembly—vital if EVs are to meet their required cost and adoption targets.”

Automation is key to increasing assembly safety, quality and traceability and delivering battery technologies cost effectively, which is critical to the expansion of electric vehicles,” said Vainio. “With production speed and flexibility essential to the successful scale-up of the EV battery industry, our cellular production architecture enables manufacturers to quickly validate a cell design and then roll out production cells globally with uniform quality, safety and productivity standards.”

Source: ABB