- A charging hub for heavy-duty vehicles requires a tremendous amount of power, and local utilities can take years to install new electrical service. Part of Zeem’s competitive advantage is that it has secured access to plenty of power in a prime location near LAX.

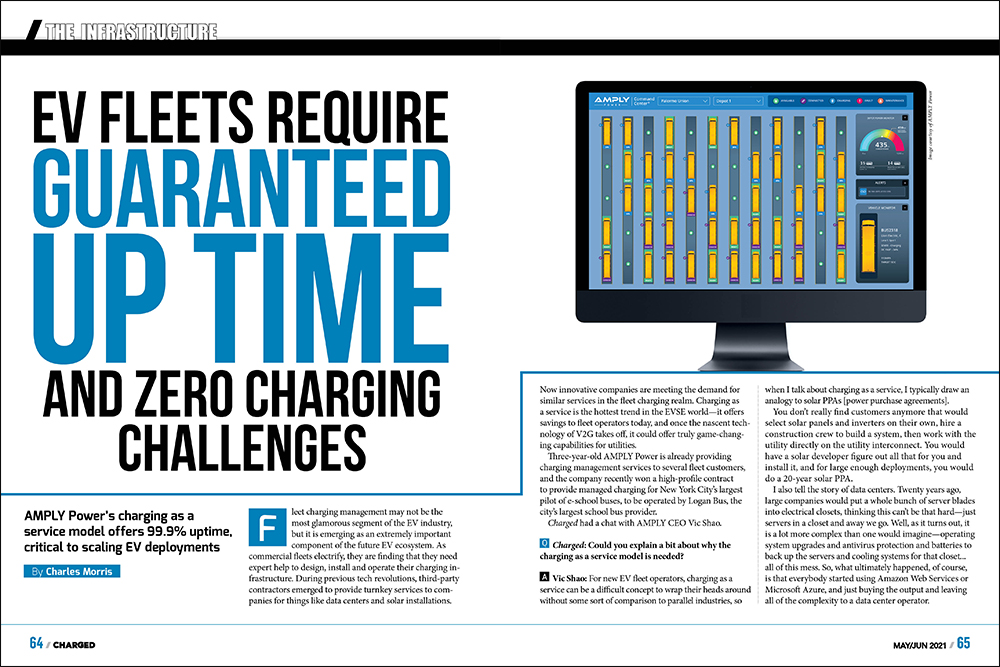

- Charging-as-a-service is a popular option for fleet operators who want to focus on their core businesses and let experts handle the charging infrastructure. Zeem’s fleet-as-a-service model adds vehicle leasing and ancillary services to the equation.

- Zeem is able to offer a cost per mile below that of diesel, thanks to California subsidies. Gioupis believes that, as more economical electric trucks come on the market, using Zeem’s model, the need for subsidies will fade over the next three to five years.

Q&A with Zeem Solutions CEO Paul Gioupis.

Charging-as-a-service is a hot business proposition these days, and for good reason. Electrifying a vehicle fleet is a complex undertaking that requires specialized skills and resources that most companies don’t have. It makes sense for organizations to focus on their core activities, so just as they outsource things like IT or building maintenance, many want to outsource the charging infrastructure for their electric fleets.

A growing number of companies, including vehicle OEMs and specialist startups, are responding to this demand by offering charging-as-a-service. A few are going a step further and offering the whole enchilada: fleet-as-a-service, which includes not only everything to do with charging, but the vehicles and their ancillary services such as maintenance, warranties, insurance and even supervised overnight parking. A fleet operator no longer needs to actually operate a fleet—all a company has to do is provide the drivers and load the trucks.

One of the (many) difficult aspects of setting up infrastructure is securing enough electrical power to charge large numbers of electric trucks or buses. Getting local utilities to provide new service can take years. Companies that can secure adequate supplies of energy up front—staking out the electrical real estate, so to speak—have an ace in the hole. That’s part of the competitive advantage of Zeem Solutions (the name stands for ZEro EMissions).

Charged spoke with Zeem Solutions CEO Paul Gioupis, who’s been involved with commercial EVs since the early days, and he had a lot to say about various aspects of fleet electrification.

Charged: Covering electric truck OEMs over the past few years, it used to puzzle me that companies kept going out of business, but it finally dawned on me that fleets weren’t willing to go all-electric without doing lengthy pilots. They wanted to buy one or two trucks and test them for several years, and startup companies couldn’t stay alive that long. It sounds like you went down that same path and you found a way to sidestep all that.

Paul Gioupis: I started off in the EV industry in 1998. I was involved in the funding of Smith Electric Vehicles, and I helped to build the entire technology stack on the vehicle—battery system, wire harnesses, onboard charger, battery management system, you name it. I helped them source it, pulled together partners, and they either white-labeled it or built it on their own.

Fast-forward to 2017. Smith Electric didn’t succeed. I started to see that there were dozens of OEMs that were starting to build commercial electric vehicles, and that there was quite a bit of commonality in the components. When you look at things like controllers, motors, e-axles, really not too many manufacturers are out there.

I got compelled to start Zeem about five and a half years ago, and started to realize that the vehicles and the charging infrastructure were commoditizing. So we started focusing on the services. We started as a call center and made over one million phone calls to fleets all across the United States. We had a qualification process. How many vehicles in your fleet? Do you run 150 miles, 200 miles or less? Do you own or lease your vehicles and your facilities? How much power do you have? We took all that information and qualified over 14,500 prospects who were ready to convert to electric

We started acquiring vehicles about four years ago. At the time, there were eleven OEMs. This is your Lightning eMotors, Motiv, Phoenix Motors—early days. I went to all of them and said, “I want to buy one or two pieces, I want to run them around for a while, come back to you, give constructive feedback, build the product to what our fleets are suggesting, and then from there we’ll place large volume orders.”

I realized the future wasn’t going to be building the electric truck, it was going to be providing the service.

We gave deposits to eleven companies, and four delivered (a bunch of them went out of business). Then we worked closely with them on cultivating the product and fixing issues that fleets would point out to me. That helped us get our vehicle mix to what we have today. I started bringing these vehicles to fleets in New York, New Jersey and California. I realized that our sales team kept sending me to all the same places. I would end up by the airport, by the port, or by the distribution centers, and I started to realize that’s where this EV activity’s going to be.

Because I was funding Smith, every single OEM came to me and said, “I need money.” I saw them from day one, and I realized that they didn’t have enough capital or engineering power to keep up. So I realized the future wasn’t going to be building the electric truck, it was going to be providing the service.

I started asking potential customers, “What if I centralized my location? If I was within a few miles of your operations, if I had the EVs and charging infrastructure, if I was servicing, maintaining and housing the vehicles overnight, is that something you would consider?” And we had over 80% of fleets say, “Yeah, if you took on everything and it was just turnkey for me, then I would consider it.” So it started compelling us to look in certain areas, and we arrived at LAX [Los Angeles International Airport].

Around LAX right now we have over 400 fleets that are qualified. They aggregate to 6,500-plus vehicles—buses, shuttles, Class 8 tractors, box trucks, vans, and so on. That vehicle mix helped us determine that this was a good place for us to be.

We’re in Southern Cal Edison territory. We did a capacity study in the area and we realized that there was a very tight industrial zone right outside of LAX, where we had this huge interest from customers, and there was seven megawatts of available power that was sitting on the grid at that time. So we said, “We want to take all seven megawatts. We’re going to put in an EV charging depot.”

Around LAX right now we have over 400 fleets that are qualified. They aggregate to 6,500-plus vehicles.

The Charge Ready Transport Program with Southern Cal Edison (SCE) is fantastic. Our team is very fluent on it. That’s a big basis of our business. We know all the utility make-ready programs across the US. It’s first-come, first-served at the utility. “You want seven megawatts? What’s your vehicle purchasing schedule?” The moment we came back and said, “We have 70 vehicles in the fleet right now,” the utility said, “We can deliver that load to you. You actually do need all seven megawatts.” And they assigned us every bit of capacity that was available on the grid.

Now, all of that is significant, because if anybody wants to come in to build charging in this area, they just can’t get power. Get in line. To get a primary electrical line—minimum four to five years.

So we locked in all the capacity, then we put in what we think is the best design to maximize vehicle parking and charging overnight. We were in a prime area where electrification was going to happen very quickly. We are trucks-as-a-service, and we are the only group that I know of that actually owns a site, has vehicles in the fleet, owns charging infrastructure and has contracted customers.

We are trucks-as-a-service, and we are the only group that I know of that actually owns a site, has vehicles in the fleet, owns charging infrastructure and has contracted customers.

Charged: It sounds like you got in early and grabbed all the electrical real estate. Are there other fleet operators that now want to get that capacity, but find that you’re already sitting on it?

Paul Gioupis: The answer is very much yes. The first phone call I made when we energized our first chargers was to Los Angeles World Airports [aka LAWA, the owner and operator of LAX]. They’re famous for having a very aggressive electrification program. I notified them that this would be very challenging for them to do. They said, “No, no, we buy a lot of power from the utility. We’re going to have no problems getting the power we need.”

About two weeks later they came back and said they were given a timetable of minimum three years, top five years. This is LADWP [Los Angeles Department of Water and Power] and this is LAWA, so you’d imagine that there’s some sort of priority. There’s just not. It simply takes time to build more capacity.

Charged: Zooming out to the larger industry, what about the hundreds of other fleets across the country that want to electrify? Are they all going to have to wait five years to get powered up? Is this a huge bottleneck for electrification?

Paul Gioupis: It’s fragmented. Certain areas, there’s power availability. In Newark, for example, you could just about get as much power as you want within six to nine months. There are some areas of California where you can get really good power access. Washington state has an abundance of power very cheap from all the hydro. But where that scarcity issue is, is where all the fleets are: Chicago, New York City, primarily in the big cities where you’re going to get first-mover adoption.

It’s fragmented. Certain areas, there’s power availability. In Newark, for example, you could just about get as much power as you want within six to nine months.

So, for the next two to three years, part of the art of Zeem is: Where are those areas? Where are those customers ready to move right now? What Zeem is going to do, we’re going to show them what a depot looks like. We could take 20, 30 different operators on one single site. We could take a van all the way up to a tractor, manage that on this lot. We’re going to coin depot-as-a-service. I can come in there with my team and say, “This is how much power you have today. This is your crawl-before-you-walk scenario.” And then we would help them build the infrastructure for the next three to five years.

Charged: So you’ve got your site there at LAX that’s up and running, and you’ve got customers. Have you got some other locations in the pipeline?

Paul Gioupis: We have a very aggressive rollout plan over the next three to five years. What I can tell you is that the next sites are going to be Newark, New Jersey, and Savannah, Georgia. We have two other sites that we’re looking at in California where I think we’ll [soon] have executed leases and be starting to move on populating those depots.

Charged: Tell me more about the various ways of optimizing power consumption. Vehicle-to-grid (V2G) tech is a hot topic these days.

Paul Gioupis: We’re very mindful of the grid pull. There is very much truth to all the EVs draining the grid. And there’s a way to build these depots consciously from day one to be generous with the grid. How do you really scale EV charging? How do you use the energy the right way? Push it back and forth. Because it’s not a myth about the power draws. We need to be smart about how to address that, and I think the true answer is bidirectional charging. If you understand bidirectional charging, it’s a perfect fail-safe for keeping a depot like ours going.

Vehicle-to-grid works really well at your own site if you have 200 vehicles, which is more than 200 megawatt-hours of battery sitting there, and you have the highest-capacity [bidirectional] chargers that are smart and can send energy back and forth. If I’m drawing 10 megawatts and then suddenly everybody flips their air conditioner on, I want to be able to push that load right back and do it instantaneously, and to do that understanding that between 4 and 9 pm in California, specifically in SCE territory, we need to be giving back. Those timetables change throughout the country, so we are intimate with the timetables of the utilities, and the time-of-use rates.

Charged: How many megawatt-hours of battery capacity do you have on your lot at the moment?

Paul Gioupis: Right now, with just 70 vehicles, we have a little bit more than 35 megawatt-hours. That is a lot of power. You could power a small city with that kind of power. And when we are fully stacked, now we’re talking like 70, 80, 90 MWh plus. If you took a hundred of those Nikola trucks as an example, that right there is 73 MWh.

Charged: Do you need to have a large-scale charging operation to make V2G practical?

Paul Gioupis: Very much so. You must have a lot of scale. We are at the core of the largest vehicle-to-everything MOU, with the Department of Energy, California Energy Commission, National Electrical Contractors, Volvo, BYD. We are in the middle of this. Zeem is the only as-a-service company to have a depot with chargers and vehicles already running.

The pioneer of vehicle-to-grid is part of my team. His name is Tom Gage. I watched the BMW i3s at Delaware University [an early V2X pilot], and my mind was blown. Owning the assets and having the right charging equipment on the site for bidirectional charging, and seeing that vision through that Tom saw in 2009—that is a very important part of the foundation of Zeem going forward.

Charged: What about solar+storage?

Paul Gioupis: There’s not enough on-site generation possible from solar to support a large commercial EV depot. Take an acre of solar, and that’ll charge a few vehicles maybe, but not enough to really support a location. I think in the future, load management is going to be the most impactful way to manage power. You may have a nameplate capacity on a charger of 100 kilowatts, but you can have software within your system that could knock it down, so you’re not pulling so much power from the grid. Or you could take a lower amount of power, spread it across a number of chargers and get a lower output.

That load balancing software is out there. There were a couple of names that really dominated that market, but there’s new entrants now that have come on like bp pulse that I would be happy to put out there. Prior to that, PowerFlex was the best. The good news is that load management software is becoming more widely available.

Another snake oil sales group is the battery guys. I’m always asked, “How much storage at the site?” People come and say, “You need five megawatts of storage,” and I say, “How do you know that?” “Well, we’ve done this simulation, and we’ve taken data from this one truck and then multiplied it by 50.” None of that stuff is really going to work.

Charged: Charger reliability is a huge issue. Your chargers are not public chargers, but I have a feeling you have some ideas about why the uptime is so bad. Why do these darn things not work?

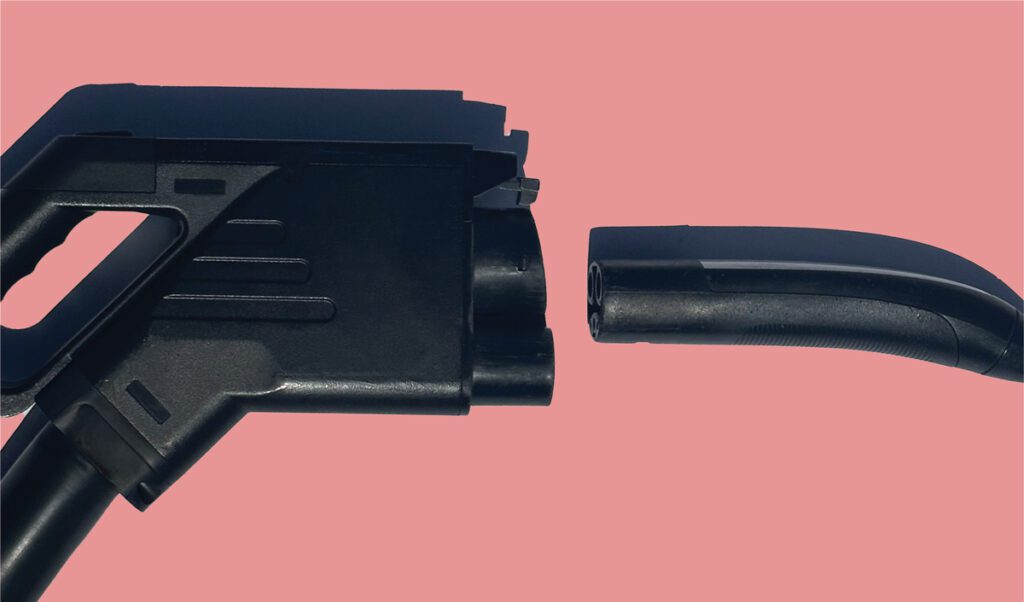

Paul Gioupis: The vehicle handshake is really critical. Tesla’s the best. If you bring a Tesla to an EVgo charger, when you plug in, the communication back and forth from the vehicle to the charger is the problem. That’s the handshake. A lot of times when you’re trying to plug, unplug, and it’s not working, you pick up the phone and you call ChargePoint or whoever it may be, and then they reset the charger, then it goes.

Why do we buy the most expensive UL-listed charger on the planet? Because it’s the best. It’s the Terra 184 from ABB. I’m happy to say it because everybody in the industry knows.

It’s 10 times worse in commercial trucks because…every single truck manufacturer has their own inlet. Hey, I’ve got this DC inlet like everybody else has, but I have a different interface, and mine is 100 kilowatts or 125 or 200 kilowatts. That needs to be standardized, because without this being standardized, the handshake is a problem everywhere you go.

Why do we buy the most expensive UL-listed charger on the planet? Because it’s the best. It’s the Terra 184 from ABB. I’m happy to say it because everybody in the industry knows. It’s got 120 volts up to 900 volts. It’ll charge anything—a bus, a truck, a Porsche, doesn’t matter. We bought the equipment knowing that’s the case. Every bit of product we put into our depots has to have the full amperage and voltage range or else it’ll never come on our lot.

Charged: For a fleet going electric using your service, are they looking at a cost per mile that’s equivalent to diesel, or does it depend?

Paul Gioupis: I’m happy to say that almost every single vehicle that operates out of our depot today operates under the cost of a diesel. Now, the reason is because we took California subsidies. I wish I didn’t have to take the California subsidy to meet that.

The good news is that more OEM product is starting to come to the market. We finally got the Ford E-Transit. It’s a $57,000 van. [GM subsidiary] BrightDrop is now adding an $85,000 van that is going to be scalable and serviceable across the US. All of that’s going to change the game. Today, we’re forced to play with nascent product, which prevents the industry from moving very fast. I think you’re going to see that change over the course of the next 12-36 months with these OEMs. It’s going to make it a lot easier to electrify, and it’s going to make our offering that much better.

The TCO right now, I can honestly say 75% or 80% operates under the cost of diesel. But the next two to three years with those OEMs supplying the market, I don’t think we’re going to need those subsidies in order to level that out.

Charged: You don’t just provide charging infrastructure—you also provide the vehicles, and even amenities for drivers.

Paul Gioupis: Yes. 24 hours a day, we have human beings on site. When a fleet pulls into our depot, the drivers are treated like kings and queens. They get out, they’re greeted by a depot coordinator, they walk around, they do a quick inspection on the vehicle. They then take the vehicle, jockey it up to a fast charger, top it up and then jockey it for the next day, or they’ll go back to that driver and say, “Hey, you’re topped up,” and they could continue their route.

Drivers have access to the lounge area, restrooms. It’s a big deal. If you’re running routes or if you’re moving people from the airport to the hotel, you can’t use a bathroom. Here at the depot, you can. You have a membership, you’re welcome. You want to grab lunch, you want somewhere to stop, that’s all part of the experience as well.

Kuehne+Nagel [one of our customers] is a great example. They have thousands of operators and they run product for high tech, fashion and healthcare, but they don’t own many vehicles. In the beginning they were saying, “I don’t know if this is going to work for us. My guys come in every day, they park here, we run our operations the same way every day.” Now it’s like, “Hey, I just added five vehicles to my fleet. I was limited to seven because I can only park seven in my lot. Now I just added five more.”

Kuehne+Nagel, by the way, took two years to do business. They’re a very conservative company that is aggressive about emission reduction but cautious to make sure the solution is a fit. Zeem, we are a full OpEx. You want a $500,000 Nikola truck and you want to be able to charge and park that every single day, give us one month down-payment and the first month, and you’re out the door. For $15,000, you’re out the door tomorrow.

That model is going to transform the way that cargo and people are moved, because it’s a different way to manage a fleet. Now you don’t need a five-year lease where you need to come in, set up an office and get a receptionist and the whole nine yards. Stop right at Zeem, and we’re a mile away from LAX. You’re not going to get a better location. We paid through the nose for that reason.

Charged: Quick thoughts on automated or wireless charging? I’ve spoken to some companies that think that’s really important for fleet charging.

Paul Gioupis: I think it’s got tremendous potential. When you’re unplugging and plugging, that’s a human interaction that if I could take that away, that makes me money and is more efficient. Inductive charging makes all the sense in the world. I’ve been following Momentum Dynamics, which is now InductEV, and WiTricity, and all the guys that are out there. I’m talking to all of them, but they want me to be a customer. I want to be able to prove their concept. I’m not going to pay full price to prove out a wireless charger. I’d rather have one sitting at my lot where 10 vehicles come in and charge on it every day. And then if you want me to turn to any customer you want and say, “Yeah, this works or doesn’t work,” that’s a good testimonial for those companies. We’re a good testing ground to prove this kind of tech.