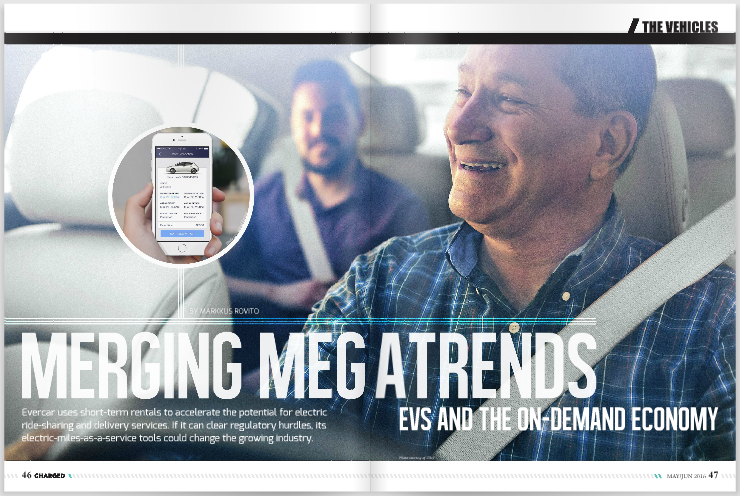

Evercar uses short-term rentals to accelerate the potential for electric ride-sharing and delivery services. If it can clear regulatory hurdles, its electric-miles-as-a-service tools could change the growing industry.

On paper, EVs seem like the perfect choice for the on-demand economy. In a world where vehicles are being pushed to spend more time on the road and less time in the parking lot, why wouldn’t you choose the option with the lowest overall cost per mile?

The big obstacle is that buying a car based on its lifetime costs – and not sticker price – requires a level of financial foresight that is rarely exercised by the general public. That is also true in the commercial and transit arena, where electric drive proponents have found that it takes a considerable effort to convince fleet managers to get off gas and diesel – even when the numbers add up in the long term.

An evolving Vision to remove the friction

Where some see an adoption problem, others identify opportunity. At the end of March, Vision Fleet, a company focused on helping fleets deploy plug-in vehicles, changed its name to Evercar, which was a branch of the company that had been operating in Los Angeles since 2015.

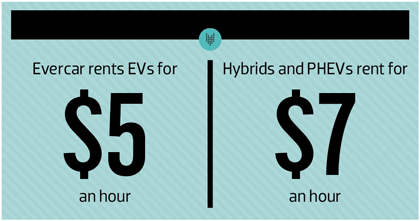

Evercar rents EVs (Nissan LEAFs at present) for only $5 an hour to member drivers who use them to work with ride-sharing and delivery services like Uber, Lyft, Postmates, DoorDash, Instacart and more. This allows Evercar members to work for these transportation network companies (TNCs) without actually owning a car – or accruing wear and tear on their personal vehicles. Evercar covers the insurance, cleaning, maintenance costs and fuel for unlimited miles.

So how does a company rent EVs and cover all the other costs for only $5 an hour without being some kind of Mafia front? That secret sauce simmered for a couple of years under Vision Fleet’s program to help deploy EVs to fleets for customers including the cities of Indianapolis and Atlanta. Vision’s philosophy was selling electric travel miles as a service, which Evercar CEO Michael Brylawski says was inspired by the evolving solar energy industry. By refining the telematics, math and other data coming in from its Vision Fleet customers, the company figured out how to make short-term rentals to individual drivers viable, and launched Evercar last year in Los Angeles, with plans to expand to a second market sometime this summer.

Part of the beauty of Evercar’s model is that it works better with pure EVs than with PHEVs or hybrids. Currently, Evercar also rents Toyota Prius hybrids for $7 an hour – 40% more than EVs, because they are less cost-effective. That’s music to an EV aficionado’s ears, because we are so used to hearing about the high upfront costs required to go electric.

Brylawski, an MIT graduate, founded Vision Fleet about three years ago, after almost two decades of working toward clean and efficient mobility as a VP at the Rocky Mountain Institute and a co-founder of both Fiberforge and Bright Automotive. Around 2010-2011, he saw the Chevy Volt and Nissan LEAF come out – what he called “prime-time vehicles.”

“They had a great value proposition in terms of functionality and economics,” Brylawski told Charged. “Fleets in particular were uniquely suited to get those benefits from the vehicles: the ability to have controlled routes, tax incentives, the opportunity to do great utilization, driver training and so on.”

However, Brylawski said that, as of 2015, there were still only about four plug-in vehicles out of every thousand government and commercial fleet vehicles – or 0.2% plug-ins. Then, as successful entrepreneurs often do, he noticed a parallel with the solar industry, which was still stagnant in the 2000s, even as the cost per watt started to drop. When companies like SolarCity, Sungevity and Sunrun started to redefine the solar business model, they took away the barriers to entry for installing solar panels, and essentially sold solar energy services at a lower cost per kilowatt to the customer, rather than selling the panels themselves.

Brylawski believed he could pioneer a similar “electric miles as a service” business model, and sell those miles to fleet operators. Vision Fleet would take on the responsibility for the vehicles, the infrastructure, the deployment, the training, the telematics to link the systems together, and even the risks in terms of maintenance. Then it could offer customers the simple value of reliably cheaper costs per mile.

His company pioneered that business model with the city of Indianapolis in early 2014, when the former Marine and Republican Mayor Greg Ballard wanted to transition his fleet away from fossil fuels. “Since then we’ve grown that fleet to over 200 EVs,” Brylawski said, “the largest operator of plug-in vehicles of any municipal fleet, though there are a few cities that are aggressively going after that mark.”

Vision Fleet is now known as Evercar for Fleet, and is in the schedule for the US government’s General Services Administration to work on federal fleets.

However, Evercar for Fleet’s greatest legacy may be paving the way for Evercar’s short-term rental initiative for the growing on-demand economy. “We’ve taken all this technology and the platform to deliver to the fleet market into what we see as the fastest-growing fleet, which is ride-sharing,” Brylawski said.

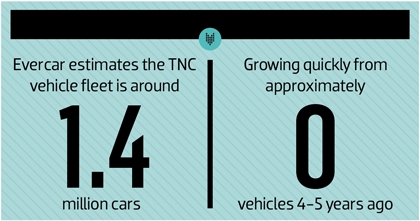

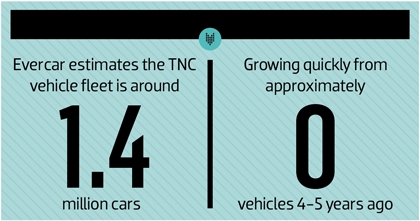

The CEO estimated that the total number of government sedans active today is 1.8 million, while the total number of vehicles in the fleets of the various TNCs is around 1.4 million and growing fast – compared to zero only 4-5 years ago.

Evercar in action

Interested drivers apply to join Evercar, and also apply to work with Uber, Lyft, or the other companies that Evercar partners with. Evercar does a background check on the driver, and within 3-10 days on average, the person is approved to use the online system to reserve a car to drive. A text message gets them into the car at one of the company’s 10 metro LA locations, and the driver must return the car to the designated parking lot at the end of the shift. Drivers buy five Evercar hours up front, but after that, they aren’t billed for their other hours until they have received payment from the TNCs they’re working for.

Brylawski said that using Evercar is 20-30% cheaper than driving your own car. “The drive cycle in ride-share, particularly in a big city, is a lot of stop-and-go driving. There’s a lot of wear and tear, and of course it’s a very inefficient drive cycle for a gasoline vehicle. A lot of people start driving, and they see the expenses for insurance, gasoline and wear and tear on their vehicle and gasoline, and we’re able to bundle that into these vehicles.”

Charging by the hour rather than the day or week helps Evercar get the most out of its vehicles, and the company uses its accumulating data to operate the EVs more efficiently, as well as to help the drivers. “We optimize how these electric vehicles are operated, charged and shared,” Brylawski said. “We get our utilizations to a point where we can make this very, very affordable and help the drivers make more money.”

To that end, Evercar offers a certain amount of training for drivers, and is working on a service called Evercar Coach, which will advise drivers on what times of day are most profitable, which days of the week are best for different TNCs, and locations that could be the most promising. “Because we’re exclusively focused on putting these vehicles into ride-share platforms, we’ve got unique insights on where drivers can earn more revenue,” Brylawski said. “It’s an interesting way to uniquely apply the value of EVs.”

He continued by noting that the $5 per hour cost for an Evercar LEAF is not much more than a driver would pay for gas at LA’s current prices. “We couldn’t drive the cost to that rate without EVs,” Brylawski said. “This is not something you could make work with gasoline vehicles, just because the maintenance cost alone would overwhelm that cost structure. This is the greatest showcase of EVs’ operational benefits.”

As Evercar expands its pick-up locations, it matches parking opportunities with public fast-charging locations. Brylawski said there are 55 public Level 3 stations in LA that are convenient for drivers to get to, but the cars generally charge up with Level 2 overnight if they’re not being used. Cars are available 24/7.

Brylawski cited one case in which a driver took a first-gen LEAF out for 25 hours, drove more than 400 miles total, did eight fast charges and earned $50-60 more than they would have using their own car. He finds that achievement especially impressive given the limited 84-mile range of the first-gen LEAF. In the near future, Evercar plans on deploying thousands of extended-range EVs from Nissan and GM, including the 200-mile-range Bolt, and the Tesla Model 3 whenever it becomes available. In fact, part of the symbolism of the Evercar name refers to “electric vehicle” for the first two letters and “extended range” for the second two.

Even with the LEAF’s limited range (relative to upcoming EVs), it’s been very rare that a driver has to reject a trip because the destination is outside of the available range – less than one out of every 100 trips, according to Brylawski. Most of the requested ride shares are in dense urban environments, and the average Evercar driver travels 16-17 miles in an hour.

Regardless of the EV range, though, Evercar relies on its technology to make its business model work. While it started out as more of a financing company, that has changed greatly. “It does require a lot of work on the back end,” Brylawski noted. The two biggest departments of the 30-person-and-growing company work on its technology platform and its operations platform. “We actually have our own custom-developed telematics platform that really helps manage vehicles in this use case,” he said. “We track all the vehicles in our network operations center; we understand their state of charge; we text or call the drivers when they need to recharge; we guide them to the fast-charge stations and do a lot of customer support.”

However, the financing is still important, which is why it’s critical for the company to get a foothold in California. The company buys its vehicles – rather than leasing them – taking advantage of federal and state tax incentives, and also does the same with the EVSE that it purchases. Brylawski said manufacturers are very aggressive in their pricing and financing options in California, whereas they tend to be less so in other states.

So when a fleet, or an individual ride-share driver, does not need to purchase the vehicle, insurance, fuel, etc, it comes down to a price per mile, and then it’s an apples-to-apples comparison between EVs and ICE vehicles. “Then you can showcase the lifecycle advantages of EVs – even with today’s low fuel prices,” Brylawski said, “and find ways to deliver a lower cost per mile – sometimes significantly lower – because you’re also leveraging utilization and low maintenance costs. You can make these vehicles very cost-competitive.”

The regulator’s dilemma – it’s nothing personal

It’s no secret that the “sharing economy,” or the “on-demand economy” has turned several industries on their heads, while engendering fairly equal parts of love and hate, depending on whom you ask. Airbnb has pissed off at least as many apartment dwellers as it has enriched, but travelers love it for the cost and amenities benefits. And that’s exactly why the hotel industry is scrambling for government regulations against it in many tourist cities.

Of course, the colossus of the sharing economy is on everyone’s lips. In just seven years Uber has created its own cottage industry, and even a new acronym: TNC. Lyft, Instacart, Postmates, Wingz, Didi Chuxing (in China) and others are all TNCs. The label TNC itself originated in 2013 from a designation that the California Public Utilities Commission (CPUC) created for companies that connect customers paying for driving services from non-commercial vehicles. That paradox – non-commercial vehicles serving commercial purposes – is like the flux capacitor causing a chain reaction that could unravel the fabric of the space/time continuum, and destroy the entire universe…of individual transportation as we know it.

To people of a certain age or disposition, TNCs just make sense. If you have money and don’t want to drive yourself to a destination or go shopping, just pay someone else to do it for you. You get what you want, someone else gets paid, and everyone’s happy, right? Everyone but the industries that TNCs displace, such as taxi and limo companies, and to some extent couriers and other delivery services.

Those industries unhappy with TNCs have a legacy of government regulation behind them, and they now want TNCs to be subject to the same or a greater amount of regulation. We could write a book on the grievances against TNCs (in fact, at least one person already has: Raw Deal, by Steven Hill): lack of worker background checks, independent contractor rights, insurance and taxation considerations, and on and on ad infinitum. Suffice it to say, this is where we reach an impasse, with a government wishing to support two industries that are seemingly at odds with one another.

Traditionally, the CPUC has come down on the side of innovation, especially when that innovation would help to solve some of the problems that cars and traffic pose. However, the CPUC is currently considering several TNC-related measures: some that address safety concerns; some that update regulations in TNCs’ favor; and others that may subject TNCs to regulations similar to those that the taxi industry faces.

In any case, some issues facing the CPUC at the time of writing could have sweeping implications for Evercar and any other business looking to provide on-demand vehicles for on-demand drivers.

At the CPUC’s most recent Public Agenda vote on April 21, the commission voted to approve commercial carpooling, allowing services like UberPOOL and Lyft Line to operate legally. These services offer cheaper fares to ride-share users who don’t mind sitting next to strangers headed in the same general direction (the CPUC had previously chosen not to enforce the 50-year-old California law against commercial carpooling on those companies). Other TNC-related matters were addressed, but two items, one on driver background checks and another on leased vehicles, were tabled for a future vote.

Currently, ride-hailing companies are required to use “personal vehicles,” and the CPUC agenda contained an item to define “personal vehicles” as ones that the drivers had possessed for four months or more. Such a definition would basically prohibit Evercar’s main focus in California, and put the kibosh on short-term rental services from Hyrecar and Enterprise in California.

Luckily for Evercar, the influential Uber and Lyft have an interest in allowing as many people to drive for their companies as possible. Evercar also has other heavyweights on its side, such as Enterprise and GM, which had a representative present on April 21 to speak against the reclassification of “personal vehicles,” even though its Express Drive short-term rental partnership with Lyft doesn’t yet operate in California.

The most recent CPUC voting meeting was held on May 9, but the matter of “personal vehicle” designation for TNCs was not on the agenda, so it would seem that Evercar can continue to operate unfettered for now.

That’s positive news for the 400-500 drivers in the Los Angeles area who are applying to drive with Evercar each week, according the company’s Director of Marketing, Michelle Wright. “We’ve had several productive conversations with the commission…and feel our position has been duly noted (and was truly an unintended consequence). We’re optimistic that the CPUC is going to remedy the situation.”

EVs for the people

The CPUC doesn’t just have a business regulation issue on its hands – it’s also a jobs question, with many low-income drivers willing to work waiting for the answer. Companies like Evercar and comparable services lower the barriers to entry for TNC gigs. Brylawski quoted an estimate that 15-25% of interested ride-sharing drivers don’t have a qualifying vehicle.

“Those services have a max number of miles and condition of the vehicle, and a lot of people who want that job don’t have the vehicle or can’t get financing for one,” Brylawski said. “As we mature, we’re also finding there’s people attracted to this because they don’t want to put wear and tear on their own car, or worry about the hassles of doing it with their own vehicle.”

According to Brylawski, most Evercar applicants have never driven an EV, because they don’t typically match the demographic of an EV owner. Rather, it’s often students, retirees or, in LA, underemployed members of the creative economy, who want to work part-time with flexible hours.

“Ultimately, it’s the technology platforms and the hands-on support that people value the most,” Brylawski said. “You really couldn’t do this without advances in telematics and cloud computing that have happened over the last couple years. EVs are just the tool to get things done. I’m personally into the technology. I’ve worked on it for 30 years. I love EVs for their own sake, but the real-world community of EV enthusiasts is pretty small. If we want this to scale to provide the benefits of EVs to a much larger audience, you’ve got to figure out how to reach those audiences. The cool thing is once they’re in the EVs and using them, there’s very high satisfaction on both the fleet side and the Evercar ride-share side.”

If Evercar can prove its model in a string of cities, it could do much to spread positive impressions of EVs and possibly make them more visible as options for larger fleets. On Evercar’s ride-sharing side, each driver is a small business, and each car is a fleet of one. Success breeds more success, so it’s conceivable that the expansion of the ride-sharing Evercar, targeted for this summer, could feed the expansion of Evercar for Fleet.

“We haven’t really spent a lot of time promoting it,” Brylawski said. “We wanted to make sure the system worked first. I see the world headed much more to this on-demand way of getting around. More people in cities are shifting away from owning their own car that sits parked for 22 hours and toward sharing assets.”

This article originally appeared in Charged Issue 25 – May/June 2016. Subscribe now.