If we’ve heard it once, we’ve heard it a thousand times: EVs and charging infrastructure present a chicken-and-egg problem. This thesis has been the topic of countless EV industry conference panels over the past decade.

In recent years, many experts have attempted to declare the issue settled. Back in January 2013, European Union Climate Commissioner Connie Hedegaard wrote that “we can finally end the discussion about the chicken and the egg when it comes to whether the infrastructure needs to be present before the electric car market explodes. It has to make sense to buy an electric car, and it doesn’t if you can’t even drive halfway across [Denmark] without running out of charge.”

However, despite the conclusions drawn by Hedegaard and others, we still hear the topic discussed all the time.

The good news is that those on the front lines of infrastructure deployment report a very noticeable shift in the attitude of their customers. “Finally, after years of discussion, there is growing activity and excitement for charging station projects,” Efacec’s Mike Anderson told Charged. “I see that people are now starting to realize that the installed chargers are driving people to buy the cars.”

Anderson is EV Charger Sales Manager for the Portuguese company’s US division. He believes that it’s the convenience of fast chargers that’s making the biggest difference. “When someone sees how easy it is to pop into Starbucks for coffee and get up to 50% of their battery life back in 15 to 20 minutes with DC fast charging, it makes a big impact. I think that’s what’s garnering a lot of the new infrastructure push now.”

Navigating the standards

The shift in momentum for the fast charging industry couldn’t have come too soon. It’s been a long road for those who’ve attempted to shape the nascent industry in the past few years, with new obstacles at every turn.

The war between the CHAdeMO and SAE Combo standards placed everyone in an awkward position early on, including charging equipment manufacturers and those attempting to plan infrastructure projects. For a few years, only CHAdeMO-equipped Nissan LEAFs were on the road in meaningful numbers, yet all of the major automakers that aren’t Japanese agreed to use a different plug. In these circumstances, many opted to “wait and see,” rather than “build it and they will come.”

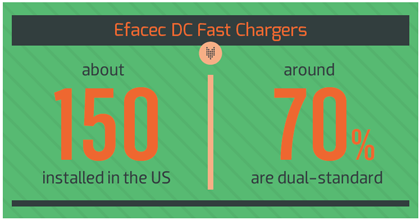

Fortunately, as EVs fitted with SAE Combo plugs – like the BMW i3, VW e-Golf and Chevy Spark EV – hit the road and grow in popularity, DC fast charger manufacturers have successfully promoted a variety of chargers that support dual standards. Anderson estimates that, of about 150 Efacec chargers installed in the US to date, 70% are dual-standard. The company supplied about 50 CHAdeMO-only units for two early projects, but since then, customers have largely requested both charging plugs.

“The only reason someone would still request a CHAdeMO-only fast charger is if they’ve only been able to secure funding for the CHAdeMO portion of a project,” explained Anderson. “We’ve had a couple folks buy the chargers with CHAdeMO only, then work to try to get financing for the SAE Combo side as well. And when that happens, they can upgrade the unit even if it’s already installed. We can go onsite and update the power cabinet with some more components inside and the second connector.”

Other than a handful of cases in which a customer requests a single-plug charger for a private installation, like an automaker’s testing facility, Anderson says that “as EVs are getting more prolific around the country, everyone sees the value of two connectors on one station.”

Incentivized

The EV-savviness of Efacec’s client base ranges from EVSE distributors and utility companies, which are very familiar with the equipment and the industry, to retail property owners, who know very little about how fast chargers work and what to expect from them. So, the sales team is required to answer an array of questions about the latest regulations and incentives that are very detailed, constantly changing and different in every market.

“The different incentives not only drive the vehicle purchases, but the infrastructure requirements too,” said Anderson. “Georgia, where we’re based, just voted to do away with its $5,000 EV tax credit. So, we’ll see how that affects vehicle sales and charger rollout.”

Last year, Maryland enacted some of the country’s most generous tax credits for both new vehicles and charging stations – up to $3,000 for qualifying PEVs and 50% of the purchase and installation price of EVSE, up to $5,000 for a commercial unit. It didn’t take long for Efacec to see the increased demand, and this summer DC fast charging installations will begin to roll out across the state, including one project led by an Efacec distributor to deploy 15 of its dual-standard fast chargers at Royal Farm gas stations throughout Maryland.

Outside of the states that have significant tax credits, Anderson also reports seeing increased activity for projects that are funded by private investors, automakers and utility companies.

“With the utilities, it’s based on the laws of the state as to what their level of involvement can be with providing charging services direct to consumers,” said Anderson. “It’s a heavily regulated industry: whether they can own, operate, charge for electricity, or even provide it for free. It’s literally all over the map.”

A world of charging

In the US, Efacec’s charging equipment can be found on just about every public charging network: NRG EVgo, ChargePoint, Greenlots, EV Connect and OpConnect. The company’s work in Europe prepared it to work well with a lot of different network service providers. “Every time you cross the border into another country, there is a set of new networks to deal with,” said Anderson. “There are three to four times more networks in Europe than in the US.”

Efacec has been in the car charging business since 2008, and in 2010 it partnered with Nissan in support of the rollout of the LEAF in Europe. Now with over 600 DC fast chargers installed worldwide, site locations include Sweden, Norway, Portugal, England, North Africa, Dubai, Brazil, South Africa, USA and the Caribbean.

In the US, all of Efacec’s installed stations are the 50 kW model, but in Europe the company also has 20 kW DC chargers and Level 2 charging stations deployed. Anderson told us that they’re currently in the certification process to bring the other products to the states, and he sees a fair amount of demand for DC charging in the 20 kW range. “I think the lower price point is going to attract new customers, and the smaller physical size is also beneficial,” he said. “Also, the 20 kW will run on 208 V three-phase, which is a lot more available than 480 V, which is what our 50 kW requires, and it has all the same features – dual connectors and the same color screen and push-button interface.”

The company has also announced a 24 kW wall-mounted DC charger that it expects to be very popular, based on its price point and the ability to use either 208 V three-phase or 240 V single-phase power. The small, sleek charger weighs about 130 pounds, but is only capable of one charging connector per unit because of the packaging constraints.

A culture of convenience

A hundred years ago, when cars were fighting for road space with horses, and gas stations were few and far between, people were willing to strap 5 cans of gasoline to the bumper. Unfortunately there is no analogous intermediate solution for EVs, and until the new technology meets or surpasses the convenience of legacy vehicles, adoption will be limited.

“People don’t want to be restricted as to where they can drive an EV,” said Anderson. “The days of early adopters willing to drive around with extension cords in their trunk and asking to use people’s outlets are behind us. It’s primarily the economics that’s driving adoption now – the ability to save on the fuel costs – but consumers are not going to be inconvenienced in order to do that. That’s why I think we’re seeing more of a push for fast charging infrastructure now. Everyone has realized that in order to drive car sales, consumers need to see convenient quick charging sites in their communities.”

This article originally appeared in Charged Issue 19 – May/June 2015.