Better Place, the startup that aims to build a worldwide network of EV charging and battery-switching stations, announced Friday that it has scored $200 million in additional equity financing, bringing the company’s valuation to $2.25 billion.

Better Place, the startup that aims to build a worldwide network of EV charging and battery-switching stations, announced Friday that it has scored $200 million in additional equity financing, bringing the company’s valuation to $2.25 billion. New investors in this round include heavyweights like GE and UBS.

Better Place will use the latest bag of loot to expand its empire in Western Europe – it opened an office in Paris in September. The company already plans to launch commercial service in Denmark and Israel in early 2012, and in Australia in the second quarter. It also has pilot projects going on in California, Hawaii, Ontario, China and Japan.

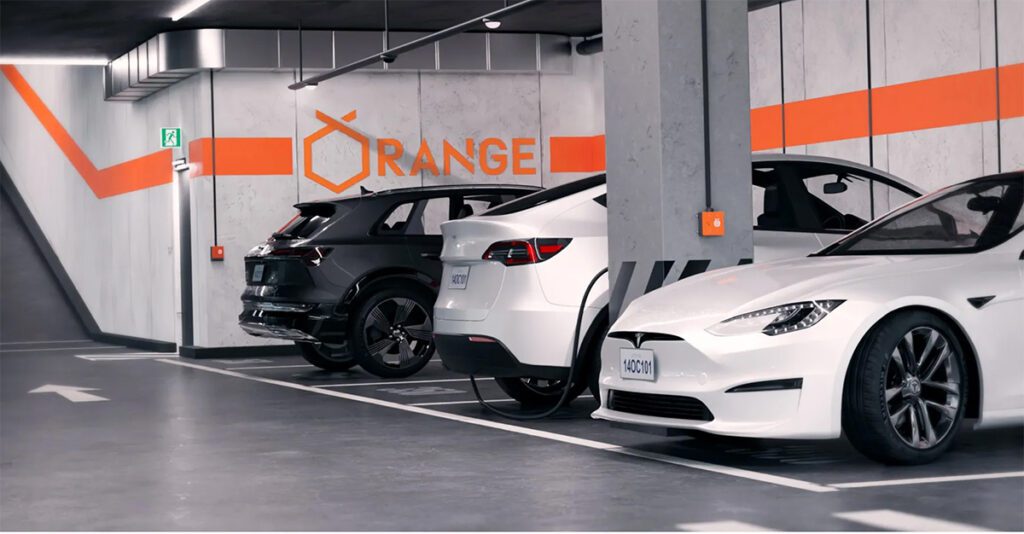

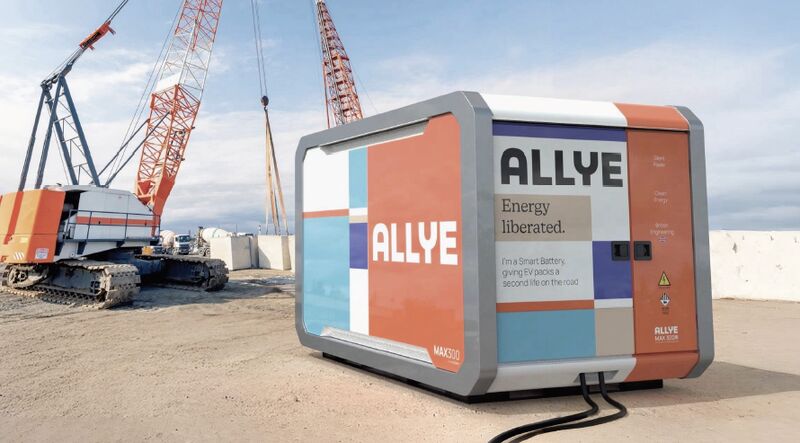

BP’s unique robotic battery switching stations, which can replace the battery in a Renault Fluence Z.E. electric sedan in less time than a typical stop at the gas station, have drawn a lot of media coverage, but more traditional charging stations are also part of the company’s strategy. Even more interesting is its underlying concept of marketing transportation as a subscription-based service, like cell phones, with customers buying a certain number of miles per month.

“We’ve worked hard over the past four years to engineer and build a technology solution that competes with oil-based transportation,” said Shai Agassi, Founder and CEO. “We are entering the next phase of growth for our company where we prove that our solution works, that it’s in demand, and that it scales, as we begin to push into new markets and attract new investors and new partners. I believe that our investors should be applauded for having the vision to finance the future of transportation.”

Images: Better Place