- By all accounts, electric school buses offer an ideal use case for vehicle-to-grid (V2G) technology. Synop provides software that enables V2G for fleets, allowing local utilities to communicate with fleet operators and initiate V2G transactions.

- V2G pilots abound, but Synop is one of the few firms that can claim to be doing V2G on a least a quasi-commercial basis—in 2023, the company enabled some 200 V2G transactions across 4 US states, sending some 30 MWh of energy back to the grid.

- Synop CEO Gagan Dhillon believes that, at the moment, V2G makes sense only for a few use cases (school buses, drayage), and that the technology will need to mature before we see widespread deployment. Not all utilities are capable of feeding energy back to the grid, and the revenue and financial aspects of V2G are still largely undefined.

Q&A with Synop co-founder Gagan Dhillon

Vehicle-to-grid (V2G) technology is a hot topic—many EV industry execs say it has the potential to transform the transport and energy industries (we hear the term “game-changing” a lot). However, others have told Charged that they expect it to be more of a niche technology, useful only in certain applications. One thing everyone seems to agree on is that one of the most promising use cases for V2G is an electric school bus fleet.

The proliferation of electric school buses at school districts across the US is being driven by several factors. The iconic yellow buses travel regular routes that tend to be short, and they return to central depots where they have plenty of time to charge. School districts appreciate the savings on fuel and maintenance, and the idea of sparing schoolchildren from breathing diesel fumes tends to appeal to parents and other stakeholders, even those who might otherwise be unenthusiastic about EVs.

School buses’ typical duty cycles make them an ideal use case for V2G. They have large battery packs, they congregate in large numbers at depots and, at a typical school district, they sit parked during the evening hours and over the summer months—typically times of peak energy demand when utilities are most likely to need storage to relieve the grid.

All these factors combine to give electric school buses a shorter payback period than just about any other EV application—but V2G offers the potential not just to save costs, but to generate revenue—and that’s something our chronically underfunded schools can always use.

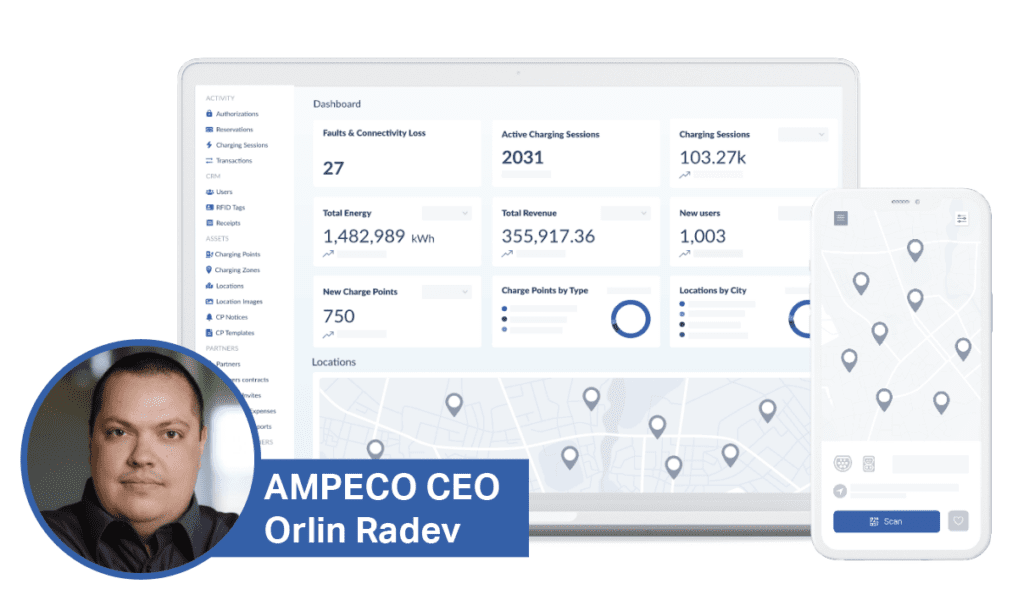

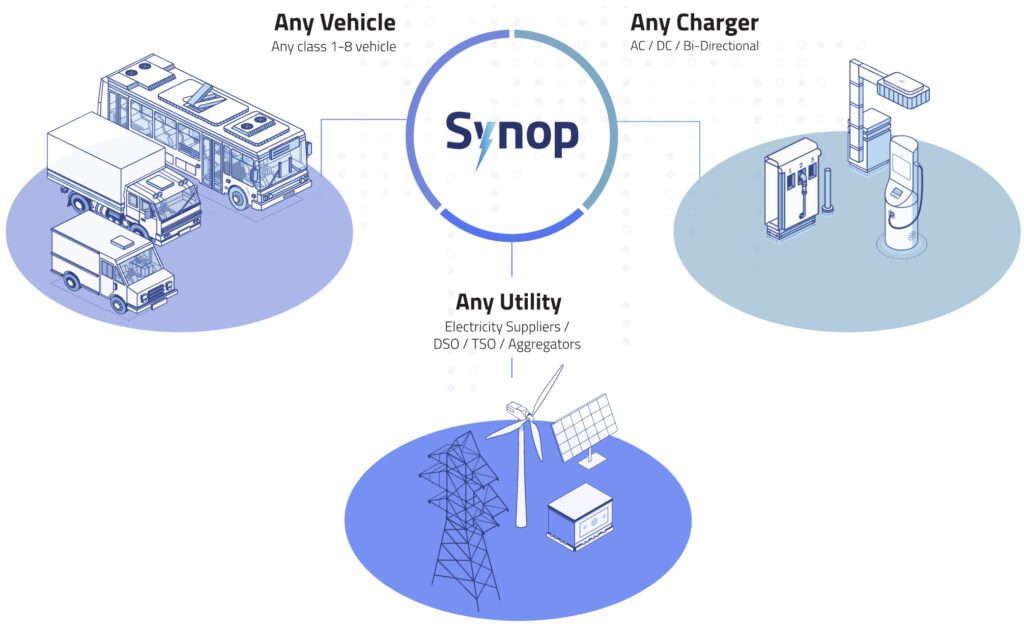

Of course, making V2G work requires software, and that’s where Synop comes in. The Brooklyn-based startup provides a platform designed to optimize energy management for EV fleet charging. Synop’s commercial charging and energy management software integrates with vehicles, chargers and utilities, enabling V2G transactions.

Here’s how it works: Synop’s system receives prompts from the local utility requesting a certain amount of storage for a specific time period. The software then verifies the fleet charging schedule to confirm excess capacity. Upon validation, the platform delivers the appropriate charging schedule to the chargers using the Open Charge Point Protocol (OCPP), and the excess energy is discharged from the vehicle battery packs back to the grid.

This isn’t just hypothetical. During the summers of 2021 and 2022, Synop participated in a commercial V2G pilot for Massachusetts electric utility National Grid. School bus operator Highland Electric Fleets led the project, BorgWarner provided the DC fast charging system, Thomas Built Buses provided the vehicle, and Proterra (since acquired by Volvo) provided the battery technology. Over 158 hours across both summers, a single bus discharged 10.78 MWh to the Massachusetts grid, generating $23,500 in revenue.

Charged recently spoke with Synop co-founder and CEO Gagan Dhillon.

Charged: What inspired you to start a company to develop fleet charging management software?

Gagan Dhillon: I was exposed to the world of commercial trucking through some projects I was doing with Volvo Trucks, and almost all their fleet customers were thinking about electrification. This was 2020, and co-founder Andrew Blejde and I didn’t think anybody was building charging, energy and vehicle management tools in an operational software system, so that a fleet operator could have all of that in one place. We landed our first customer in late 2021. That was Highland Electric—they’re a school bus operator, and they’re offering a turnkey solution for electric school buses.

We started providing charging management and energy management software for depot operators. Those operators have since started to develop tools for workplace charging, to open up those chargers for opportunity charging, so now we’re starting to manage that for them as well.

Charged: Are you mainly focused on school buses?

Gagan Dhillon: No, actually, we have Class 8 electric trucks, we have last-mile delivery vans. The school bus stuff gets the most press for us, but I would say there are as many Class 8 trucks and delivery vans on our platform as there are school buses.

Charged: Everybody seems to agree that school buses are an ideal use case for vehicle-to-grid, but that at the moment V2G is pretty much in the pilot stage. But your pilot with Highland generated some serious cash, and you’ve since developed other projects—could we describe those as commercial?

Gagan Dhillon: I think vehicle-to-grid is still very much a nascent technology, and I do think that vehicle-to-grid is also a use case specific to the school bus world [at the moment]. We did about 200 vehicle-to-grid transactions in 2023, across probably 20 or 30 vehicles. We sent back 30 megawatt-hours of energy, which is the equivalent of powering 1,000 average US homes for a day. And we’ve done that across four different states.

I don’t think we’re ready to say that these are fully baked commercial opportunities, just because there’s so much that goes into executing one. The commercialization of them is still being defined, the revenue a vehicle operator generates is still being defined—it’s very case-by-case. It’s going to take a bit of time for everyone to get on the same page about what V2G can do from a revenue and financial standpoint. But from a use case standpoint, we demonstrated that this technology works, and that we can still maintain the uptime of a vehicle even if we drain its battery.

Charged: You have projects with several utilities across four different states.What are some of the differences among those projects?

Gagan Dhillon: The hardest part is always the connection between the charger and the vehicle. The thing that does not really matter as much is the locale, as long as the utility has the ability to pull energy off of a site. Typically, a utility will never go through setting us up if they can’t do that, so that’s a big barrier that gets solved before we ever show up. But being able to optimize the connection between a vehicle and a charger, and then being able to dispense energy and then repower the vehicle within a timely period for its duty cycle—that orchestration is the hard part.

Charged: So, the ability to feed electricity back to the grid is not something that a utility can just automatically do?

Gagan Dhillon: They need to have the ability to accept power on their end, and then they need to be able to have a view into the power available. That’s one of the things that we give utilities—they can come onto our platform and say, “I’ve got 10 kilowatt-hours of energy available at this site based on the energy that these vehicles currently have. I’m going to pull that power between 3:00 and 4:00 pm.” So those insights, that operational readiness, is what they’re relying on us for.

We’re working with a number of companies, including Highland Fleets, Lion Electric, and Prologis. We’re Prologis’s backend for all the fleet electrification work that they’re doing. Those are some of the ones I can name publicly.

Charged: Let’s say we want to set up a school bus V2G program. What are the pieces of the puzzle? What different kinds of companies have to work together?

Gagan Dhillon: That’s the easy part: it’s the school bus fleet operator and the utility. They need to be the ones that opt in. Then they need a software provider to enable that opt-in and enable the execution of the transaction, and that’s where we come in.

“It’s going to take a bit of time for everyone to get on the same page about what V2G can do from a revenue and financial standpoint. But from a use case standpoint, we demonstrated that this technology works.”

Charged: Some companies provide charging management software as part of a turnkey fleet management system. Might some of these turnkey infrastructure providers also be your customers?

Gagan Dhillon: We are just software—we believe that the software is going to be the key piece in this industry. A lot of the other stuff is going to become more and more commoditized, so we want to build best-in-class software for fleet operators.

Most of the turnkey infrastructure providers are customers of ours. We’ve got five of those customers. I am not at liberty to say which ones, because we provide a custom white-label solution to them, so if they introduce a software tool, it’s going to look and feel like their tool, and that’s the value proposition that we’re giving them.

Charged: What do you think about Proterra? I really thought that was a strong company, and I was pretty shocked when they crashed.

Gagan Dhillon: Yeah, I was probably equally shocked—we had good relationships with Proterra. We work with a lot of joint customers and a lot of their school buses are on our platform. I know that they’ve gone through an auction process and different parts of the business have been sold off, but I think that powertrain business needs to stay as part of our industry because of how many businesses rely on it.

[Editor’s note: Volvo acquired Proterra’s battery business in February 2024.]

They had a software that they developed called Valence. Some of their customers used Valence and some did not. We had the ability to onboard their hardware onto our system, so we had a partnership that allowed that in certain cases.

Charged: I’m seeing the development of a flexible ecosystem where a company might provide one piece of the puzzle, or several pieces, or they might offer a whole turnkey package. It gets confusing—we’ve got TaaS, CaaS, EaaS. How does all that stuff fit together, and how does somebody sort through that alphabet soup?

Gagan Dhillon: I think the more acronyms, the harder it gets for people, and I think this industry still has a lot of maturation that it has to go through. There are a lot of hardware players in this space, and I think there’s going to be consolidation there.I also believe that there is going to be a new set of standards that need to be developed for fleet operators, and these acronyms need to become a lot more defined.

My candid belief is that people are sometimes being sold solutions that are too complex for their needs. This is the natural cycle of an early-days industry—people are learning and operators are learning. I think in about a year or 18 months, solutions will start to become productized so you know what you’re buying every single time, and it’s the same tool set to solve the same use case. I think our industry really needs that if it’s going to take the next step to electrify all the assets people want to electrify.

Charged: What are some other compelling use cases for EVs at the moment?

Gagan Dhillon: Drayage, taking goods from ports, especially in California and other seaports, and then driving them to the initial warehouse. We have at least 10 customers in that space currently. And then of course there’s the last-mile delivery use case. Not at liberty to speak on this one yet, but we’ve got some substantial partners in last-mile package delivery.

Charged: Could these also be use cases for V2G?

Gagan Dhillon: Hypothetically, V2G could be applied to drayage and last-mile delivery, though predicting their duty cycles and dwell times—and matching these to the grid’s energy needs—is more challenging than with predictable electric school bus routes. A drayage truck has a substantial battery, and could power roughly 400 homes for an hour, possibly having a transformative impact on the grid.

Charged: From the software standpoint, would you say different use cases are pretty similar, or is there a lot of customization you need to do?

Gagan Dhillon: No, there’s not any customization, and it’s purposely built that way because it enables us to quickly scale with customers. Our big value proposition is that you can bring any type of vehicle that’s connected to telematics and any type of charger that has an OCPP connection. We will go through the interoperability testing, onboard that asset, and make sure that you can deploy it as quickly as possible. Typically, it takes a customer less than a day to get up and running on our platform.

Charged: Zooming out to the overall commercial EV industry, some of the players are fighting hard against electrification. Some of the trucking trade associations are supporting bills to try and roll it back, they’re suing everybody in sight. Do you think they’re going to succeed in slowing things down?

Gagan Dhillon: Man, I hope not, but never underestimate the power of people in force. I think what really has to happen is the cost of EVs has to become more realistic, so the use case makes a lot more sense for the operator and themselves. Right now it’s just unrealistic to expect anybody to pay nearly $400,000 for an electric truck. Even with the incentives, that’s a hard cost for somebody to stomach, and then you put in other hardware costs, so I think we’re going to continue to deal with headwinds for consumer adoption.

Charged: Well, that’s a good argument for focusing on things like school buses and drayage, right?

Gagan Dhillon: Yeah. And that’s why we think that those are the use cases that matter for the time being.