Widespread adoption of electric commercial vehicles has seemed to be just around the corner for several years now. This has been a puzzling and frustrating situation for EV advocates (and even more so for electric truck builders), because the economic case for electrification is strong. Several industry experts have told Charged that the slow progress is mainly due to fleet operators’ cautious timelines. Saving money on fuel is important, but reliability is mission-critical, and fleet buyers have insisted on extensive pilot programs before placing major orders.

Well, pilots have now been underway for several years, in several parts of the world, and the results are coming in. The giant fleets are placing giant orders, and shoals of smaller fish will surely follow. Two charging industry veterans decided that a massive tsunami of commercial EVs is on the way, and that when the wave hits, there will be a huge demand for fleet charging infrastructure services. Hoping to ride that wave, the two founded In-Charge Energy to provide turnkey commercial EV infrastructure solutions.

Cameron Funk, previously the CEO of international infrastructure provider innogy eMobility’s North American unit, is now the CEO of In-Charge Energy. Terry O’Day, who previously led North American strategy for innogy eMobility, is now In-Charge’s COO. The two founders have an ocean of experience in the EV infrastructure space, including stints at ABM, NRG, EVgo and Edison International. O’Day estimates that, between the two of them, they’ve managed the installation of over 30,000 charging stations.

In-Charge Energy recently concluded a Series A funding round led by Macquarie Capital and ABB Technology Ventures. As part of the deal, Greg Callman, a former Tesla exec who led the development of the Supercharger program, and is now Senior Managing Director of Macquarie Capital, joined In-Charge Energy’s Board of Directors.

In-Charge COO Terry O’Day chatted with Charged to explain how his company helps fleet operators get charging solutions in place.

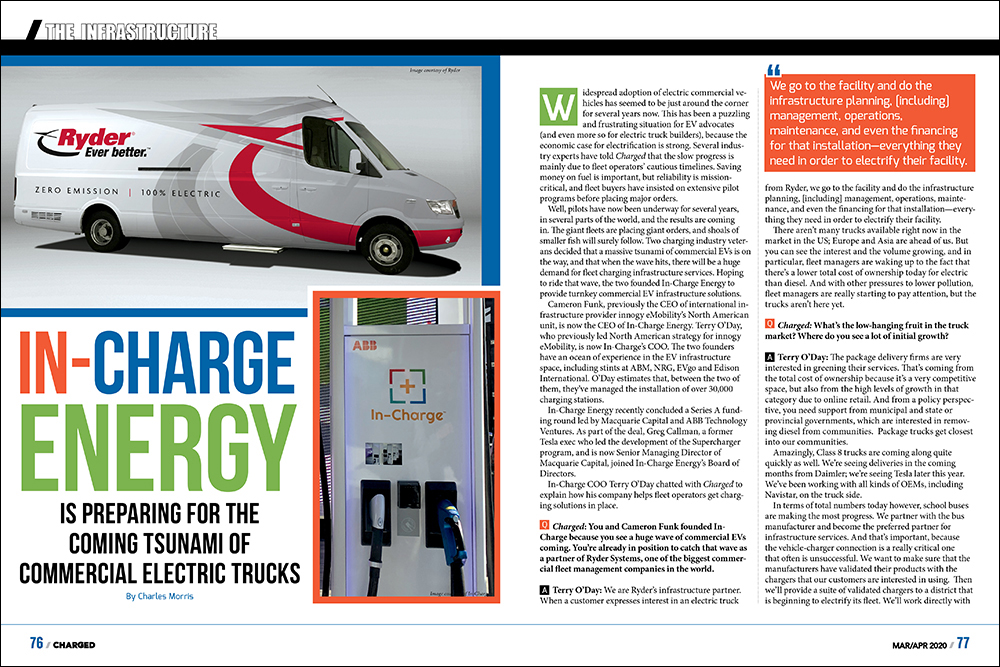

Charged: You and Cameron Funk founded In-Charge because you see a huge wave of commercial EVs coming. You’re already in position to catch that wave as a partner of Ryder Systems, one of the biggest commercial fleet management companies in the world.

Terry O’Day: We are Ryder’s infrastructure partner. When a customer expresses interest in an electric truck from Ryder, we go to the facility and do the infrastructure planning, [including] management, operations, maintenance, and even the financing for that installation—everything they need in order to electrify their facility.

There aren’t many trucks available right now in the market in the US; Europe and Asia are ahead of us. But you can see the interest and the volume growing, and in particular, fleet managers are waking up to the fact that there’s a lower total cost of ownership today for electric than diesel. And with other pressures to lower pollution, fleet managers are really starting to pay attention, but the trucks aren’t here yet.

Charged: What’s the low-hanging fruit in the truck market? Where do you see a lot of initial growth?

Terry O’Day: The package delivery firms are very interested in greening their services. That’s coming from the total cost of ownership because it’s a very competitive space, but also from the high levels of growth in that category due to online retail. And from a policy perspective, you need support from municipal and state or provincial governments, which are interested in removing diesel from communities. Package trucks get closest into our communities.

Amazingly, Class 8 trucks are coming along quite quickly as well. We’re seeing deliveries in the coming months from Daimler; we’re seeing Tesla later this year. We’ve been working with all kinds of OEMs, including Navistar, on the truck side.

In terms of total numbers today however, school buses are making the most progress. We partner with the bus manufacturer and become the preferred partner for infrastructure services. And that’s important, because the vehicle-charger connection is a really critical one that often is unsuccessful. We want to make sure that the manufacturers have validated their products with the chargers that our customers are interested in using. Then we’ll provide a suite of validated chargers to a district that is beginning to electrify its fleet. We’ll work directly with that district on planning the infrastructure buildout—identifying the locations, the total load, finding other load on the site, whether that’s from energy efficiency or from utilizing renewables on-site. We end up working directly with the district or the private fleet operator for the buses in order to implement their electrification plan.

Charged: Why don’t the vehicle OEMs want to handle infrastructure themselves?

Terry O’Day: They’ve got their hands full building trucks and buses, and that’s the entry point for the customer. Purchase decisions are organized around vehicle features and capabilities, and the infrastructure question comes second. The smart manufacturers are focused on producing excellent vehicles and working with partners to assure that they’re integrated with the multitude of charging options that exist in the market. They don’t want to bog down their sales by establishing new business units and revenue targets associated with installing charging. They just want a service partner who’s going to get it done.

Charged: Tell us about Ryder. What truck options do they have available now?

Terry O’Day: They’ve got Class 8 trucks that are coming into the fleet this year. They have purchase orders out on electric vans, and have taken delivery of some of those already. All told, Ryder has 65,000 existing customers across the US and 800 facilities. They see [electrification] as disruptive to their existing business, so they are getting ahead of that by investing in understanding the business, and developing partnerships so that they can have access to new models when their customers all start to ask for electric.

Charged: Is your policy to own the EVSE, or do you sell it and then provide an ongoing service agreement?

Terry O’Day: We are open to either model, depending on what the needs are for the customer. What we have found is there’s a ton of variability in how fleets approach their buying, ownership, operation and maintenance, so we need to be very adaptable. Many folks are looking for a cookie-cutter business model in EV infrastructure, and it just doesn’t exist. The fact is that every facility is a snowflake, so you have to create a scalable model that addresses the needs of each of those fleets in an efficient way. And [you do that] not by standardizing the product and creating a one-size-fits-all product, [but] by standardizing your service processes.

Charged: Do you see a role for battery storage in your ecosystems?

Terry O’Day: Definitely. A number of these facilities have demands that exceed the existing service capacity, and storage can be helpful to address that problem. It is also helpful for balancing loads to minimize demand charges. But storage today is still a pretty expensive proposition, so the ROI is longer than what most fleet managers are interested in. We want to be able to find ways to get them up and operating without having to bring in micro-grid strategies or utility service upgrades, because when you do that, you add a lot of schedule risk, and you burden the pilot with costs that may not be comparable to what they’ll experience in the long run for the full fleet electrification. Once the fleet is comfortable operating their pilot program, and they’ve demonstrated the metrics that will allow them to grow, then we’ll take a look at a micro-grid solution that would include batteries and renewables as well as utility service upgrades where needed.

Charged: How is it working with the utilities for these kinds of service upgrades?

Terry O’Day: It’s pretty costly and time-consuming for their service planning groups. As an example, the California utilities are a bit of a mix. Southern California Edison has been great, and PG&E is very interested in bringing people into their approved program. But the reality is that they only have so many service planners, so eventually you end up in a queue for the service planning function, and that is a challenge. We need to figure out how to enable them to grow their capabilities in service planning as these fleets begin to come online and make purchases.

Apart from my work at In-Charge, I’m the Mayor Pro Tempore of Santa Monica, and we are electrifying the Big Blue Bus [municipal bus fleet]. That’s more than 200 buses. We brought [Southern California Edison] out to the site and they said, ‘You’re going to need a new sub-station. It’s going to cost $5 million.’ And our bus manager said, ‘Okay, our council said we’re doing this, so get started.’ And Edison initially responded, ‘Oh, well, we’re going to need five years.’

So, the service planning function appears to be a real bottleneck. I think that the utilities generally are aware of it, at least. It’s impossible to paint the utility sector with a single brush, because there are more than 3,000 utilities in the United States. But the bigger ones are beginning to catch on that this is a great opportunity to create a really harmonious load and a flexible load, and they’re beginning to pay attention to the service planning function.

Charged: What about using demand management to avoid utility demand charges?

Terry O’Day: We have demand management solutions built into our strategies. In most cases, that’s going to require storage on site. Fleet operations are typically revenue-producing, or revenue-affecting anyway, so if they’re not working, then the fleet owner is experiencing real pain on their financials. So, they have a high need for reliable infrastructure and vehicles. Demand management would have to be used sparingly in that context. If you turn off those chargers, then they still need to make sure the vehicle is ready to perform its function when it gets called upon. Demand management can exist within that reality, but it can conflict with it for sure, so some real smart planning [is required] in order to pull that off.

A classic story that I witnessed firsthand was with Universal Studios. They were on a demand management service interruption rate from the utilities, so they enjoyed lower electricity costs. But when the rolling blackouts came and they got the call to reduce their demand, they had hundreds of people on rides and roller coasters. They can’t turn those off, so they ended up paying for incredibly expensive electricity as a result. So, high-reliability operations need to have other options if we put them on demand management.

Charged: Are you seeing mostly DC fast charging in truck applications, or are fleets open to AC options as well?

Terry O’Day: A lot of the delivery vehicles, from the vans to the package cars, are still talking about Level 2, and they think that’ll work for them overnight. It does for a portion of their fleet, but as we get into the projects, and as they begin to get their hands on vehicles, they find out that faster is just better. So if you can afford to get the capacity into your facility, you’re going to want DC fast charging.

It [also] goes to the reliability issue. I visited a school bus yard in New York last month, and it was 13 degrees outside in the middle of the day. The driver for the morning run came back, and she was at a 0% state of charge on a bus that was supposed to be able to handle two full days of activity. We investigated the problem, and all the charging and infrastructure was installed fine, but the bus was using 80% of the battery’s state of charge just to heat the cabin and keep the battery itself warm. In that case, a DC charger would have gotten her back on the road for the afternoon shift. DC gives you that added reliability factor that a lot of fleets are going to need.

Charged: Is there openness to a mixed solution? Like DC when you need it?

Terry O’Day: Yeah, because it gets expensive to do DC for every vehicle. At the low end of DC and the high end of AC, there’s a bit of an overlap—you can deliver about as much power on a high-end AC charger as on a low-end DC charger.

Charged: What are the next steps for your company?

Terry O’Day: You’ll hear from us when we announce new partnerships. We have some pretty major installations that we’re currently engineering, so you’ll probably see some ribbon-cutting announcements soon for some major installations nationwide. As we just got funded, we’re also picking up really talented people to join our team and help us grow. You’ll recognize some of the names.

This article appeared in Charged Issue 48 – March/April 2020 – Subscribe now.