The oil and gas giant’s EV investment rationale is outlined in its new report, BP Technology Outlook.

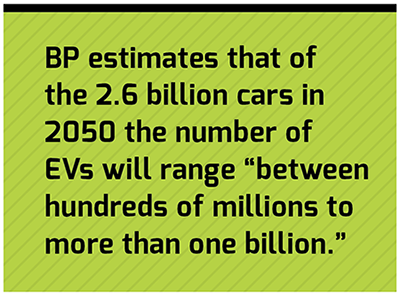

Demand for travel is central to modern society. Currently, transport accounts for 20% of global primary energy use. The global light-duty fleet of cars, vans, and light trucks is here to stay for the foreseeable future. In fact, it’s estimated that by 2050, planet Earth will have 2.6 billion vehicles zipping around on it. That’s quite an increase – up from 1.2 billion in 2015

Those are some opening thoughts and predictions contained in a fascinating report issued by BP, called “BP Technology Outlook 2018.” A central thesis is the parallel advancement and interplay between energy and technology, largely a beneficial synergy with important implications across many global concerns and disciplines, from energy to wealth and economics to the environment and climate.

BP published its first Energy Outlook in 2015. It’s noteworthy that the 2018 report includes a new Transport section, which is largely focused on transportation electrification, which is rather interesting for a report produced by one of the largest oil and gas companies in the world. BP estimates that of the 2.6 billion cars in 2050, the number of EVs will range “between hundreds of millions to more than one billion.”

This new focus on transport is highlighted in an introduction by BP CEO Bob Dudley, who writes that transportation is one energy topic “where progress has been even faster than expected three years ago.” Dudley specifically refers to the “potential for growth among electric and self-driving vehicles” as well as the “increasing competitiveness of wind and solar power and the rapidly falling costs of batteries.” All critical factors for EV adoption and success.

BP projects cost parity between EVs and ICE vehicles by 2050, predicting that technology will “transform transport over the coming decades, as vehicles powered partly or fully by electricity become cost-competitive with those solely using internal combustion engines.” One major reason: more powerful and cost-effective batteries.

BP’s modeling indicates that battery costs per kilowatt hour (kWh) will fall from today’s $200/kWh to around $50 by 2050 for 60 kWh packs. Importantly, these optimistic projections assume a “step change” in battery performance, for example, if “lithium-ion chemistries are followed by solid-state or metal-air battery designs.”

Many of these battery developments are still theoretical, hardly close to production. However, there is clear momentum in R&D where smart people and resources are focused. Consider how significantly costs have come down for high energy density lithium-ion batteries since 2010. That kind of beneficial trend is inherent within energy and technology research.

BP writes that advances are needed on three types of batteries “that are developing rapidly,” with great potential for power storage, electric vehicles and other applications:

Metal-air batteries: Electricity is generated through a chemical reaction that oxidizes a metal such as lithium or zinc using oxygen from the air.

Flow batteries: Two liquid electrolytes are stored in external tanks to hold charge. Energy is released by pumping the charged fluids through an electrochemical cell. Because of their simple structure, it can be relatively cheap to add storage capacity to flow batteries.

Solid-state batteries: These replace liquid electrolytes with a solid material such as glass. This configuration allows for higher energy density than today’s lithium-ion chemistries. Solid-state cells do not contain flammable electrolytes, so they also offer safety advantages.

Naturally, if EV numbers expand as the Outlook projects, that presents significant issues for electricity generation and delivery. BP estimates that within the UK, charging EVs could increase demand by “around 19 terawatt-hours (TWh) in 2030 and by around 70 TWh in 2050,” potentially 5-10% of total demand.

Investments

In 2018, BP made three significant investments that reveal more about the company’s electrification strategy and the solutions it’s exploring in fast charging battery tech and infrastructure.

In May, BP Ventures announced a $20 million investment in StoreDot, which is developing a new battery technology that it hopes will enable ultra-fast EV charging rates, multiple times faster than what is possible with current Li-ion technology. The company is working on a “flash battery” for consumer electronics, which will hopefully ready for the market in 2019. When fully developed, StoreDot says its technology could match the range-recharge time of refueling a gas tank.

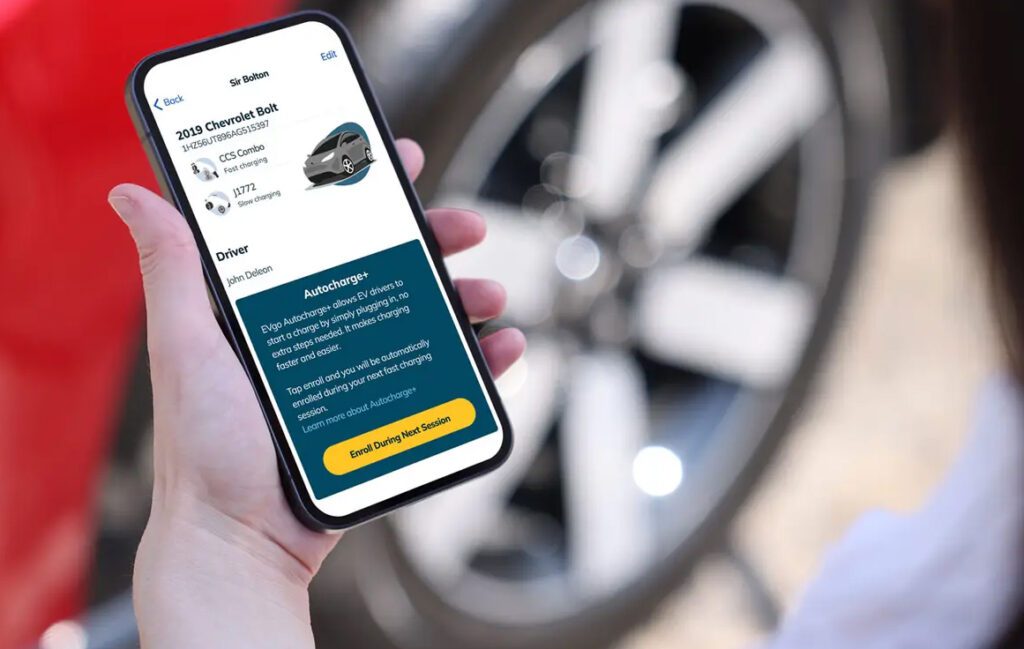

If StoreDot, or other battery firms, are able to reach those ambitious goals, the next hurdle to clear is building out scalable infrastructure. To that end, in January BP announced that it was investing $5 million in FreeWire Technologies, a US-based manufacturer of mobile rapid charging systems. BP is testing FreeWire’s Mobi Charger units at selected retail sites in the UK and Europe.

FreeWire units are essentially battery packs and charging station hardware on wheels that allow EVs to fast charge without connecting to the electrical grid. “We’re deploying our Mobi Chargers at select BP gas stations (‘forecourts’ as they call them in the UK),” FreeWire CEO Arcady Sosinov told Charged. “Fossil fuel giants are recognizing customer needs and looking ahead to the electric future of mobility by opening up to new EV charging solutions. The whole value proposition to a company like BP is that we can eliminate the construction, the permitting, the trenching, the service upgrades and all the other civil works that happen to enable EV charging. Civil works on a gas station are actually significantly harder and more expensive than in most other places. So if you want to turn a gas station into an EV charging facility, you’re going to need to either put money into construction and civil works or buy technology solutions to try and mitigate that.”

BP has a FreeWire pilot project underway now at its retail site in Hammersmith, a district of West London. A BP spokesperson said early users “have been impressed by FreeWire’s speed of charge.” BP wants to expand the project, and is looking for more EV drivers in the Hammersmith area. (To participate, you can send an email to FreewirePilot@bp.com to get started.)

Finally, in June, BP announced an agreement to purchase Chargemaster, which builds charging stations and operates a network of over 6,500 public charging points – the largest in the UK, according to the company. One of Chargemaster’s key priorities is expanding fast charging infrastructure, including 150 kW rapid chargers capable of delivering 100 miles of range in just 10 minutes.

Low-carbon economy

One section of the Outlook focuses on energy and technology changes and the transition to a low-carbon economy. Importantly, BP writes that “currently expected technology advances alone would not deliver the carbon reductions needed for a ‘two-degree world,’” i.e. keeping the rise in average temperatures to below two degrees Celsius compared with pre-industrial levels.

BP refers to carbon reductions just from technology and related efficiencies as an “unconstrained future.” Carbon reductions are significant, but energy-related emissions would still rise by around 15% between 2015 and 2050. (Keep that increase in perspective, however, because it is significantly less than the 70% increase during the previous 35-year period [1980-2015].) Nevertheless, a two-degree world will require an additional 70% decrease in carbon emissions by 2050.

In other words, even with the newest and best technological advances, there remains a shortfall in carbon reductions. BP writes that “further action would be required, such as putting a price on carbon emissions, as well as consumers making lower-carbon choices.” As EVs become competitive with ICE vehicles, BP writes, “it may be that factors other than technology-related costs, particularly government policies, play a decisive role in determining the shape of the vehicle fleet of 2050. Indeed, tailpipe CO2 emissions targets are already encouraging vehicle manufacturers to sell more battery and plug-in electric vehicles, while action to improve urban air quality also favors electric vehicles.”

The Outlook contains an “external perspective” commentary by Kelly Sims Gallagher, Professor of Energy and Environmental Policy at Tufts University. Gallagher writes:

“Although the costs of many cleaner energy technologies are falling rapidly, they do not compete on a level playing field. Conventional fossil fuels enjoy incumbency, which means that most of the existing rules and infrastructure were created to support them and not the cleaner alternatives. New government policies and business practices are necessary to change the rules of the game, and to foster a more cost-effective and productive transition to a low-carbon future. Government must enhance support for low-carbon energy research, development and demonstration, and then create a coherent and consistent policy approach to support the commercialization of clean energy technologies in a way that enhances equitable access to energy for all.”

Carbon pricing extends throughout all energy technologies – not just transportation, but heating, industrial uses, appliances and cooking. Vehicles would not take on that total cost.

Recall CEO Dudley’s comment that transportation is one energy technology topic “where progress has been even faster than expected three years ago.” Can or will that progress continue on its own, without some kind of market-based intervention directly linked to carbon emissions?

When those kinds of policy questions are settled – around the world – technical issues will come into much greater focus.

This article originally appeared in Charged Issue 39 – September/October 2018 – Subscribe now.