By Lisa Jerram, principal research analyst overseeing Navigant Research’s Transportation Efficiencies program

Wireless charging is becoming more mainstream among consumer electronics – witness the proliferation of wireless chargers at CES 2018 – but it is not just for smartphones and fitness bands. Automakers are working in earnest to offer wireless charging options for their plug-in vehicles. It’s seen as a way to make the EV charging experience seamless, which is a key goal for the EV market, in which consumer uncertainty around charging (in place of conventional fueling) creates friction and is a barrier to adoption.

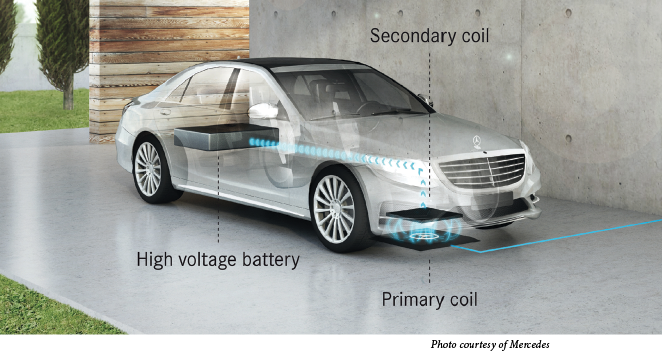

Wireless technology for EV charging has been under development for the past decade, with a handful of technology companies exploring different solutions. Regardless of a particular company’s approach, the basic wireless EV charging system includes a ground pad that lies beneath a parked vehicle and a receiving system embedded into the underside of the vehicle, which connects to the EV’s power electronics and battery systems. The system also has a stationary control unit mounted in proximity to the ground pad. Power is transmitted from the ground pad to the receiver and is managed by the control unit.

Although aftermarket wireless charging technology has been available since 2014, wireless charging will primarily be offered as a factory-installed option by the OEMs, much the same way DC fast charging capability was initially offered as an option by automakers. Both Mercedes and BMW have announced that they will offer wireless charging for select plug-in vehicles in 2018, and other automakers are set to follow suit. Technology companies, Tier 1 suppliers and automakers have been intensely focused on refining and improving the technology in advance of full-scale commercial rollout.

Vehicle positioning and ground clearance are crucial for successful deployment. Wireless chargers must be able to charge a low-riding sports car and an SUV with high ground clearance equally, especially if they will be placed in a public charging location. Also, wireless charging stations must be reasonably forgiving of vehicle placement. If the requirements for parking the vehicle are too exacting, the convenience of the wireless charger for the driver disappears.

Companies are developing systems that can accommodate a range of charging levels. EVs have gone from accepting AC power at around 3.6 kW to 7.2 kW, and Tesla supports 17 kW. Many automakers are targeting 11 kW, and perhaps 22 kW. Like connected chargers, wireless chargers need to meet these charging levels to ensure drivers get the fastest AC charge their vehicle is capable of.

Alongside this activity is the need for industry standards. Ultimately, the wireless charging market should be similar to the connected charging market. Today, automakers are responsible for the charging equipment on the vehicle, and a range of suppliers design and manufacture the offboard charging stations, some in collaboration with automakers but most as a standalone product. The goal for wireless charging is for standards to enable a range of suppliers to design and manufacture the offboard equipment and compete on price, design, and capabilities. This means that the onboard receiver must be able to communicate with any charging pad. Automakers, technology companies, Tier 1 suppliers and others are working with the SAE International to establish a set of standards for various power levels.

Finally, there is the issue of safety. No automaker wants its EV to create safety concerns. The technology companies are working on foreign object detection and living object detection, which means ensuring charging events are not trigged by stray objects under or near the car, or even more importantly, by children or animals.

Where does wireless charging make sense?

While these technology issues are critical to the commercial viability of wireless charging, they largely look to be solvable. Key developers in this space, like WiTricity and Qualcomm, are devoting significant resources to refining the technology in cooperation with OEMs and automotive suppliers. There do not seem to be any major barriers from a technology perspective, or even issues that would significantly delay the introduction of wireless charging as an option. However, technological success does not automatically lead to market success. The biggest question around wireless charging today is, What is the value proposition offered by wireless charging compared to current corded charging technology?

It’s a given that wireless charging will have a price premium over conventional conductive charging. Automakers are quiet on what the final price will be to the consumer, but it’s reasonable to assume that a buyer might have to pay at least $1,000 to have a wireless charging system, potentially much more. The EV charging market continues to be price-sensitive, both in the home and in commercial applications. However, there are a few areas that might see wireless charging provide value and drive sales.

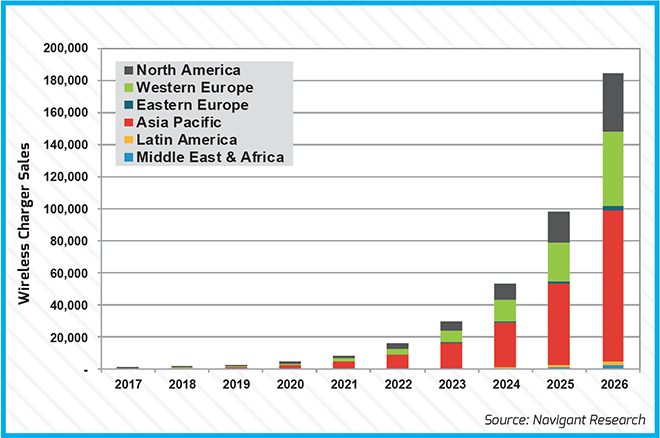

Basically, wireless charging could see demand in situations where convenience, reliability, or aesthetics are valued. For drivers of premium EV models, the convenience and aesthetic benefits of not having a cord could drive interest in paying what would be a relatively small premium compared to the overall price of the EV. For charging stations in the public right of way, cords can be hazardous and create visual pollution, so wireless charging could see demand in this application. For applications where drivers cannot consistently be relied upon to plug in the EV – for example, in shared vehicle services or fleets – wireless charging offers a solution. These are all likely applications in the near term. Navigant Research’s 10-year forecast for wireless charging is conservative, predicting that wireless will make inroads into the premium EV home charger market and in public and fleet applications.

Wireless charger sales by region, world markets: 2017-2026

However, as much as we see uncertain steps toward wireless charging for smartphones, the way for wireless charging to become the dominant mode for EVs is not yet clear. To get there, wireless charging will have to be widely available in the locations where corded charging is offered today (e.g. workplaces, hotels, entertainment, and retail sites) so drivers will not have to switch back and forth between using a cord and charging wirelessly. In the classic chicken-and-egg conundrum, charging site hosts will wait until they see a significant number of wireless-capable EVs on the road before installing new equipment. At the same time, the rate of uptake will increase if automakers commit fully to wireless technology as an EV charging offering and provide it at a relatively low cost. Wireless charging could also be the preferred option for automated EVs, as these vehicles will not have a driver to plug the car into the charger. Automated vehicles will not likely see major deployment levels until the mid-2020s, but these vehicles could drive significant growth of wireless charging systems from 2025 onward.

This article originally appeared in Charged Issue 36 – March/April 2018 – Subscribe now.