“When you get off the plane in Oslo, Norway, it is like entering fairytale land for people in the EV industry,” says Rami Syväri of charging network operator Fortum.

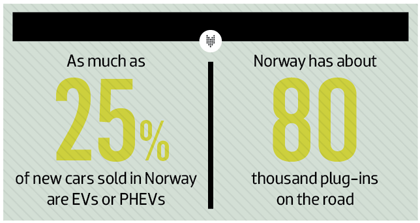

Thanks to hefty government incentives – including zero import taxes, charging incentives and bus lane access – Norway has quickly catapulted its EV market from early-adopter status into mass-market acceptance. As much as a quarter of all new cars sold in Norway are EVs or PHEVs, and some dealers report over 90% EV sales. Today, the country has about 80,000 plug-ins on the road, and with a population of just 5 million, that puts Norway at the top of the global market share list.

Companies that operate in Norway’s EV-topia are years ahead of other world markets in terms of lessons learned and processes improved. Syväri is the International Expansion Manager for Fortum’s Charge & Drive charging services. As the leading fast charging service provider in Norway, the company has a unique glimpse into a future where EVs are mainstream.

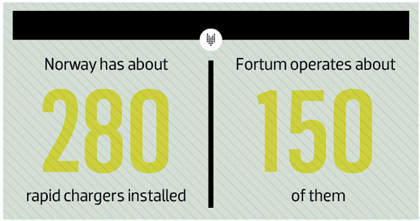

“Charge & Drive is the largest player in Norway’s quick charging,” Jan Haugen Ihle, Fortum’s Country Manager for Norway, told Charged. “There are about 280 rapid chargers in the Norwegian market and we currently own or operate approximately 150 of them. We also won a new contract in December to deploy 77 fast chargers in 44 locations along six major transport corridors in Norway.” The typical Charge & Drive location includes two 50 kW CCS and CHAdeMO ports and a double 22 kW Type 2 port.

Fortum – an energy company with areas of operation in the Nordic and the Baltic nations, Russia and Poland – also operates its Charge & Drive network in other countries that are in various stages of EV market development. “At Charge & Drive we have the benefit of observing and learning from three different market stages at the same time,” explained Syväri. “Finland is in the early stages with about 5 million people and 1,500 plug-in vehicles, Sweden is a bit more developed with 10 million inhabitants and around 15,000 vehicles, and Norway is leading at the mass-market stage with 5 million people and 80,000 vehicles.”

Being involved in these three markets at three different stages of building fast charging networks gives Fortum a clear view of the different challenges that are faced at each stage. So, we asked Syväri and Ihle to describe some of the top lessons learned.

1: Develop great user guides and 24/7 hotlines

Early adopters are people who know exactly what they want when they go shopping. They are typically tech-savvy and want to be part of the movement. “Early on in the game they could even educate us on the subject,” said Syväri. Most EV markets in the world are still in this stage, in which drivers tend to be the trend-setting sort.

However, in a mass market, like Norway’s, essentially everybody becomes an EV buyer. More and more people buy EVs because it’s the best solution for them, but they do so without as much research or self-education as early adopters. When they drive off the car lot, they often expect charging to be as simple as refueling a gas car.

“When new mass market buyers arrive at the charging stations, they really need to have detailed and simple-to-understand instructions,” said Syväri. “And you also need to have a 24/7 skilled hotline to help out.”

Charge & Drive describes times when, even with clearly displayed charging instructions, people go inside retail stores at charging sites to ask employees for help. “We’ve had reports of drivers asking McDonald’s employees to show them how the charger works,” said Syväri. “So, great user instructions are definitely needed, but it’s also important to clearly display a hotline number to call if you need further assistance.”

2: Tag all customer calls

To continually improve the customer experience, Charge & Drive emphasizes the importance of tagging all customer service calls that come in to the service hotline. This allows the network operator to analyze trends and determine what areas of the user interface need to be improved.

“In March, for example, 43% of the calls to our hotline were about text message payments,” explained Syväri. Text message, or SMS, payments allow users to pay for products via a mobile phone. EV drivers are instructed to text a certain code to start the charging session, and to text another code to stop. The payment is then applied to the customer’s mobile phone bill.

“While we thought that text messaging would be an easy way of identifying yourself to a charger and paying for the session, it turns out it’s not, because 43% of the customer support calls is too much,” said Syväri.

When Charge & Drive noticed this trend in its tag records, it began to work on easier payment options to reduce the friction for new customers. It quickly launched payment options within its charge point locator app. Now, regular users can easily save their payment options and tourists can input their credit cards into the same app that they use to find the charging stations.

3: Mitigate queuing anxiety

We’re all familiar with the notion of range anxiety, but unless you’ve spent time driving in one of the few EV-dense markets, you may not be aware of queuing anxiety. Simply put, it’s the fear of having to wait in line to use a public charging station.

Looking at their session data, Charge & Drive noticed that locations with two or three charging stations had higher average usage rates than locations with just one station. By engaging its customers, the company learned that regular users were avoiding sites with just one charging station, for fear that they would have to wait in line.

“These situations occur where the market is hitting mass,” said Syväri. “To avoid queuing, people tended to drive to where they assume there is a lower chance of waiting in line. In early-stage markets, station redundancy isn’t an option because of limited resources. In Finland, for example, where we are just starting to build corridors, the focus is on getting the first chargers in place. To start a new market from zero, you need to use your resources for showcases. First you want to build the ability to drive on a long corridor, and do it with the least amount of chargers possible in the beginning. However, as the market grows you need to realize that redundant chargers are very important, because drivers will favor those locations.”

4: High-quality charging hardware is critical

This may seem like common sense, but until you’ve experienced the headaches of lower-quality hardware it’s hard to appreciate. The cost of repeated service calls to charging stations can quickly exceed any up-front savings on cheaper units.

“We learned that we really need high quality and good designs,” said Syväri. “The reason is that low quality ends up driving costs up. Sending out a technician is extremely expensive, and the same is true for user interface designs. If the UI is bad, the customer calls the help center.”

5. Keep good fault logs

As well as tagging customer service calls to see trends happening from the user’s perspective, Charge & Drive stresses the importance of good bookkeeping for any technical problems that arise with the chargers. The company keeps detailed fault logs of any issues experienced with the system, as well as communications between the chargers and the back end.

Image courtesy of ABB

Image courtesy of ABB

“There will always be challenges over time with any hardware,” said Syväri. “With good fault logs we are able to immediately go deep in analyzing the data to find what is wrong with the charger. It’s not always obvious what the problem is, but with more information you can send out technicians that already have a good idea of what the problem is. This reduces both system downtime and service costs.”

6. Know your business case and stick to it

Navigating the new EV industry is tricky for any company attempting to build a long-term business model. In the past few years we’ve seen many small companies come and go, and large corporations announce EV charging initiatives only to scale back the scope.

The good news is that as the infrastructure market develops, there are now great examples of some models that work well and some that don’t. It’s a good idea for any company in the market to examine these case studies, stay lean, and focus on what has proven to be a sustainable business.

Consumer facing

Like many other infrastructure trailblazers around the world, Charge & Drive experimented with payment schemes on the consumer side, and settled on the view that they are selling a charging service.

“We are primarily selling a charging service,” said Syväri. “A retail location could allow an EV driver to plug into a normal outlet, and they could get the same amount of electricity as using one of our DC fast chargers. However, what we are offering is a high-tech solution that enables someone to get the energy in a much shorter time. So the benefit we’re offering is access to the technology and the service. It’s the whole package – the speed, instructions, customer service, easy payment functionality, etc.”

Because it’s selling a service, Charge & Drive sets prices per minute and not per kWh. This has the added advantage of incentivizing drivers to use the chargers for only the minimum amount of time needed. “The charging rate gets slower over time, and eventually reaches zero when the EV is fully recharged,” explained Syväri. “So the motivation of the user to free up the charger is slowing over time with per kWh pricing. With minute-based pricing the cost per benefit is growing over time and the user will occupy that charger the absolute minimum amount of time needed. This means the average charging time drops, which increases the availability of the station. And, in fact, that availability is the largest benefit that the users want from the service.”

In the beginning, the company received some critical comments from drivers who thought paying for the amount of electricity used was the fairest pricing structure – similar to the way we’re used to paying for gasoline by the gallon. However, Syväri said that after the market begins to mature and queuing becomes an issue, the benefits of paying per minute become clearer to drivers and they’re eventually happy with that pricing model.

Business-to-business

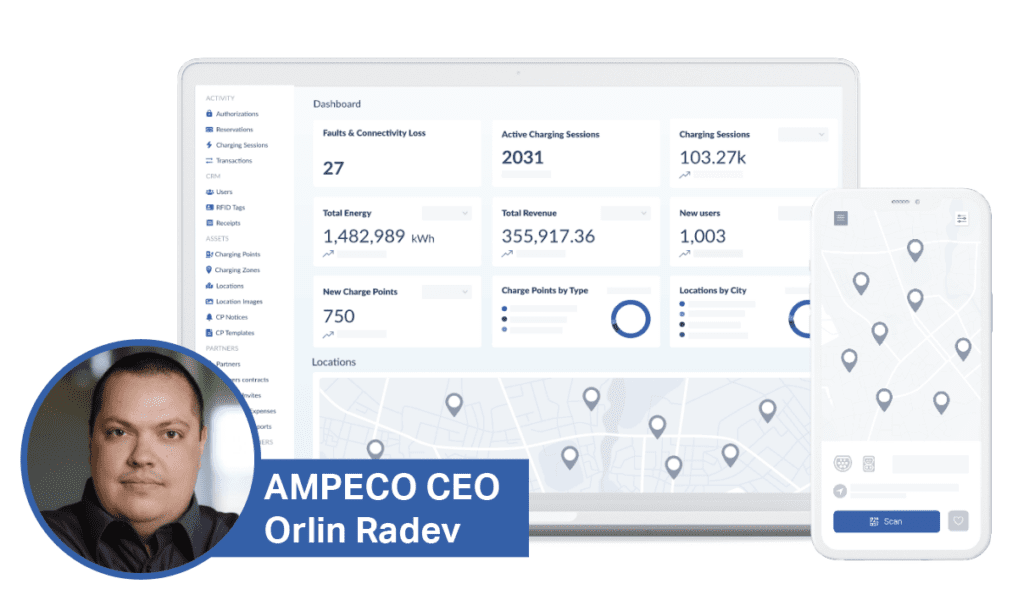

On the business management side, Fortum zeroed in on a few different models that worked for them. It invests in chargers, installs, operates and offers end-user services. It also operates and maintains chargers owned by other companies. And, finally, it offers a cloud-based software-as-a-service system that others can use to operate their own chargers.

“To have a good EV charging business, you really need to know how many charges a day you’re going to need to be profitable and have the ability to optimize that,” said Syväri. “So, you need to have a system which tells you this kind of basic information, and we offer that as well.”

More mass markets

A lot of EV industry watchers have high hopes that the $30,000, 200-mile EV will be the tipping point that brings a lot of the early adopter markets into the mass adoption phase. The Chevy Bolt EV will be the first to hit the US in a few short months, so the transition could be here before we know it.

In the meantime, there is a lot we can learn from studying Norway, where the mass market has arrived not because of range increases but because of government incentives. Ihle told us that he was recently at a charging site in Norway where a couple drove up in their Nissan LEAF, and both of them were over 70. “That gives an impression of where a market is,” he said. “They were not the most tech-savvy people, or interested in the nitty-gritty of the EV industry. They just want to buy a car and have everything work smoothly.”

This article originally appeared in Charged Issue 23 – January/February 2016. Subscribe now.

Top image courtesy of Norsk Elbilforening (CC BY 2.0)