An educated EVSE: Part of the academia-to-enterprise pipeline, MOEV Inc.’s distributed power smart-charging systems may be the economical answer to California utilities’ grand infrastructure plans.

The usually pejorative term “ivory tower” refers most often to an intellectually cut-off academia, which sits separated from the practical world, musing away on obscure research or useless pursuits. However, it’s shortsighted to think of the academic ivory tower as wasteful unless no one ever brings something useful down from it. The occasionally overlooked purpose of academia is exactly what its critics target: it provides a protective environment in which to tackle challenging questions and problems for the simple sake of finding solutions and gaining knowledge, whether the results are practical or not.

The cool thing is that more often than not, the best ideas will out. In the process of studying problems for the simple sake of finding answers, a small percentage of those answers will suggest a larger potential for doing good in the world at large, and that’s usually the time when an academic pursuit becomes a business. In that way, academia functions similarly to a venture capital firm. The VCs’ only goal from the outset is to pick ideas that will make a profit, but in some respects, the VC firm just picks its 10 favorite darts to throw at a target, expecting one of them to hit the bullseye.

When it comes down to plucking intellectual property (IP) out of academia and spinning it off into a business, “one gets a sense that a technology is able to solve an immediate problem for a real user, as opposed to only solving a technically or fundamentally hard problem,” said Dr. Rajit Gadh, a professor of engineering at UCLA and co-founder of MOEV Inc. A Los Angeles startup spun out of UCLA IP less than a year ago, MOEV develops EVSE hardware and software for distributed smart charging that could reduce some of the burdens of workplace and multi-unit dwelling (MUD) charging.

Gadh sees it as a plus to be located in Los Angeles, which, although not the tech startup mecca that its northern neighbor Silicon Valley is, does have the highest concentration of registered plug-in drivers – about 26,000 – in the biggest plug-in state in the country. “Charging is a physically fixed application,” Gadh said. “Being in proximity to this market is an advantage.”

MOEV’s IP and founding team come out of UCLA’s Smart Grid Energy Research Center (SMERC), which focuses its research and invention on the next-generation electric utility grid with DOE funding. That group works on many problems and product prototypes, as one can see from their publications at smartgrid.ucla.edu, but there’s another key factor concerning which ideas get spun off into companies: timing.

“The timing of a prototypical technology has to be just right, and that’s difficult to determine or predict,” said Dr. Peter Chu, a co-founder of MOEV. “Eventually, a very small number of technologies have the potential to be of use to the industry and therefore of commercial value at a given point in time.”

The time seems to be right for MOEV’s cloud software-controlled smart charging infrastructure, because right around the time that MOEV spun out of SMERC late last year, the California Public Utilities Commission (CPUC) lifted its 2011 band on investor-owned utilities owning EV charging infrastructure (the controversy over that decision is its own story). Now three major California utilities have proposals on the table for installing many thousands of EV chargers. San Diego Gas and Electric, Southern California Edison and Pacific Gas and Electric all have separate proposals to install tens of thousands of public charging stations over the next several years.

Once again, a promising EV startup owes its potential success not only to academic research, but also to government intervention. Time and again, Charged has covered new ventures – names like Spider 9, EC Power, EnerG2 and California Lithium Battery – that thrive off of some combination of university IP and governmental action, whether that be a grant, purchase incentives or in the case of MOEV, the lifting of a regulation. Of course, just because California utilities are now looking to spend more than $1 billion of combined money on EV chargers, that doesn’t mean the riches will automatically flow into MOEV’s coffers. So let’s see why MOEV’s founders believe its charging system is so utility-friendly.

Sharing the load

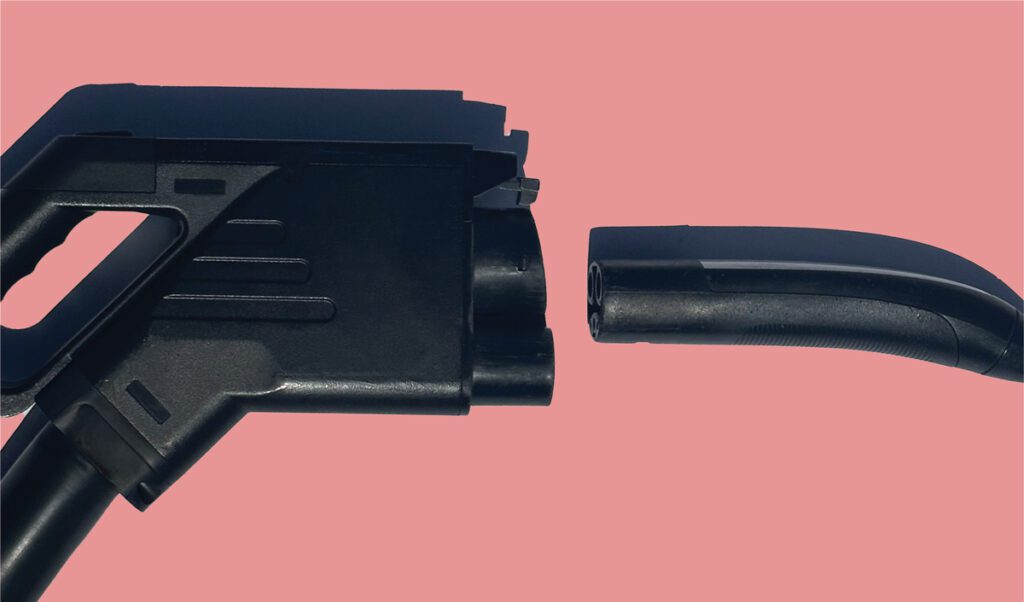

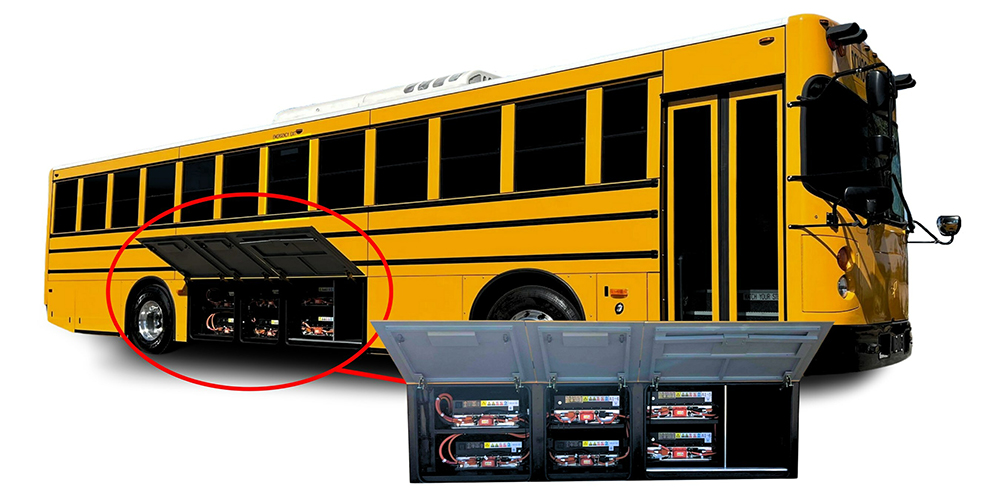

Two key innovations of MOEV’s charging system are circuit sharing and dynamically allocated power. Many typical locations for public charging, such as a workplace or MUD, won’t have a lot of extra electrical infrastructure. MOEV’s system can take a single 100 W line and divide it among four cable handles.

“Vehicles are connected for more time than they’re charging,” said Michael Boehm, MOEV’s Director of Business Development. “If someone has a LEAF and they need to leave it for three hours, and someone else has a Volt they’re parking for eight hours, we can trickle-charge the Volt and send the majority of the power to the LEAF, so we satisfy the customers. We’ve developed many algorithms that can optimize the charging experience, depending on one’s rate sensitivity, the type of vehicle and the amount of time to charge. The utilities like it, because another thing you can do is take the demand response signal and damp down all of the charging sections.”

MOEV’s charging network can handle many different distributed energy objects on the grid, making it easier to manage energy loads. “It’s a happy future for the utilities when they can control what happens with EV charge loads,” Boehm said. “UCLA looked at how you could use the vehicle charging load to complement your solar generation. If a cloud goes over the photovoltaic, you could drop your charge load, and you’ll be net-neutral to the grid. So it could be an alternative to more expensive V2G local battery storage, which still needs a of work to figure out.”

Each big utility will probably have its own take on how to implement its charging network, and MOEV’s “well behaved” system provides a lot of flexibility for designing it. “The utilities have this vision for how charging should act, and regulators allow them to throw some money at it,” Boehm said. “Often what we do in California becomes a model for other places, so it’s interesting to look at what the model for public charging will be.”

While at SMERC, MOEV’s founders installed more than 200 chargers, tweaking and collecting data from them for around four years. They experimented with combining them with solar energy and energy storage. Since seeing the opportunity to spin out MOEV in late 2014, the start-up has installed two systems – one of them as part of an educational micro-grid – and has three more in the pipeline. MOEV has its own EVSE hardware that it designed, patented and built. Typically, each charger is a “quad-box” with four cables, but they can have anywhere from two to eight charging cables working off of a single electrical line.

There’s also a retrofit version of the system MOEV can use for larger-scale projects. “We have engineered a solution that works retroactively with other dumb chargers,” Boehm said. “It doesn’t provide as great a benefit as with our own hardware, but we can provide the load shedding, the management and so on using other folks’ chargers.”

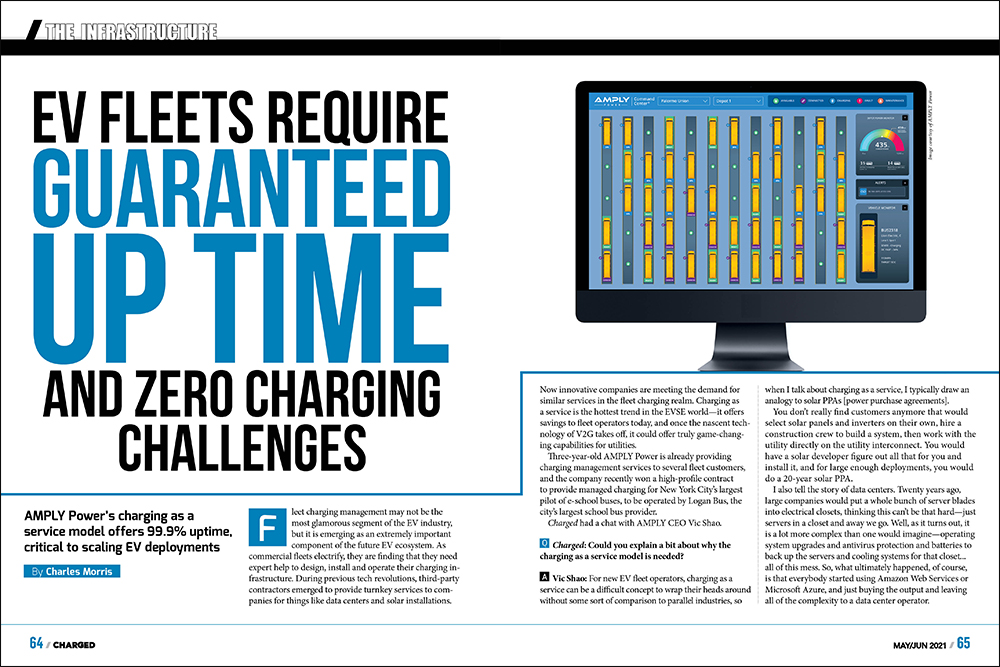

The retrofit gateway box holds the “brains” of the MOEV system, and Boehm says it’s quite inexpensive because he sees MOEV as primarily a software company and that’s where the biggest value of the system lies. “We really make our money on the services contract,” Boehm says, “the cloud service to run it, manage it and provision it with new algorithms.”

The full MOEV hardware will cost a premium for now, but it’s a system you’re not likely to find anywhere else, and that’s partly a result of MOEV’s academic origins. “That makes sense, because we approached the problem from an intellectual/academic point of view,” Boehm said. “We talked to all the stakeholders, figured out where there’s a niche and what to create to keep that business niche. In California we call the system a demand aggregator. The hardware will for sure cost more than a $500-600 dumb charger, because (1) we’re not in volume manufacturing yet and (2) we do a lot more sophisticated things and need to meter everything. That alone adds a fair amount to the bill of materials.”

A Use-Case Scenario

We asked Boehm to walk us through a MOEV charging experience, from installation to consumer use.

It begins with MOEV visiting an interested site owner to find out where the chargers would be, how many circuits there are and whether there are communication uplinks like ZigBee or Ethernet. For each circuit, they run a conduit down to a box, and in the case of the quad-box, it would have four charging cables coming out. Whether it’s using a wired or wireless communication protocol like Wi-Fi or cellular, they establish an uplink to connect the charging box to the cloud and punch in some info about the available power of the circuit.

Next it’s the user’s turn. If this were a workplace charger, each employee would set up their EV and account with MOEV’s smartphone app. In the app, they tap in the charger’s code, which sends a request to the cloud, then the network turns on the appropriate charger and cable for that user. After starting the session, they indicate how much power they need and how long they will be plugged in. An individual site host can also ask them for additional information, for example, the rate they’re willing to pay. If one customer is willing to pay more per kWh, they may get top priority. (That’s one feature a site host could implement with the flexible software, but it would not apply to every site.) The user’s app then sends a notification when the charging finishes, as well as a statement with the final bill, kWh used, etc. The app also helps them navigate to available chargers.

“The way we see it, we’ve got three happy customers,” Boehm said. “First is the site owner, because if they wanted four chargers, there’s not enough circuits for four standard installs. They would have to put in a transformer, a new set of panels and switches and circuit breakers and then run those cables down to wherever the chargers are. So they could well offset five times the cost of the hardware in infrastructure costs.”

“Second, the EV owner has a nice smartphone app to help them through the experience, and there’s a greater availability of plugs for charging. And the fact is, most charging sessions do not require a full Level 2 for a full eight hours. So the utilities are happy about it, because they don’t have to build up a lot of new infrastructure, and if it’s dumb charging and everyone plugs in at 9 am, you have a big surge then, and they’ll share their pain in the form of demand charges with the site host. They also have the ability to leverage this against renewable energy integration. It’s a win-win for all.”

MOEV over, V2G

There’s one tricky caveat to this big win-win vision for California, which is that the CPUC has approved in principle the right of investor-owned utilities to install EVSE, but they have not yet approved each individual utility’s proposal. And there is some opposition both in the EV industry and among consumer advocates to letting utilities make this investment. Detractors say that it’s a government handout of an effective monopoly to the utilities, that the proposals don’t include enough DC fast chargers, that it’s not fair for the utilities to pass on EVSE costs to all their customers, regardless of whether they drive EVs or not, etc.

However, Boehm is optimistic. “I don’t see the regulators as being a big risk,” he said. “They’ve already approved it. We’ve had a change of chairmanship in the CPUC, but the policy has stayed the same. I think those units will all be installed in the next three or four years. That will be a lot of EVSE coming into California, which is great news for our industry.”

Furthermore Boehm sees the MOEV system as an immediate way to realize some of the potential benefits of vehicle-to-grid (V2G) technology, which may still be quite a few years away.

For one thing, he says that for V2G to achieve success on a broad scale, the OEMs/manufacturers would have to make certain vehicle information available that they currently hold very close to the vest, such as state-of-charge information and the ability to trigger bi-directional charging. Not every EV is currently made to be V2G-compatible, and of those that are, some have bi-directional charging software disabled. Researchers such as those at SMERC trying to work on V2G technology usually have to approach the OEMs to get them to supply a vehicle that can do bi-directional charging.

“I think that will be the next big change in the charger industry,” Boehm said, “and that will take a while to come about, because of OEMs’ reluctance to share data. It may even be that the first V2G models are in fleet sales, because with fleets, the liability may be more local; they’re more flexible; they’re more customized. It’ll be interesting to watch that space.”

This article originally appeared in Charged Issue 18 – March/April 2015.