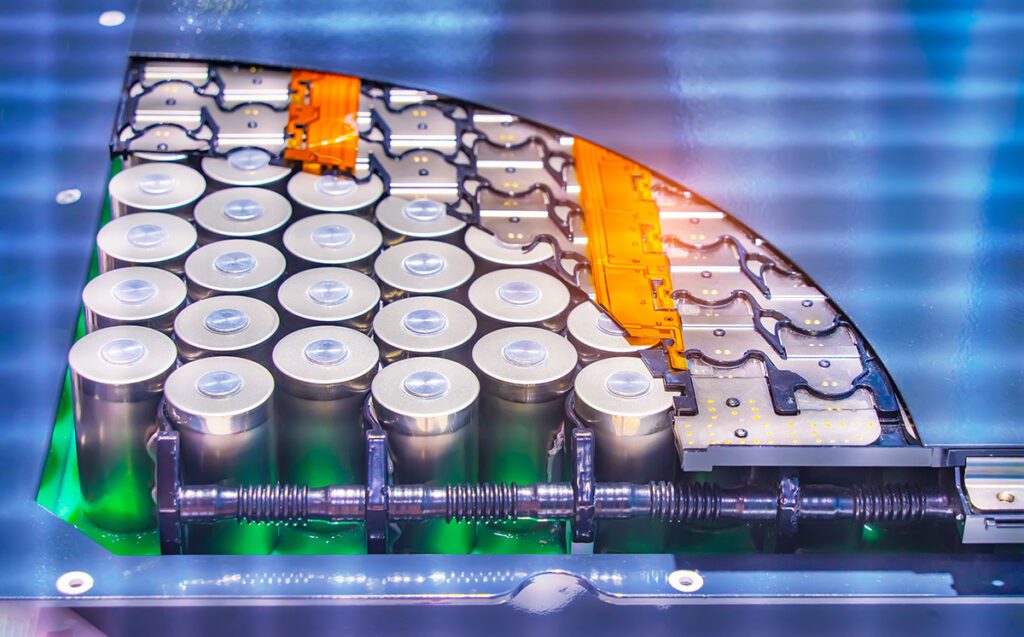

In 2019, over 59,000 tons of nickel and 14,400 tons of cobalt were deployed globally in passenger EV batteries, a one-year increase of 39% and 34%, respectively, according to data from Adamas Intelligence’s EV Battery Capacity and Battery Metals Tracker. Panasonic used 51% of the global market share of nickel (down from 56% in 2018), followed by CATL and LG Chem, with market shares of 15% and 12%, respectively. Rounding off the top five were BYD and Envision AESC with market shares of 7% and 3%, respectively.

60% of Panasonic’s nickel deployment in 2019 went into nickel-rich Li-ion cells used by Tesla EVs, and 39% went into NiMH cells and Li-ion cells used by Toyota hybrids. The remaining 1% was deployed in PHEVs.

When it comes to cobalt, CATL took the lead in 2019 with a 21% global market share, followed by last year’s leaders LG Chem and Panasonic with 20% and 17%, respectively. Filling out the top five were BYD and Samsung with market shares of 11% and 9%, respectively.

Overall, the aforementioned 5 cell suppliers were collectively responsible for 78% of all cobalt deployed globally in passenger vehicle batteries in 2019, up from 69% occupied by the top 5 in 2018.

Source: Adamas Intelligence