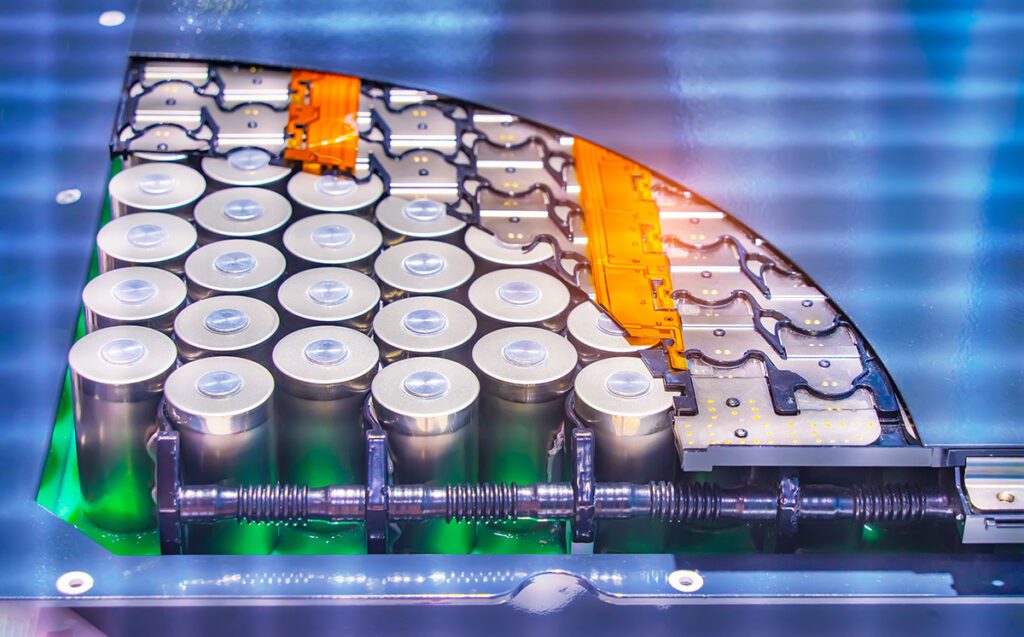

Australia is a lithium mining powerhouse—the country mines about 53 percent of the world’s supply of lithium. However, lithium must undergo several processing steps before it’s ready for use in batteries, and almost all of Australia’s lithium is sold to China, which dominates lithium processing.

Moving the processing closer to the mines is important not only for national security reasons, but for sustainability (shipping heavy raw materials around the world has a massive emissions footprint), so Australian companies are exploring ways to bring processing closer to home.

By all accounts, it will be a tall order. China has hundreds of lithium refining plants and years of experience. Furthermore, analysts say that the investment needed to set up a lithium hydroxide plant in Australia is far higher than in China—roughly two-and-a-half times higher by some estimates—and Australia’s stronger environmental and labor standards will make it hard to compete with China on price.

On the other hand, Australian producers may be able to command higher prices for their lithium. Australia has a free trade agreement with the US, so battery makers using lithium refined in Australia would benefit from tax credits included in the US Inflation Reduction Act.

At the recent Group of 7 summit, President Biden and Prime Minister Anthony Albanese of Australia jointly announced projects intended to strengthen the supply chain for critical minerals. The Australian government has already invested hundreds of millions of dollars to support the lithium refining industry.

Pilbara Minerals, Australia’s largest independent lithium miner, is working with Australian tech company Calix on a project to refine spodumene to a lithium phosphate salt—a key step in the chain from mines to battery cells. The companies are considering plans to invest up to 70 million Australian dollars ($47 million) to build a demonstration plant.

A government report last year forecast that Australia could take 20 percent of the global lithium refining market by 2027—currently the figure is less than 1 percent.

At the moment, Australia has just two facilities that produce battery-grade lithium hydroxide, and a third is under construction. The largest facility, co-owned by American chemical firm Albemarle and Australian mining company Mineral Resources, began producing lithium hydroxide last year, more than a year behind schedule.

However, the incentives to build new supply chains are strong, and Australia has plenty of lithium. “The guy with the rock wins,” said Joe Lowry, founder of advisory firm Global Lithium. “And Australia’s got the rock.”

Source: New York Times