Long-haul trucks are going to be a tough nut for EVs to crack, but it’s never smart to bet against Tesla. That’s the one-sentence summary of the trucking industry’s reaction to Tesla’s recent announcement that it will unveil an electric semi-truck in September.

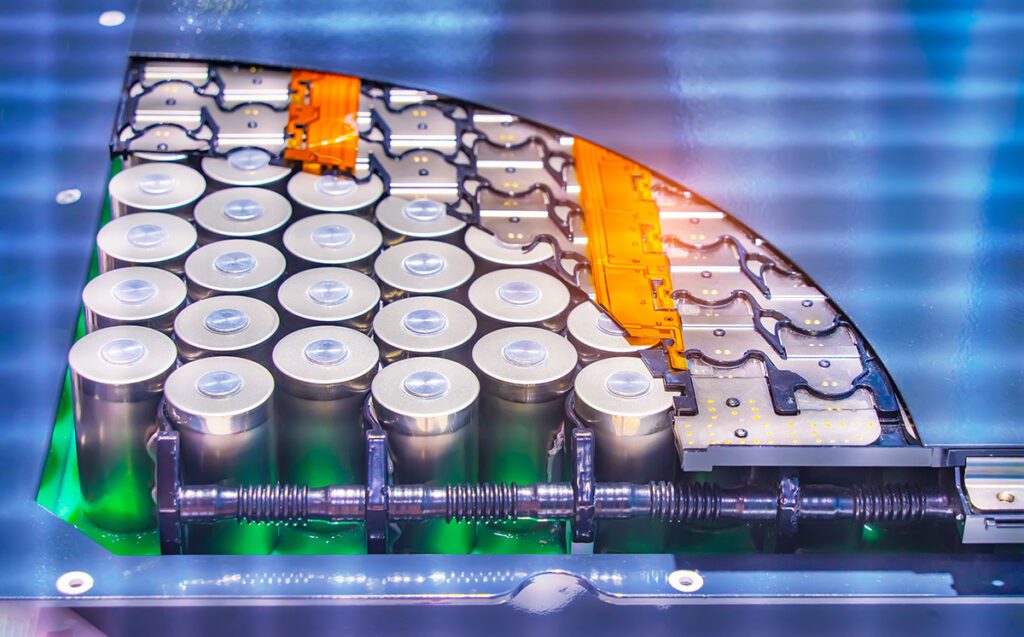

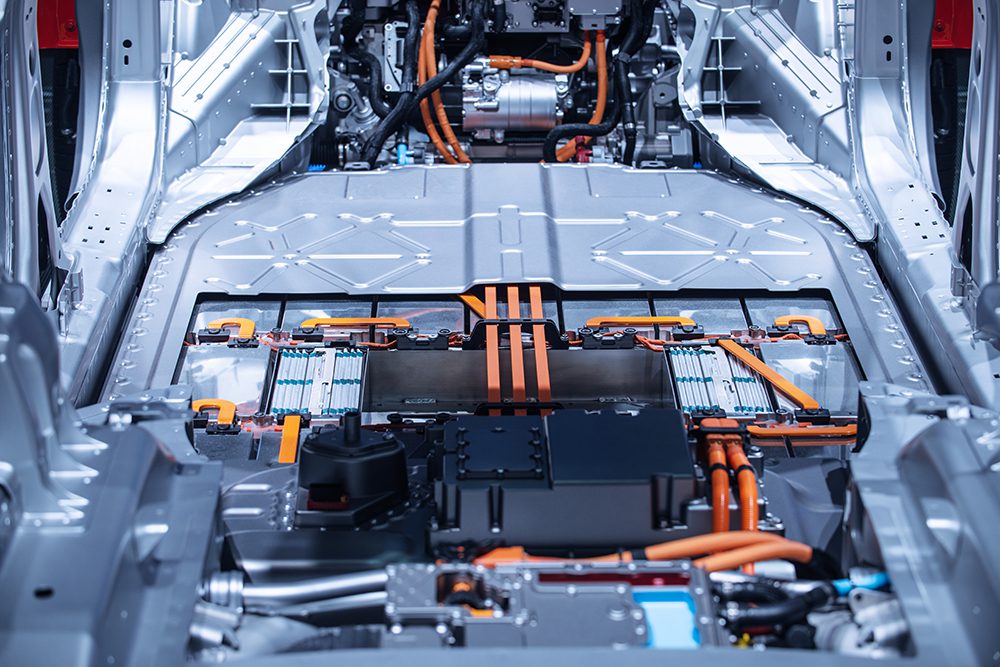

The challenges involved in electrifying big rigs are huge. The battery for a semi-tractor would probably have to be around 8 times the size of the one that powers Model S, and its ponderous weight would cut into precious cargo capacity. There is no highway charging network suitable for heavy-duty vehicles. And diesel fuel is cheap, so there’s little incentive for operators to switch from conventional trucks.

Industry analysts agree that Tesla could pose a serious challenge to established truck manufacturers, but “we’re a long way out from a real threat,” as Michael Baudendistel, an analyst with Stifel Financial, wrote in a recent investor report.

“Given the happily consolidated nature of the domestic truck manufacturing market, the prospect of a new competitive threat, from a company with previous success in disrupting established industries, is undoubtedly unwelcomed news” to vehicle manufacturers such as Daimler, Paccar, Volvo and Navistar as well as powertrain suppliers such as Cummins, Baudendistel said. However, before Tesla could launch truck production, it would have to solve “a litany of significant issues.”

“The pace of change is slow in the trucking industry,” Baudendistel added. “After years of optimistic expectations that natural gas would overtake diesel, today it accounts for less than 5 percent of the North American Class 8 market.”

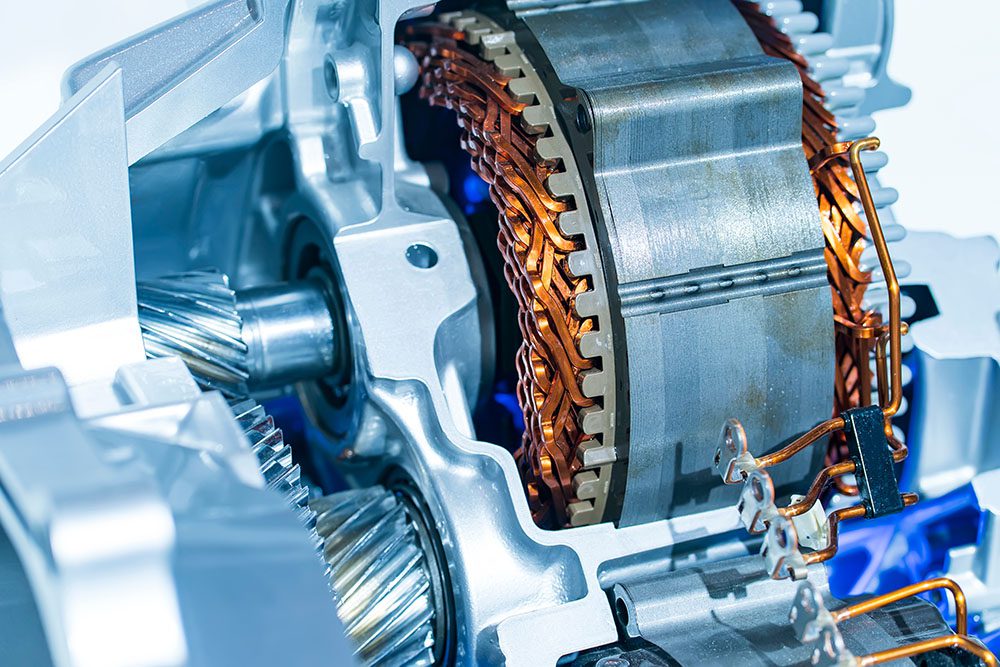

Other segments of the heavy-vehicle market are moving to electric powertrains. Terminal trucks, which are used to move containers around at ports and distribution centers, are good candidates for electrification, as they don’t require much range, and can be recharged at a central facility. Electric transit buses are also being deployed in cities around the world. However, the architecture of a bus is different from that of a truck. “The structure of a bus, with its long wheelbase, allows you to put a lot of batteries underneath,” points out Antti Lindstrom, an analyst at research firm IHS Markit. “You don’t have that in a semi-truck.” Human passengers are also much lighter than the loads typically carried by long-haul trucks.

Lindstrom has his eye on Nikola Motor Company, which recently unveiled a Class 8 truck that uses both lithium batteries and a hydrogen fuel cell. Hydrogen allows for fast fueling, and the fuel cell can power an electric powertrain without the need for large, heavy battery packs.

There are a lot of variables in the trucking industry, so calculating an economic case for an electric truck is complicated, says Piper Jaffray analyst Alex Potter. Nonetheless, he clearly believes the threat from Tesla is real. “Commercial vehicle makers – and their suppliers – would be wise to stymie their laughter and take these tweets seriously,” Potter writes. “We are downgrading truck stocks CMI and PCAR partially because we think their valuations already reflect cyclical optimism, but also because we think TSLA’s impending arrival could pressure valuations.”

The prize at stake is a large one. “In North America and Europe alone, we think the heavy truck market likely represents a revenue opportunity in excess of $100 billion per year (vs. TSLA’s estimated 2017 revenue of ~$11 billion),” Potter writes.

Source: Trucks.com, Electrek