Earlier this week, Nikkei

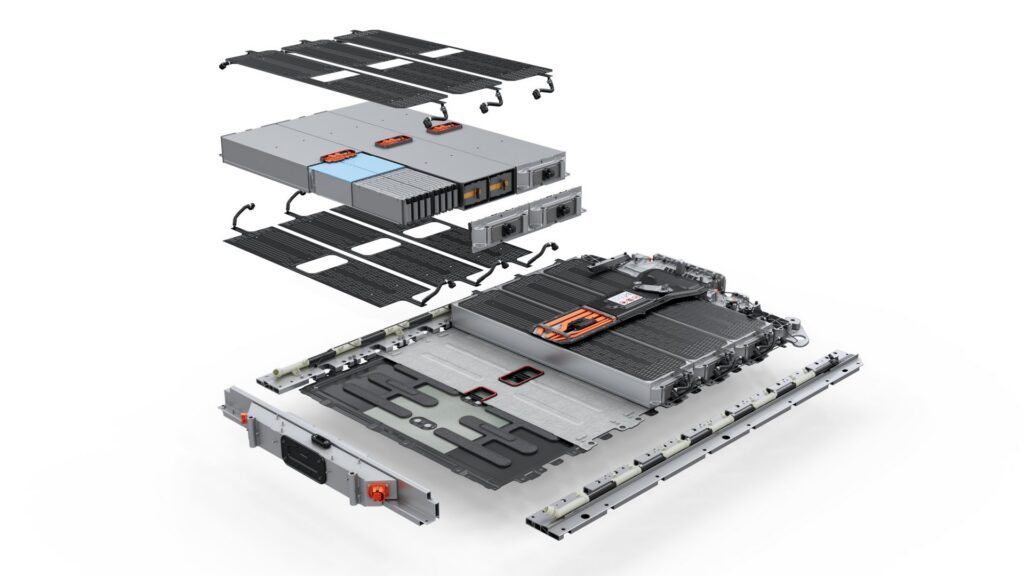

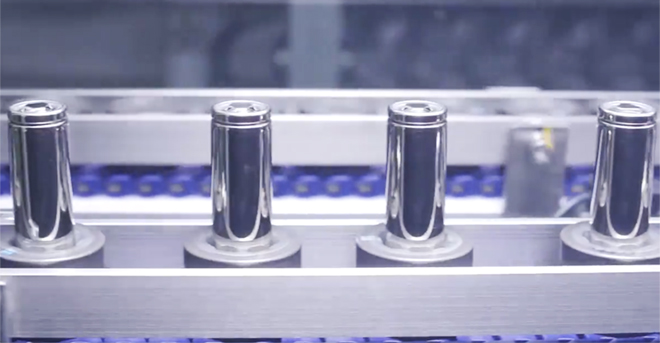

reported that Tesla and Panasonic have suspended plans to expand the capacity

of Gigafactory 1. The two companies had planned to increase capacity at the

Nevada plant by about 50 percent by 2020, but financial problems have forced them

to put those plans on hold, the newspaper said.

Panasonic will “study additional investments over 35 GWh,” the Japanese company told Bloomberg, apparently meaning that it will consider ongoing demand before deciding when or whether to expand production capacity beyond the current 35 GWh.

“Panasonic will also suspend its planned investment in Tesla’s integrated automotive battery and EV plant in Shanghai,” Nikkei reported. “Instead, it will provide technical support and a small number of batteries from the Gigafactory. Tesla is committed to buying batteries for the cars built at the Shanghai factory from a number of makers.”

Electrek, generally very well-informed about Tesla’s doings, called the report “questionable,” noting that Nikkei cited no sources for the information. Also, Nikkei’s report that Panasonic is suspending a planned investment in Gigafactory 3 seems odd, because the company has not previously announced any such investment. Tesla has not announced any partners for Gigafactory 3, and has indicated that it would focus on vehicle production at first, sourcing cells from several manufacturers.

Following the report, Tesla issued a statement that was intended to clarify the issue: “Both Tesla and Panasonic continue to invest substantial funds into Gigafactory. That said, we believe there is far more output to be gained from improving existing production equipment than was previously estimated. We are seeing significant gains from upgrading existing lines to increase output, which allows Tesla and Panasonic to achieve the same output with less spent on new equipment purchases. However, we will of course continue to make new investments in Gigafactory 1, as needed. Most importantly, contrary to what is implied in this report, our demand for cells continues to outpace supply. It remains the fundamental constraint on Tesla vehicle and Powerwall/Powerpack production.”