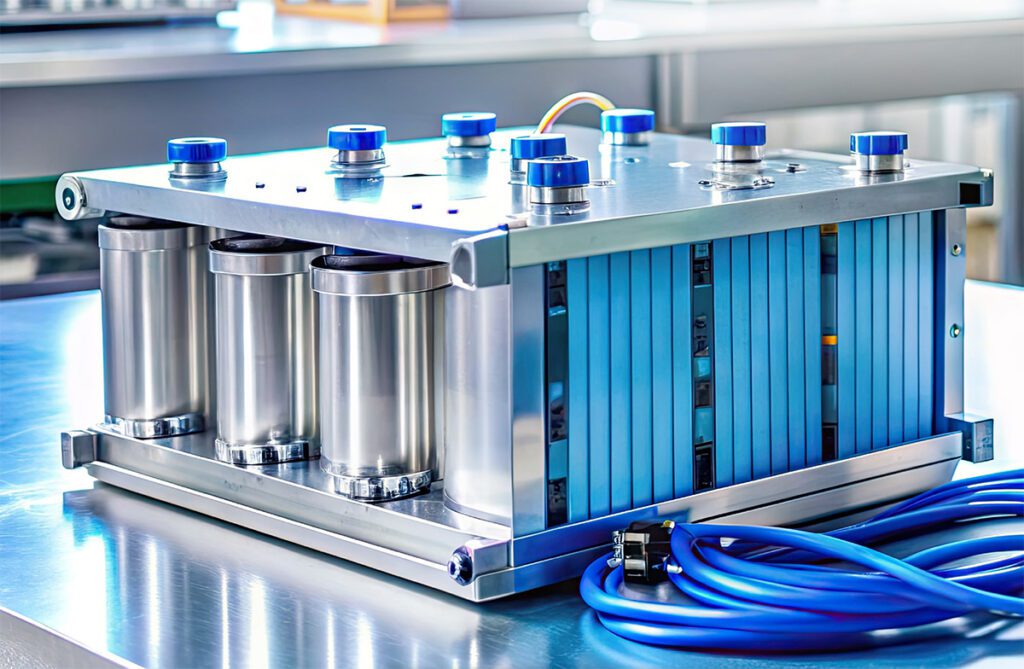

Japanese giant Panasonic is by far the largest automotive batter supplier at the moment, with a 39% market share. According to a new report from Lux Research, it will probably hang onto that position, increasing its share to 51% as EV batteries grow to a $30-billion market by 2020. However, there’s a real possibility that Korean rival LG Chem could knock it off its lofty perch.

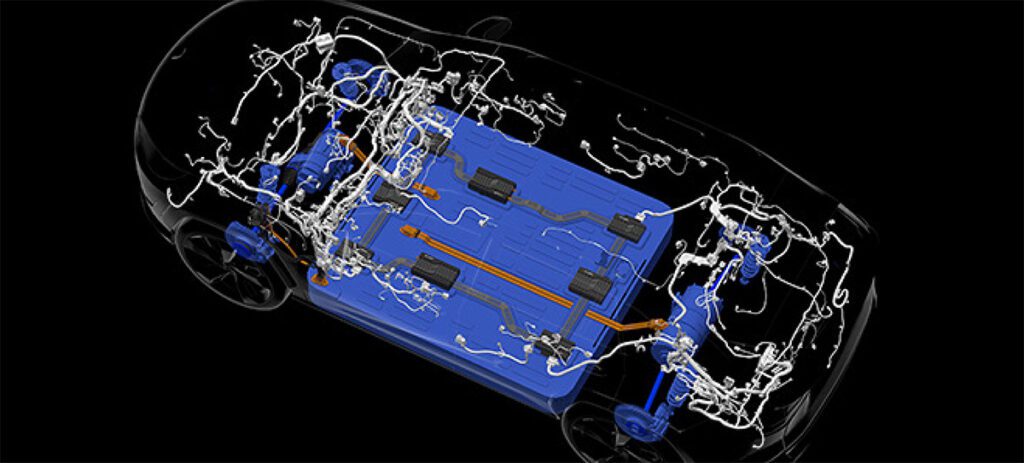

“Watch the Throne: How LG Chem and Others Can Take Panasonic’s EV Battery Crown by 2020” points out that Panasonic relies heavily on a single customer – Tesla, currently the top US seller of plug-ins – whereas LG Chem has signed up several large automakers, including GM, VW, Daimler, and Ford, that have the potential for large future sales.

Lux notes that the Renault-Nissan Alliance is something of a wildcard. AESC, its joint venture that sources batteries from NEC, has fallen behind in technology, creating an opportunity for LG Chem, which already supplies Renault, to win Nissan’s business as well.

Automakers and their suppliers definitely have their eyes on the next generation of battery technology. Samsung Ventures has invested in solid-state battery developer Seeo and in graphene-silicon anode maker XG Sciences. Volkswagen has backed Quantumscape and GM Ventures has invested in Sakti3, Envia Systems, and SolidEnergy Systems.

“The battery world’s big three – Panasonic, LG Chem, and Samsung SDI – are engaged in an all-out war for market share in the emerging plug-in vehicle opportunity, yet their strategies differ wildly,” writes Lux Research Senior Analyst Cosmin Laslau.

Source: Green Car Congress