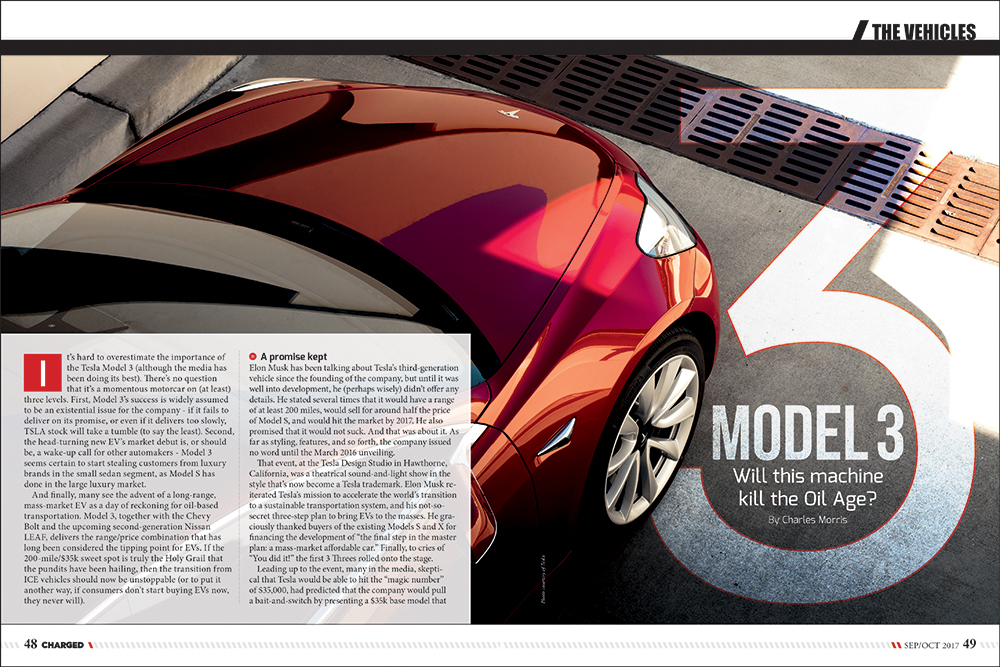

It’s hard to overestimate the importance of the Tesla Model 3 (although the media has been doing its best). There’s no question that it’s a momentous motorcar on (at least) three levels. First, Model 3’s success is widely assumed to be an existential issue for the company – if it fails to deliver on its promise, or even if it delivers too slowly, TSLA stock will take a tumble (to say the least). Second, the head-turning new EV’s market debut is, or should be, a wake-up call for other automakers – Model 3 seems certain to start stealing customers from luxury brands in the small sedan segment, as Model S has done in the large luxury market.

And finally, many see the advent of a long-range, mass-market EV as a day of reckoning for oil-based transportation. Model 3, together with the Chevy Bolt and the upcoming second-generation Nissan LEAF, delivers the range/price combination that has long been considered the tipping point for EVs. If the 200-mile/$35k sweet spot is truly the Holy Grail that the pundits have been hailing, then the transition from ICE vehicles should now be unstoppable (or to put it another way, if consumers don’t start buying EVs now, they never will).

A promise kept

Elon Musk has been talking about Tesla’s third-generation vehicle since the founding of the company, but until it was well into development, he (perhaps wisely) didn’t offer any details. He stated several times that it would have a range of at least 200 miles, would sell for around half the price of Model S, and would hit the market by 2017. He also promised that it would not suck. And that was about it. As far as styling, features, and so forth, the company issued no word until the March 2016 unveiling.

That event, at the Tesla Design Studio in Hawthorne, California, was a theatrical sound-and-light show in the style that’s now become a Tesla trademark. Elon Musk reiterated Tesla’s mission to accelerate the world’s transition to a sustainable transportation system, and his not-so-secret three-step plan to bring EVs to the masses. He graciously thanked buyers of the existing Models S and X for financing the development of “the final step in the master plan: a mass-market affordable car.” Finally, to cries of “You did it!” the first 3 Threes rolled onto the stage.

Leading up to the event, many in the media, skeptical that Tesla would be able to hit the “magic number” of $35,000, had predicted that the company would pull a bait-and-switch by presenting a $35k base model that lacked the amenities everyone wants. But a true knight does no such things. The Iron Man assured us that every Model 3 would come with the main features that make a Tesla a Tesla: 5-star safety ratings; a 0-60 time of less than 6 seconds; a range of at least 215 miles; standard Autopilot hardware and Autopilot safety features; plenty of passenger and cargo space; and Supercharging capability.

The reservation list opened the morning of the show, and by the time Musk finished his presentation, 115,000 people had plunked down their $1,000 deposits. By the time deliveries began a year later, that number had grown to half a million.

Even if all goes as planned, Tesla won’t be producing that many cars per year until the end of 2018, so the waiting list is obviously going to remain a long one for the foreseeable future. For this reason, Tesla has been “anti-selling” Model 3, trying to convince prospective customers to order a Model S instead, and put some money in the bank right now. Tesla’s web site includes a chart that compares the two models, making it quite clear that Model S is the premium vehicle: “Model S is our flagship, premium sedan with more range, acceleration, displays and customization options…Model 3 is a smaller, simpler, more affordable electric car. Although it is our newest vehicle, Model 3 is not ‘Version 3’ or the most advanced Tesla.”

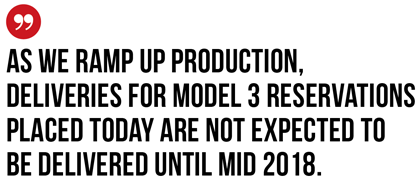

Admitting that a particular model has drawbacks is surely yet another first for an automaker. Car companies’ promotional materials tend to accentuate the positive and ignore the negative, often to a ridiculous extent. Tesla, however, hammers home the point that Model 3 is a lesser model – and not only that, but you’ll have to wait (oh no!). Consider this wording, which violates every principle of conventional marketing wisdom:

Model S: “New Model S inventory cars are available for delivery in approximately 7 days while custom orders are delivered in 30-60 days.”

Model 3: “As we ramp up production, deliveries for Model 3 reservations placed today are not expected to be delivered until mid 2018.”

In February 2017, Tesla began building preproduction units at its California assembly plant. In April, Reuters reported that Tesla planned to streamline the process of building the Model 3 production line by cutting out a step that was previously considered standard procedure. Automakers typically test a new production line by building vehicles with relatively cheap prototype equipment that can be modified to address problems, then discarding the temporary tools once production is running smoothly – a process known as “soft tooling.” Tesla skipped that step, and installed permanent equipment on the line from the beginning. Musk told a group of investors that “advanced analytical techniques” (computer simulations) would help Tesla to advance directly to production tooling.

Some observers called it a risky move. Production equipment designed to produce millions of cars is expensive to repair or replace if it doesn’t work. However, lower-grade temporary equipment may have been part of the problem with the long-delayed Model X in 2015. According to an anonymous source cited by Reuters, Tesla had no time to incorporate lessons learned from soft tooling, making its value negligible: “Soft tooling did very little for the program and arguably hurt things.” Tesla has also learned to better modify production tools, and its 2015 purchase of Michigan tool and die manufacturer Riviera Tool means it can make equipment faster and more cheaply than before.

Photo courtesy of Steve Jurvetson (CC BY 2.0)

For once, Tesla was not the first to try a new way of doing things. Audi recently launched production at a plant in Mexico using computer simulations of the entire assembly line and factory, and the company said this allowed the plant to launch production 30 percent faster than usual. An Audi executive involved in the Mexican plant launch, Peter Hochholdinger, is now Tesla’s VP of Production.

Limited production of Model 3 began in July, right on schedule (much to the chagrin of pundits who had been insisting for months that Tesla would be late). Replaying a scene that took place during Model S development, TSLA stock soared as it became apparent that Tesla would deliver the game-changing vehicle on time.

The first production Model 3, destined for Elon Musk’s personal stable, rolled off the line without fanfare in July. The big party took place at the end of the month, when the first 30 customers received their vehicles, and the configuration tool, which lets reservation holders choose their colors and options, went live.

Once again, Musk told the Tesla story, took some well-earned bows, and thanked his team, as well as everyone who has bought a Model S or X. “You make the 3 possible. The money that we make [on an S or X] all goes into building Model 3.” Perhaps not what the Wall Street types who are impatient for Tesla to start posting profits want to hear, but strong stuff for true believers.

With uncharacteristic understatement, Musk said, “The thing that’s going to be the major challenge for us over the next 6-9 months is, How do we build a huge number of cars?” Then he dropped his formal pose and said, “Frankly, we’re going to be in production hell. Welcome to production hell!”

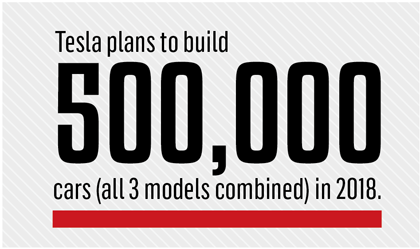

Tesla plans to ramp production to 5,000 units per week by the end of 2017, and to build 500,000 cars (all 3 models combined) in 2018.

Brave new features

For now, there are only two variants: the $35,000 Standard model has 220 miles of range (EPA estimated); a 0-60 mph time of 5.6 seconds; and all the hardware necessary for full autonomy. The optional Long Range Battery ($9,000) boosts the range to 310 miles (and shaves half a second off the 0-60 time). Enhanced Autopilot adds limited self-driving capabilities, including self-parking, for $5,000. Full Self-Driving Capability will be available in the future for another $3,000, but it will be “dependent upon extensive software validation and regulatory approval, which may vary by jurisdiction.”

Tesla is determined to make its vehicles the safest on the road. At the launch event, Musk presented a video showing a side crash test being performed on Model 3 and the venerated Volvo S60, which he called “arguably the second-safest car in the world.”

As expected, Model 3’s interior is spare and clean, with nothing to break up the dashboard but a touchscreen. “The cars will be increasingly autonomous,” said Musk, “so you won’t really need to look at an instrument panel all that often. You’ll be able to do whatever you want…watch a movie, talk to friends, go to sleep.” Yes, there is a cupholder.

Many reviewers have been impressed by the spacious, open feel. Although Model 3 is smaller than Model S, it actually has more headroom in the back, thanks to the fact that it is not a hatchback. Several other features add to the perception of roominess, including the large window in the back, the absence of a transmission tunnel, and the smooth, instrument-cluster-free dashboard.

Model 3’s cargo-carrying capacity is respectable, although naturally it is substantially less than that of the larger S. The back seats fold completely horizontal, and between the rear space and the frunk, Model 3 has 15 cubic feet of cargo space – more than almost any other car in its class (the BMW 4 Series and Jaguar XE each beat it by a single cubic foot).

However, the utility of cargo space isn’t just about cubic feet, but about accessibility – that’s why the auto world is divided into hatchbacks and sedans. Loading large and/or heavy objects is easy with a hatchback like Model S (or the Toyota Prius or Honda Fit), but it can be almost impossible with a sedan-style trunk. Model 3 has a sort of cross between a hatchback and a trunk, with a wide opening that can supposedly accommodate a bicycle or surfboard.

As with Model S, once the car has the necessary sensors and control hardware, adding other Autopilot features, including new ones yet to be developed, is just a matter of pushing out a software update, so the sky (or perhaps a buyer’s bank account) is the limit. The greatest benefits of vehicle autonomy (smoother traffic flow, fewer parking lots) will be realized when most or all vehicles are autonomous, so the new technology will surely trickle down to even the lowest-priced cars eventually. We’re sure that Tesla envisions a future in which every Model 3 can get around on its own.

More speed will also probably be available in time. Tesla has assured us that “there will be versions that go much faster” than the 5.6 seconds of the Standard Model 3. In answer to questions from Tesla fans on Twitter, Elon Musk said that Model 3 will “of course” offer Ludicrous mode as an option.

Other future options are likely to include dual-motor all-wheel drive (expected around the beginning of 2018 at a cost of about $5,000), an air suspension feature that can dynamically adjust ride height, a towing hitch and a vegan interior (no leather).

Who knows what other nifty options may be in the pipeline? Many in the financial press believe that Tesla is counting on high-margin options to make Model 3 profitable.

Charging for charging

Tesla’s Supercharger network is one of the brand’s greatest assets – a valuable benefit for customers and a strong selling point against the (so far, mostly theoretical) competition. When Tesla introduced Model S, free Supercharging reassured prospective buyers who were worried about running out of juice, but the company can’t (and shouldn’t) continue to offer free unlimited Supercharging once it starts delivering vehicles in large volumes. Shortly after the first Model 3 launch party, Tesla replaced the “free unlimited” policy with a new one that it believes is fair to both existing and future owners (it is, however, a bit complex, and we will make no attempt to summarize it here).

All Model 3 have the capability for Supercharging, and although it will not be free, “it will still be very cheap, and far cheaper than gasoline, to drive long-distance with the Model 3,” Musk has promised.

While some Tesla fans have cried foul, most experienced EV drivers seem to agree that offering free-for-all charging be a bad idea for all concerned. Some of the most popular Supercharger locations are already congested, and adding half a million Model 3 drivers to the user base could turn a quick and hassle-free charging experience into a nightmare. We value what we pay for, and services that are free tend to get abused. Even a nominal charge will encourage drivers to use the Superchargers when they really need them, and possibly to take better care of them. Drivers who can afford a $35,000 new car aren’t likely to mind paying ten or fifteen bucks if they get convenient access to a fast charge when they need one.

A new platform

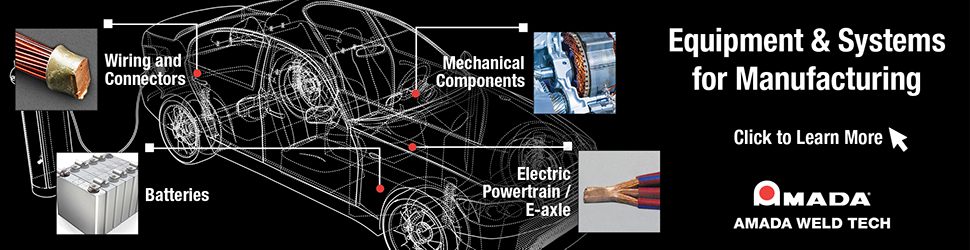

Outwardly, Model 3 looks pretty much like a smaller version of Model S, but in fact it represents a new platform, and there are important technical differences. CTO JB Straubel confirmed that in 2015, during a talk at the University of Nevada, saying that the Model 3 would be built on an entirely new “third generation” platform. “For better or worse, most of Model 3 has to be new,” said Straubel. “With the X, we were able to build with a lot of common components with S, but with the Model 3 we can’t do that. We are inventing a whole new platform…It’s a new battery architecture. It’s a new motor technology [and] a brand new vehicle structure.”

As Straubel succinctly predicted back in 2015, Tesla (with partner Panasonic) developed a new battery cell for Model 3, designed a new motor that reportedly uses permanent magnets, and incorporated more steel into the frame and body panels.

Bigger cells, better chemistry

Since Model 3 was announced, most Tesla-watchers have agreed that, in order to deliver a 200-mile EV at the desired price point, Tesla would have to develop a better and/or cheaper battery pack. Thus, there has always been an essential link between the Model 3 and the Gigafactory, where Tesla expects that economies of scale and new production techniques will enable it to reduce battery pack costs by over 30%. The enormous edifice, now called Gigafactory 1, started producing battery cells in January.

Tesla and Panasonic expect to have 6,500 full-time employees at Gigafactory 1 by 2018. Tesla is now forecasting a production capacity of 35 GWh of battery cells in 2018, and three times that amount when full production begins around 2020.

At first, Tesla was cagey about the actual capacities of the Model 3 battery packs. Model S and Model X use a naming scheme that specifies each variant’s battery capacity: a Model S 75 has a 75 kWh battery pack, a Model S 85 has an 85 kWh pack, and so on. Tesla seems to have abandoned that scheme – perhaps it was thought to be too nerdy? Whatever the reason, Model 3 currently offers only two battery options: Standard, with 220 miles of range, and Long Range, with 310 miles. The lack of specifics led at least one writer of an analytical bent, Electrek’s Fred Lambert, to extrapolate the pack capacities from the vehicle’s EPA certification documents. Finally, Elon Musk explained that the Standard pack has a capacity of “just over 50 kWh,” while the Long Range pack has “about 75 kWh.”

This is important information, as it offers a clue to the cost of Tesla’s battery packs, which directly affect the company’s gross margins, and its position vis a vis competitors (should any appear). Like any automaker, Tesla refuses to disclose its exact battery costs, but Musk has said that he will be “disappointed” if the company can’t bring the cost below $100 per kWh by 2020.

Model 3 uses next-generation cells, co-designed by Tesla and Panasonic, that feature improvements to the chemistry as well as the geometry of the cell. During a recent earnings call, Musk and JB Straubel explained how the new cell design is expected to deliver “an energy density improvement and, of course, a significant cost improvement.”

“The cathode and anode materials themselves are next-generation,” said Straubel. “We’re seeing improvements on the 10-15% range on the chemistry itself in terms of energy density.”

Tesla will not disclose the exact formula that it uses to produce its world-class cells, but in 2015 Musk said that it was one of the first to introduce silicon in automotive-grade lithium-ion batteries. “We’re shifting the cell chemistry for the upgraded pack to partially use silicon in the anode,” he explained. “This is just sort of a baby step in the direction of using silicon in the anode. We’re still primarily using synthetic graphite, but over time we’ll be using increasing amounts of silicon in the anode.”

Silicon is widely considered to be the next big thing in anode technology, because it has a theoretical charge capacity ten times higher than that of typical graphite anodes. Jeff Dahn, the prominent battery expert and exclusive research partner of Tesla, described “a race among the battery makers to get more and more silicon in.” So, it’s safe to assume Tesla continued down the Silicon alley with the Model 3 cells.

The company also customized the cell’s shape and size to further improve the cost and packaging efficiency. The new “2170” cells are 21 mm in diameter and 70 mm long, slightly larger than the “18650” (18 mm in diameter and 65 mm long) used in Model S and Model X.

“We’ve done a lot of modeling to try to figure out what is the optimal cell size,” explained Musk. “And it’s not a lot different from [what we’re using in S and X], we’re sort of 10% more diameter, maybe 10% more height. But it’s a cubic function, so it effectively ends up being, from a geometry standpoint, maybe one-third more energy per cell. Then the actual energy density per unit mass increases.”

“Fundamentally, the chemistry of what’s inside is what really defines the cost position though,” added Straubel. “It’s often debated what shape and size, but at this point we’re developing what we feel is the optimal shape and size for the best [cost efficiency].

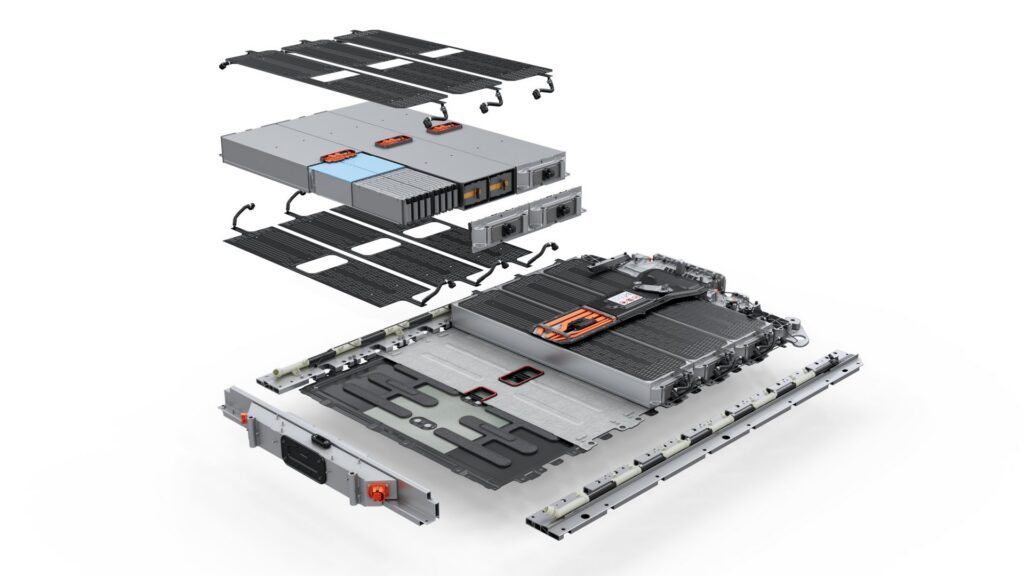

A Model 3 battery pack contains only 4 modules, compared to 16 modules in a 100 kWh Model S pack. The Standard 50 kWh Model 3 battery pack contains 2,976 cells in groups of 31 cells per brick – there are 2 modules of 23 bricks and 2 modules of 25 bricks. The Long Range 74 kWh pack (the one currently in production), consists of 4,416 cells in groups of 46 cells per brick.

The new battery packs exhibit several other differences from the Model S/X packs (as revealed by technical documents published by Electrek). Unlike the Model S and Model X battery packs, the Model 3 pack is not made to be easily swappable. This would seem to be the final nail in the coffin of the battery-swapping idea. Some have speculated that Model 3 would feature an external high-voltage connector on the vehicle’s underside (in addition to the normal charging port), which would be used by an autonomous charging gadget that patent applications revealed the company has been working on. Such a port is not visible on the Model 3 technical documents, so it seems Tesla has abandoned that idea as well (although it surely has plans for some kind of autonomous charging system, perhaps the snake charger Tesla teased in a 2015 YouTube video).

Overall, the Model 3 battery pack design looks like a much more compact, streamlined package. The charger, fast-charge contactors, and DC-DC converter are all integrated into the pack, saving weight and cost, and simplifying the assembly of the vehicle. Tesla also eliminated the external battery pack heater – the new pack can be heated when necessary using only waste heat from the powertrain, even when the car is parked.

Motoring

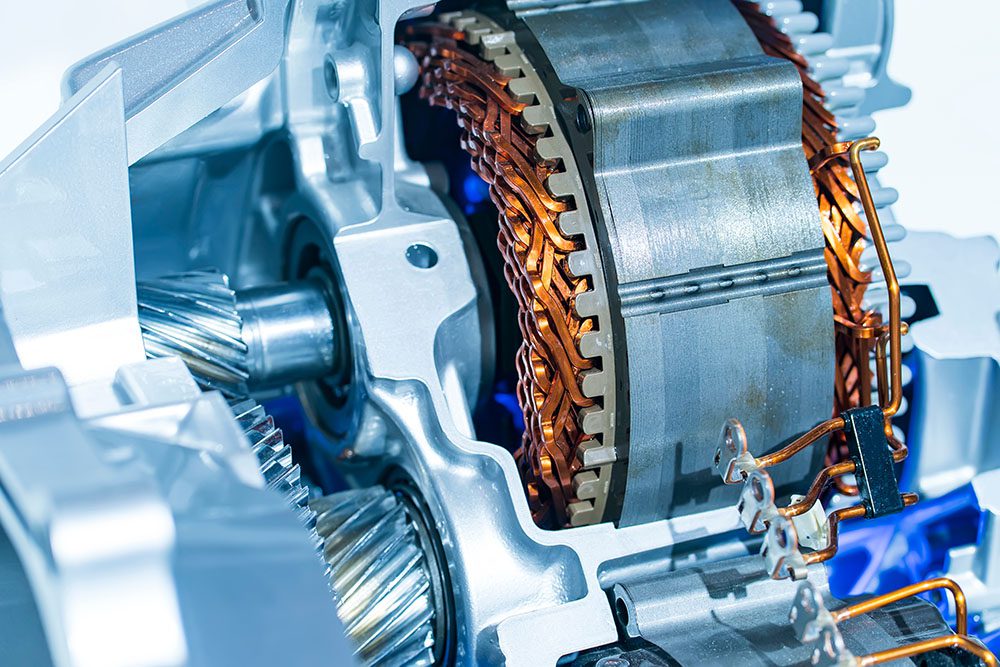

The EPA certification application also revealed what could be a big change at the other end of the powertrain. The document states that Model 3 uses a 3-phase permanent magnet motor, as opposed to the induction motor used in Models S and X.

Tesla declined to comment on the exact motor topology, but we know that Tesla uses sophisticated computer simulations to evaluate different motor designs and optimize them for the desired parameters of a vehicle. These parameters are different for Model 3 than they were for Models S and X, so it’s safe to assume that Tesla’s engineering team found that a PM motor design was the best fit for the new car.

As Tesla’s Chief Motor Design Engineer, Konstantinos Laskaris, told Charged (in our March/April 2017 issue), “Understanding exactly what you want a motor to do is the number-one thing for optimizing. You need to know the exact constraints – precisely what you’re optimizing for. Once you know that, you can use advanced computer models to evaluate everything with the same objectives. This gives you a panoramic view of how each motor technology will perform. Then you go and pick the best.”

Laskaris wouldn’t discuss exactly how Tesla went about selecting the optimal motor design for Model 3, but his comments yield some insight into how an automaker makes tradeoffs among various parameters, including performance, energy consumption, body design, quality, and costs. “All of these metrics are competing with each other in a way. Ideally, you want them to coexist, but given cost constraints, there need to be some compromises. How much driving range are you willing to trade for faster acceleration, for example? The electric car has additional challenges in that battery energy utilization is a very important consideration.”

Laskaris explained that you can’t have everything – both high efficiency and high performance, for example – but you can make intelligent choices between competing parameters. “This is the beauty of optimization. You can pick among all the options to get the best motor for the constraints. If we model everything properly, you can find the motor with the high-performance 0-60 constraint and the best possible highway efficiency.”

There may also be historical reasons for a switch in motor technology. By many accounts, the reason Tesla went with an induction motor in the first place is because it inherited the design from AC Propulsion. The induction motor used in the Roadster actually had roots going all the way back to GM’s ill-fated EV1. The EV1’s motor was designed by Alan Cocconi, who based it on existing AC induction motor specs. Tesla licensed the AC motor design from Cocconi’s company, AC Propulsion.

Marc Tarpenning told me in a 2013 interview that the Tesla team moved on from AC Propulsion’s motor pretty early in the game. “We redesigned it a year before we were in production…long before we were even into the engineering prototypes.” (The AC Propulsion guys, who didn’t get to ride the Tesla rocket to fame and fortune, insist that there is a lot of their DNA in the Roadster motor, but that’s another story.)

The proud history of the induction motor notwithstanding, when Tesla designed Model 3, it started with a blank sheet of paper, and it had much expanded R&D capabilities, including advanced virtual modeling that probably wasn’t available back in the aughts, when the company designed Model S.

Steely Dan

When Model S deliveries began in 2012, industry observers applauded its innovative use of aluminum body panels, but five years later, we can’t say that it really started a trend. Today, aluminum is used extensively to improve the fuel efficiency of profitable pickups such as the Ford F-150, and in a few sport models from Audi, Jaguar and Range Rover. It is used to a certain extent to lighten EVs such as the LEAF, but it hasn’t displaced steel as a body material, thanks to its higher cost, plus concerns about its durability and ease of repair. As many Tesla owners have reported, aluminum body panels can be shockingly expensive to repair after even minor collisions. Aluminum’s big advantage, lighter weight, may soon be rendered moot by a new generation of high-strength steels that’s currently under development.

Be all that as it may, it was probably price that led Tesla to use a hybrid steel/aluminum body for Model 3. “We’ve got to be cost-effective,” said Chris Porritt, Tesla’s VP of Engineering, back in 2014. “We can’t use aluminum for all the components.”

Simple production, please

One major difference between Model 3 and its predecessors: Tesla designed it to be “easy to produce.” One aspect of this is that the bells and whistles have been kept to a minimum, and the available options are few (although Elon has hinted that more will be available in future). “We got quite adventurous with the Model X,” said Musk in 2015. “We’re not going to go super-crazy with the initial version of the [Model 3]. There are things that we could do with the Model 3 platform that are really adventurous, but would put the schedule at risk.”

Model S is currently available with 3 battery pack options, rear-wheel-drive or dual motor, 7 paint colors, 6 different interiors, 4 styles of wheels, two roof options, and more. It all adds up to more than 1,500 possible configurations. Model 3 has fewer than 100. Part of the reason for this is to streamline the production process, making it easier to quickly ramp up to mass-market volume.

Another tidbit about Model 3: it could take the title of most American-made car. The Kogod School of Business issues an annual study that ranks cars according to how “made in America” they really are. At the moment, according to Tesla, about 55% of Model S components are US- or Canadian-made. Model 3, with its Nevada-made 2170 battery cells, may be as much as 95% US-sourced, making it the “most American” car available. Tesla also plans to obtain much of the raw materials for those cells in the US. The company is believed to be developing a source of lithium at Silver Peak, not far from the Gigafactory, and Nevada lawmakers have proposed new tax incentives aimed at increasing lithium production in the state.

Tesla and the “nauseatingly pro-American” Elon Musk have always celebrated their patriotic bona fides (and what could be more patriotic than employing over 25,000 Americans in a rapidly growing, future-oriented industry?), but of course, Tesla’s decisions to keep production close to home aren’t made only for patriotic reasons – they have to do with access to skilled workers, and keeping supply chains short.

Crashing the sedan scene

Model S has ruled the large luxury sedan segment for a couple of years now, outselling the offerings of legacy automakers such as Audi, BMW, Lexus, Jaguar and Mercedes. Will the Model 3 pull off a similar feat? Several media outlets have compared the new EV’s features and pricing to small and mid-size sedans from the popular luxury brands, and their conclusions do not bode well for the establishment.

When it comes to acceleration off the line, Model 3 beats almost every other sedan in its price class. Elon Musk has promised that Model 3’s safety ratings will be second to none. Autopilot is probably already the equal of any of the driver assistance systems offered by its competitors, and will be continuously improved via over-the-air updates. Model 3’s 8-year, 100,000-mile powertrain warranty is twice as long as that of many competitors. Standard features such as the giant touchscreen and standard internet access are either unavailable or optional on competing sedans.

Several publications, including Bloomberg, Electrek, Electric Moose and CleanTechnica, have compiled charts comparing Model 3 side-by-side with its similarly-priced rivals, and they leave no doubt that the Tesla is just a little (or a lot) better than any of them. And that’s before considering the savings on fuel and maintenance, or the EV’s ace in the hole: the driving experience that almost all reviewers agree is smoother, quieter and more pleasant in general.

Perhaps it’s fortunate for the legacy brands that you can’t drive a Model 3 off the lot today. According to Tesla’s web site, if you place an order now, you can expect delivery in 12 to 18 months. And once the 3 starts hitting the streets in numbers, and the reviews start piling up, demand could far surpass Tesla’s 500,000-unit (if all goes well) annual capacity. The waiting list may grow longer.

Will Model 3 prove to be the “wake-up call for the rest of the industry” that so many have predicted, or will the legacy OEMs hit the snooze button, as they have so many times before? Tesla’s mission has always been to get more people driving EVs, even if it’s not the one selling them. Elon Musk has said many times that he welcomes competition from the major automakers.

Many reviewers, including this writer, have raved about the Chevy Bolt, and the next-gen Nissan LEAF is expected to be a contender as well. However, so far none of the majors has offered any real competition for Tesla. This has less to do with the quality of their EVs than with a fundamental difference of strategy. As regular Charged readers understand (but most mainstream media do not), the Big Three and their European and Asian counterparts have chosen to build just enough EVs to satisfy government regulators, and not to advertise them to the mass market. (This may be changing – GM has been taking out full-page ads for the Bolt in national newspapers and magazines, and there’s a rumor afoot that it plans to substantially increase production.)

If the legacy automakers do stick to their low-volume EV strategy, the ironic result could be that Tesla gains a near-monopoly of a market that’s constricted by a supply bottleneck. Everyone may want an EV, but with Tesla producing a measly half-million cars per year (a fraction of the 18 million annual sales in the US alone), most buyers will end up settling for what automakers have on the lots. It’s hard to see how Model 3 can steal much market share from other OEMs as long as there’s an 18-month waiting list.

At least one competitor has already tried to capitalize on that situation. Nissan responded to the flood of Model 3 reservations with ads that said, “No one should have any reservations about getting an electric car today. Why wait when you can drive an all-electric LEAF now?”.

This article originally appeared in Charged Issue 33 – September/October 2017 – Subscribe now.