EV advocates have long been puzzled by the policies of Toyota. The company that initiated vehicle electrification in 1997 with the Prius, and that currently makes the second-best-selling plug-in vehicle in the US (the Prius Prime) has consistently dismissed the benefits of pure EVs, insisting that hybrids are superior, and diverting resources to fuel cell vehicles.

However, the Japanese giant seems to be accelerating its electrification plans. As Reuters reports, Toyota now projects that electrified vehicles will account for half of global sales by 2025, five years ahead of previous forecasts.

Toyota says it aims to have at least 10 electrified models by 2020, covering vehicle categories from compacts to medium-sized crossovers and sedans to SUVs and minivans. The company released images showing six possible new models, although it didn’t indicate which ones might be pure EVs and which hybrids. The company also isn’t saying when, or whether, any of the new models will make it to the US (other automakers have recently been teasing new EVs aimed at the Chinese market).

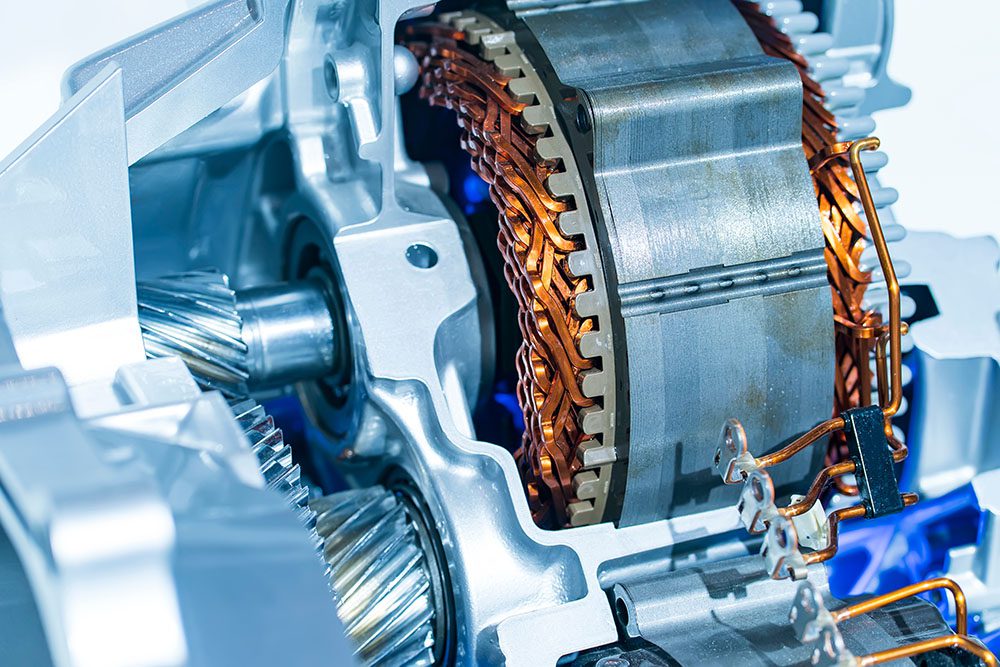

The increasing pace of electrification is causing Toyota to broaden its list of battery suppliers. Toyota is facing higher-than-expected demand for batteries – perhaps a 20-fold increase by 2025.

“We consider ourselves as a maker of electric vehicle batteries, going back to when we developed the battery for the Prius, but there may be a gap between the amount of batteries we can produce, and the amount of batteries we may need,” Executive Vice President Shigeki Terashi told journalists recently.

Toyota has been developing its own battery technology for decades, and has also partnered with Panasonic to develop prismatic cells. Now it plans to add two Chinese battery suppliers to the mix: BYD, one of China’s biggest EV makers, and Contemporary Amperex Technology (CATL), which already sells batteries to Honda, Nissan, BMW and Volvo.

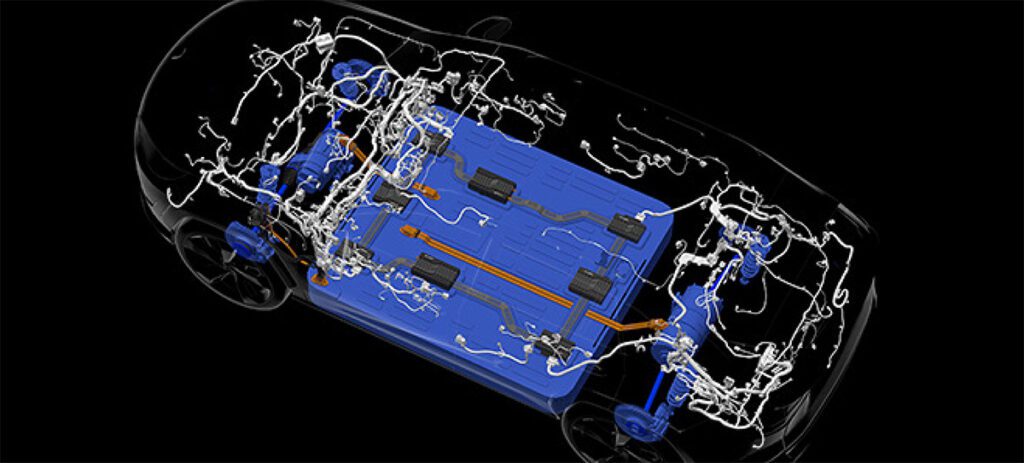

Toyota has also announced a collaboration with Subaru on an electrified vehicle platform called e-TNGA. The two firms will use the platform to develop a C-segment all-electric SUV, which may be sold under both brands. The proposed platform is designed to be highly flexible, supporting front-wheel, rear-wheel and all-wheel drive configurations and several powertrain options (shades of VW’s MEB architecture).

As several other global auto execs have, Terashi conceded that EVs are likely to be money-losers in the medium term, as it will take years to generate the necessary economies of scale. The key to profits in the BEV business may lie in developing new mobility models such as on-demand ride-sharing services, he said.

Terashi also said Toyota still believes that fuel cell vehicles are the future. “We haven’t changed our policy towards battery EVs. We are not shifting our focus to prioritize battery EVs, nor are we abandoning our FCV strategy.”

Sources: Reuters, SlashGear, autoevolution