Sponsored by TTI

By Mike Gardner, Director of the Advanced Technology Market Development at Molex.

What the future of connected vehicles means for suppliers, and how Molex is navigating the transition.

Take a look at the headlines and it’s clear: connected vehicle technology—which allows a vehicle to gather data and communicate with its surroundings—is about to become the new normal. The European Commission, for instance, is moving forward with plans to deploy Cooperative Intelligent Transport Systems, accelerating the large-scale development of connected vehicle technology throughout Europe. The U.S. Department of Transportation is developing similar connected vehicle safety applications, which it estimates could save thousands of lives on the road each year.

And that’s not all. VW just announced that over the next five years it plans to cut 7,000 jobs while simultaneously growing its software and engineering department as the auto maker moves towards a more connected future. And the impending rollout of 5G communication in the United States will only further spur the growth of the connected vehicle market.

As more vehicles are built with connected features, suppliers must become more innovative than ever, providing not just components but solutions that can evolve to meet ever-changing requirements. Molex is embracing the new industry by partnering with authorized distributors like TTI to stay on top of market trends and engage with customer feedback, while relying on the well-established expertise both companies have in the transportation and industrial spaces.

The Evolution of Connected Vehicles

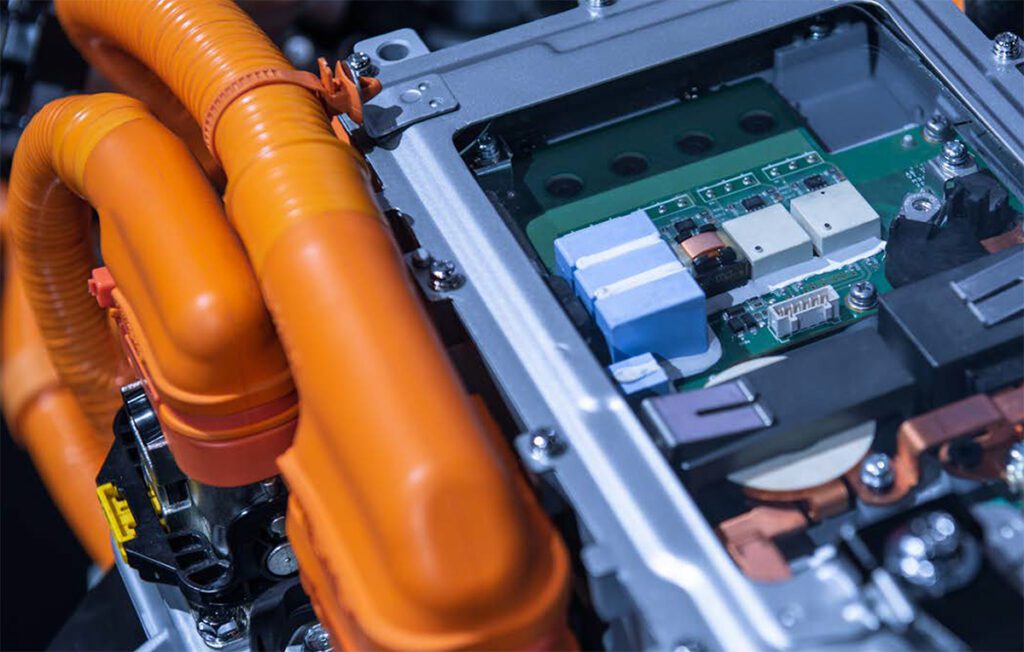

There’s a lot of nuance to connected mobility, whether it’s the connectivity within the platform of the vehicle itself, or the ability to share data across multiple vehicles or outside infrastructure. Most cars today are made up of a group of different systems that are all placed in the vehicle and function independently and with limited access to the data in their environment. The introduction of networks to the car provides the ability to both open up and consolidate these systems, removing any redundancy in memory and processing capabilities while streamlining the functionality of these devices to be more harmonized. This is the transition towards connected mobility that is occurring within the vehicle itself.

One of the biggest drivers of in-vehicle connected mobility has been infotainment—the integration of mobile devices into the vehicle to enhance and personalize navigation, communication, and entertainment capabilities. In-vehicle infotainment applications continue to expand, requiring the vehicle to handle increased bandwidth demands to accommodate high-quality video displays and high-resolution images of knobs and switches with advanced user interfaces.

As newer vehicles are increasingly manufactured with the connection and bandwidth capabilities to handle consumer demands, they can also support more complex vehicle-to-vehicle or vehicle-to-infrastructure connections. This capability has existed for years in a simpler form through telematics—boutique telematics systems such as OnStar provided connections that allowed for remote GPS, communications, and diagnostic services. Today, telematic control units have additional functionality and operate as a type of hub between the vehicle network and cloud network.

The potential for vehicle communication—and the various forms of what a vehicle can connect to—continue to grow. Even when a vehicle transmits passive data—such as a drop in temperature signaling icy conditions—that can be picked up through the infrastructure nomenclature, which could lead to the deployment of salt trucks to the area. And when it comes to vehicle-to-vehicle communication—which can communicate real-time dangers on the road ahead—direct connection via telematic control units and antennas avoids the latency caused by information traveling to the cloud and back to the car.

These capabilities aren’t just for automobiles. The connected vehicle space is also growing in the trucking, shipping, mass transit, and agricultural industries by facilitating better inventory and asset tracking. One of the biggest concerns of trucking companies is monitoring the location of their trailers, so that if cargo is lost or abandoned it doesn’t sit undetected for months. Already, entire fleets are monitored by telematics systems, but with the growing capabilities of connected vehicles, freight transportation can become even more safe and efficient.

Similarly, the science behind using telematics with farming equipment is growing rapidly—real-time data about water and field conditions can alter fertilization distribution on the fly, for example.

And while the pure speed of a 5G network connection is expected to help connected mobility and the Internet of Things achieve peak performance, there is still plenty of development that can be done today with existing 4G connections. While 5G will facilitate lower-latency access to the cloud with larger amounts of data, the mechanisms remain the same and should be developed in preparation for the new network.

Manufacturing a Solution

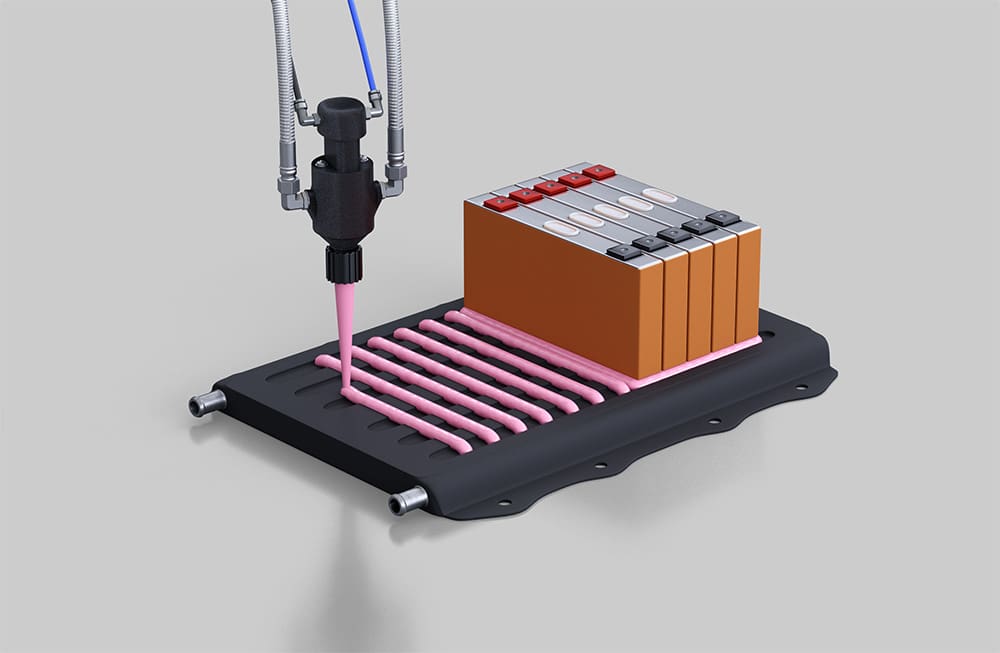

The rapid evolution of vehicles from a series of hardware components to an interconnected combination of hardware and software has created challenges—and opportunities—for suppliers. Molex is balancing experience and innovation to facilitate the ongoing growth of connected vehicle technology.

For more than 75 years, Molex has been known in the industry as a cable and connector supplier, but more recently has focused on becoming a solutions provider. The transition for Molex into the connected vehicle space is not a stretch—it’s an opportunity waiting at the doorstep, and the key to navigating that transition is relying on longstanding industry experience.

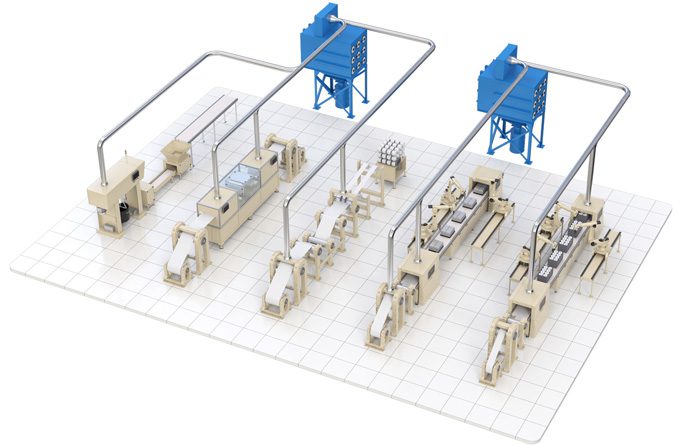

Molex is using its strong foundation of architectural engineering to accommodate what these new systems require in a solutions platform. Molex’s experience of building network interface cards and connectors at a plant level remains relevant even as it transitions to newer, remote solutions.

Another important aspect in Molex’s transition is taking cues from market trends, advances in science, and customer feedback to understand what spaces they’re moving into and how to adjust products to meet new needs. When faced with a new, exciting, and constantly-evolving field such as connected vehicles, it may feel like new approaches and products need to be made from scratch. But a combination of relying on longstanding foundations and understanding the end customer can serve as a reliable guide—otherwise you will produce something that isn’t of value, and nobody is going to pay for additional features that they don’t need.

One challenge with building products for an emerging market can be making connections with customers. Molex is collaborating with distributors such as TTI that have similar verticals and approaches to the market to expand their offerings in the connected vehicle space. Maintaining regular communication with development-savvy distributors ensures that potential customers are aware of what solutions Molex can provide in the connected vehicle space. Through partnerships such as the one Molex has with TTI, suppliers can access a distributor network that has homed in on a specific vertical through market development and established relationships with customers.

Lastly, Molex is taking steps to shape itself as an organization focused on the future. It has established a connected mobility team, and recently acquired the Connected Vehicles Solution division of Laird, which designs telematic and antenna solutions. But its real success lays in cross-pollinating internally across verticals, such as automotive, transportation, and industrial spaces. As Molex has grown larger, there are more opportunities to collaborate between divisions, and connecting the dots internally has been a key part of the organization’s approach to manufacturing connected technology solutions rather than reinventing something that already exists.

There is no clear roadmap ahead for connected vehicle technology due to its constant growth and evolution. Above all, Molex is prioritizing flexibility while growing its presence and expertise in the market—there will be trial and error as well as ongoing adjustments to strategy. This is where it’s important to go where the market needs you, or where there’s the opportunity to add value. The industry is ever-growing and ever-changing, and there’s no end in sight.

Challenges in the CV space

While the future looks bright for connected vehicle technology, challenges have already begun to emerge—and suppliers may have to play a role in addressing them.

Connected vehicles produce a massive amount of data that can be used for anything from in-the-moment adjustments to analyzing and predicting crop yields—and that data can be especially valuable in the agricultural sector. Farming IoT platform OnFarm estimates that the average farm will generate an average of 4.1 million data points per day in 2050, up from 190,000 in 2014.

While it’s typically assumed that the landowner, not the equipment they use, owns the data, the issue grows complicated when farmers lease connected vehicles. Some leasing companies give farmers a better leasing rate if they share the equipment’s data, and others run businesses where they will give farmers a return on the data if the company is able to use it. There are interesting new business models that are developing around connectivity and data collection.

Lack of standardization in the connected vehicle space is another emerging challenge. Connected mobility technology requires a lot of proprietary approaches to grow and mature, but until there’s a generally-accepted set of standards, the adoption of connected vehicle technology will be slow to advance. Over-the-air (OTA) communications are crucial to gathering data and pushing out updates, but when a vehicle has up to 80 connected modules—often from different vendors—how are they distributed and updated?

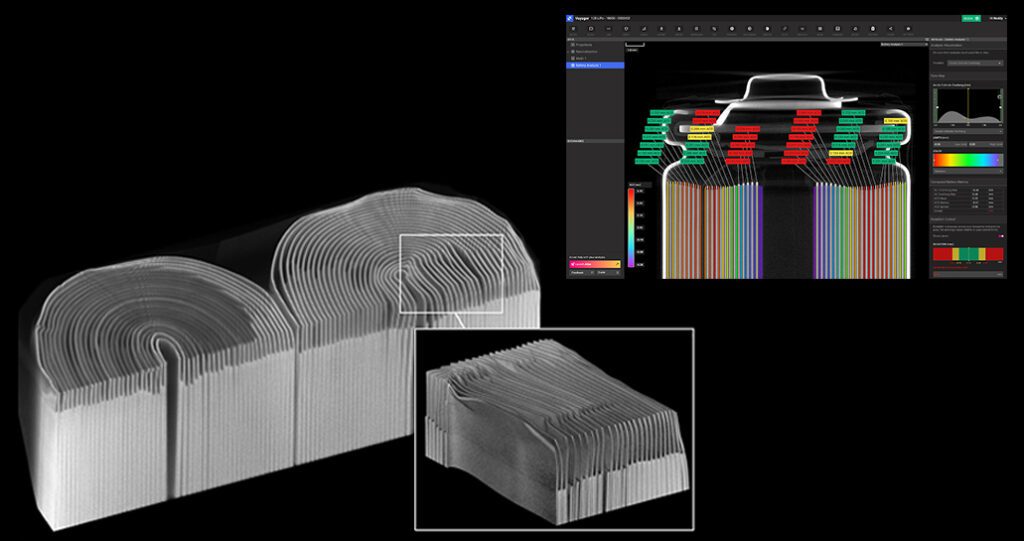

That’s one problem that the newly-formed eSync Alliance is trying to solve with its membership and compliance programs. The organization aims to build a path that creates end-to-end secure OTA and data services for the connected car through a global network of cooperating suppliers. While most providers claim to have the ability to push out OTA updates, that means something different to everybody, and the architecture of efficiently updating an automotive network is very complex. eSync Alliance strives to make a platform that allows innovation and proprietary solutions while standardizing OTA deployments.

Without standardization, the connected vehicle industry won’t be able to survive. If every supplier has a different means of updating a vehicle’s software, the added cost and complexity would force vehicle manufacturers to either reduce their supplier base or to deal with the greater complexity of OTA communication. Over the next few years, standardization will prove critical to help this technology mature at a faster rate, and suppliers can play a key role in helping it grow in an efficient, safe, and innovative manner.