Tesla’s earnings report for the first quarter of 2016 revealed that the company fell just short of its projected deliveries, and that revenue and loss figures came in fairly close to analysts’ forecasts.

The company reached a new quarterly production record of 15,510 vehicles, up 10% from Q4 2015. It shipped 14,820 units, fewer than the forecast 16,000, thanks to “Model X production challenges.”

Tesla reported $1.6 billion in revenue and an adjusted loss per share of $0.57. Most analysts were expecting $1.61 billion and $0.60 per share, according to Bloomberg.

However, on the morning after, as the TSLA stock price jumped around like a Willys in 4-wheel drive, all anyone wanted to talk about was: How is Tesla going to ramp up production to meet the unprecedented demand for Model 3?

Elon Musk reiterated the company’s projection for this year, saying, “We remain confident that we can deliver 80,000 to 90,000 new Model S and Model X vehicles in 2016.”

After that, things are going to take off like a SpaceX rocket. “We are on track to achieve volume Model 3 production and deliveries in late 2017,” write Musk and CFO Jason Wheeler in a shareholder letter. “Given the demand for Model 3, we have decided to advance our 500,000 total unit build plan (combined for Model S, Model X, and Model 3) to 2018, two years earlier than previously planned.” Musk told analysts that Tesla may be producing a million vehicles a year by 2020.

Unsurprisingly, skepticism would be too mild a word for the reaction from veteran automotive pundits. If Tesla succeeds (once again) in reaching its goals, hats may become the newest item of fashionable cuisine in Detroit.

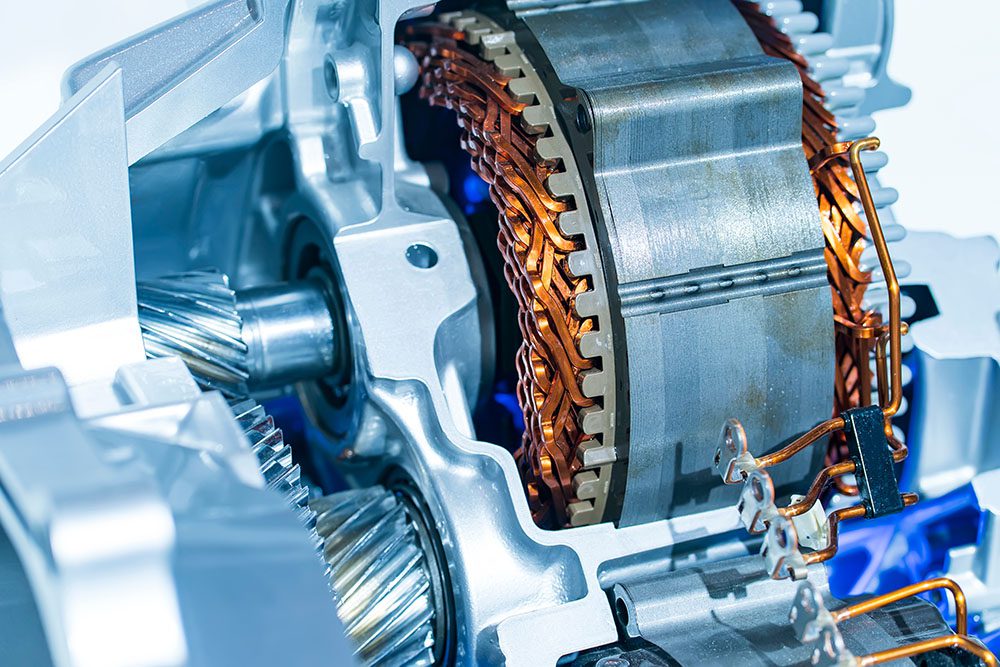

“Tesla is hell-bent on becoming the best manufacturer on earth,” said Musk, who reportedly has been keeping a sleeping bag next to the Fremont production line. “Thus far, I think we’ve done a good job on design and technology on our products. The key thing we need to do in the future is to also be a leader in manufacturing.”

Stock market analysts are concerned about the inevitable need for the company to generate more cash, which could dilute the value of current investors’ shares. “Increasing production five-fold over the next two years will be challenging and will likely require some additional capital,” Musk acknowledged.

Meanwhile, Tesla announced that two high-ranking executives, Production Vice President Greg Reichow and Manufacturing Vice President Josh Ensign, will be leaving the company. Is this a positive or a negative for Tesla? The pundits are divided – some lament the loss of key production execs on the eve of a historic (or quixotic?) ramp-up, while others suspect the two may be blameworthy for the Model X production problems.

Sources: Tesla, Bloomberg, Business Insider, Wall Street Journal