US-based battery inspection technology startup Liminal has closed a $10-million strategic investment round led by LG Technology Ventures, the venture capital arm of South Korean conglomerate LG Group.

The round also included new investment from Taiwanese firm Chailease Holdings as well as participation by current investors including ArcTern Ventures, University of Tokyo Edge Capital Partners, Good Growth Capital, Chrysalix Ventures and Ecosystem Integrity Fund.

Liminal previously raised $8 million in Series A funding in 2022 and $17.5 million in an A2 round last year.

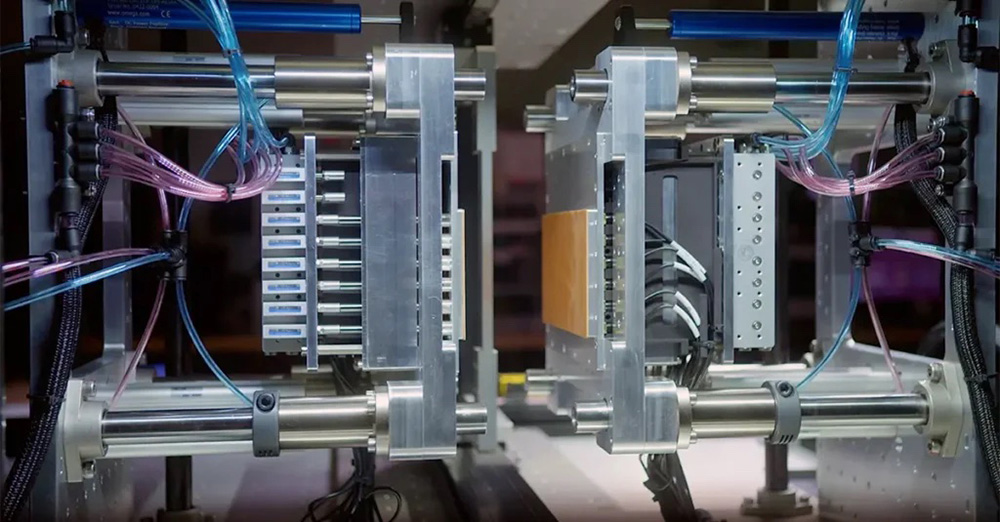

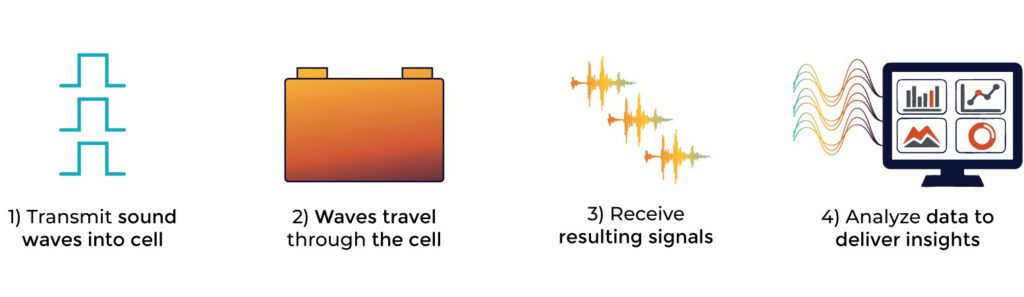

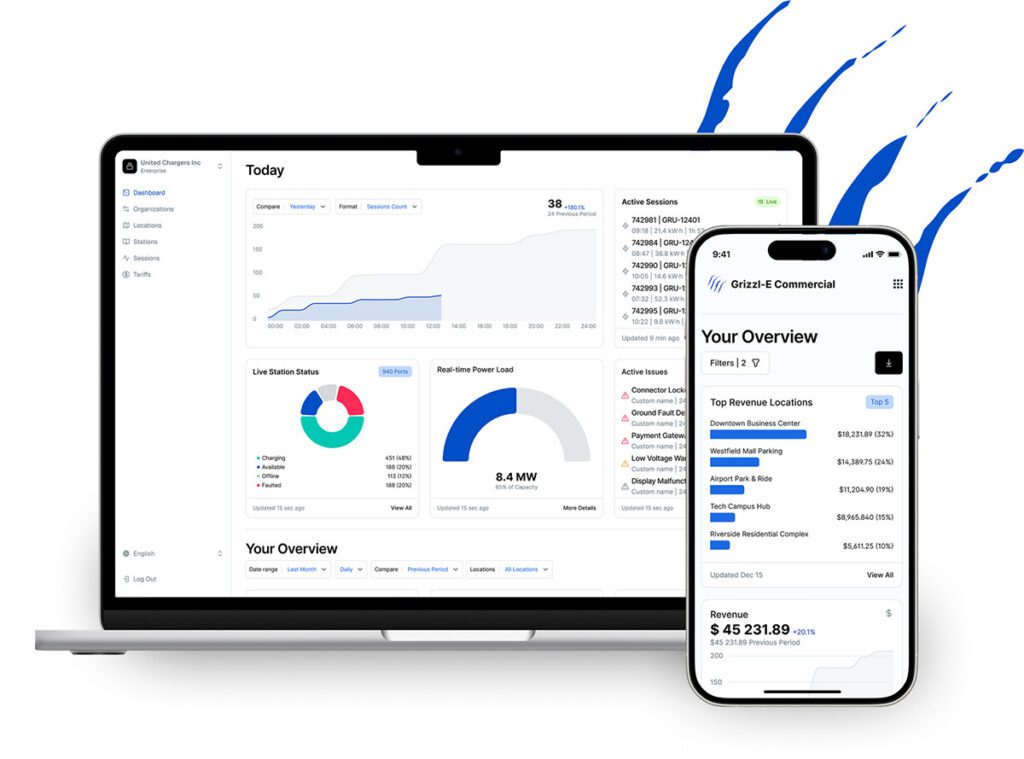

The company’s quality control systems use ultrasound inspection and physics-informed data science to provide insights to battery cell manufacturers to accelerate production ramp-up, improve quality and reduce scrap as well as costs. The company said it has deployed its in-line inspection product in a European gigafactory late last year, has an active pilot with a major Asian battery cell manufacturer, and will be deploying with a US-based automotive OEM in the coming weeks.

“This funding will enable us to more rapidly deploy our quality control solutions with more customers and into more production lines,” said Andrew Hsieh, co-founder and CEO of Liminal.

“LG Technology Ventures is committed to investing in companies we believe have the power to move industries forward,” said Robert McIntyre, Managing Director at LG Technology Ventures. “The current state of the EV market and the challenges manufacturers are having in scaling battery production demonstrates the pressing need to solve for battery quality—an area where Liminal has demonstrated success.”

Source: Liminal