A few days ago, share prices of lithium miners including Albemarle, SQM, Livent, Piedmont Lithium and Lithium Americas ,plunged, losing as much as 9% on a day when the S&P 500 dropped only a fraction of a point.

There had been no major moves on the commodities market, and investors not privy to inside information wondered what was going on. Then analysts revealed that the world’s largest EV battery maker, China’s Contemporary Amperex Technology, had changed its pricing strategy.

As Barron’s reports, CATL will now price its batteries on a lithium price-linked basis—50% of the batteries will embed a price of 200,000 yuan (about $30,000) per metric ton of lithium carbonate, and the rest of the batteries will embed the lithium carbonate spot market price (which is now around 428,000 yuan per metric ton, having climbed ninefold over the past few years).

Barron’s explains that CATL’s move means lower battery prices (at least for now). The company mines some of its own lithium, so it’s in a position to sacrifice earnings from its mining operations in order to sell more batteries. Citi analyst Jack Shang wrote that this looks like a classic ploy to gain market share, and he expects other battery-makers to follow suit.

Is a lithium price war in the offing? Well, as EV sales grow, demand for lithium is expected to remain high, and most analysts don’t seem to expect much lower prices in the long run. “While noisy, we think this should not become an industrywide practice, and lithium prices should ultimately be a function of lithium supply and demand dynamics, which we still see in a deficit for the next three years,” wrote J.P. Morgan analyst Lucas Ferreira.

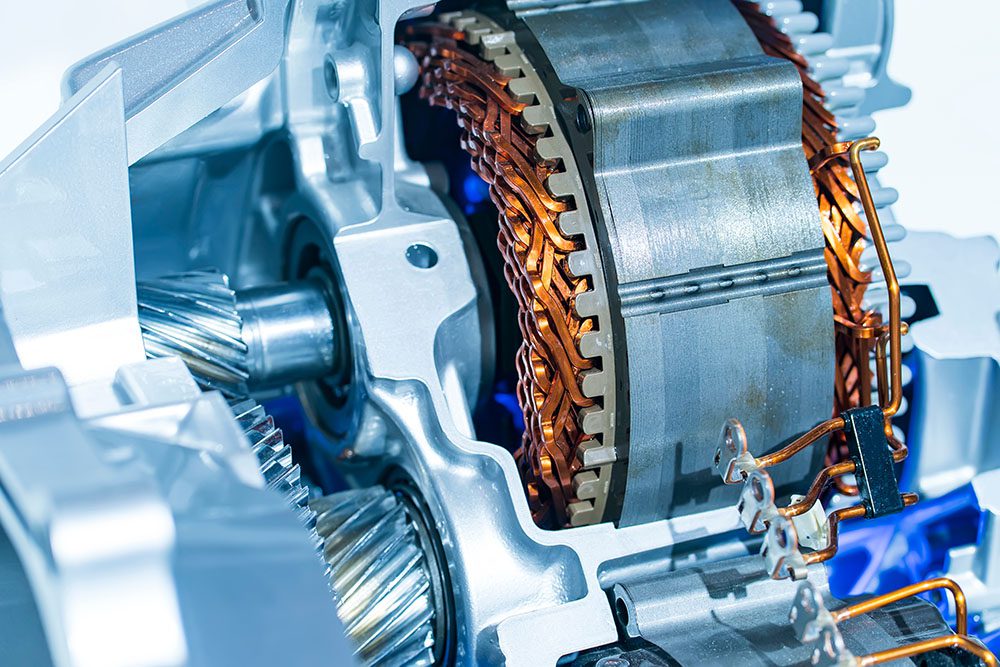

The chain from lithium to batteries to EVs is a complex one, and it’s certain to change over the next few years as Western automakers (goaded by governments) move to develop domestic sources of raw materials.

All things considered, Barron’s believes that CATL’s new pricing strategy is likely to mean lower profits for battery-makers, slightly higher profits for carmakers—and good news for lithium miners.

Source: Barron’s