The company celebrated some good financial news, as it notified the holders of senior convertible notes that it has satisfied conditions for the release of $30 million of restricted cash.

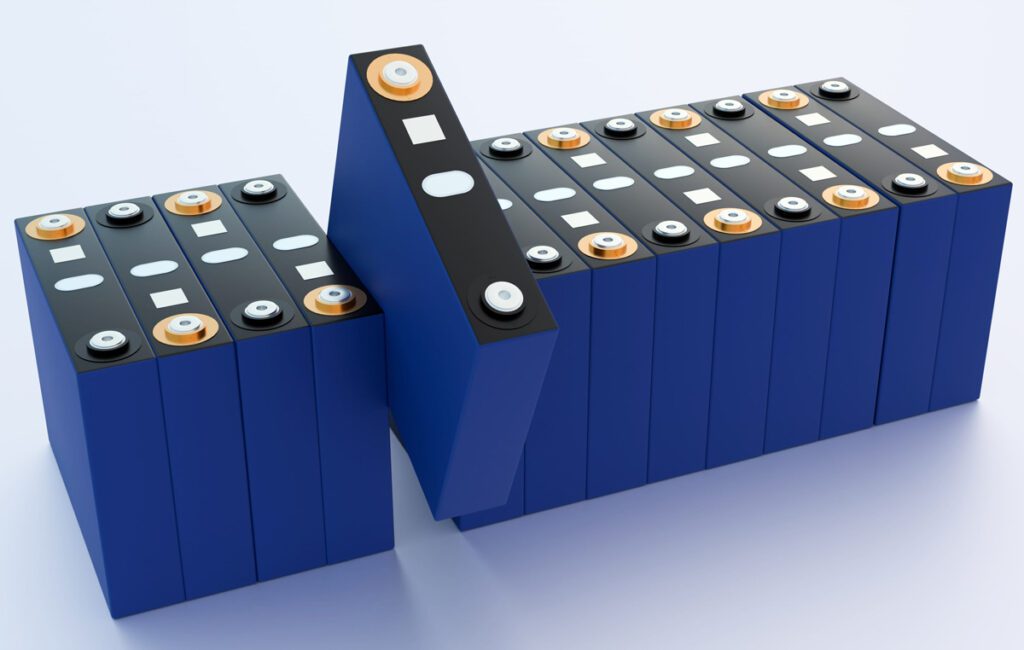

Massachusetts battery maker A123’s recent road has had more twists and turns than a Grand Prix race track. At the beginning of June, battered by an expensive recall of some defective battery cells, the company conceded that it might be near bankruptcy. A couple of weeks later, it announced a potentially game-changing new battery technology, and all was rosy again.

This week, the company celebrated some good financial news, as it notified the holders of senior convertible notes that it has satisfied conditions for the release of $30 million of restricted cash. The money had been subject to an account control agreement related to the notes, and should now become unrestricted and available for general corporate purposes.

Also this week, A123 (Nasdaq: AONE) announced that it will sell 7,692,308 shares of common stock at an offer price of $1.30 per share, as well as warrants to purchase additional shares of stock. The sale of the stock and warrants is expected to net the company around $9 million.

Source: A123 Systmes

Image: A123Systems