- For EVs to deliver their full emission-reducing potential, the battery supply chain must be as clean as possible, and cathode active materials (CAM) are a key part of the sustainability equation. Umicore takes a fourfold approach to minimizing the emissions embedded in its materials.

- LFP chemistries are popular in China for several reasons, but in other regions, LFP’s value proposition can be very different. Umicore sees the market trending toward multiple cell chemistries, and believes that its new high-manganese HLM battery technology is a strong alternative to LFP in markets outside of China.

- Automakers have high hopes for solid-state batteries, mainly because of their improved safety characteristics. Umicore is actively working with cell manufacturers to advance SSB tech, and recently opened a material prototyping center in Belgium that supports all the steps in SSB production, from formulation to testing. The company expects the first commercial applications to appear around 2027.

Q&A with Umicore’s Robert Privette

Umicore traces its roots to a Belgian mining company formed in 1906. Since then, it has moved on from mining to a variety of high-tech pursuits including refining, recycling and the manufacture of specialized metal products. Today it’s one of Belgium’s largest companies, and has a strong presence in e-mobility, including the manufacturing and recycling of EV battery materials. Umicore started developing battery materials in Asia in the mid-1990s. It has since built a complete battery materials supply chain in Europe, and is about to build a new cathode and precursor production facility near Kingston, Ontario, which will be its fourth global gigafactory.

The Inflation Reduction Act heavily incentivizes production of battery raw materials in North America, and OEMs and battery makers are rushing to establish production of cathode active materials and precursors in the region. Umicore aims to create regional circular supply chains that include all the steps of battery production, from raw materials to refining to processing to recycling.

Charged spoke with Robert Privette, Umicore’s Business Development Manager for North America.

Charged: How do your cathode active materials (CAM) contribute to the sustainability of EV batteries?

Robert Privette: Rechargeable batteries are among the building blocks for the green energy transition. Total emissions over the lifetime of an electric vehicle are considerably lower than those of an internal combustion engine. However, at the start of its useful life an EV tends to come with a higher “carbon backpack” because of the battery.

Cathode active materials are not only a performance and cost driver in EV batteries—they are also a significant contributor to an EV’s overall emissions, so the cathode is in the spotlight of carbon reduction efforts. Challenges and opportunities go together, and for battery materials companies with a track record like Umicore’s, the opportunity is tremendous. Improvements are visible at the vehicle level, bringing down the carboncontent of an EV, potentially by as much as 20-25%.

Cathode active materials are not only a performance and cost driver in EV batteries—they are also a significant contributor to an EV’s overall emissions, so the cathode is in the spotlight of carbon reduction efforts.

How do we do this? Our approach is fourfold. Recycling, when done properly, reduces a battery’s carbon backpack considerably compared to mining. It’s part of our circular business model which we adopted 23 years ago. Based on our precious metals recycling, we pioneered industrial-scale battery recycling in 2011 in Belgium. Our plant has an annual input capacity of 8,000 metric tons, and recovers cobalt, nickel and lithium at both industry-leading yields and at battery-grade quality for use in new EV batteries.

Second, the use of renewable electricity. Production at every single battery materials plant that we’re starting up will be powered by 100% renewable energy sources from day one. This is the case at our gigafactory in Europe, which relies on wind energy, and it’s also what we plan for our soon-to-come plant in Canada.

Third is the choice of raw materials. Here again it’s about balancing the many opportunities of fast-growing demand for EVs and building out new capacity with the challenge of ensuring the sustainability of raw material flows. Umicore is offering our customers low-carbon options in our supply chain. An excellent example is our supply contract with Terrafame in Finland, which produces ultra-low-carbon nickel compounds, and we are committed to having similar supply contracts in North America.

Last, but certainly not least, it’s about developing the right chemistry. For many years now Umicore has been at the forefront of using higher-voltage NMC technology: we squeeze more energy out of the same amount of CAM and thereby cut the carbon per kilowatt-hour of battery energy. Providing CAM with excellent cycle life through our proprietary know-how also enables second-life battery applications, which means that the carbon footprint of a battery can be extended to additional functional applications such as grid and home storage applications.

This all fits into our overall strategic approach to further roll out our local-for-local supply chains for battery materials and decarbonize the supply chain of electric vehicles. Today in Europe, we have refining, pCAM (precursor) and CAM production and their recycling all on one continent. This shortens the supply chain for our customers and provides them security of supply. Today we’re the only company to have a complete battery materials supply chain in place outside of China, and we intend to replicate this in North America where, short-term, we will start with a gigafactory that combines pCAM and CAM manufacturing in Canada.

That’s why carmakers like Volkswagen want to team up with us. In Europe, we’ve formed a joint venture named Ionway, with their battery company PowerCo, and we’re exploring a supply agreement in North America.

Charged: How has the US Inflation Reduction Act created new opportunities for global raw materials firms?

Robert Privette: The IRA has substantially impacted the global battery supply chain. The announced investments supporting the US battery supply chain are causing companies to take a fresh look at business opportunities in North America, and have led many governments outside the US to support or reconsider their own domestic investments in manufacturing. Furthermore, IRA-compliant battery critical mineral supply could be redirected globally to supply US electric vehicles, thereby benefiting from the US Clean Vehicle Tax Credit.

For Umicore, our plans to build our pCAM and CAM gigafactory in Canada were made and announced before the IRA made headlines. Several aspects are key in choosing a location, including the availability of all the resources and the ecosystem we need—battery metals, renewable energy, talent and infrastructure, close to our customers.

The IRA has substantially impacted the global battery supply chain. It’s causing companies to take a fresh look at business opportunities in North America, and has led many governments outside the US to support or reconsider their own domestic investments in manufacturing.

For our precursor and cathode active materials production, we can benefit from North American free trade agreements to create added value associated with the cathode constituent material, which is at the heart of an EV battery’s performance. Companies producing upstream precursors, such as Umicore, will be able to access critical raw materials like nickel, manganese and cobalt sourced from the US, Canada and Mexico.

In Europe, the European Commission’s Critical Raw Materials Act (CRMA) and Net-Zero Industry Act (NZIA), which are both complementary, aim to secure strategic access to raw materials in a sustainable way and boost the development of, and production capacities for, net-zero energy technologies within the EU. Measures that are proposed include a streamlined process allowing for fast-track permitting for clean-tech projects as well as funding. The details have yet to be hammered out.

Initiatives like the development of a so-called battery passport will ultimately enable consumers to make educated purchase decisions, and such tools will help stimulate the regional supply chain for rechargeable batteries.

Charged: What’s the status of Umicore’s battery materials plant in Canada and plans for North America?

Robert Privette: Umicore’s activities in Ontario actually go back to 1914, starting in Markham, Ontario where today we produce and recycle precious metal products for the jewelry and industrial markets. We also manufacture automotive catalysts in Burlington, and in Fort Saskatchewan, Alberta since 1996, we make cobalt-related materials.

Together with the Canadian and Ontario governments, we announced the go-ahead for the construction of our gigafactory in Loyalist and celebrated the groundbreaking in October. Because of the pCAM and CAM combination, the plant is one-of-a-kind in North America, and for Canada, pCAM is the missing piece in the puzzle that will complete its battery value chain. Our investment decision is backed up with a 10-year supply agreement with [Japanese battery manufacturer] AESC, taking high-nickel battery materials equivalent to 50 GWh annually by 2030 and powering the cars from its customers in North America, like BMW. Such concrete, value-creative customer contracts are at the basis of all our investment decisions. Engineering and permitting processes are already ongoing, and we expect to begin construction later this year and have the plant up and running by 2026, to ramp up production to an annual 35 GWh. The plant will process current NMC (nickel, manganese, cobalt and lithium) battery technologies, but will also be equipped to process mid-term high-manganese (HLM) as well as longer-term solid-state battery technologies and future sodium-ion.

Later, we plan to add refining and recycling capacities in the region and build a regional-for-regional battery materials supply chain similar to the ones we have established in Europe and in Asia.

Charged: LFP chemistry is becoming a dominant cathode choice in China, but we don’t see significant LFP production in North America. What is Umicore’s perspective?

Robert Privette: LFP is popular in China due to strong local government incentives and the domestic LFP ecosystem, where different industries provide feedstocks for each other. However, outside China, LFP’s value proposition changes due to raw material sources for this technology, more stringent greenhouse gas emission regulations and, in Europe, also legislation related to recycling targets for battery materials.

Regarding North America, the cathode supply chain is in an early stage due to the current modest cell production capacity. This situation will change dramatically, as hundreds of GWh worth of cell production is forecast for North America by the end of the decade. The chemistry of these battery cells will be driven by OEMs targeting EV customers with varying applications and buying priorities, ranging from short-distance city cars to long-distance luxury cars.

LFP is popular in China due to strong local government incentives and the domestic LFP ecosystem. However, outside China, LFP’s value proposition changes due to raw material sources for this technology, more stringent emission regulations and, in Europe, also legislation related to recycling targets for battery materials.

We therefore see the market trending toward multiple cell chemistries through 2030. Also, since the manufacture of LFP is not nickel-based and therefore not compatible with that of NMC and high-manganese technologies, it requires the construction of specific LFP-technology plants and a new supply chain.

As regards Umicore, we view our new high-manganese, HLM battery technology as a strong contender to LFP, outside of China. It’s an extension of our current NMC battery technology portfolio, with high energy density targeting EVs with a 250-mile-plus driving range. We’re now also addressing cost-to-performance, without compromising the driving range. Manganese-rich cathode materials reduce exposure to nickel in favor of lower-priced, abundant manganese, yet deliver energy density comparable to high-nickel, so they provide an affordable vehicle without compromising range.

Another advantage is that because HLM contains some nickel, it’s economically attractive to recycle, contrary to LFP. For our HLM technology we’ve reached the industrialization stage, our customers are testing it and we expect to be ready for production by 2026, which we will be able to do at all our current three and future, four, gigafactories.

Charged: Where is Umicore with solid-state batteries?

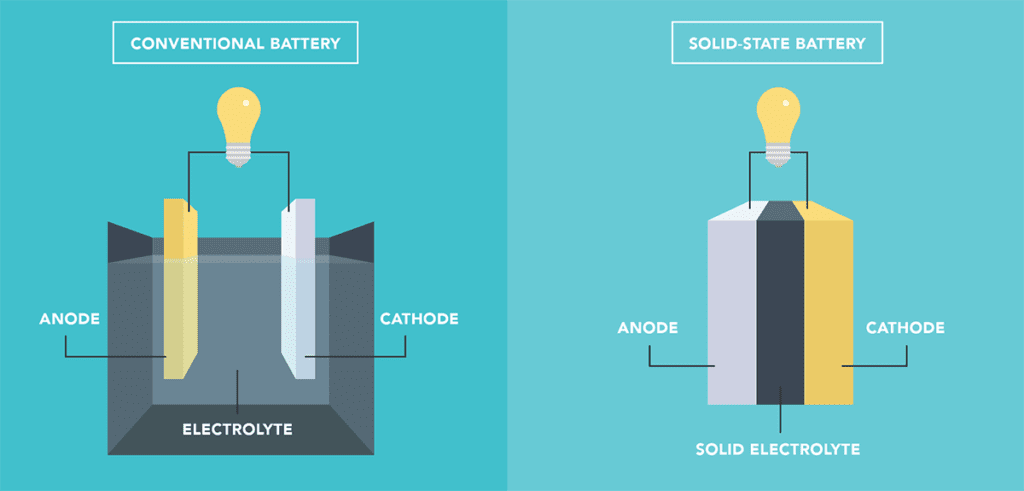

Robert Privette: Solid-state batteries are the next promising EV battery technology that could improve not only performance but most of all the safety of EV batteries. For car manufacturers the promise of improved safety through the use of a non-flammable electrolyte, replacing the current flammable liquid electrolyte, is the key advantage.

Another critical advantage is that the SSB’s improved energy density over today’s battery technology could reduce the weight and size of batteries with opportunities for increased vehicle range, lower battery costs and more design freedom.

Umicore is working actively together with battery cell and battery materials makers, like Idemitsu, to advance solid-state battery technology. We’ve recently opened our solid-state battery material prototyping center in Belgium. It’s one of the world’s largest and most advanced facilities which supports all the SSB technology steps, from formulating the materials to their testing in batteries. Instead of taking materials from glove box to glove box, this center, which runs under ultra-dry and clean conditions, allows us to accelerate development speed and time to market. It’s also in this center that we work with Idemitsu on a catholyte, where the cathode and electrolyte are one component. We’ve recently indicated that overall, we expect the start of production of first SSB technology to happen around 2027, with the appearance of solid-state demonstration cars, using Umicore’s CAM, as of 2024.

We expect the start of production of solid-state batteries to happen around 2027, with the appearance of solid-state demonstration cars, using Umicore’s CAM, as of 2024.

Charged: How do you see battery recycling impacting the EV market?

Robert Privette: Battery recycling provides a sustainable, circular supply of raw materials in a mature market. Efficient and effective collection and recycling of end-of-life batteries results in minimal requirement for new mining. The market for EVs and Li-ion batteries is growing rapidly, and currently the demand for new materials far outpaces the volume of end-of-life Li-ion batteries. Scrap from battery production is being recycled, however this currently represents only a fraction of the raw materials required for today’s rapidly expanding EV market. This situation will change as the EV market becomes more mature. However, we will be dependent on raw materials from primary (mined) sources for many years.