The US and Europe badly need to start manufacturing battery cells, and break the Chinese dominance of the market. But there’s no joy in Batteryville these days—once-promising startups are failing and/or scaling back their plans.

Northvolt, a European company that was founded in 2017, and raised over $13 billion, has struggled for two years to ramp up production at its Swedish cell plant, and is now scrambling for funding to keep the plant open. KORE Power and Freyr Battery have canceled plans to produce cells in the US.

Morrow, a Norwegian company that opened a cell factory in Norway last year, is postponing projects and laying off staff. Canadian battery recycler Li-Cycle has built facilities in Alabama, Arizona and Germany, but paused construction on projects in France and Norway due to a lack of cash.

The problems plaguing these pioneers can’t be blamed on the EV villain of the hour—the storm clouds were gathering well before the new anti-EV administration took power in the US. So, what went wrong?

Christopher Chico, writing in The Battery Chronicle, explains the histories of these companies in detail, and identifies some of the common mistakes they made.

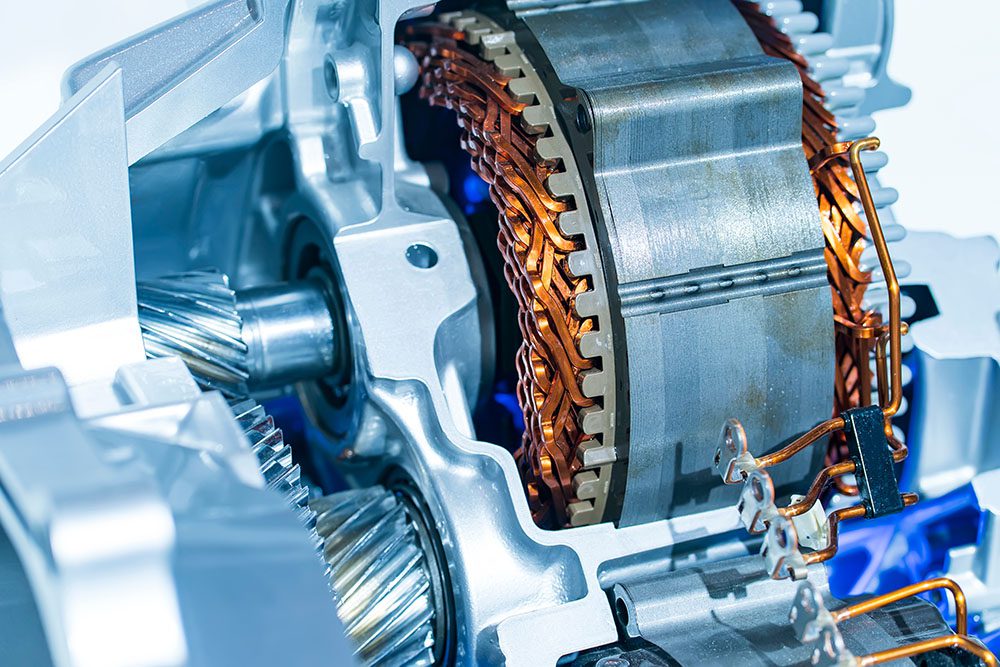

Cell manufacturing ain’t easy—Chico explains that industrial-scale production of lithium-ion batteries usually involves at least 50 individual processes, from electrode manufacturing to cell fabrication to formation and integration. Some companies seem to have underestimated the complexity, and their teams didn’t have enough expertise.

“Let’s be honest, Asian companies are the only ones that can produce battery cells at giga scale,” Chico writes. “They have been doing it for a long time. In the West, we have talented people, but we lack experience in large-scale cell manufacturing.”

In hindsight, it’s not hard to see a lack of focus. Some of these newcomers to the battery industry tried to emulate Chinese and Korean companies with 25 years of experience, and establish vertical integration—that’s a worthy goal, but as Chico notes, it’s one that took those established players many years to achieve.

Some companies strayed from their core business of cell manufacturing, getting into sidelines like lithium mining and recycling.

Some firms bet on unproven technologies. “Freyr rushed into unproven semi-solid batteries (via 24M technology) without real-world experience,” Chico tells us. “Morrow bet on experimental LMNO chemistry.” Both ended up going back to standard lithium-ion batteries (after burning through lots of CapEx and OpEx cash).

Mr. Chico concludes that Western companies need to remember that they are competing with Asian cell producers such as CATL, LGES, Panasonic and Samsung SDI. The dream of Western battery production isn’t dead, but the shakeout probably isn’t over—survivors will need to focus on their core business, and they may have to bring in talent from across the Pacific.

Source: The Battery Chronicle