Massachusetts-based maker of advanced lithium batteries, plans to release its first quarter 2012 financial results this Tuesday. Net loss is expected to be around $125 million.

A123 Systems, the Waltham, Massachusetts-based maker of advanced lithium batteries, plans to release its first quarter 2012 financial results this Tuesday, before financial markets open. Net loss is expected to be around $125 million.

As one of the best-known publicly-traded EV-related companies, A123 (NASDAQ: AONE) is bound to draw comparisons with Tesla Motors, which released an upbeat quarterly report last week. Like Tesla, A123 is a young American company with some innovative technology that has so far enabled it to hold its own against much larger competitors. Also like Tesla, A123 received some federal support under the stimulus bill, but also has substantial sources of private financing.

Unlike the Silicon Valley automaker, the Massachusetts battery builder has been dealing with bad news lately – a manufacturing defect that the company expects will cost it almost 52 million bucks, as well as lackluster performance at Fisker, A123’s most high-profile customer. While TSLA has been tooling down the NASDAQ highway, AONE is sitting on the shoulder with parts and tools spread out in the dirt, as its stock hovers around the terrifying one-dollar level.

"Our anticipated quarterly revenue for the first quarter is below our prior expectations due to the deferral of revenue recognition for product shipments that are subject to the prismatic cell field campaign that we previously announced," said CEO David Vieau. "As we reported previously, we have determined the root cause of the defective cells and are in the process of revalidating our manufacturing systems and procedures in Livonia to make sure the necessary process controls are in place. We have started shipping replacement products to customers in support of this field campaign and while we are committed to delivering replacement packs and modules to impacted customers as quickly as possible, we must remain disciplined with respect to the rate of our production ramp to ensure quality going forward. As a result of this deliberate ramp and the utilization of a portion of our manufacturing capacity for non-revenue generating production, we are adjusting our full year revenue forecast. We continue to anticipate completing commitments for our field campaign over the next several quarters. As we have not experienced a change in demand from existing customers, we anticipate that most of the revenue corresponding to our reduced guidance will be shifted into 2013."

Source: A123 Systems & Green Car Congress

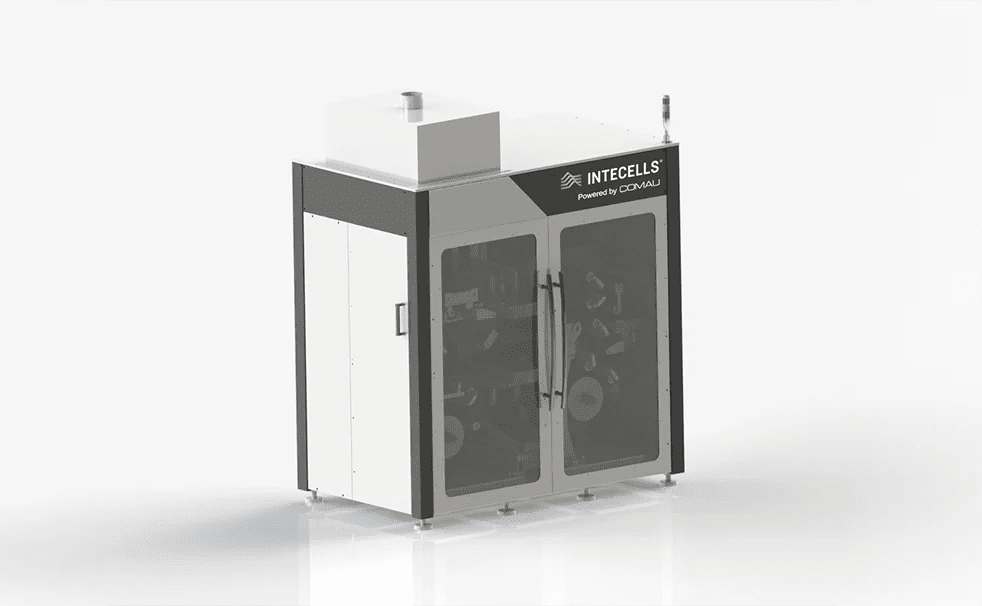

Image: A123 Systems