Envia Systems crushed the record for energy density of an automotive rechargeable Li-ion battery at 400Wh/kg. Now all the small start-up has to do is partner with everybody, become the industry standard, and change the world.

Most of us know the public library as a place to get some free Wi-Fi, meet up with people for Craigslist transactions, and oh yeah, maybe even borrow a book. Sadly, most do not use the publicly-funded institutions of knowledge to determine how we’re going to shape the future of personal transportation. Yet that’s just what happened in July of 2007 when Mike Sinkula and Dr. Sujeet Kumar devised a plan for Envia Systems in a public library.

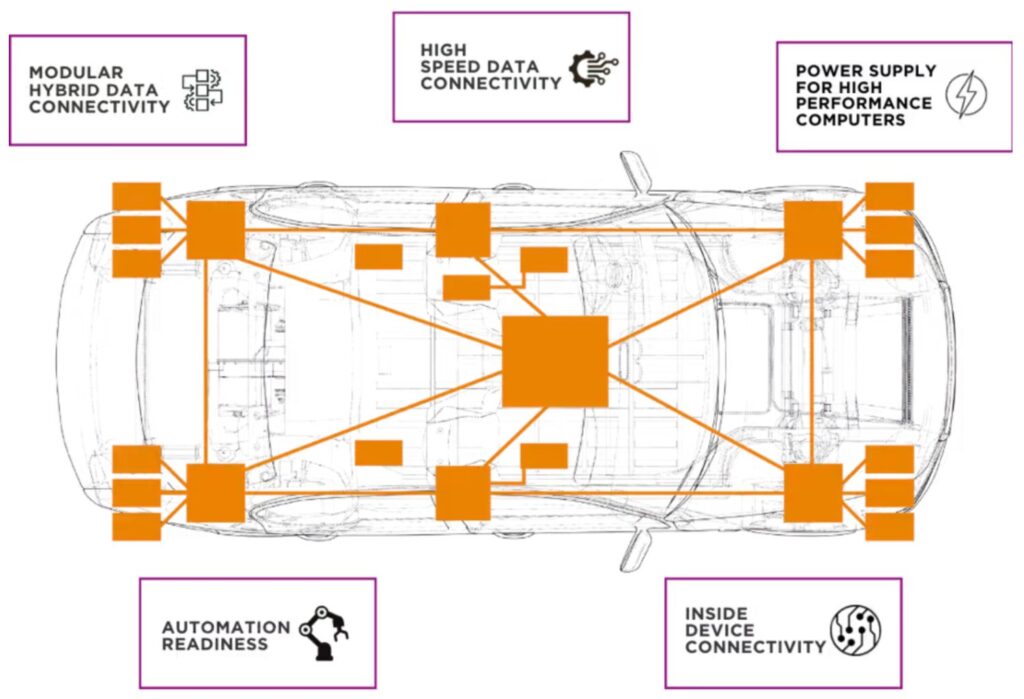

“We had the idea that electric vehicles need higher energy, because their main limitations were the range and the cost,” said Dr. Kumar, who is now President and Chief Technology Officer of the Newark, California-based private company. “We wanted to build high-energy batteries at low cost for electric vehicles,” he continued. “We saw an opportunity there.”

“We had the idea that electric vehicles need higher energy, because their main limitations were the range and the cost,” said Dr. Kumar, who is now President and Chief Technology Officer of the Newark, California-based private company. “We wanted to build high-energy batteries at low cost for electric vehicles,” he continued. “We saw an opportunity there.”

Credit that foresight for Envia’s announcement in February that the company achieved the highest-ever recorded energy density for a rechargeable lithium-ion cell: 400 Watt-hours per kilogram (Wh/kg). That’s more than double the energy density of the state-of-the-art EV batteries that we see on the road this year.

What’s more significant is that Envia’s record-breaking test was not simply a proof-of-concept test, like when geeks armed with liquid nitrogen and protective gear overclock a PC processor to insane levels for a few seconds. The real-world EV battery test featured Envia’s automotive grade 45 Amp-hour (Ah) cell, under the supervision of ARPA-E (Advanced Research Project Agency-Energy), a US federal agency that searches for domestic energy R&D initiatives to promote and fund.

What’s more significant is that Envia’s record-breaking test was not simply a proof-of-concept test, like when geeks armed with liquid nitrogen and protective gear overclock a PC processor to insane levels for a few seconds. The real-world EV battery test featured Envia’s automotive grade 45 Amp-hour (Ah) cell, under the supervision of ARPA-E (Advanced Research Project Agency-Energy), a US federal agency that searches for domestic energy R&D initiatives to promote and fund.

Envia promises that when commercialized, its 400Wh/kg battery technology will cut the cost of a 300-mile-range EV in half. It sounds fantastic on paper, but when and how will Envia take these highly-charged power packs to market?

BUILDING A BETTER ELECTRON TRAP

Kumar, who has a Ph.D. in Materials Science and a background in developing lithium batteries for Greatbatch, co-founded Envia with Sinkula, who is Envia’s Director of Business Development. Atul Kapadia came onboard as the founding investor, and is now Chairman and CEO of Envia.

“I think our accomplishment is pretty formidable,” Kapadia said. “If you want to be in an automobile five years from today, you better be getting qualified today. If not, then there’s no chance that you’re going to be in the next generation of vehicles. And Envia is being qualified.”

When the Electrochemical Power Systems Department at the Naval Surface Warfare Center in Crane, Indiana performed ARPA-E’s test of Envia’s batteries, the batteries cycled a total of 23 times (see test results below). However, Kumar later claimed that in Envia’s California lab, the same batteries have cycled more than 500 times, about half of the 1000 cycles a battery needs to meet automotive production standards.

“If you have a battery that cycles below 100 times, that means there’s a lot of science left,” Kumar explained. “If a battery has cycled 300, 400 times, then it’s mostly engineering that can take it all the way to 1000. So there is some engineering left in our 400 Wh/kg battery – it’s not all done.”

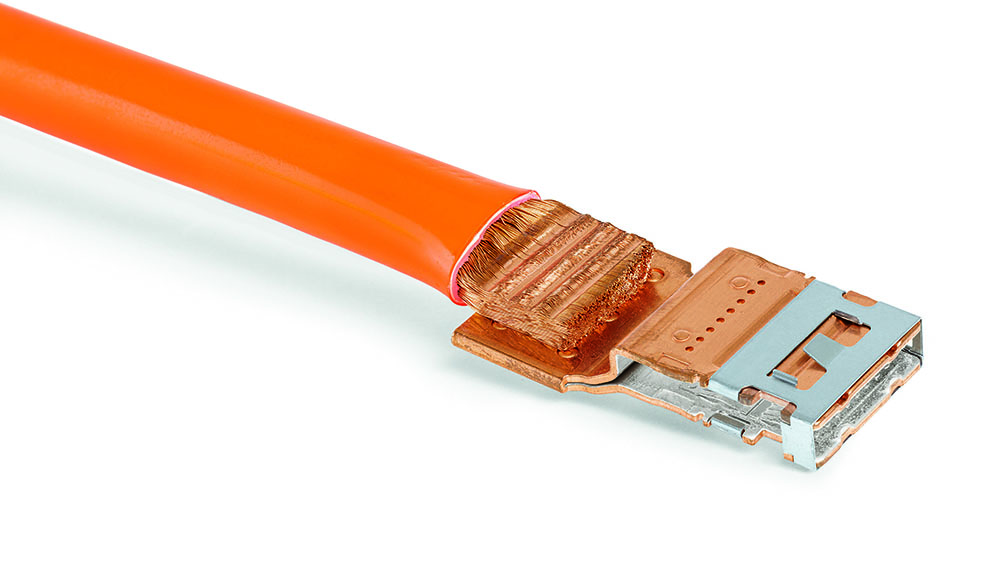

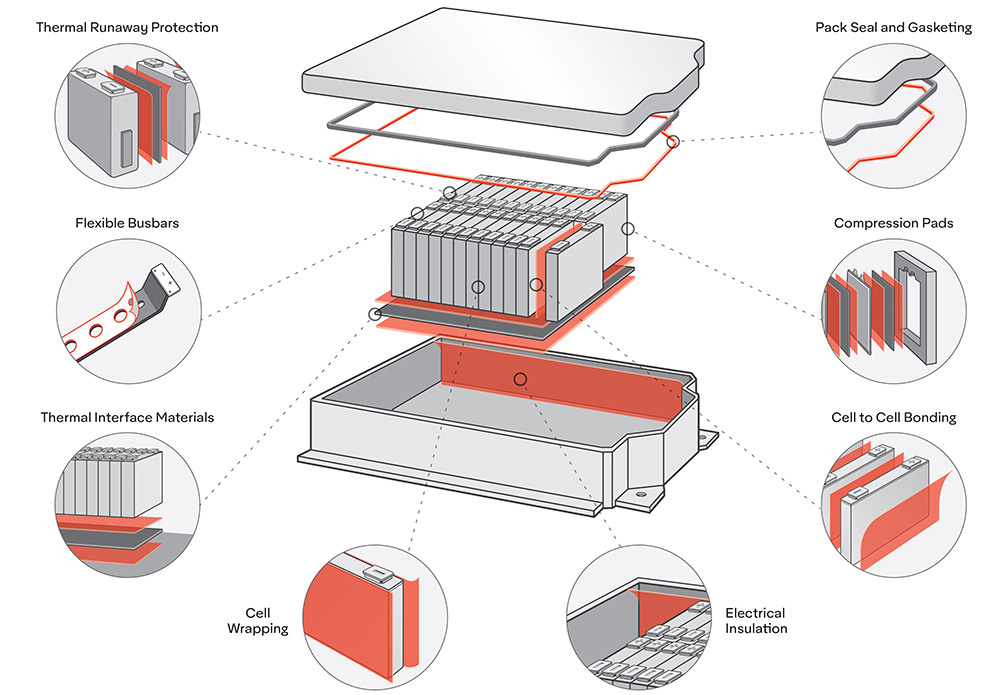

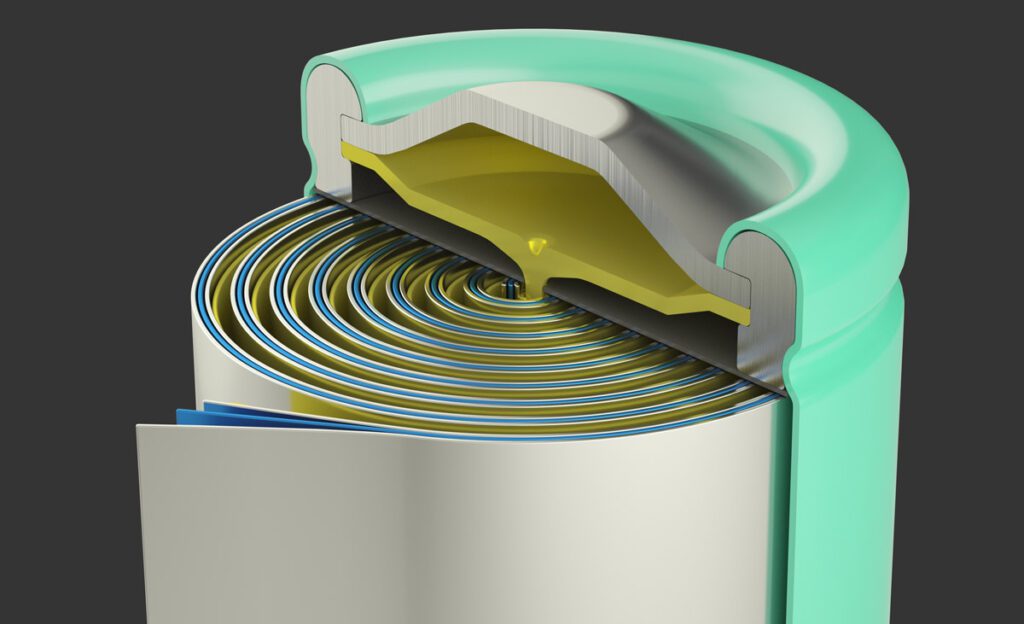

Three core proprietary components set Envia’s 400Wh/kg Li-ion batteries apart: the HCMR (High Capacity Manganese Rich) cathode, the Si-C anode, and the EHV Electrolyte. The readiness of these components will determine how soon the batteries go to market. “Our cathode is very unique,” Kumar said. “It has two times more capacity than the highest-capacity cathode in the market today. Secondly, it is based on manganese, which is a low-cost metal. So in increasing the capacity, we have actually reduced the cost compared to the other highest-capacity cathode, which is very nickel-rich.”

It’s the combination of increased energy density, which will requires less battery material per Watt-hour, with a change in cathode composition away from nickel to manganese, that results in the anticipated cost savings of 50 percent over today’s best known competition. That comes from Panasonic’s partnership with Tesla Motors to supply nickel-type cathode Li-ion batteries for the Model S.

Previous EVs were lucky to get 150 Wh/kg from their batteries, at an exorbitant cost of about $375 per kilowatt-hour in the case of the Nissan LEAF. The Model S may squeeze as much as 240Wh/kg from its Panasonic batteries, and Tesla CEO Elon Musk is on record claiming that the battery cost, which now hovers above $200 per kilowatt-hour, should fall below $200 soon.

The rough target price for Envia’s batteries is $125 per kilowatt-hour, which as Daily Tech reported, could help result in 300-mile range EVs for $20,000.

“We don’t really care how many miles your car goes or what size the battery pack is,” Kapadia said. “If you use Envia’s technology, it will be cheaper per kilogram. By doubling the energy density, we halve the material. Secondly, by changing the composition, with high-grade manganese, we reduce the price further. We have a double punch on the pricing.”

“Now thirdly,” Kumar continued, “because you have a high-energy battery, you also need less amount of anode, less amount of electrolyte, less amount of separator. It’s like a domino effect.”

Envia’s cathode is the closest component to completion, one to two years away in the company’s estimation, and it has customers in the industry to whom it will begin delivering components as they are ready. But Kumar estimated that the full technology may be three to four years off.

“The entire cell design falls right into the schedule that Envia has,” Kapadia said. “Envia’s goal is to have 8 to 10 percent of all vehicles on the road electric by 2018. If we can prototype the entire package by 2015, we can see cars with this technology on the road by 2018.”

WHEN THE CATHODE MEETS THE ROAD

Envia has a materials pilot plant in Newark, California, and a cell prototype plant in Jiaxing, China. But the company plans on its partners carrying the bulk of the manufacturing chores.

Envia has a materials pilot plant in Newark, California, and a cell prototype plant in Jiaxing, China. But the company plans on its partners carrying the bulk of the manufacturing chores.

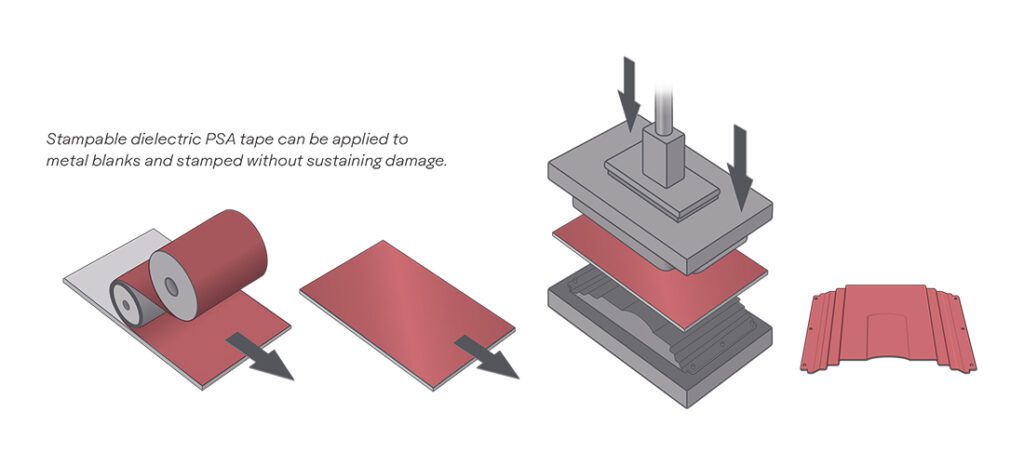

Despite the proprietary components and manganese-rich cathode, Envia’s Li-ion technology can be produced using existing manufacturing techniques and tools.

“The real intellectual property is in the materials – the cathode chemistry and the anode chemistry,” Kumar said. “We can take it to any other lithium-ion battery manufacturing plant in the US or Asia.”

Kapadia further explained that Envia enjoys the flexibility of being a small private company, and will work with customers in a number of ways: a joint venture, a licenser of technology, or producing small runs of its proprietary materials in its own plants. Envia is also well-funded, having raised $17 million in December 2010.

“We have almost all the money in the bank right now,” Kapadia said. “Our burn is very low. We are very capital-efficient. We have 35 people – more than 80% of them are engineers and scientists. We have 16 Ph.D.s on our team. We will start partnering with our customers, the customers will introduce us to their supply chain, and we’ll start partnering with them.”

While such easily-made plans can often go awry, Envia’s model seems to work well so far. Envia has pulled funding from a half dozen or so key investors, ranging from General Motors Ventures to Japanese chemical giant Asahi Kasei, and they look to build on that investment base when adding partners.

“GM is one of the best investors for the advice they give us,” Kapadia said. “At the end of the day, they are the end customer, so we learn a lot from those guys. And there is nothing that binds us with GM that we cannot work with other automotive OEMs. GM has shown the highest level of ethics at our board meetings. They recuse themselves from meetings where we are discussing competitive programs or competitive specs.”

Over the next year or two, Envia’s mission is to continue to engineer its technologies to meet the many specific specs required for its individual component customers it has in Europe, Japan, Korea, and the US. The company expects to announce some specific customers later this year, who will be among the first to utilize Envia’s proprietary materials.

There should also be further announcements on the sustained cycling of Envia’s 400 Wh/kg technology and more about the safety components of the batteries. As of now, Envia touts its cathode’s higher thermal stability as a deterrent to post-crash fires in EVs.

Another near-term goal for Envia is to seek out partnerships. “Our competition will probably end up becoming our partners,” Kapadia said. “Envia’s mission is to make the 300-mile electric car real. The only way to make it real is to make it inexpensive, and to make it inexpensive you commoditize the market. We want to go out there and make everybody successful in bringing the prices of these batteries down.”

As Envia plans to rely on partners for production, it’s going all-in on its intellectual property. Right now, the company has the best thing going, but there’s no guarantee that they’ll be king of the energy density mountain forever, or that everyone will want to work with them before something else is developed.

“There is a massive macroeconomic capacity out there to make cells and batteries and materials,” Kumar said. “We worry less about production and manufacturing. When the customers come and start working with us, we can tap into their capacity to get these products to market. Our business model does not rely on economies of scale to bring cost down, like many of our competitors.”

Supposing for a moment that Envia’s technology does take off with automotive partners, there is also an incalculable need for higher-energy-density rechargeables in the explosive fields of mobile computing, consumer electronics, and the like. Would Envia make a move into those fields? “All I can say is, stay tuned,” Kumar said.

Stay tuned we will. More power for less money. It’s the future that everybody wants, and as soon as possible. We can’t wait to see if Envia is the one to take us there.

An electrochemical storage cell – commonly, but incorrectly, referred to as a battery by most people – is comprised of two electrodes with different electronegativities (desire for electrons) suspended in an electrolyte (a polar solvent which can transport ions between the electrodes internally so that electrons can flow between the electrodes externally). The bigger the gap in electronegativity between the two electrodes, the higher the voltage the electrochemical cell will produce, but the electrolyte must not break down in the process (literally from electrolysis).

Envia claims to have formulated improved electrode materials with much higher surface area and conductivity, as well as an electrolyte capable of withstanding a higher voltage. Together these improvements could allow a battery to store more electrical energy per unit volume and weight.

What makes Envia’s cells special?

Cathode

Envia has built on Argonne’s layered-layered chemistry to fine tune the composition of Ni, Co, Mn and Li2MnO3. They use a unique cathode chemistry based on a unique crystal structure. It is a High Capacity Manganese Rich (HCMR™) cathode coupled with proprietary nanocoating processes to further enhance cycle life.They claim innovations on particle morphology (particle size, shape, distribution, tap density & porosity), excellent stability at high voltages, and high capacities with long cycle life.

Anode

Envia uses silicon-carbon nanocomposite anodes. Through the research funded by an ARPA-E grant, they have been able to demonstrate very high capacities (1530 mAh/g) and promising cycle life performance.

Electrolyte

Envia has developed a High Voltage Electrolyte. In cyclic voltammetry studies the electrolyte has shown stability up to 5.2V (vs Li/Li+) without any rapid increase in the oxidation currents. As opposed to standard electrolytes that have displayed almost complete oxidization above 4.5V.

The Naval Surface Warfare Center – Crane Division, under sponsorship of ARPA-E, performed tests on Envia’s batteries to verify their claims. Here are some excerpts from their test report.

The Naval Surface Warfare Center – Crane Division, under sponsorship of ARPA-E, performed tests on Envia’s batteries to verify their claims. Here are some excerpts from their test report.

Envia Systems Prototype Cell Test

GDD GXS 12-005

1. Introduction

1.1 Naval Service Warfare Center, Crane Division (NSWC Crane) Test & Evaluation Branch was tasked by Advanced Research Products Agency – Energy (ARPA-E) to perform Verification & Validation testing on two high capacity lithium ion pouch type cells, manufactured by Envia Systems of Newark, California. The testing included verification of cell capacity and energy density at C/10 and C/3, 100% depth of discharge (DOD), as well as cell capacity and energy density at C/3, 80% DOD. One cycle at C/20 was performed at the manufacturer, therefore Crane’s cycling started at cycle 2. Total testing cycles were 23, with 22 of those being performed at Crane (Cycles 2-23).

2. Test Samples

2.1 The Envia Systems cells are prototype lithium pouch rechargeable cells. The cells have a capacity of 46 Ah and an energy density of 400Wh/Kg. The cell’s dimensions are approximately 97 mm wide, 190 mm long and 10 mm thick. The cell’s approximate weight is 365 grams. Cell serial numbers are 400WhK-07-005-111205 (designated as 005) and 400WhK-07-006-111205 (designated as 006).

5. Conclusions

5.1 One of the highest energy cells used in consumer applications is the NCR18650A manufactured by Panasonic, which can be used as a comparative asset to the Envia cells. The NCR18650A cell specification claims 3100 mAh capacity, 3.6 V average and weighs 45.5 grams. The calculated energy density of this comparative cell would be approximately 245 Wh/Kg.5.2 The test results from the prototype cells tested at Crane were in line with the results obtained from the manufacturer. The claims of 400 Wh/Kg were substantiated through the cycling tests performed at Crane. This is a 160% energy density increase over the industry standard indicated in paragraph 5.1.