On the march toward widespread adoption of 100+ MPGe plug-in vehicles, the Prius Plug-in could take the most significant step.

“When you think of hybrids, you think of Prius.” So says Geri Yoza, National Manager for Advanced Technology Vehicles, Product Planning Department at Toyota.

Of course, that would be the standard company line at Toyota, but for once, it’s a company line that cannot be disputed. In the year of its 15th anniversary since being introduced in Japan, global cumulative sales of Prius models will exceed 3 million in 2012. Prius now has not only the most recognizable name in hybrids, but one of the most recognizable automotive names bar none. Through the first quarter of this year, Prius models sold 247,230 units worldwide, third behind only the Toyota Corolla and the Ford Focus.

While it was not the first hybrid, nor the sexiest hybrid, the Prius remains the hybrid. And according to the US Department of Energy’s numbers at Fueleconomy.gov, several of the Prius models are the most fuel-efficient cars in their class.

Now the question becomes, can the Prius Plug-in (PPI) hybrid electric vehicle replicate the success of the Prius hybrid and put PHEVs on the map of the car-buying public at large? The first PPIs rolled into dealerships in 15 states in February of this year. For the full five months of March to July (the latest month available at press time),  Toyota sold just over 5,000 PPIs in the US, which averaged 3-5% of total US Prius sales per month. Even in its limited markets, the PPI outsold the nationwide Chevrolet Volt in April before sales plateaued later.

Toyota sold just over 5,000 PPIs in the US, which averaged 3-5% of total US Prius sales per month. Even in its limited markets, the PPI outsold the nationwide Chevrolet Volt in April before sales plateaued later.

By next year, Toyota plans to extend the PPI’s reach to all 50 states.

ALL IN THE FAMILY

Light up your cigars, the Prius family has been breeding like bunnies. Part of the reason behind the 2012 explosion of Prius sales must be due to the new Prius models that address varying customer needs. Besides the PPI, the more spacious Prius v wagon launched in late 2011, and the subcompact 4-door Prius c followed the PPI to dealerships in March of this year. Those two new hybrids bookend the 3rd-generation Prius liftback in terms of capacity, price and mileage, giving families or young singles more appropriate Prius options.

While it carries the largest sticker, the plug-in model provides the option of greater fuel efficiency for the large Prius customer base, as well as all of the new eyes that are looking the way of the Prius. So far, the results for PPI sales have been mixed, yet promising.

While it carries the largest sticker, the plug-in model provides the option of greater fuel efficiency for the large Prius customer base, as well as all of the new eyes that are looking the way of the Prius. So far, the results for PPI sales have been mixed, yet promising.

In April, the PPI not only outsold the Chevy Volt despite being in only 15 states, but a May report from Cars.com found that the PPI was in fact the third fastest-selling car in the country in terms of time spent on a dealer lot. The average PPI car lasted only five days on the lot before sale, just behind the BMW X3 and X5, which sold in four days.

However, since then PPI sales have declined while overall Prius sales continue to do gangbusters over 2011 numbers. For instance, in June, Toyota sold 19,150 total Prius units in the US – a 340 percent increase over June 2011. Of those Prii, 60 percent were 3rd-generation Prius liftbacks, 19 percent Prius c, 17 percent Prius v, and 4 percent Prius Plug-in. The PPI did slightly better in the previous month of May, when 5 percent of 21,477 Prius cars sold were plug-ins.

However, since then PPI sales have declined while overall Prius sales continue to do gangbusters over 2011 numbers. For instance, in June, Toyota sold 19,150 total Prius units in the US – a 340 percent increase over June 2011. Of those Prii, 60 percent were 3rd-generation Prius liftbacks, 19 percent Prius c, 17 percent Prius v, and 4 percent Prius Plug-in. The PPI did slightly better in the previous month of May, when 5 percent of 21,477 Prius cars sold were plug-ins.

One has to consider the fact that since the terrible tsunami and earthquakes hit Japan in March 2011, supplies of the Prius – and many other Japanese goods – were down for much of 2011. However, there’s an undeniable upswing in Prius popularity, with customers choosing the classic liftback model first, followed by the least expensive models in order: the Prius c, Prius v, and Prius Plug-in.

LIFE AFTER HYBRIDS

Beyond mere numbers, there is a deeper question of whether or not previous hybrid ownership indicates that a person will buy another hybrid, PHEV, or EV. A recent Polk study issued in April focused only on hybrids, and returned somewhat discouraging figures. In 2011, only 35 percent of previous hybrid owners bought another hybrid (down from 38.9 percent in 2010). Part of that is due to the availability of more fuel-efficient ICE cars, such as the Ford Fiesta, that can break 40 MPG on the highway.

However, the feedback was better for Toyota in particular. The Polk study showed that many hybrid customers who didn’t buy another hybrid still stayed loyal to the brand of their old hybrid. So for Toyota, 60 percent of Prius owners who bought a new car in 2011 bought another Toyota, and 41 percent – well above the average – bought another hybrid from either Toyota or another maker.

However, the feedback was better for Toyota in particular. The Polk study showed that many hybrid customers who didn’t buy another hybrid still stayed loyal to the brand of their old hybrid. So for Toyota, 60 percent of Prius owners who bought a new car in 2011 bought another Toyota, and 41 percent – well above the average – bought another hybrid from either Toyota or another maker.

If it’s hybrid brand loyalty Toyota wants, it’s got the models to encourage it: 12 hybrid models are currently available, including the Lexus offerings. If the Polk study suggests that hybrid owners at least stay brand-loyal, then owners of the now discontinued Honda Accord Hybrid and Ford Escape Hybrid would be more likely to purchase another Honda or Ford, but not necessarily a hybrid.

While the Polk study focused solely on hybrids, additional data issued separately by Nissan and Chevrolet last year found encouraging links between hybrid ownership and a step-up to PHEVs or EVs. Nissan had a bank of about 130,000 people who expressed interest in the LEAF, and found that more than half of them were Prius owners.

In a much smaller sampling of people, Chevrolet found that of the people who traded in a vehicle for a Volt, about one-third of those were trading in a hybrid.

Incentives have also swung away from hybrids and toward PHEVs and EVs. Federal tax credits now apply to PHEVs and EVs only, as do HOV single-occupancy car pool lane stickers in most states that have them, such as California. Yoza mentioned that the PPI is doing particularly well in such states and that in California and other states that follow the ZEV mandate, the PPI has a warranty of 10 years/150,000 miles.

THE LONG HAUL

So while some of the trends and data bode well for the PPI, and others bode ill, we will get to see how the Prius Plug-in story plays out over time. Yoza was quick to point out that the PPI is not a pilot program. “Even when we launched the Prius, it was a roll-out program,” she said. “Automakers spend a lot of time, especially when it comes to new technologies, to train their dealer service technicians and sales people. You want to build consumer awareness and educate consumers. You have to get all your stakeholders involved. You’ve got utilities to talk to. To put all of these things together takes time.”

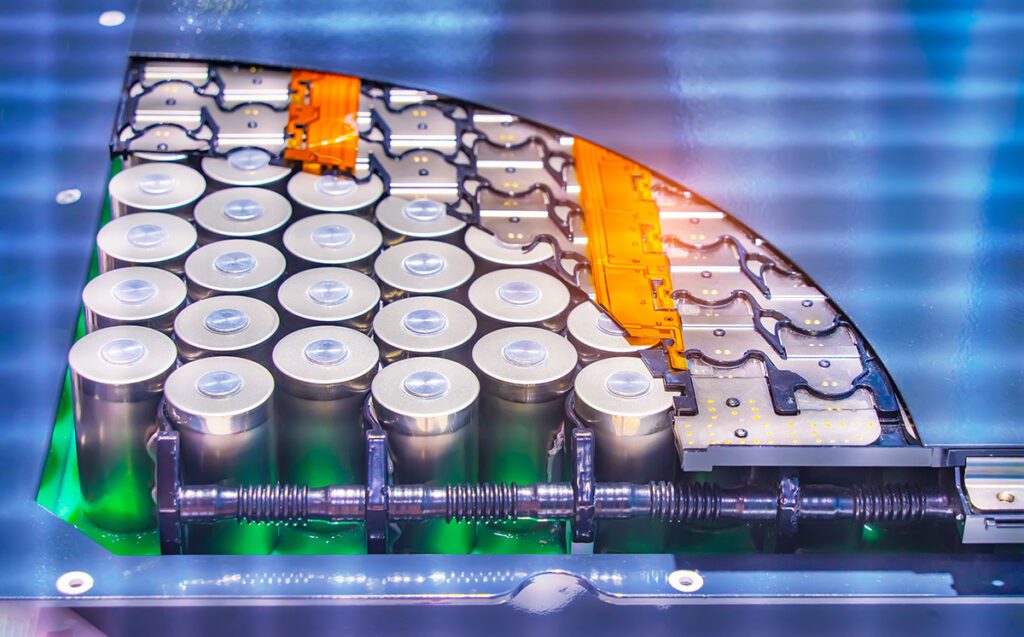

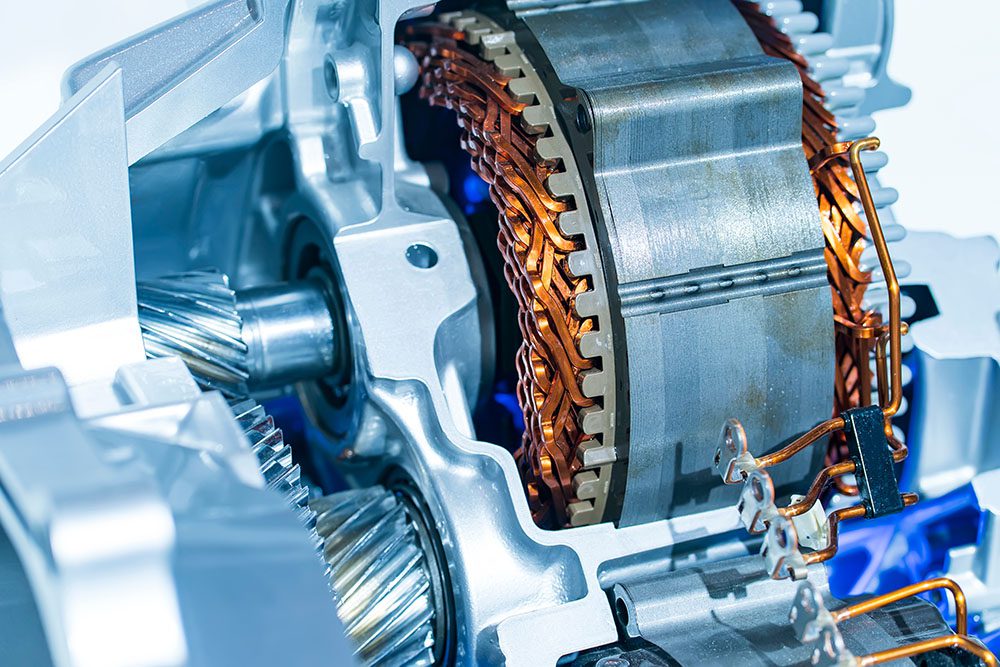

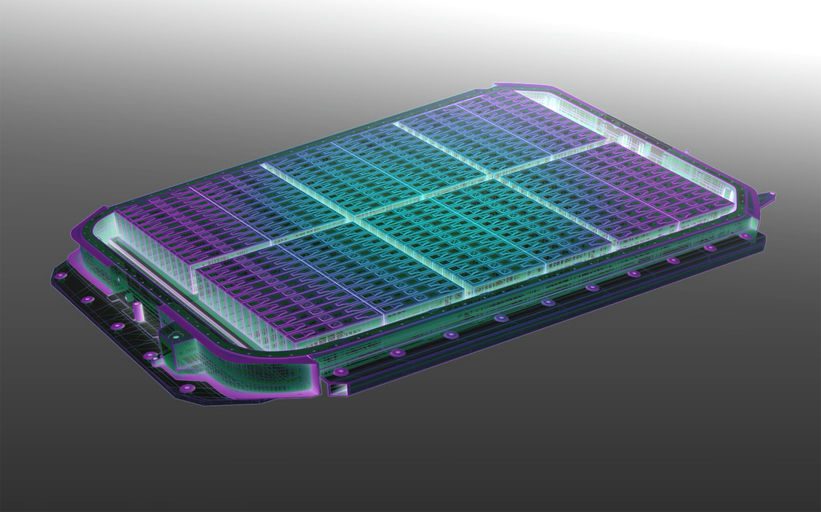

If Toyota is gearing up for a long journey toward electrified vehicles, the small-battery pack Prius Plug-in does have the air of an incremental step toward that goal. The PPI has a 4.4 kWh Li-ion battery pack that’s good for 11 miles at a top speed of 62 mph in the all-electric EV mode. Complementing that is a 10.6 gallon gas tank. All told, the PPI is rated for 50 MPG (combined city and highway) in hybrid mode and 95 MPGe in EV mode.

The argument for small battery pack plug-in hybrids is simple: fewer batteries means less of a price premium. The cheaper the vehicle, the more people will consider purchasing. As more and more consumers become familiar with the technology, the automakers can incrementally one-up each other with respect to electric-mode specs, efficiency, and price point until the day battery improvements make an unmistakable case for fully electric cars. We can already see such a pattern taking place, with the Ford C-Max Energi PHEV scheduled to one-up the PPI in terms of all-electric range (20 miles) and price ($29,995 after the $3,750 federal tax credit) when it comes out this fall. The C-Max is expected to have the same 95 MPGe as the Prius Plug-in.

The argument for small battery pack plug-in hybrids is simple: fewer batteries means less of a price premium. The cheaper the vehicle, the more people will consider purchasing. As more and more consumers become familiar with the technology, the automakers can incrementally one-up each other with respect to electric-mode specs, efficiency, and price point until the day battery improvements make an unmistakable case for fully electric cars. We can already see such a pattern taking place, with the Ford C-Max Energi PHEV scheduled to one-up the PPI in terms of all-electric range (20 miles) and price ($29,995 after the $3,750 federal tax credit) when it comes out this fall. The C-Max is expected to have the same 95 MPGe as the Prius Plug-in.

Prius Plug-in, image courtesy of Toyota C-MAX Energi, image courtesy of Ford Motor Company

Carmakers have a choice between building smaller or larger battery pack vehicles, like EVs or large-battery PHEVs such as the Volt. For now Toyota has gone small. But just how useful is a battery pack with an 11-mile range?

Last year GM released some data from the Chevy Volt’s Onstar link that showed how many of the total Volt miles were covered from power off the electrical grid. What it showed was that about two thirds of Volt owners travelled less than 40 miles – the battery range of the Volt – per day, meaning they would not have to switch to gas.

From Yoza’s perspective, she thinks many PPI owners can accomplish small trips entirely on the car’s 11-mile EV mode range. She also argues for small battery pack PHEVs, saying that “once you deplete your traction battery, then you’re carrying all that weight around.” Less weight makes for higher MPG ratings in hybrid mode, and in the case of large fleets, the entire battery capacity of smaller pack vehicles will be used more often, fully utilizing the investment in batteries more often.

Be that as it may, at its current pace of sales, the PPI will not sell the 16,000-17,000 units that Toyota predicted it would in 2011, while the Volt is on track to exceed 18,000. However, it’s not a direct comparison or a competition. The Volt’s all-electric range of 35-40 miles triples that of the PPI, and its base price of $40,000 exceeds the PPI’s base price of $32,000 as well. The Volt may well appeal more to the customer that prioritizes driving in EV mode over cost.

With all the years of R&D, sales, and marketing that Toyota has put behind the Prius in making it a success, you have to give the company credit for doing its part in the transition to EVs. As we watch the PPI roll out nationwide, we can only hope that the well-earned popularity of the brand lends itself to the plugged-in movement. Toyota has led the horses to water. Will they drink?

Issue: AUG/SEP 2012

Images of Toyota Prius Plug-in Courtesy ofToyota UK