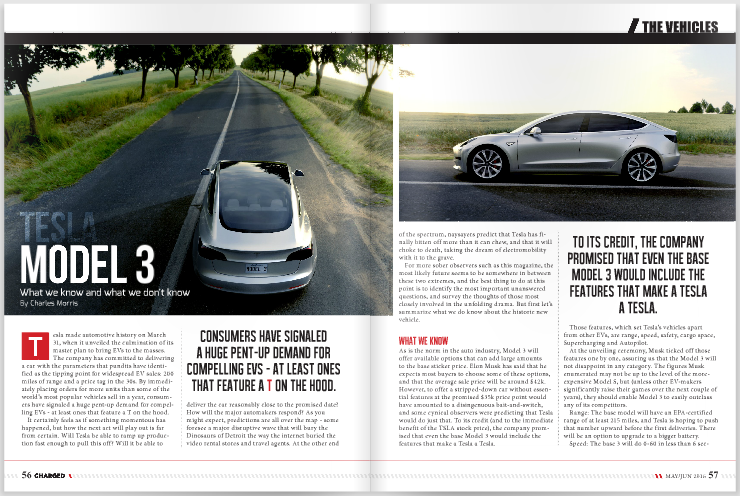

Tesla made automotive history on March 31, when it unveiled the culmination of its master plan to bring EVs to the masses. The company has committed to delivering a car with the parameters that pundits have identified as the tipping point for widespread EV sales: 200 miles of range and a price tag in the 30s. By immediately placing orders for more units than some of the world’s most popular vehicles sell in a year, consumers have signaled a huge pent-up demand for compelling EVs – at least ones that feature a T on the hood.

It certainly feels as if something momentous has happened, but how the next act will play out is far from certain. Will Tesla be able to ramp up production fast enough to pull this off? Will it be able to deliver the car reasonably close to the promised date? How will the major automakers respond? As you might expect, predictions are all over the map – some foresee a major disruptive wave that will bury the Dinosaurs of Detroit the way the internet buried the video rental stores and travel agents. At the other end of the spectrum, naysayers predict that Tesla has finally bitten off more than it can chew, and that it will choke to death, taking the dream of electromobility with it to the grave.

For more sober observers such as this magazine, the most likely future seems to be somewhere in between these two extremes, and the best thing to do at this point is to identify the most important unanswered questions, and survey the thoughts of those most closely involved in the unfolding drama. But first let’s summarize what we do know about the historic new vehicle.

What we know

As is the norm in the auto industry, Model 3 will offer available options that can add large amounts to the base sticker price. Elon Musk has said that he expects most buyers to choose some of these options, and that the average sale price will be around $42k. However, to offer a stripped-down car without essential features at the promised $35k price point would have amounted to a disingenuous bait-and-switch, and some cynical observers were predicting that Tesla would do just that. To its credit (and to the immediate benefit of the TSLA stock price), the company promised that even the base Model 3 would include the features that make a Tesla a Tesla.

Those features, which set Tesla’s vehicles apart from other EVs, are range, speed, safety, cargo space, Supercharging and Autopilot.

At the unveiling ceremony, Musk ticked off those features one by one, assuring us that the Model 3 will not disappoint in any category. The figures Musk enumerated may not be up to the level of the more-expensive Model S, but (unless other EV-makers significantly raise their games over the next couple of years), they should enable Model 3 to easily outclass any of its competitors.

Tesla Model X and Model 3 at the unveiling event. Image credit: Jurvetson/Flickr (CC BY 2.0)

Range: The base model will have an EPA-certified range of at least 215 miles, and Tesla is hoping to push that number upward before the first deliveries. There will be an option to upgrade to a bigger battery.

Speed: The base 3 will do 0-60 in less than 6 seconds. “At Tesla, we don’t make slow cars. And there will be versions that go much faster.” In answer to questions from Tesla fans on Twitter, Elon Musk said that Model 3 will “of course” offer Ludicrous mode as an option. There’s no word yet on exactly how quick it will be, or how much it will cost (on the Model S and X, $10,000 buys you a 0-60 time of 2.8 seconds).

Safety: With power comes responsibility. Musk promised that Model 3 will score 5-star safety ratings in every category.

Optional features: Rear-wheel drive is standard, and there will be an option for dual-motor all-wheel drive, which Musk said will cost less than $5,000. Like Model S, there will be an optional air suspension feature that can dynamically adjust ride height. Other options will include a towing hitch and a vegan interior (no leather).

What we Don’t know

What will Model 3’s cargo compartment be like?

Tesla says the Model 3 fits 5 adults “comfortably,” and some of the lucky souls who got a ride in one at the unveiling ceremony agreed that it does. However, some are concerned that Model 3’s design may have traded away cargo capacity in favor of passenger space.

Tesla has said that Model 3 will have two trunks and more cargo space than any car of its size, and that the back seats will fold completely horizontal. Musk assures us that a 7-foot surfboard, or a bike, will fit.

Tesla’s Chief Designer Franz von Holzhausen takes his family for a Model 3 drive. Image credit: Jurvetson/Flickr (CC BY 2.0)

Tesla’s Chief Designer Franz von Holzhausen takes his family for a Model 3 drive. Image credit: Jurvetson/Flickr (CC BY 2.0)

However, the utility of cargo space isn’t just about cubic feet, but about accessibility – that’s why the auto world is divided between hatchbacks and sedans. Loading large and/or heavy objects is easy with a hatchback like the Model S (or the Toyota Prius or Honda Fit), but it can be almost impossible with a sedan-style trunk. At least from the few pictures we’ve seen so far, Model 3 appears to have a sort of hybrid between trunk and hatch.

Musk explained the reason for the compromise: “Only way to get enough rear passenger headroom was to move the rear roof cross-car support beam thus no hatchback like S and X.” He also assures us that Tesla will address the issue: “Won’t be a hatchback, but we should be able to increase the opening width and height.” And later: “Aperture will be big enough for almost anything.”

Cargo space is a sore point with other EVs, especially non-native models, many of which cannibalize trunk space for the battery. Tesla’s “skateboard” design makes it possible to maximize interior space, but there still may be a tradeoff between passenger and cargo space. Despite Musk’s assurances, we’ll have to include the cargo compartment in the Things We Don’t Know category for now.

How much autonomy will Model 3 offer?

[Editor’s note: This section was updated after the print edition went to press.]

Tesla says that all threes will come standard with Autopilot hardware, and that all Autopilot “safety features” will be included even in the base model. It’s safe to assume that anything not considered a safety feature will be a software-enabled option. This would include the Summon feature, self-parking and other fun stuff.

As with Model S, once the car has the necessary sensors and control hardware, adding other Autopilot features, including new ones yet to be developed, is just a matter of pushing out a software update, so the sky (or perhaps a buyer’s bank account) is the limit. The greatest benefits of vehicle autonomy (smoother traffic flow, fewer parking lots) will be realized when most or all vehicles are autonomous, so the new technology will surely trickle down to even the lowest-priced cars eventually. We’re sure that Tesla envisions a future in which every Model 3 can get around on its own.

During a talk at the Code Conference in June, Elon Musk hinted that this will happen sooner rather than later (or at least, willing minds interpreted his comments that way). When asked if the Model 3 will be fully autonomous, Musk hesitated, then said that he will offer more details at another big event “toward the end of the year.” He added that it will be “really big news,” and that Tesla will do “the obvious thing.” Back in December 2015, Musk predicted that Tesla’s fully autonomous level 4 technology would be ready in about two years.

Access to the Supercharger network

[Editor’s note: This section was updated after the print edition went to press.]

Tesla’s Supercharger network is one of the brand’s greatest assets – a valuable benefit for customers and a strong selling point against the (so far, mostly theoretical) competition. In the wake of the launch party, the question of the hour was: Will 3 buyers get the same free Supercharging privileges that S and X owners enjoy?

“All Model 3 will have the capability for Supercharging,” was all that Tesla would say at the time. At the annual shareholder meeting in June, however, Elon Musk confirmed that Supercharging will not be free for Model 3 owners.

“It will still be very cheap, and far cheaper than gasoline, to drive long-distance with the Model 3,” said Musk, “but it will not be free long distance for life unless you purchase that package. I wish we could [make it free], but in order to achieve the economics, it has to be something like that. It’s not because we want to make things more expensive, it is because we can’t figure out how to make it less expensive.”

So, there it is: there’ll be no free-for-all, but an unlimited charging package may be available as an option (Musk didn’t say how much the package will cost).

Tesla fans on the Tesla Motors Forum and elsewhere have discussed this issue from every possible angle, and most of the more experienced EV drivers seem to agree that offering free-for-all charging would have been a bad idea for all concerned.

The downside for the company is obvious. Tesla eventually plans to sell millions of cars, and they’re designed to last. An open-ended commitment to free charging could be a financial albatross of Coleridgean proportions.

Free unlimited access for all might be a bad deal for Tesla customers too. Some of the most popular Supercharger locations are already congested, and adding even a quarter million Model 3 drivers to the user base could turn a quick and hassle-free charging experience into a nightmare.

We value what we pay for, and services that are free tend to get abused. Even a nominal charge will encourage drivers to use the Superchargers when they really need them, and possibly to take better care of them. Drivers who can afford a $35,000 new car aren’t likely to mind paying ten or fifteen bucks if they get convenient access to a fast charge when they need one.

From Musk’s comments, it sounds like Tesla will offer unlimited charging for a one-time fee. However, that might not be the best pricing model. Tesla has already run into problems with Model S owners using Superchargers for daily charging, instead of for occasional long trips, as the company intended. Other than sending schoolmasterly emails to offenders, Tesla has no real way to curb this tragedy of the commons.

Other possible pricing models include charging by the kWh, or charging a fixed fee per session. However, doing things this way encourages drivers to leave their cars plugged in as long as possible, an action which they derive little benefit from, because the rate at which charging stations deliver energy is highest early in a session, and tapers off towards the end.

The main thing users want from a fast charging service is that it be readily available when needed, according to Rami Syväri of Norwegian network operator Fortum Charge & Drive, which has made an in-depth study of driver charging behavior. Fortum believes that charging per minute is best, because it incentivizes drivers to use chargers for the minimum amount of time needed, which increases the availability of each station.

How will the tax credits shake out?

It’s safe to say that most buyers of Models S and X, with their price tags well north of 70 grand, are not much influenced one way or the other by the $7,500 federal tax credit for EV purchases. For Model 3 however, that credit represents over 20% of the base price, and it could be very important indeed for the “average” car buyers who make up the target market.

The EV tax incentive was designed to give a boost to early adopters of a new product, and as such it is designed to “sunset” once a particular automaker reaches 200,000 in EV sales.

By most estimates, Tesla has already sold around 50,000 vehicles in the US, and it plans to sell about that number again by the end of 2016. If it keeps ramping up production of Models S and X as planned, it could be very close to the 200,000 mark by the end of 2017, when deliveries of Model 3 are scheduled to begin.

According to Internal Revenue Code 30D, when the 200,000-unit threshold is reached, the tax credit will automatically be phased out “beginning with the second calendar quarter after the calendar quarter in which at least 200,000 qualifying vehicles manufactured by that manufacturer have been sold.” Then, the credit will drop to $3,750 for six months, to $1,875 for another six months, and then it will be gone.

Tesla has already logged over 400,000 orders globally for Model 3. Even if only a quarter of those translate into US deliveries, many of those buyers are going to get a reduced tax credit, or none at all. Obviously, those who placed orders earlier are more likely to get the whole cookie, but there are too many variables to know for sure which buyers will slip in before the cutoff point. Tesla tends to produce its vehicles in batches – all of one trim level first, then the next, and so on. It has said that it will deliver Model 3 to existing customers first, then to buyers on the West Coast, and expand from there, so geography may play a role in who gets the goodies.

It will be ironic if all the tax credits get soaked up by the affluent buyers of the Roadster, S and X, leaving none for the theoretically more deserving middle-classers waiting patiently for the 3. “One could argue [that Tesla] sort of wasted their credits on the very wealthy, people who didn’t need it,” Kelley Blue Book’s Rebecca Lindland told Wired. (An interesting note: Germany recently approved an EV purchase incentive, but it excludes cars priced over €60,000, so Models S and X won’t be eligible, but Model 3 will.)

The Tesla team is well aware of the issue. “Our production ramp plan should enable large numbers of non X/S customers to receive the credit,” tweeted Elon Musk. “We always try to maximize customer happiness even if that means a revenue shortfall in a quarter.”

There is a way that Tesla could manipulate deliveries to maximize the number of customers that get the credit, based on the fact that, once a carmaker hits the 200,000-unit mark, the phase-out is based on calendar dates. If the company delivers its 199,999th car on the first day of a quarter, it would theoretically have two quarters to deliver as many cars as possible, all qualifying for the full tax credit.

It’s also worth mentioning that the fate of the EV credit could depend on the US presidential election in November. A Republican-led government could conceivably ax the credit (although it’s rare for Congress to eliminate existing programs), while a Democrat-dominated Washington might vote to extend it.

How will the global auto industry respond?

“The Model 3’s huge reservation list should serve as a big wake-up call for the rest of the industry,” Kelley Blue Book Analyst Tony Lim told Automotive News.

Will the big automakers respond to that wake-up call, or will they hit the snooze button, as they have so many times in the past? This is the big question, and the answer, to be revealed over the next few years, will be all-important for Tesla and (if you’ll forgive us a bit of melodrama) for the fate of mankind.

Tesla’s mission has always been to get more people driving EVs, even if it’s not the one selling them. Elon Musk has said many times that he welcomes competition from the major automakers.

Musk and his crusading carmakers have had some success in this regard. Former GM exec Bob Lutz has acknowledged that Tesla was a major inspiration for the Chevy Volt. More recently, Tesla has become a role model for the German luxury brands, all of which have been accelerating their plug-in plans (it has also inspired a crop of brash startups backed by Chinese tech investors).

However, so far we’ve seen nothing that could really be called competition for Tesla, much less any sign that the majors envision a truly mass-market EV in the near future. Now that Model 3 has garnered more orders in a week than most legacy models sell in a year, is this about to change?

Some Tesla skeptics believe that at some point, the majors will get serious about their own EV programs and, with their massive financial resources and economies of scale, will bury the Silicon Valley upstart.

This is theoretically possible, and may conceivably happen, but many who comment on the EV scene fail to understand that there’s a fundamental difference between Tesla and other OEMs. Tesla exists only to sell EVs, and it wants to sell as many as it can. For the most part, the Big Three and others are building EVs only because governments are forcing them to. They have built some excellent plug-in automobiles, but have largely opted not to invest in any substantial advertising for them, and they have failed to motivate their independent dealers to really push them.

While there are surely pro-EV factions within all the major automakers, on the whole the companies would be happy to see emissions regulations in the US and Europe watered down (a result they have spent millions lobbying for), and to keep their EVs in a permanent test marketing program.

This attitude is not (entirely) the result of any oil-funded conspiracy, or even of typical corporate short-sightedness. It’s simply a sound business decision. Automakers are currently enjoying their highest levels of sales and profits in history. To give one example, Ford recently announced that its net income for the first quarter of 2016 more than doubled, driven mostly by “insatiable demand” for trucks and SUVs. For the decade to come, automakers have their eyes on China, where – while the government is struggling to electrify its way out of choking air pollution – consumers want just what Americans want: the biggest and most powerful vehicles they can afford.

All that said, it can’t be denied that several of the majors are moving steadily forward. The Chevy Bolt will give buyers a 200-mile, $35k electric option at least a year before the Model 3 shows up in anyone’s driveway. The Nissan LEAF has boosted its range to over 100 miles, and the Ford Focus EV will soon match that. BMW, VW, Kia and others have announced ambitious electrification plans for the medium term.

Journalists have been asking auto industry execs how they plan to respond to the Tesla tidal wave. Most have responded with vague generalizations, saying that they’re pleased to see demand for EVs, and plan to be at the forefront of new technology. However, so far none have signaled any real change to their current strategies.

Perhaps the most positive-sounding of the bunch is Nissan CEO Carlos Ghosn, who told Automotive News that the increased awareness of EVs would push Nissan to improve its own electrified vehicles, and said, “We welcome competition because it can expand the market. It’s going to stimulate demand.”

Nissan also responded to the raft of reservations for Model 3 by running print ads in several national newspapers that took a gentle poke at Tesla, saying “No one should have any reservations about getting an electric car today. Why wait when you can drive an all-electric LEAF now?”

This article originally appeared in Charged Issue 25 – May/June 2016. Subscribe now.