Cummins is a huge presence in the diesel engine market around the globe. The company designs, manufactures and sells billions of dollars’ worth of diesel engines (and some engines powered by “alternative fuels” such as natural gas). Ranging from 2.8 to 95 liters, the company’s engines are found in nearly every type of vehicle and equipment on Earth, from pickup trucks to 18-wheelers, from berry pickers to 360-ton mining haul trucks, as well as a full line of recreational and commercial marine diesels.

The Indiana-based company is also a world leader in stationary power generation from 2.5 to 3,500 kW. These critical pieces of equipment turn liquid or gas fuels into electricity when power from the grid won’t cut it (or fails completely). For example, electric generator sets (gensets) are a must for hospitals or health centers that need sustained power during blackouts or storms. Cummins generators are also commonly used in residences, data centers, telecom, manufacturing, mining, marine and defense to name a few industries.

Beyond its heavy equipment manufacturing, Cummins operates a bit like a tech company that seeks domain expertise in the basic science that drives its products. With more than $700 million invested annually in R&D since 2011, Cummins isn’t resting on its laurels.

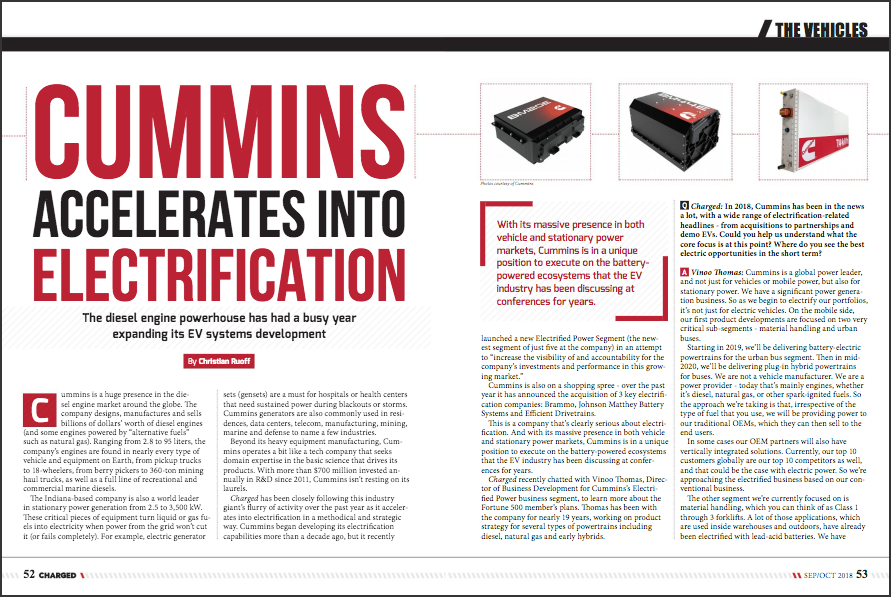

Charged has been closely following this industry giant’s flurry of activity over the past year as it accelerates into electrification in a methodical and strategic way. Cummins began developing its electrification capabilities more than a decade ago, but it recently launched a new Electrified Power Segment (the newest segment of just five at the company) in an attempt to “increase the visibility of and accountability for the company’s investments and performance in this growing market.”

Cummins is also on a shopping spree – over the past year it has announced the acquisition of 3 key electrification companies: Brammo, Johnson Matthey Battery Systems and Efficient Drivetrains.

This is a company that’s clearly serious about electrification. And with its massive presence in both vehicle and stationary power markets, Cummins is in a unique position to execute on the battery-powered ecosystems that the EV industry has been discussing at conferences for years.

Charged recently chatted with Vinoo Thomas, Director of Business Development for Cummins’s Electrified Power business segment, to learn more about the Fortune 500 member’s plans. Thomas has been with the company for nearly 19 years, working on product strategy for several types of powertrains including diesel, natural gas and early hybrids.

Charged: In 2018, Cummins has been in the news a lot, with a wide range of electrification-related headlines – from acquisitions to partnerships and demo EVs. Could you help us understand what the core focus is at this point? Where do you see the best electric opportunities in the short term?

Vinoo Thomas: Cummins is a global power leader, and not just for vehicles or mobile power, but also for stationary power. We have a significant power generation business. So as we begin to electrify our portfolios, it’s not just for electric vehicles. On the mobile side, our first product developments are focused on two very critical sub-segments – material handling and urban buses.

Starting in 2019, we’ll be delivering battery-electric powertrains for the urban bus segment. Then in mid-2020, we’ll be delivering plug-in hybrid powertrains for buses. We are not a vehicle manufacturer. We are a power provider – today that’s mainly engines, whether it’s diesel, natural gas, or other spark-ignited fuels. So the approach we’re taking is that, irrespective of the type of fuel that you use, we will be providing power to our traditional OEMs, which they can then sell to the end users.

In some cases our OEM partners will also have vertically integrated solutions. Currently, our top 10 customers globally are our top 10 competitors as well, and that could be the case with electric power. So we’re approaching the electrified business based on our conventional business.

The other segment we’re currently focused on is material handling, which you can think of as Class 1 through 3 forklifts. A lot of those applications, which are used inside warehouses and outdoors, have already been electrified with lead-acid batteries. We have products that we sell in those segments with lithium-ion technology. We have a couple of big customers for those types of products today within the portfolio. We also have other customers in the similar size smaller vehicle range, Polaris for example. So that’s one section of the electric product development that is already in production.

There are also significant projects within the company across multiple other segments, in what we call mobile off-highway equipment, but we can’t go into too much detail at the moment.

So, these are the nearest product developments on the mobile side that are occurring right now. There are also significant stationary applications that are in the development cycle.

Charged: We write a lot about electric urban buses, and our readers are well versed in the factors driving that market. Could you educate us a bit on forklifts? What’s driving the transition from lead-acid to Li-ion packs?

Vinoo Thomas: There is an aspect of the economics, of course, because you can get more out of your machine productivity-wise if you move from lead-acid to lithium-ion. You can simply pack more energy on the piece of equipment, so it can run longer.

Or you can choose to design it lighter and smaller, so you can actually get a better design of the equipment. Think about warehouses, for example – they’re stacking things between narrow aisles. So a smaller mobile lift is an important aspect of the productivity of that warehouse. The more stuff you can stack in that warehouse, and the tighter you turn that piece of equipment between the aisles, the higher the economic metrics. Moving to Li-ion increases that significantly.

The other aspect is the safety and sociability aspect. Lead-acid batteries produce fumes and gases while charging, so you need to do it in well ventilated rooms. They also require manual monitoring and maintenance – like adding distilled water to the electrolyte. All that’s taken out with the movement toward lithium-ion. There are multiple benefits which then show up as a total cost of ownership benefit to the end user.

In the US and Canada, there are around two to three hundred thousand units a year, and 60-70% are lead-acid today. Lithium-ion is slowly penetrating pretty heavily in very specialized areas. If you look at some of the big franchises, the big companies, as they move toward more socially responsible products in their supply chain, they’re beginning to invest heavily in Li-ion.

Charged: We hear a lot of conversations about how EVs and stationary battery packs are synergistic, and the markets will grow hand-in-hand. One thing that’s unique about Cummins’s electrification efforts is that you already have a big presence in both the mobile power and stationary power markets. How do you compare the two opportunities for electrification?

Vinoo Thomas: We definitely think it is significant that Cummins has a presence in both these sectors. For example, there is opportunity to create enough aggregation of scale from some of these mobile applications to develop these stationary applications. That is a significant portion of our product-planning exercises.

If you think about our engines as an example, we build one B-platform engine somewhere on this planet every 15 seconds. We’re able to do that because that base platform is used across a whole variety of applications. On- and off-road, mobile, stationary, etc.

Our approach with energy storage is very similar – we develop base platforms and modules which can then be applied across multiple form factors and applications around the globe. That’s going to be one of the key things that differentiates Cummins from another competitor which is very focused in a particular sub-segment.

With electrification, this also allows a huge opportunity with the concept of secondary-use batteries. The idea is that after a battery ages to a certain point – let’s say 70% of its original capacity, for example – it’s no longer useful in mobile applications. But there could still be value in stationary applications – mainly because volume and weight are not as important when it’s off a vehicle. So a pack could be reused in stationary after mobile.

However, there are major challenges if you don’t have a complete ecosystem. As you can imagine, the design of the pack and module is super-critical. There is no standardization, so if you’re working with packs designed by many different companies, you have to reverse-engineer everything and then integrate the packs after the first use. This basically destroys the value of second-use, because it just builds up the cost of that refurbishment. If you have to do a lot of work then you might as well just use a brand-new pack.

Cummins, on the other hand, has a closed-loop ecosystem. The battery modules coming out of mobile applications are designed by us. Naturally, they will have our interfaces and we’ll have a complete lifetime dataset. We also have a significant aftermarket business which exists today with the channels in which we can move the core back and forth between different applications. We’ll be leveraging all of that in the electrified power business unit as well – very important aspects as we look at stationary use.

Hopefully, over time there will be some industry protocols established to use second-use packs designed by other companies as well. But as of today, it doesn’t look very feasible.

Charged: With that ecosystem, it seems like you also could easily lease a battery pack to different commercial customers over its life, extracting the full useful value. Is that something you’re considering?

Vinoo Thomas: Yes, in fact we have some experience with these models. For example, there are some mining applications where we provide full-service operation and maintenance contracts on sort of a cost-per-hour basis with productivity thresholds and metrics. We take care of everything so that the machine is active and productive.

As the world now changes to electrification, those types of leasing models become more attractive for the end user because then they can mitigate risk and defer that capital investment. If someone introduces a new battery technology six years from now that is significantly better than today, leasing can offload those risks away from customers. I think those types of models will become more and more interesting in this space.

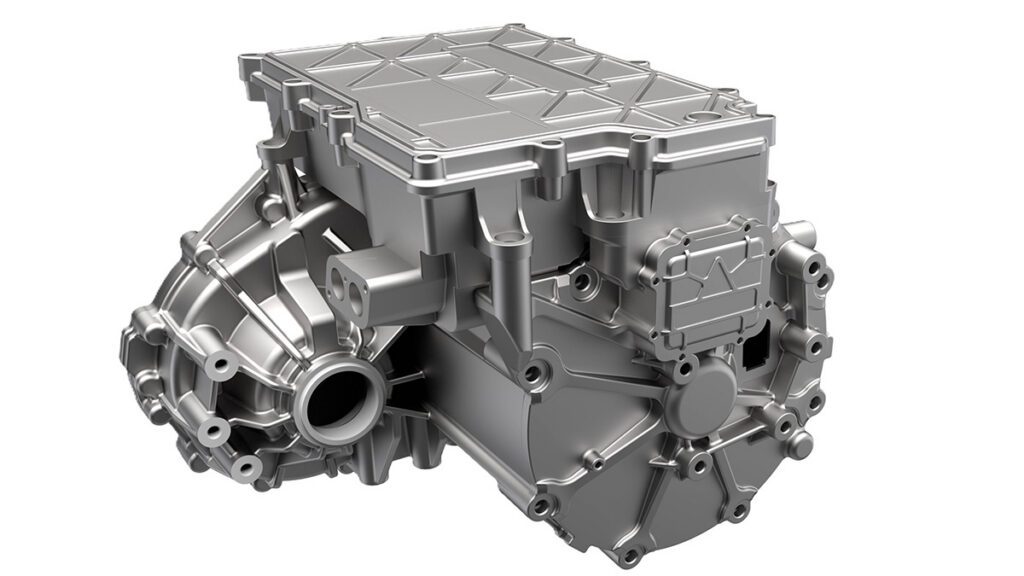

Charged: In May, Cummins debuted a new battery pack line-up for commercial vehicles. What can you tell us about those products?

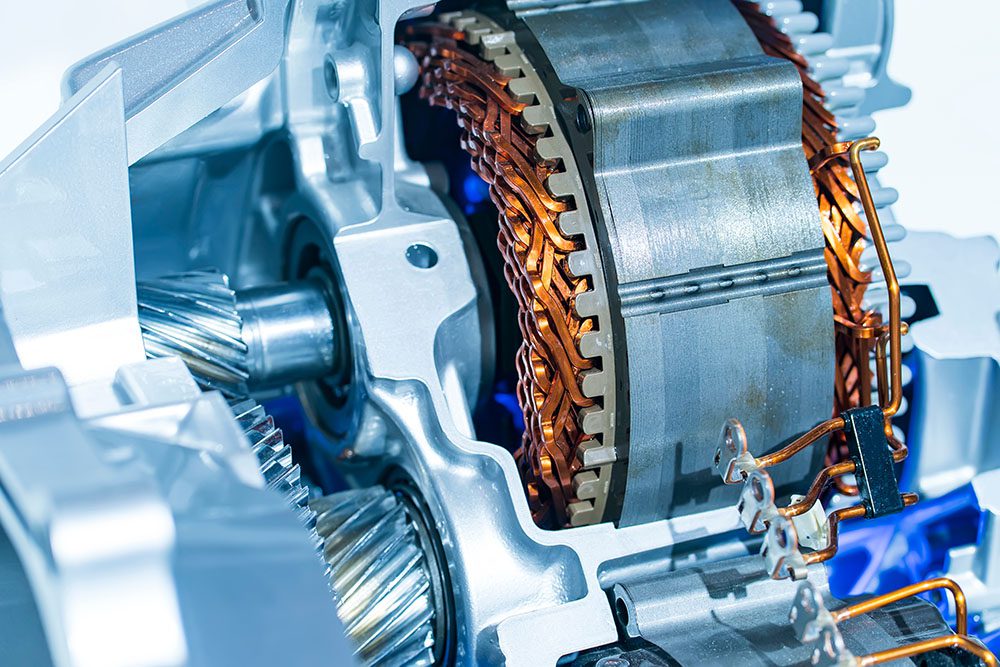

Vinoo Thomas: We call that the Energy Series of our battery packs for commercial vehicles. The product range includes the lower-voltage (24 V, 36 V, etc.) modules designed to power material handling applications, up to the higher-voltage (650 V) 74 kWh packs designed for urban buses and trucks. These are Cummins-designed and -built Li-ion batteries using a proprietary control technology. We’re approaching it like Lego blocks of battery power that can be installed in various other applications – the modular design allows the system to be scaled.

These systems are meant for higher-energy drive cycles where you’re charging overnight and then utilizing the vehicle over the entire day. Typical applications for urban buses, for example, would probably have six of the larger packs that can get you about 200 miles of range depending on the drive cycle. This is more than sufficient for a lot of the drive cycles from an urban bus perspective globally. Other applications could be urban delivery trucks and a few off-road applications.

What we’re trying to do is create a very rationalized portfolio of platforms in energy storage that we can then quickly reconfigure, whether it’s by size or chemistry type, depending on what’s required for use in multiple types of mobile and stationary applications.

Charged: Last summer, you debuted a fully electric Class 7 demonstration Urban Hauler Tractor, dubbed AEOS. Cummins is not a vehicle builder, so why did you build a truck? What do you think about the current market for electric tractor-trailers?

Vinoo Thomas: Our goal with AEOS is to show our customers what is feasible. It’s an electric vehicle that has a 150- to 200-mile range depending on drive cycle. It’s built to be comparable to a typical Class 7 and 8 truck, with a 12-liter diesel engine and transmission. It demonstrates what the state of the art is.

In terms of the market for class 7 and higher, there are very specific sub-segments where electrified power makes sense. In North America, drayage [the transport of goods over short distances, for example within port facilities] is an important application. Also regional haul, in very specific instances where you’re traveling less than 150 miles. However, I would say the long-haul [market] isn’t going to be truly economical until the price of batteries comes down significantly.

Charged: You mentioned that you’re developing a PHEV system for urban buses that will launch in 2020. Do you think these heavy commercial applications will use PHEVs as a stepping stone to an all-electric future?

Vinoo Thomas: It’s interesting, because that’s based on segment, region and regulatory landscape. There are markets that are completely switching – and it’s full EV or nothing. Many urban bus and drayage markets are trending this way, I think because of economics and sociability concerns (the emissions in highly populated areas).

PHEVs are also starting to look more interesting to some markets, especially hybrids that offer multiple drive modes such as parallel, series and combined modes which can be switched depending on the drive cycle. If you have a delivery vehicle without a predictable route, for example, all-electric could diminish the productivity of that asset significantly. Most truck owners don’t want their asset to be inflexible, and only applied to a specific drive cycle.

The system we’re currently developing is optimized to trade off between the two energy types – the diesel fuel, in this case, and the electrical energy. You can seamlessly switch back and forth depending on the drive cycle and the requirements of that particular end user. It’s ideal for cities and other areas which are starting to be regulated as diesel-free. It also then gives you the flexibility to not be that dependent on charging infrastructure.

Charged: Cummins recently announced the acquisition of three EV technology companies: Brammo, Johnson Matthey Battery Systems and Efficient Drivetrains. Can you walk us through the decisions to acquire each of those companies?

Vinoo Thomas: Our established strategy is that energy storage is a critical capability, and we want to fully own the expertise in-house. We’re not just system integrators; we have to develop deep sustainable competencies in subsystems. Energy storage is an important subsystem. Once that was determined, we then went about looking at opportunities for us that were economical and also provided us good sources into some key anchor customers.

Brammo was first because of its technical capability and good IP, but also access to key markets. Material handling was an important early market that we wanted to enter, because we previously did not participate in Class 1 to 3 material handling. That was the reason for acquiring Brammo.

Cummins and Johnson Matthey had a long-standing relationship, so we understood the culture and the capabilities quite extensively. It was a natural fit to acquire the Johnson Matthey Battery Systems division, mainly because of their deep electrochemistry knowledge.

If you look at our after-treatment business – technology that reduces NOx and particulate matter in engine emissions – you’ll see a good parallel. We don’t just invest in actually building an assembly of the after-treatment, but also significant capabilities in the chemistry part of that business. It’s important to have deep R&D in coatings, after-treatment catalysts, etc. We believe the same is true for energy storage. Having that capability fully owned in-house was an important aspect.

Also, the systems IP of Johnson Matthey was a good complement to Brammo. Brammo was very much focused on the smaller pieces of equipment, less than 60 V type of packs. Johnson Matthey was focused on 300 V and above. Together, both these acquisitions provided us with a full range, both from a mobile and stationary aspect for battery systems, along with the electrochemistry. It basically created a well-rounded battery division for us very quickly, within six months.

Then, as we look towards the future, particularly for commercial vehicles in the US, Europe and China, we see a significant regulatory trend. And we think heavy-duty hybrid technologies will meet some of those emissions and fuel economy regulations in the future.

We think that Efficient Drivetrains offers significant IP that’s quite differentiated in the marketplace that can take our hybrid capabilities a step above the rest. The company also offers us significant commercial inroads, because they already have established products in an important sub-segment for Cummins, which is the school bus market. With both these commercial and technical leads, Efficient Drivetrains is a really good acquisition for Cummins.

Charged: It appears Cummins is making aggressive moves to become an electrification leader. Internally, do you see EV tech as a potential disruptor to your core traditional businesses?

Vinoo Thomas: It’s fair to say Cummins’s position is that electrification is really important, and we’re embracing it not as a disruption, but as an opportunity. At the end of the day as a power company, we’re agnostic to what type of fuel is used to create that power. It could be liquid fuel, whether it be compression ignition or spark ignition, all-electric, or a blend of two, like hybrids.

For us, it’s important to showcase that we are a portfolio provider. Not all fleets will quickly require all these technologies in all their different depots or locations. It’s not a light-switch event. It will take time. The long-term strategy is to have a full portfolio which is then distributed and serviced by the same channel, the troubleshooting is done with the same tools, the updates are done with the same telematics solutions. Those things are very important from the perspective of running a business.

The people using our products are experts at other things – like moving freight, for example. They’re not experts in powertrains, nor do they want to be. So, having a portfolio for them, irrespective of a regulatory and market landscape, is our primary goal. Hopefully, we can do that by having the portfolio ready when the technology and the market demand it.

This article originally appeared in Charged Issue 39 – September/October 2018 – Subscribe now.