Electric vehicles (EVs) have their partisans and detractors. Supporters see the be-all and end-all transportation solution, while opponents argue the technology is too young. Somewhere between the two extremes lies the truth: today’s commercially available EVs have strengths and weaknesses compared to internal combustion engine (ICEs). The strong points include lower operating costs and lack of tailpipe emissions. Drawbacks include higher initial cost, bulky batteries and limited range.

This means that EVs are well suited to certain transportation tasks and (at the moment) unsuitable for others. A company that can find and fill a niche in which EVs’ strengths are important, and their limitations irrelevant, should be able to build a good business in the near term, and be poised for even greater growth in the future, as EV technology improves.

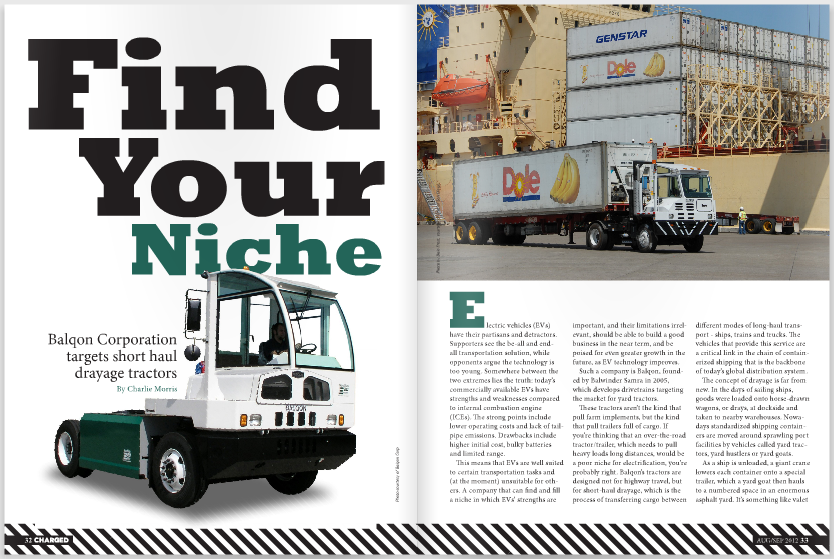

Such a company is Balqon, founded by Balwinder Samra in 2005, which develops drivetrains targeting the market for yard tractors.

These tractors aren’t the kind that pull farm implements, but the kind that pull trailers full of cargo. If you’re thinking that an over-the-road tractor/trailer, which needs to pull heavy loads long distances, would be a poor niche for electrification, you’re probably right. Balqon’s tractors are designed not for highway travel, but for short-haul drayage, which is the process of transferring cargo between different modes of long-haul transport – ships, trains and trucks. The vehicles that provide this service are a critical link in the chain of containerized shipping that is the backbone of today’s global distribution system.

The concept of drayage is far from new. In the days of sailing ships, goods were loaded onto horse-drawn wagons, or drays, at dockside and taken to nearby warehouses. Nowadays standardized shipping containers are moved around sprawling port facilities by vehicles called yard tractors, yard hustlers or yard goats.

As a ship is unloaded, a giant crane lowers each container onto a special trailer, which a yard goat then hauls to a numbered space in an enormous asphalt yard. It’s something like valet parking for containers, except that no restaurant parking lot could ever be this big or this busy. A large container ship carries as many as 4,000 containers, which need to be unloaded at the rate of one container every two minutes, with loading and unloading often taking place at the same time. A modern port facility employs a huge number of yard goats, and they are in more or less constant motion.

All these trucks rushing around may seem chaotic. Wouldn’t it be more efficient to have the crane load containers directly onto a train? Efficient it might be, but in practice, this seldom happens, both for reasons of practicality (a train would need to advance one car length as each container is loaded), and flexibility (not all the containers on the ship are going to the same place, or even in the same direction). Containers are aggregated into huge lots only for their long-haul trip across the ocean. Once they reach a port, they will disperse to thousands of individual destinations, some traveling by rail, some by truck, and some by other ships. The only feasible way to handle the traffic is to transfer them from a ship to a short-term holding area, where they wait to be picked up by a shipper for the next leg of their journey.

In this application, the limitations of EVs aren’t problems. Each trip from ship to holding area is a few hundred feet at most, so yard goats don’t need to have a long range. They operate only within a port facility, so a charger is never far away. A typical goat works two 10-hour shifts each day, so it can top up its charge on lunch breaks, and get in a four-hour charging session after each work day.

So, an electric tractor using current technology is perfectly capable of doing this job. But what really seals the deal is the fact that ICE-powered yard goats cause a serious problem that EVs do not have – a stinking, smoky, black problem. To illustrate the point, consider the USA’s largest and second-largest container ports, the Port of Los Angeles and its neighbor, the Port of Long Beach.

The Port of LA processes almost eight million containers each year, which requires the goaty services of 16,000 diesel trucks. These trucks use industrial engines, which aren’t subject to the same emissions regulations as the tame automotive diesel engine that powers your VW Golf. The pollution they generate is a serious problem, both locally and regionally. The drivers spend a lot of time idling, and getting in and out of the trucks to deal with paperwork, which means they are exposed to lots of acrid engine fumes. The twin Ports are a major source of air pollution – by some estimates, they are responsible for 40% of Southern California’s air quality problems. There’s a plan in the works to double the capacity of the nearby rail yard, which would mean some 32,000 trucks fouling the fair air of the Golden State.

The Port has been working on this issue for some time, and has received grants from the DOE and other agencies to reduce pollution. Since 2009, it has been experimenting with several types of advanced powertrains that promise to reduce emissions. It is currently conducting trials with both CNG and hydrogen/electric hybrid trucks. However, while these somewhat less-polluting hydrocarbons have their champions, only a battery-powered electric vehicle can deliver zero local emissions using existing infrastructure and technology that’s feasible today.

In LA (and at many large ports), not all of the rail freight can be handled within the port facility. Around 70-80 percent of goods go to a rail yard located a couple of miles from the docks, and residential neighborhoods lie between the two. Local residents would surely be happy to hear that the big rigs that roar through almost 24 hours a day were converted to EVs. At the rail yard, the transfer process is repeated. Containers are delivered to a holding area, where they wait to be loaded onto a train bound for Phoenix, Portland or Peoria, and then transferred to trucks again for the last leg of their journey to Main Street USA.

The Port of LA uses two different types of drays: yard tractors within the port facility and on-road trucks for the trip to the rail yard. On average, drivers of the on-road trucks make only five five-mile round trips per day, because of paperwork and other delays, so these trucks need only have a 25-mile range – an easy niche for EVs to fill. When not on the highway, they may spend as much as 65% of their time idling, waiting for a container or for paperwork.

Balqon’s XE-20 yard tractor can tow loads up to 30 tons with a maximum speed of 25 mph. It features a four-speed Allison automatic transmission and a 215 kWh lithium-iron-phosphate battery pack (for comparison, a Nissan LEAF has a 24 kWh pack) that can be fully charged in 6.5 hours, or 2.5 hours with the optional Level 3 charger. It comes equipped with all the usual air and electric connections and other gadgetry, including a heated and air conditioned operator cabin. The XE-20 is currently being used not only at the Port of LA, but also at a couple of military bases and steel mills, and at Ford Motor Company, which uses it for back-end logistics.

The XE-30 on-road dray also has a 30-ton capacity, but it has a five-speed transmission, a slightly larger battery, and a top speed of 45 mph. In addition to assembling the vehicles, Balqon makes the inverters, power electronics, chargers and battery management systems. The batteries come from Balqon’s partner SOL.

With diesel at $4 a gallon, Balqon’s yard tractor offers savings of around $100-150 per month compared to the cost of leasing and operating a diesel tractor. Even so, it’s a tough sale if a buyer has to come up with the purchase price of $194,000, almost double that of an old-fashioned diesel tractor. However, now that its products have some history – over 20,000 hours in the field to date – Balqon has got a large bank to offer three- and five-year leases on its products, which means customers can start saving money from day one. As Mr Samra found, “in today’s economy, people aren’t investing for the long term. If there’s a benefit they want to see it right now. And that’s what this leasing model does for them.”

Yard tractors aren’t Balqon’s only products. It also makes the M150 inner-city delivery truck, which can haul four tons, and has a maximum speed of 70 mph and a range of 90 miles loaded. Balqon also exports drive systems to bus and truck manufacturers in Europe and Asia – in fact, 84% of the company’s current revenue comes from exports. Diesel prices are higher in these markets, so it’s easier to justify using EVs in many commercial applications on an economic basis alone. However, the pollution angle is more and more attractive to buyers in Asia, where cities are growing so fast that there’s a pressing need for mass transit, but local planners find that it’s no longer politically acceptable to put nasty diesel buses into service.

Mr Samra is always mindful of the particular requirements of an individual market, and targets only those niches in which EVs’ strengths can provide value (and where their drawbacks aren’t a problem). For example, the company has found that garbage trucks aren’t a good niche, because heavy, bulky batteries would limit a truck’s payload, which isn’t acceptable to trash haulers. On the other hand, he sees opportunity in class 7 and 8 heavy tractors. Of the 760,000 on US roads, 240,000 are used on short-haul routes – not exactly a small niche.

Like any EV expert, Mr Samra has a lot to say about batteries and industrial energy storage – a natural complement to electric mobility.

Industrial energy storage

Balqon is exploring the industrial energy storage market, where the name of the game is replacing lead-acid batteries with newer lithium-ion technology. The latter offers about double the lifespan, almost no maintenance, and better transfer efficiency. So why is anyone still buying lead-acid batteries? You guessed it – up-front costs are still lower, at least for smaller classes of batteries. For high-capacity batteries (700-1,000 amp hours), however, Li-ion has reached price parity, and Balqon has identified several promising niches, including forklifts, solar storage and airport ground support equipment.

The fastest growing segment of all is in the telecom industry, providing backup batteries for cellular towers. In the wake of Katrina, the US began requiring cell phone towers to have generators. In practice, many of these towers run continuously off a diesel generator that is sized for peak load, which might be 20 kilowatts. However, at off-peak times, the load might be only one or two kW, which means a huge waste of fuel. With Balqon’s 24 kW system, the generator needs to run only about three hours a day to charge the battery, saving money not only in fuel costs but also in maintenance (by the time diesel is brought to some of these remote sites, it has an effective price of $8 a gallon).

In developing countries, the main worry isn’t natural disasters, but simply the unreliable power grid, which may go down a couple times per day, taking cell phone service with it. Phone providers that have Balqon-supplied backup storage at their towers can advertise 24/7 service. The company is doing good business in South Africa, Nigeria, India and Bangladesh.

Lithium’s potential

What really gets Mr Samra to wax poetic are the advances in battery technology that are now making their way from the laboratory to the factory floor. He put the situation in a context that commercial vehicle operators can relate to. Batteries add weight to vehicles, because they aren’t as energy-dense as diesel fuel. Better batteries will make it possible to increase payloads.

He laid out some figures that quantify the exciting potential of Li-ion batteries. Diesel has an energy density of around 14,000 Wh/kg, while lithium has the theoretical potential to offer 11,680 Wh/kg, if you could fully oxidize a lithium ion – and folks are certainly trying. However, Mr Samra calculates that a typical diesel engine has a “battery-to-wheel efficiency” of only 12.6 percent, while the potential figure for a Li-ion-powered EV is 90 percent.

Even taking the higher efficiency into account, current Li-ion technologies can’t come anywhere near the energy density of diesel, but a lithium-air battery could get very close. So, “lithium-air gets us there,” as Mr S eloquently puts it. He believes that the technology is two to three years away from commercialization (an optimistic projection compared to many estimates that put viable Li-air batteries a decade or two away).

During that time, Balqon plans to perfect its products and build relationships with suppliers and customers, hoping to be the first on the scene with vehicles ready to sell when things really start to take off. “We’re about three years from reaching almost five times the range we have today – that’s what keeps us motivated. We can see the light at the end of the tunnel.”

This article originally appeared in Charged Issue 4 – AUG/SEP 2012