Though it may have a stinky reputation, sulfur could set EVs on the path to total ICE replacement if energy-dense, low-weight lithium-sulfur batteries become the norm. British-based OXIS Energy is banking its business on it.

If American clean energy industries are to take full advantage of the emerging lithium-sulfur (Li-S) battery chemistry, they just may have to welcome another British invasion. This February, Huw Hampson Jones, CEO of Oxfordshire, England’s OXIS Energy, landed in Washington, DC to meet with lithium suppliers, separator manufacturers, and US government agencies to explore new possibilities for its Li-S battery technology.

OXIS has begun commercialization of its Li-S batteries, which it claims have the longest cycle life of any known batteries of their kind, at 300-500 cycles. Meanwhile, Sion Power of Tuscon, Arizona, in an Electrochemical Society presentation, listed the cycle life of its Li-S batteries as one its biggest challenges, and estimated its cycle life at 60-80 cycles. Berkeley, California’s Polyplus, which Charged featured in its Aug/Sept 2012 issue, also has a promising Li-S technology, but has not announced anything greater than the 40+ recharge cycles that it described to us last year.

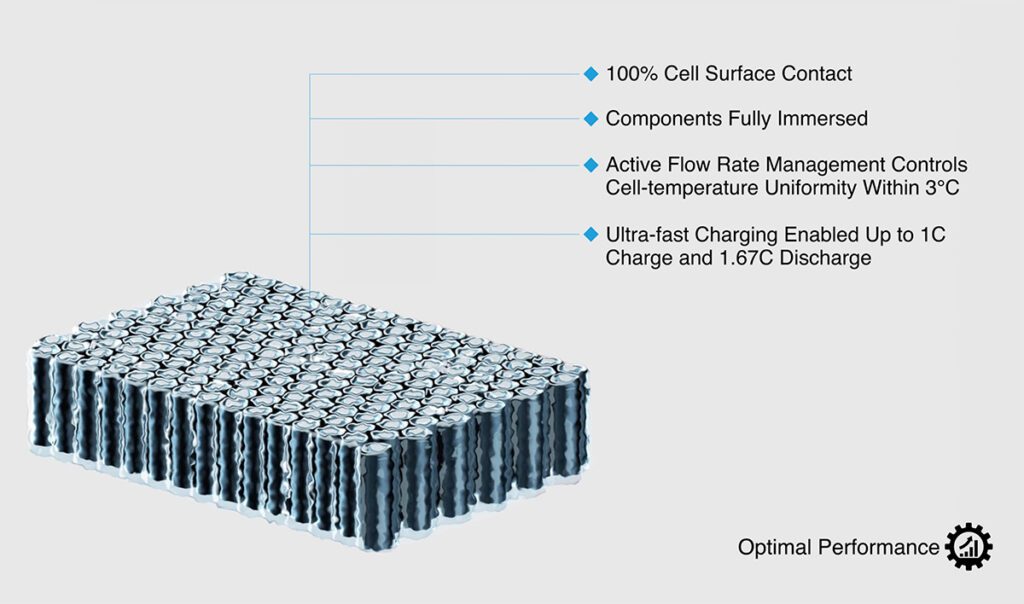

Regardless of the specific cycle life that a particular battery company has achieved, all Li-S cells share advantages over commonly used Li-ion battery chemistries, such as lower weight, the potential for lower cost and lower temperature performance, and a much higher theoretical energy density: a 2,500-2,750 Wh/kg theoretical limit, compared to 400-450 Wh/kg for Li-ion. In 2010, OXIS demonstrated 300 Wh/kg for its battery, with a target of 600 Wh/kg by 2016.

As for its proprietary achievements in Li-S technology, OXIS is hanging its bowler hat on two major breakthroughs: a sulfur passivation layer that prevents thermal runaway from taking place, and an organic electrolyte that increases the stable operating temperature of Li-S.

Sulfuric Performance

OXIS Energy began as a tiny company in 2004 out of a collaboration with the Russian Academy of Science in Ufa, Russia, more than 1,000 miles southeast of Moscow (you’ll notice many Russian names on the 14 PDF white papers and other publications available on the Technology page at OXISEnergy.com). From a staff of just eight people in 2009, OXIS has grown to 45 employees and has begun to aggressively form partnerships for commercializing Li-S batteries that take advantage of its breakthroughs.

“Lithium metal on its own is quite a volatile substance,” said Jones, “but we have perfected a way whereby sulfur acts as a fire retardant on the lithium granule such that when a short circuit, overcharging, or nail penetration takes place, the sulfur acts as a passivation layer, and prevents thermal runaway. That is how I have described it in laymen’s terms to the financiers and my shareholders. The technique provides the necessary safety.”

The second key challenge that Li-S cells present, according to Sion Power’s aforementioned presentation, is stability at high temperatures, and that’s where OXIS’ second fundamental breakthrough comes in. “We have perfected an organic electrolyte that is capable of operating at up to 140° C [284° F]” Jones continued. “The electrolyte is possibly an Achilles heel of lithium-ion, and there is a tendency for it to be volatile when there is a significant fluctuation in temperature. Now, the OXIS electrolyte can operate at 60, 80, 85 degrees [Celsius] without any material malfunctioning. And it’s an organic electrolyte, which is important, because together, the polymer lithium-sulfur cell technology from OXIS is capable of – at the end of lifecycle – being biodegradable.”

Even though OXIS can currently claim supremacy in Li-S cycle life, their current status, 300-500 cycles (a consistent 500 is the target for July 2013), is still a far cry from the needs of electric cars.

“I can address certain markets with ease,” Jones said. “Not the car industry yet, but markets such as defense, solar power, and light electric vehicles are quite happy with our getting up to 500 cycles today. The automotive sector ultimately is looking for 5,000 cycles. That approximately equates with 13 years, which is the average lifespan of a car by the time it’s sold and resold, etc. Some car manufacturers use lithium-titanate, and Tesla of course uses lithium-cobalt; they would at least want somewhere in the region of 2,000-plus. We can’t achieve that yet, but there are techniques, one of which is being patented as we speak, whereby we think that within the next two years we can hit 1,000 cycles. And even if I begin discussions today with Volkswagen or BMW, it’s going to be another five years before my technology is in their car. That’s why I’m going after markets where I can make an immediate impact today/tomorrow/next year.”

That patent is one of 30 that are currently pending for OXIS, on top of 37 granted patents already in the company’s portfolio. Dr David A. Ainsworth, OXIS’s Chief Technical Officer, added that cycle life is one of the company’s greatest challenges.

“We want to stabilize the metallic lithium electrode so it’s less reactive over the cycle life of a cell,” Ainsworth said. “One of the biggest problems is that the lithium starts to react after many hundreds of cycles, which causes premature cell failure. We are looking at more stable electrolyte solutions – different solvents and additives that may offer us improvements. And we’re looking at tailoring the structure of the cathode as well. We have our own proprietary electrolyte formulation that offers significant advantages: It is stable, should be cheap to produce, and has a high flashpoint to add extra safety to the cell.”

Another plus for OXIS is that its cells have a 100 percent available depth of discharge. “I’m not saying you’d want to do that all the time,” Jones said, “because by definition, it may have an effect. We’re still doing a lot of testing. It’s only in the last 18 months to 2 years that we’ve had sufficient capital to invest heavily in the test center.”

Engineering Notes: Lithium-sulfur Technology

Lithium-sulfur vs lithium-ion

Lithium-sulfur batteries utilize a metallic lithium anode and a cathode containing sulfur. What’s unique about Li-S technology is that all the electrochemistry happens in the solution state. Upon discharge of the cell, sulfur dissolves from the cathode into the electrolyte solution, forming polysulfides – longer chain polysulfides to begin with, which are then reduced further to shorter chain polysulfides, and eventually lithium sulfide (Li2S) itself. This differs from a lithium-ion system, in which the electrochemistry happens in the solid state – via intercalation reactions in the two electrode materials.

Energy density

Lithium-sulfur batteries boast five times more theoretical capacity than lithium-ion, thanks in part to the sulfur-containing cathode, with a capacity of 1,672 mAh/g.

The discharge process for a lithium-sulfur battery has a series of electrochemical reactions that occur: sulfur to Li2S8, Li2S4 to Li2S2, and so on. Each of these reactions yields electrons, giving sulfur a high theoretical capacity. With lithium-ion, there is only a single discharge reaction.

Safety

Another highly touted benefit of lithium-sulfur is safety. One of the things that lead lithium-ion batteries to become unstable and susceptible to thermal runaway is the fact that as the cell ages, dendrites can form on the surfaces of the electrodes, which puncture the separator, causing the cell to short-circuit. Then thermal runaway occurs, because the electrolyte has quite a low flashpoint; it catches fire, and the cell explodes.

In a lithium-sulfur system, there are a few aspects that help to improve the safety. First, it uses a non-flammable electrolyte. If the cell does heat up, it’s not going to catch fire at as low a temperature.

The second aspect has more to do with the actual chemistry itself. Instead of the insertion of lithium ions in the graphite electrode, as is the case with lithium-ion, it forms lithium sulfide on the surface of the lithium electrode. Upon subsequent charge and discharge cycles, it is removed and then replaced. In this process any dendritic lithium is re-dissolved. So, in addition to a safer electrolyte, there is less risk of dendrites forming on the negative electrode.

The Right Battery For Some of the Jobs

Despite a cycle life that falls well short of automotive Li-ion at this point, the OXIS Li-S batteries will begin to trickle into light electric vehicles as early as this year, as part of a clear long-term trajectory to penetrate the automotive industry. For 2013, OXIS is developing polymer Li-S batteries for Wisper electric bicycles in Europe, and for the Modulgo electric mini-car from French EV maker Induct. By 2014, OXIS also plans to power the Induct Cybergo, a driverless 8-passenger robotic shuttle, the QWIC Wesp electric scooter in Europe, and the control systems for Engbo’s electric marine propulsion system.

Even more immediately relevant, OXIS batteries are receiving interest from certain other markets that are extremely sensitive to safety concerns and weight. Jones told us that the batteries weigh 50 percent less than Li-ion, and that 80 percent may be achievable, a characteristic that has attracted the British military to the batteries, for use in mobile radio systems.

“The lightness is of considerable benefit to the dismounted soldier, i.e. a soldier that’s outside of a tank or vehicle,” Jones explained. “If he’s carrying 3 or 4 kilos worth of battery packs, and you can reduce that by 50 percent or more, the lightening of the burden is quite considerable.”

Jones also thinks that the OXIS batteries compare very favorably to Li-ion in terms of safety. He pointed to a test where on behalf of the British Ministry of Defense, in which the battery survived a bullet penetration without explosion or thermal runaway.

In the area of solar power, OXIS is collaborating with a UK solar photovoltaic (PV) cell manufacturer to provide energy storage for its PV systems. In that arena, Jones said that the lower weight of the Li-S batteries could also be a positive factor.

“If you target residential homes or public sector bodies,” Jones said, “then weight does matter, because the ability to fit a solar battery system into an apartment or house makes it attractive, visually, as well as storage-wise. But the key factor is safety again. If you were to put a lithium-ion battery into a garage or inside a house under the stairs, for example, the danger is the safety element as the temperature fluctuates. It could fluctuate quite violently. But if you have a system that can operate at up to 60-80° C [140-176° F], then the problem goes away.”

Perhaps sensing an opportunity stemming from Boeing’s recent 787 Dreamliner battery woes, Jones dipped his toes into the waters of the aviation sector while on his Washington trip in February. “The aviation sector has a real problem with safety and reduction of weight, in order to accommodate the newer airframes,” Jones said. “It’s going to take quite a number of years, but there is a real, genuine desire to find a resolution to that quite quickly, and it’s something that possibly we could tap into.” OXIS hasn’t yet made any announcement related to the aviation sector, but the company has been active lately in establishing partnerships for ramping up presence in the rechargeable battery market.

Sometime between these more immediate plans and automotive batteries on a more distant horizon, OXIS could tackle the consumer electronics space with small-form rechargeable Li-S batteries.

Tipping the Scale

As potentially biodegradable rechargeable batteries, the OXIS product definitely qualifies as green. But for battery start-ups like OXIS, to be green, takes green: cash, and plenty of it. In the fall of 2012, Sasol New Energy, a massive international integrated energy and petrochemicals company, infused OXIS’s coffers with a 15-million-pound (about US$23 million) investment. The Managing Director of Sasol New Energy, Henri Loubser, mentioned that the financing would include help from Sasol in commercializing and scaling up its chemical processes for its Li-S batteries.

With that chunk of change jingling in its pockets, OXIS seemed to get very busy establishing a blitz of new partnerships with ramifications for its automotive EV aspirations. It announced three new business relationships in January alone. These include a Joint Development Agreement for several years with Arkema, a global chemicals producer, to give OXIS access to specialty materials like carbon nanotubes and advanced polymers, with the aim of optimizing the conductivity of the electrolyte, which could improve energy density, and reinforcing some components to extend the lifetime and safety of the battery.

A second Joint Development Agreement links OXIS with Germany-based Bayer Material Science AG for two years, for developing new battery materials aimed at increasing the safety and mileage of electric vehicles.

Finally, and most significantly, in late January OXIS announced a joint manufacturing agreement with GP Batteries of Singapore for scaling up the OXIS Li-S battery systems.

“We will remain a technological team, granting the rights to use our technology for mass production purposes,” Jones said. “It’s not an exclusive agreement with GP; we are seeking to collaborate with other battery manufacturers as well.”

Jones also stated that through discussions with GP, they think that up to 70 percent of the current Li-ion manufacturing processes can be reused for the OXIS Li-S batteries. “That’s a fairly broad figure,” Jones said. “I’m fairly confident that within four to five months, we’ll have a more accurate figure based on having exercised the program with a real, world-class battery manufacturer.”

Ainsworth added that “part of extension of the cycle life also relates to how we build the cells and the quality of the manufacturing processes.”

The GP partnership will no doubt speed up the commercializing of OXIS’s Li-S batteries, which will in time help to bring the price down. While Jones was not specific about the relative per-unit cost of Li-S compared to current Li-ion, the relative inexpensiveness of sulfur could give OXIS an advantage. At the time of this writing, cobalt cost $25,000-26,000 per ton; nickel cost $17,000-18,000 per ton; and sulfur cost $200-300 per ton for a large bulk order.

That’s only one factor related to battery pricing, of course, but it bodes well for Li-S as the technology matures. As OXIS makes its steady climb toward automotive-grade Li-S battery packs, Jones thinks the price will be competitive, but that the other advantages to Li-S – energy density and safety – will eventually sell themselves.

“We do the prototyping of the cells here before we hand over to GP for mass production,” Jones said. “We’ve been discussing with them the price point required for particular markets, and we are fairly confident that there are going to be significant gains. The sheer volume that is expected over the next 5-10 years will be a factor in bringing the price down. But I don’t want to give the impression that I’m going to be the cheapest. I don’t want to be the cheapest in the marketplace. What I want to be is the best in terms of gravimetric energy, lightness of weight, reliability and safety.”