Let’s all shed a crocodile tear or two for the poor Tesla short-sellers. Their faces (and their balance sheets) turned an even deeper shade of red this week, as TSLA shares powered through the $200 mark without tapping the brakes, on the way to $260 and beyond. A series of positive news items has driven the rise: a healthy quarterly financial statement, promising market conditions in China, and yet another rave review from Consumer Reports, which named the Model S its top pick for 2014.

However, what really kicked the stock into overdrive was a report from Morgan Stanley analyst Adam Jonas, which envisions a “utopian society” by 2026, in which Tesla dominates both the battery and autonomous vehicle markets, and boasts revenues sixty times those of today. Morgan Stanley has doubled its target price for TSLA, from $153 to $320.

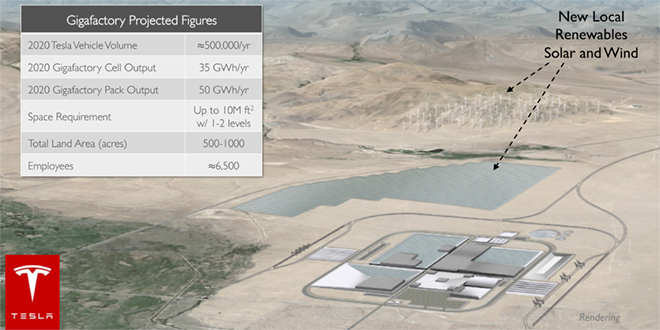

Underpinning these bold predictions is the growing conviction that Tesla’s battery Gigafactory, which Elon Musk started talking about last fall, is going to become a reality. As promised, the company has now released some details of the unprecedented facility, which it will need in order to meet its goal of producing 500,000 EVs in 2020 – a goal that will require more battery cells than 2013’s total global production.

The details of the plant, which the company released in a six-page presentation, are still pretty sketchy. The facility, which will be built somewhere in the Southwest, and will be powered partly by huge wind and solar installations, will encompass every step of battery cell and pack fabrication, from the manufacture of electrodes, separators and electrolyte to the assembly of new packs, and recycling of old ones.

Construction is to begin this year, and production is expected to begin in 2017. By 2020, cell output will be 35 gigawatt-hours (GWh) per year, and pack output will 50 GWh per year. Tesla expects the new plant to help it reduce its battery pack cost by over 30%.

What probably impressed the Wall Street boys more than all the pretty pictures and graphs is the fact that Tesla seems to have the enormous financial requirements for the new plant under control. As expected, the company has announced a new public offering to raise more capital: $1.6 billion of convertible senior notes. The company has also been talking to partners about collaborating on the Gigafactory – Panasonic and some of its suppliers have already signed on for a billion or so. According to this week’s presentation, Tesla plans to invest about $2 billion, with another $2-3 billion coming from partners.

Sources: Tesla, AutoBlog Green, Green Car Reports, Yahoo! Finance