A new study from the Energy Institute at Haas, University of California, Berkeley, has reached an unsurprising conclusion: the benefits of federal tax credits tend to go mostly to higher-income households.

Researchers Severin Borenstein and Lucas Davis found that 60% of the $18 billion in US federal clean energy tax credits issued between 2006 and 2012 went to the top income quintile (above $200,000 per year). Only about 10% went to taxpayers earning less than $75,000 per year.

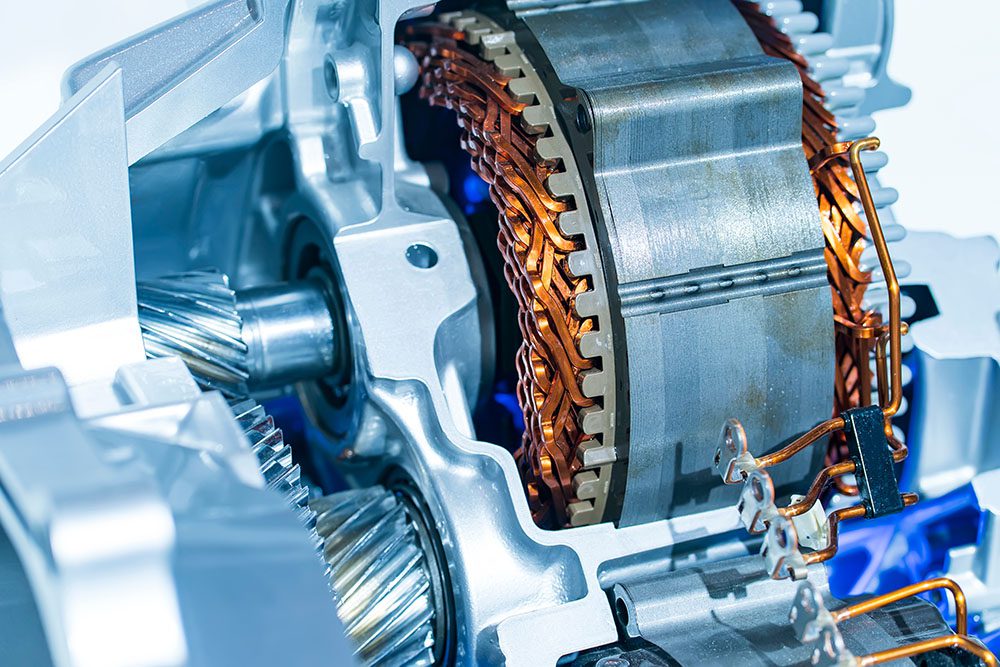

Green-vehicle tax credits are the most egregious example of all: 90% of these credits went to the top income quintile.

“The PEDVC is much more concentrated than the other categories of credits,” write Borenstein and Davis. “The bottom 80% of filers receive a little more than 10% of all credits, and the bottom 90% of filers receive only about 40% of all credits. It may simply be that electric vehicles, for the moment, are only affordable for relatively rich households. Even after the credit, electric and plug-in electric drive vehicles are expensive compared to equivalently-sized gasoline-powered vehicles.”

Together, the Alternative Motor Vehicle Credit (AMVC), which rewards purchases of hybrids and alternative fuel vehicles, and the Qualified Plug-in Electric Drive Motor Vehicle Credit (PEDVC), aimed at EVs and PHEVs, totalled $895 million, or 5% of the total clean energy tax credits awarded during this period.

As others have, the authors note that a carbon tax would be a far more progressive way to promote clean energy, as more of the burden would fall on high-income households – about four times as much as the bottom quintile, according to their calculations.

“It can often be easier politically to introduce subsidies than taxes, but the two are not equivalent,” write Borenstein and Davis. “It would seem difficult, therefore, to prefer tax credits over a carbon tax on distributional grounds. There may well be political considerations that continue to favor tax credits, but this approach comes at real cost, both in terms of efficiency and equity.”

Source: Energy Institute at Haas via Green Car Congress