For those of us who are puzzled and discouraged by the recent decline in sales of hybrid vehicles, a new paper from the International Council on Clean Transportation (ICCT) offers plenty of hope for the future. According to “Hybrid Vehicles: Technology Development and Cost Reduction,” the costs of full-function hybrid systems are likely to drop to half that of 2010 systems by 2025.

The 45 hybrid models sold in the US in 2014 collectively captured about 2.75% of the total passenger vehicle market, down from 3.19% in 2013. The main reason hybrids aren’t more popular is not hard to guess: most buyers don’t perceive the fuel savings to be enough to justify the higher purchase cost.

The consumer payback period varies widely from vehicle to vehicle. The ICCT study found that roughly 29% of current hybrid models pay back the initial price premium within 5 years, while 61% of models pay back within their useful life.

“Because most hybrid systems are at a relatively early stage of development, costs are still relatively high and manufacturers are looking to recover some of the costs by charging customers a premium,” writes study author John German.

Fortunately, there’s plenty of potential for cost reductions.

“Hybrids are far from a mature technology, and innovations and improvements are coming rapidly,” German continues. “Hybrid systems other than the input power-split design pioneered by Toyota 17 years ago are still in early stages of development, and present huge opportunities to reduce cost.”

Market leader Toyota (with 66% of US sales in 2014) and second-place Ford (with 14%) both use the same basic design: an input power-split system, which uses a planetary gear to distribute power among the engine, generator, traction motor, and drivetrain. This system excels at optimizing efficiency during city driving, and is easily adaptable to plug-in operation. However, the two large electric motors and associated power electronics are pricey.

At least six other automakers have introduced variants of a single-motor, twin-clutch hybrid system (P2). While the input power-split design is in its fourth generation, first-generation P2 hybrids are at a much earlier point on the learning curve, presenting the possibility for significant cost improvement. The market share of P2 hybrids grew from 9% in 2013 to 12% in 2014.

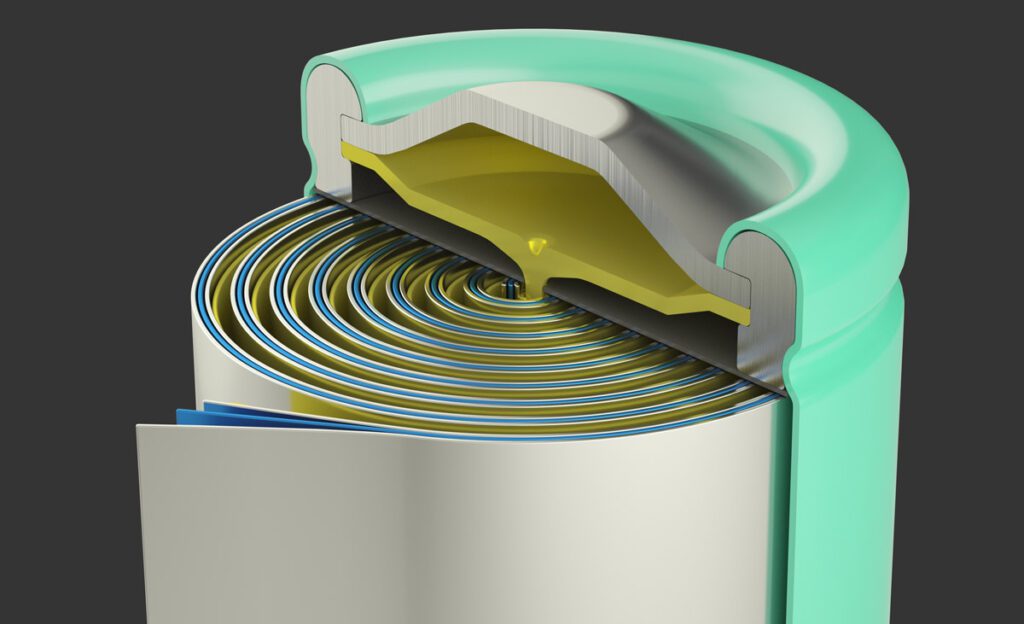

Other developing technology areas that offer the promise of cost reduction include batteries with higher power density, lower-cost 48 V hybrid systems, and the practice of integrating the motor and other hybrid components inside the transmission.

“New cell chemistries optimized for high power should reach the market as early as this year. Instead of 1.0 kWh, future Li-ion batteries for full-function hybrids should be only about 0.3 to 0.5 kWh,” German says. “These high-power batteries will cost more per kWh than current Li-ion designs, but the cost savings should still be at least $500.”

“Mild hybrid systems offer the greatest opportunity to improve hybrid cost-effectiveness,” German says. “Companies are still sorting out the relative advantages and costs of the many different possible configurations, such as voltage level (12 V – 48 V); energy storage (lead-acid, ultracapacitors, NiMH, Li-ion) and drive type (BAS or P2 configurations). An additional advantage of 48 V systems is that they can power an electric motor integrated within the turbocharger to reduce turbo lag and improve turbocharged engine efficiency and response.”

Source: Green Car Congress

Image: Abdullah AlBargan (CC BY-ND 2.0)