News travels by strange paths these days. The world first learned of a tentative deal for electric truck maker Workhorse to buy GM’s idled Lordstown, Ohio plant via a self-congratulatory tweet by the President of the US.

If the deal goes through, it could be a win-win-win-win: Workhorse might receive a windfall like the one Tesla got when it acquired the former NUMMI factory in Fremont for a song; at least some of the 1,600 GM workers who got laid off in Lordstown might get new jobs; GM would get some good PR for preserving jobs and encouraging EV adoption; and finally, EVs in general would get some good PR, demonstrating that they can be job creators, not job killers.

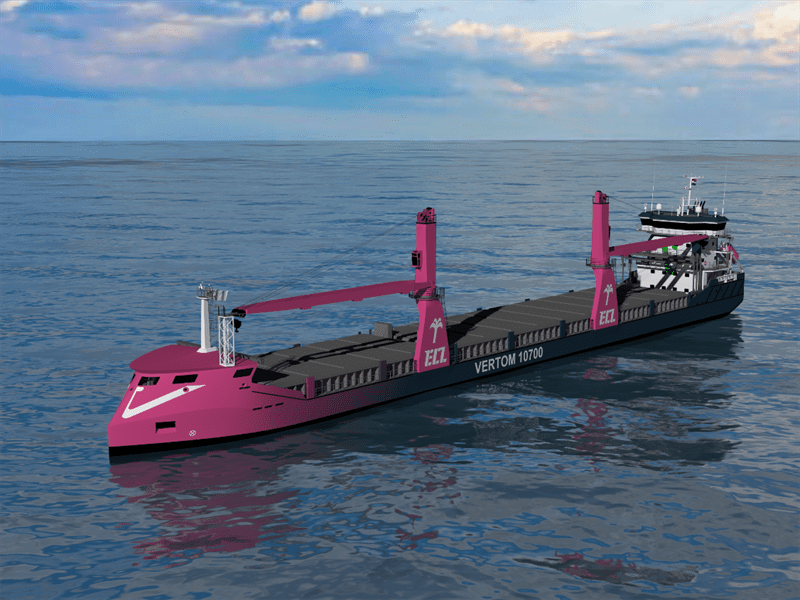

“The first vehicle we would plan to build if we were to purchase the Lordstown Complex would be a commercial electric pickup, blending Workhorse’s technology with Lordstown’s manufacturing expertise,” said Workhorse founder Steve Burns.

However, there are reasons why companies prefer to reveal news of this sort themselves, once everything is finalized. It turns out there are a number of issues that need to be worked out before electric trucks start rolling out of Lordstown.

GM and Ohio-based Workhorse have been in negotiations since the beginning of the year, but Workhorse representative Tom Colton told Jalopnik that the companies are in “roughly preliminary discussions.”

Workhorse will not be acquiring the GM plant directly – a complex arrangement would create a new entity – Workhorse would be a minority owner and Steve Burns would be the leader.

The fraught relationship between automakers and unions may come into play. The United Autoworkers Union naturally wants GM to keep the Lordstown plant open, but Steve Burns has said that Workhorse is willing to work with the UAW. The skilled labor force will be “one of our big competitive advantages,” he said. “Of course, we have to work with labor to work out the details, but we are excited to have them.”

There is one pesky little problem – Workhorse doesn’t have enough money to buy the plant, or at the moment, enough business to take full advantage of it. The company, which seemed to be a potential superstar at the time we featured it in our May/June 2017 issue, now has fewer than 100 employees, and although it does have high-profile customers including FedEx and UPS, it generated sales of only $763,000 in 2018. (The Cincinnati Enquirer sarcastically noted that this is a fraction of the yearly figure for a typical McDonald’s). Prior to the President’s blurt about the GM deal, Workhorse appeared to be on the verge of bankruptcy. “Our existing capital resources will be insufficient to fund our operations through the first half of 2019,” the company stated shortly before the news of the Lordstown deal.

However, Workhorse has a potentially valuable card in the hole – the US Postal Service is planning to replace its aging fleet of Grumman LLV delivery trucks, and a prototype that Workhorse built in partnership with commercial truck specialist VT Hackney is one of four vehicles (and the only electric vehicle) in the running. The USPS’s process of selecting a vehicle has already taken four years, but according to Trucks.com, a final decision is expected by this fall. The contract calls for 180,000 trucks to be delivered over several years, and the total value could be as much as $6.3 billion.

If Workhorse wins the contract, it’s expected to build the trucks at the Lordstown plant, but “we have a business with or without the post office to make these electric pickup trucks for these fleets,” Burns said.

Ohio politicians are cautiously optimistic about the deal. “It’s still too early to tell whether the sale is good news for workers,” said Ohio Senator Sherrod Brown.

“We have a lot of questions,” said Lordstown Mayor Arno Hill. “We’d like to find out how many people will be employed and the level of investment. We’re very optimistic that we could be on the leading edge of something here.”

Editor’s Note: This post has been updated to include Steve Burns’s more recent comments.

Sources: GM, New York Times, Cincinnati Enquirer, Jalopnik, CleanTechnica, Barron’s, Tribune Chronicle