As the popular narrative has it, GM, Ford et al are walking back on their electrification plans because EV sales have slowed. Seldom mentioned in the headlines is the fact that GM and others have very few EVs for sale at the moment, and have fallen way behind their putative schedules for releasing new models.

As John Voelcker reminds us in a recent InsideEVs article, back in 2020, GM announced plans to have half a dozen EVs based on its next-generation Ultium architecture on the market in 2024, including the Chevrolet Silverado EV, Blazer EV, and Equinox EV; the Cadillac Lyriq; and two variants of the GMC Hummer EV. In February 2022, GM said it expected to sell 400,000 EVs by the end of 2023. Its actual 2023 EV sales were more like 76,000, and most of these were the Bolt EV and EUV, which are now out of production. Only 13,838 Ultium EVs sold in 2023.

Despite the headlines that the media has been recycling for the last few months, the problem doesn’t seem to be on the demand side. Last year US EV sales set new records, both in unit numbers and market share, and brands such as Hyundai and Volvo declined to attend the pity party. Mr. Voelcker reports that GM hasn’t been able to build enough Ultium EVs to get the needed stocks to dealerships. Sales of the Chevy Blazer EV have been suspended for months, and other Ultium models are behind schedule.

For his detailed analysis of what went wrong, John Voelcker spoke with multiple EV battery experts, and tracked down quotes from GM execs that bear on the problems. His in-depth account is well worth reading in its entirety. Two major lessons stand out.

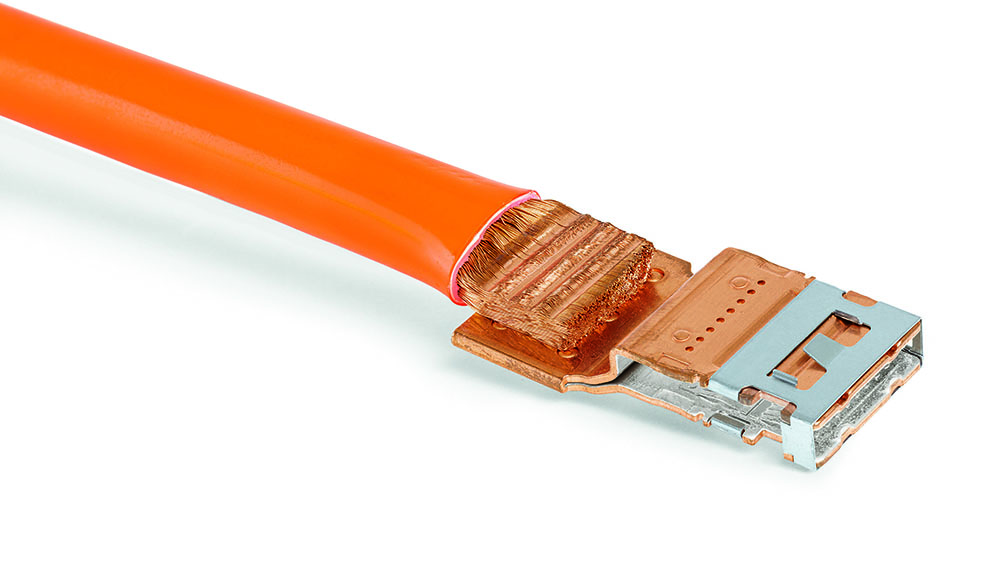

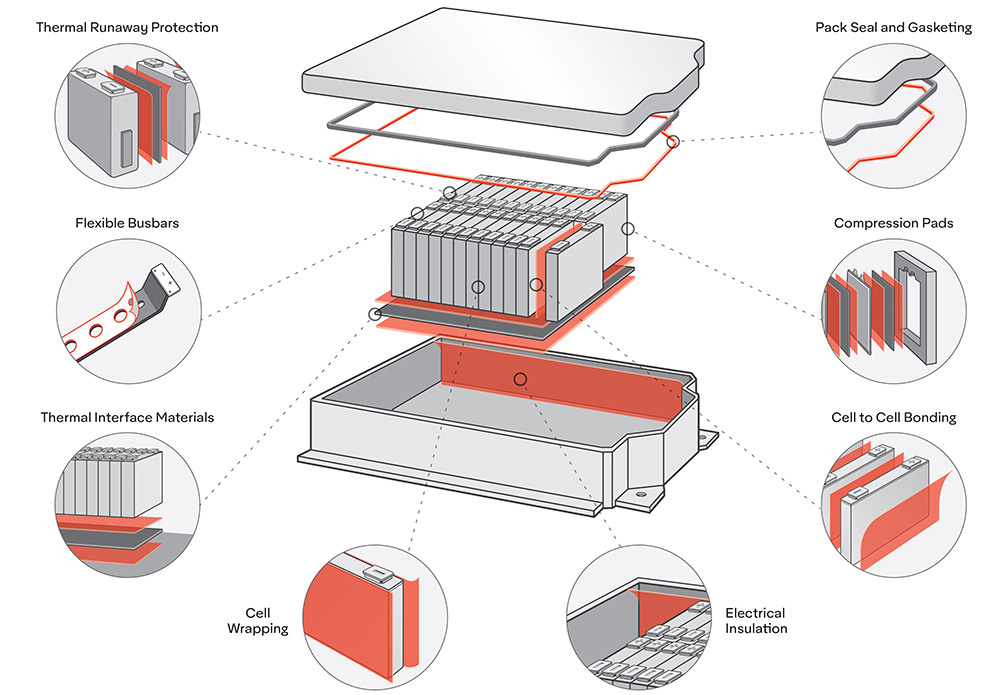

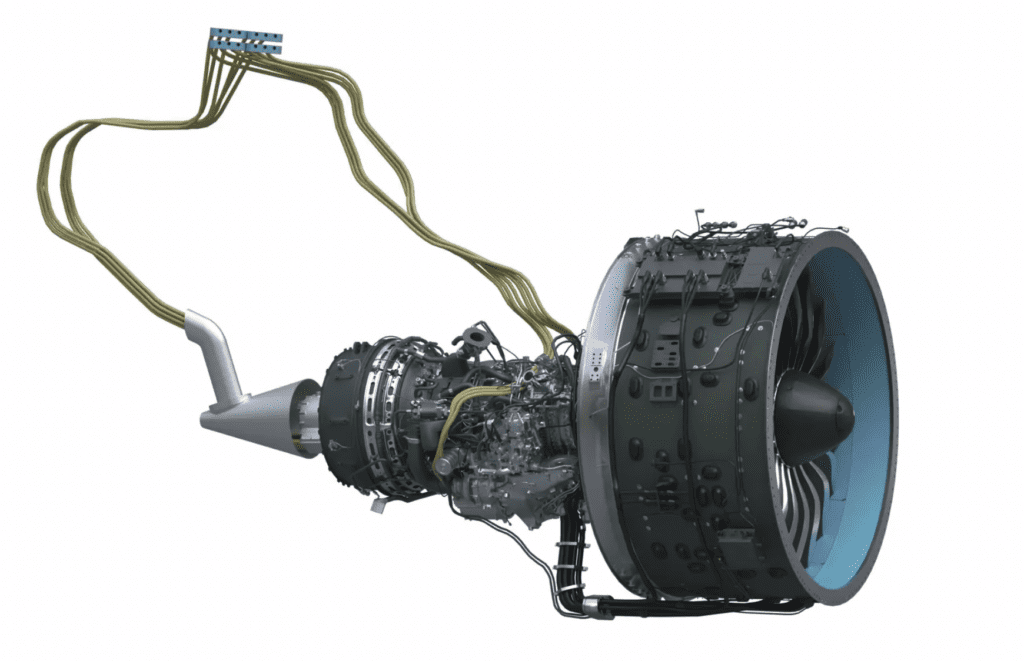

First, it’s perilous to make production predictions when it comes to new and untried technology. The batteries for the Chevy Volt PHEV and Bolt EV were largely developed by cell provider LG (in close collaboration with GM), but the Ultium architecture is much more of an in-house GM product. GM designed the modules, the packs and the wireless BMS, and GM does the assembly and integration.

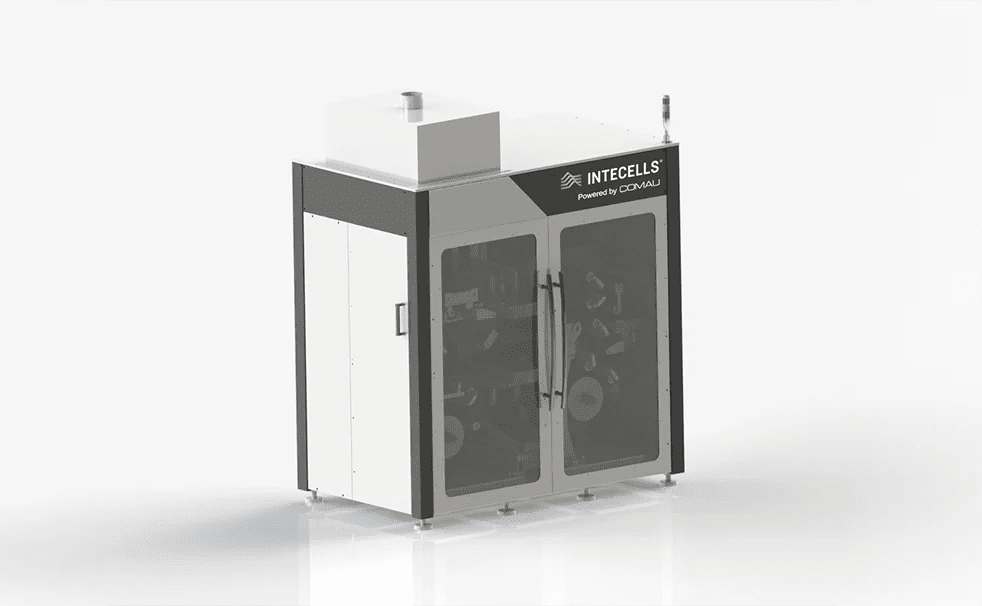

Second, automakers need to pay close attention to the “machines that make the machines,” to borrow a phrase from a certain EV pioneer that has also had its share of embarrassing production delays. By all accounts, Ultium Cells LLC, the GM-LG joint venture that fabricates Ultium cells, was not the source of the problems. Last year, Mike Anderson, GM’s VP for Global Electrification and Battery Systems said that the JV’s Ohio cell plant “exceeded some of their operational efficiency targets,” adding “Man, they killed it.”

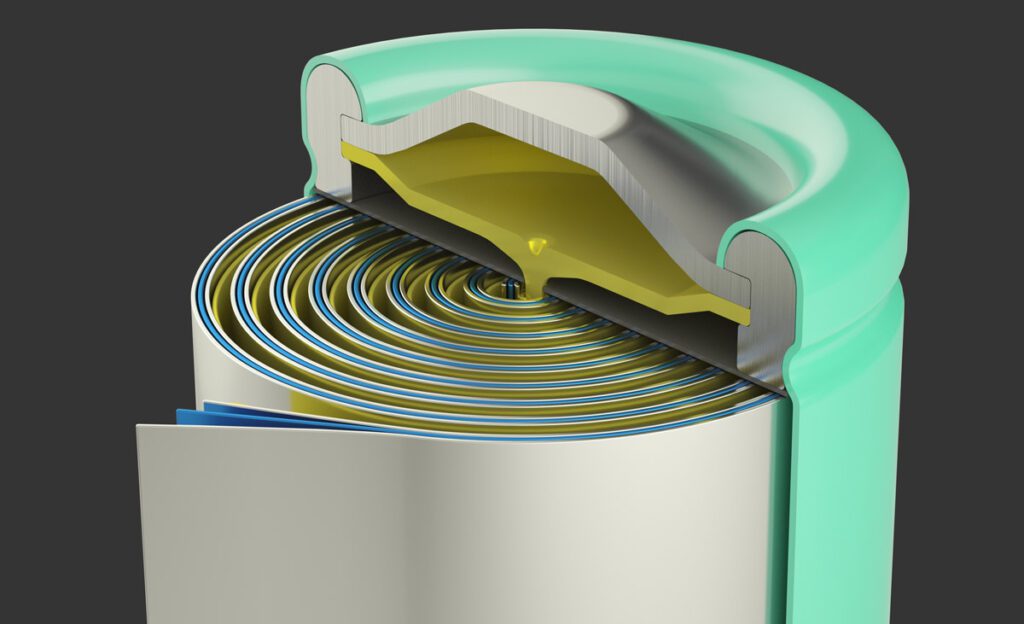

GM has said the delays stem from problems with the automated machinery that assembles the 9 kWh modules that make up an Ultium battery pack. Each of these includes 24 cells, attached to a cooling plate with special thermal adhesive, and assembly is a complex and exacting process, even for robots. “All these parts are coming together and they have to press together just right,” said Anderson with understatement. Getting this process up to speed was extremely difficult.

One source within the battery industry suggested to InsideEVs that GM ordered its automated module assembly system from a traditional Tier 1 supplier with little experience in high-volume electronics assembly. GM has refused to rat out the errant supplier, and Anderson noted that “nobody has experience doing this job…No one’s really done it at this rate and this scale, including ourselves.”

CEO Mary Barra acknowledged the problems with the automation equipment supplier pretty early in the game, and described steps the company was taking to get the lines running at the desired rate. By mid- 2024, she expects the modules to cease to be a constraint, and foresees “significantly higher Ultium EV production.”

There are certainly signs that the company is starting to clear the logjam. A GM representative told InsideEVs it hopes to produce 200,000 to 300,000 Ultium-based vehicles for GM brands this year. Meanwhile, Honda’s John Hwang said he is confident GM will deliver 40,000 units of the Prologue (an Ultium-based EV that the two automakers jointly developed) in 2024, and 70,000 per year starting in 2025.

As for those Blazer EVs, they’re still rolling off the production lines, and being stored until GM fixes the software problems that led to the sales shutdown. “We’re not losing the opportunity to make product,” said Mike Anderson. “If you’re going to make [those] kinds of numbers, you can’t take days off, you can’t get time back, so we’re not losing the time.”

When GM announced a rollback of its EV production schedule last fall, EV-haters were elated and EV fans were irritated. But this now looks more like a temporary retrenchment than a change in long-term strategy. GM’s hiring of former Tesla battery expert Kurt Kelty, and its continuing acquisitions of innovators like Mitra Chem and TEI, indicate that the company is looking ahead to the next generations of EVs (as it must, if it hopes to dodge the Chinese wrecking ball that’s aimed at Detroit).

If current trends continue, 2024 could be the Year of the Ultium EV. Will the auto dealers cooperate, or will they cling to their “piling up on the lots” narrative? We’ll all be looking to the Q1 earnings reports, due in April.

Source: InsideEVs