Florida is set to join the 26 states that impose a special yearly tax on EVs. Republican State Senator Jeff Brandes has introduced SB 1346, which would create a new annual fee for plug-in vehicle owners (in addition to the yearly registration fee paid on all vehicles). If this bill becomes law, pure EVs weighing under 10,000 pounds (which includes all passenger vehicles) will immediately be subject to a fee of $135 per year, rising to $150 in 2025. The fee for PHEVs will be $35 (rising to $50 in 2025). For EVs weighing over 10,000 pounds (e.g. trucks and buses) it will be $235 ($250 in 2025).

Editor’s note: An earlier version of this article incorrectly stated that the cutoff point for the higher fees would be 1,000 pounds. 10,000 pounds is the correct figure.

The anti-EV backlash is not coming solely from the right side of the aisle. A companion bill in the Florida House (HB 1221) is co-sponsored by Representatives Emily Slosberg (D) and Jackie Toledo (R).

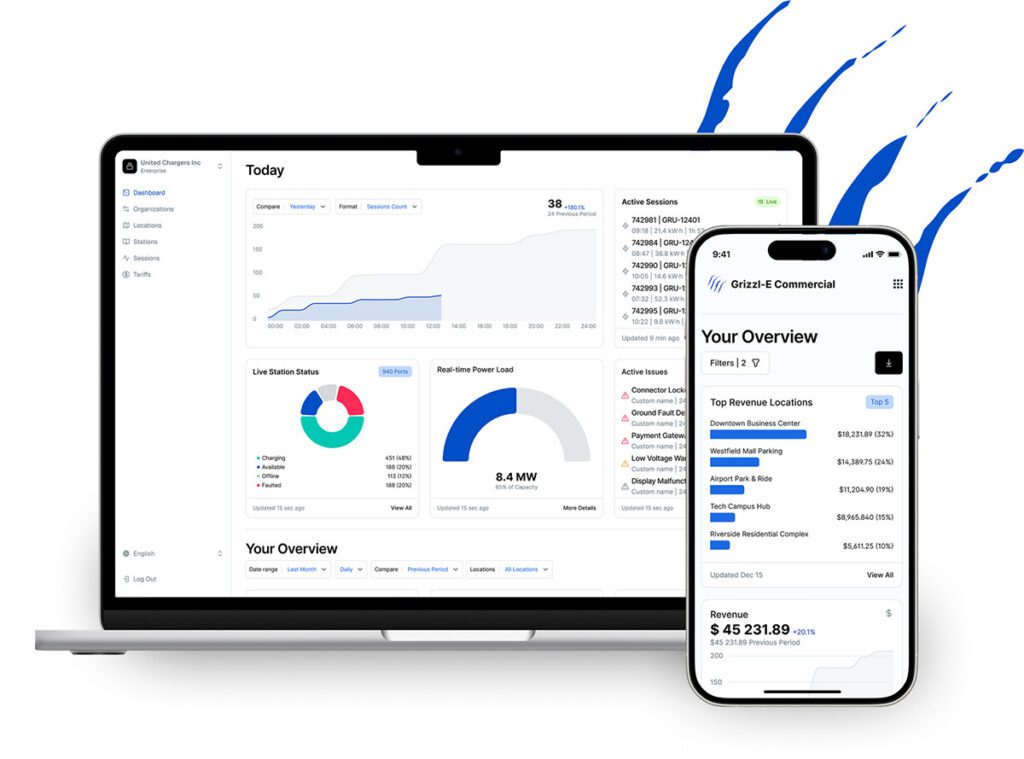

A separate set of bills would provide for 50% of revenue from the new tax to be invested in public charging infrastructure, an apparent attempt to blunt opposition to the bill from pro-EV groups. The other 50% would go to the State Transportation Trust Fund, which is used to fund road maintenance and construction in the state.

While investment in EVSE is a good thing, remember that these are two separate bills – lawmakers could choose to impose the new tax without approving the EVSE investment. It’s a clever political ploy – under the threat of having a tax and no EVSE investment, many who would otherwise oppose the measure may feel forced to support the tax+investment combo as the lesser of two evils.

In other states, lawmakers have justified taxes on EV ownership by pointing out that EVs pay no gasoline taxes, and thus don’t help to fund road maintenance (they do pay taxes on electricity, as well as state excise and sales taxes).

A recent article by CalMatters, and another from the Sierra Club, argue that this line of reasoning is specious, to say the least. The root cause of declining fuel tax revenues is the fact that the federal fuel tax and most state fuel taxes do not rise with inflation, while maintenance costs do.

According to CalMatters, EVs currently account for only about 0.5% of vehicles in the US, whereas over the past 20 years, the country has added 6% more lane miles to maintain and increased the efficiency of the vehicle fleet by 14%, while the purchasing power of fuel-tax revenue has fallen by over 30%. However you do the math, the figures make it clear that EVs can’t be responsible for more than a tiny fraction of the funding gap at the federal level.

CalMatters says another cause of revenue shortfalls is “a misplaced priority on highway expansion.” This is emphatically the case in Florida, where the legislature just approved the construction of three new toll roads that will open up vast areas of former wilderness to development.

Comparing the amounts of some current EV taxes to those of fuel taxes reveals another hint that these fees are motivated by something other than a desire to make EV owners pay their fair share of road maintenance costs. A recent analysis by Consumer Reports found that, of the 26 states that currently impose EV fees, 11 charge more than the amount paid in gas taxes by owners of comparable legacy vehicles, and 3 charge more than double the amount.

More punitive EV taxes are on the way. According to CU, 12 states are considering proposals for new taxes, and 10 of these would impose fees greater than what an average driver would pay in gas taxes. Seven would gradually increase the fees to double that amount.

To be fair, Florida’s proposed $135-150 per year is moderate compared to what EV owners in some other states are paying, and is probably not going to cause middle-class buyers to reconsider an EV purchase. However, before lawmakers shrug off the new fee, they should at least insist that, as the Southern Alliance for Clean Energy suggests, Florida complete a proposed EV infrastructure plan, to ensure that the earmarked money for charging infrastructure is invested wisely. They should also seriously consider waiving the fees for lower-income drivers.

Two more questions worth asking: what industry groups are supporting Florida’s proposed tax, and how much money have they been investing in Tallahassee? As a recent article in Politico reports, groups backed by oil industry giants, including the American Petroleum Institute and the Koch brothers’ Americans for Prosperity, have spent millions around the country to lobby lawmakers and regulatory agencies against various pro-EV measures.

Why are politicians around the country rushing to tax EVs? Simple – they’re following the example of Ronald Reagan, who said, “If you want more of something, subsidize it; if you want less of something, tax it.”

Contact information for Florida state legislators is available on the State of Florida web site, and the Florida House actually offers a list of handy tips to help craft effective appeals to your representatives in Tallahassee.

Sources: Southern Alliance for Clean Energy, Electrek, CalMatters, Consumer Reports, Sierra Club