Fisker Automotive is in talks with several potential buyers and/or investors, and won’t be able to stay open without a deal, the Wall Street Journal reported.

Fisker Automotive is in talks with several potential buyers and/or investors, and won’t be able to stay open without a deal, the Wall Street Journal reported. The WSJ cited “people familiar with the discussions,” who said that the beleaguered company has set a goal of finding a suitor by next month, and that two possible buyers have hired banks to work on offers.

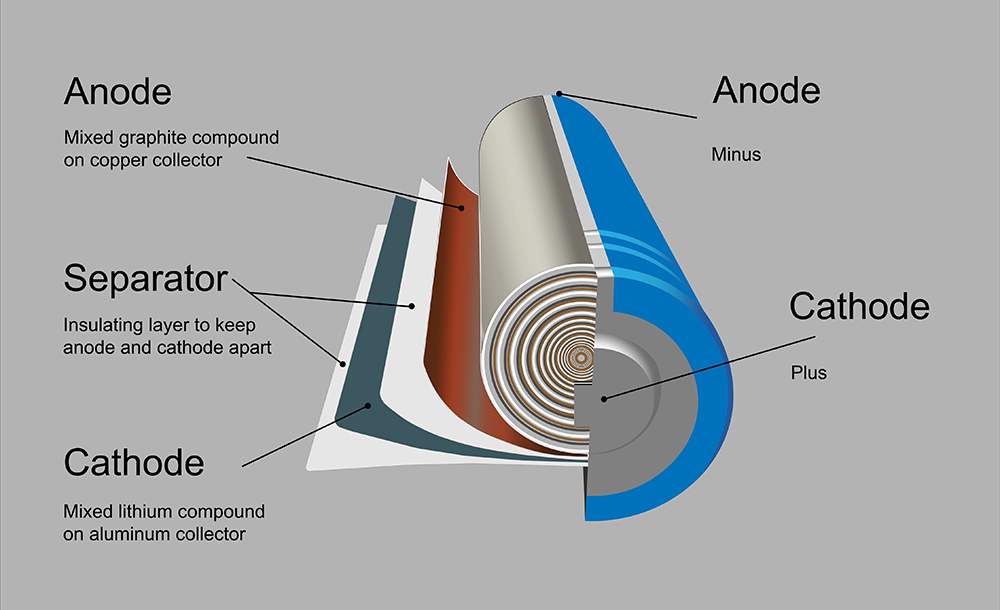

According to the WSJ’s sources, Fisker will probably be sold, but could remain independent if it finds a partner or investor. One potential investor is Chinese-owned auto-parts maker Wanxiang America Corp, which recently received US government approval to buy failed battery maker A123, whose bankruptcy recently forced Fisker to shut down its production line.

Batteries aren’t Fisker’s only problem. It’s embroiled in a lawsuit with its insurance company over 338 new Karma sedans that were destroyed by Superstorm Sandy. A couple of its cars have caught fire, leading to costly recalls and bad publicity. However, as is usual for startups, the overriding issue is simple: not enough funds.

Fisker received $192 million in DOE loans, but further funding was frozen after the company missed development deadlines for its planned next model, the Atlantic. Will that mid-market PHEV, which Fisker hopes to sell for about half the price of the $100,000 Karma, ever be built? A spokesman said the company is in “potential partnership and strategic alliance talks with the goal of moving the Atlantic project forward.”

Source: WSJ , GreenCarReports