A recent analysis by mining and metals consultancy CRU finds that demand for aluminum, driven by increased production of plug-in vehicles, is set to skyrocket by the year 2030. Demand will reach nearly 10 million metric tons, a tenfold increase over 2017 levels. According to CRU, demand for “primary aluminum-intensive extrusions and rolled products will be significantly higher than we see in internal combustion engines today.” Also, the use of scrap for secondary castings will fall as the market shifts to pure EVs.

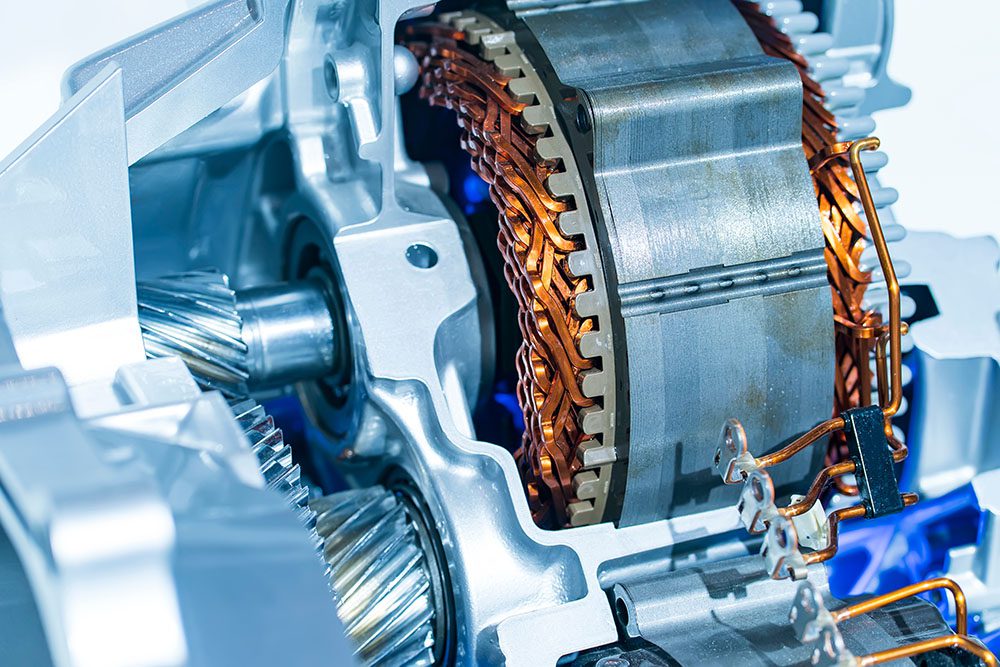

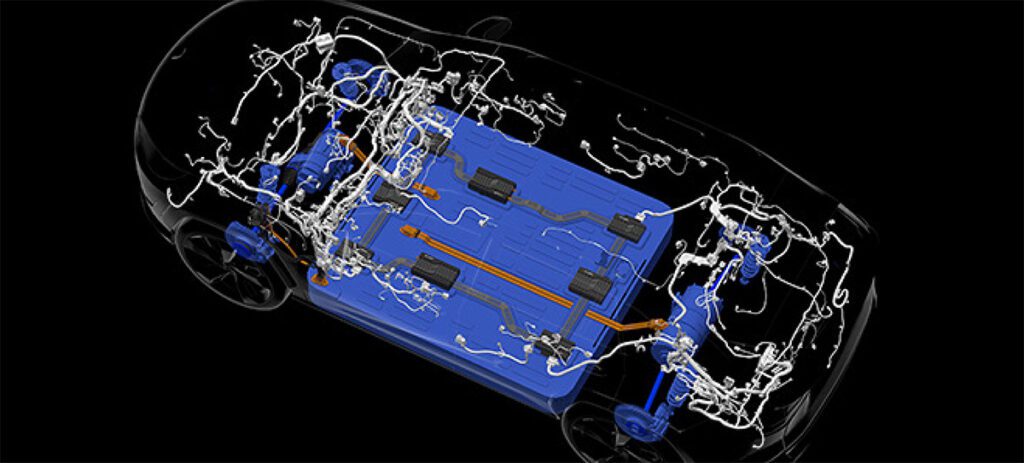

Plug-in vehicles use 25-27% more aluminum than the typical ICE vehicle (based on 160 kg of aluminum per vehicle). While the increased use of aluminum in ICE cars is primarily for weight savings, EVs use aluminum for various electric powertrain components, including battery housings, motors, inverters, converters, chargers, heat pumps, and reduction drives. Plug-in vehicles also use aluminum for the body-in-white and for components that they share with ICE vehicles, such as brakes, steering components, wheels, etc. CRU estimates that approximately 60 kg worth of these types of components will remain in all types of electrified vehicles.

To estimate the aluminum intensity of EVs, CRU interviewed carmakers, as well as Tier 1 and Tier 2 automotive suppliers. Their analysts also reviewed investor materials, information from auto shows and conference presentations from industry members.

Regarding scrap usage, CRU explains that “excluding used beverage cans, car engines are the main market for end-of-life aluminum scrap,” and predicts that by retaining the engine, plug-in and hybrid vehicles will support demand for secondary aluminum castings. CRU also suggests that makers of rolled aluminum products should be “betting against great leaps in battery technology and extended driving range,” as rolled products are less suitable for these components.

Source: CRU via Green Car Congress